Latest economic data were published last week, indicating that the U.S. economy remains on solid footing. Gold prices held up relatively well – but can it last?

Recent U.S. Economic Data Show General Health

Last week was full of economic reports. Let’s analyze them. First, the

CPI rose

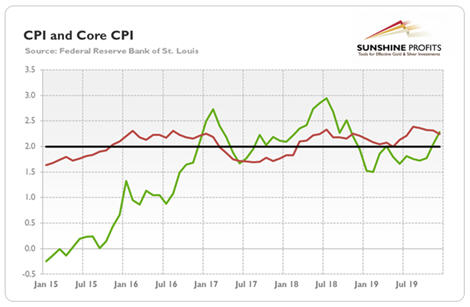

0.2 percent in December, slightly below expectations and the 0.3-percent increase in November. But as the chart below shows, the CPI (and the core CPI as well) rose 2.3 percent over the whole 2019, which was the largest advance since the 3.0-percent rise in 2011. Yet

inflation is still quite low by historical standards.

Chart 1: Annual percentage change in the US CPI (green line) and the core CPI (red line) from January 2015 to December 2019.

The wholesale inflation measured by the

PPI rose

just 1.3 percent last year, half as much as it did in 2018. It means that inflationary pressures are limited in the U.S. economy. Moreover, the

PCEPI, the Fed’s preferred inflation gauge,

rose just 1.5 percent over the twelve months ending in November. The muted inflation implies that it is unlikely the

Fed will hike the

federal funds rate anytime soon.

Although gold likes high and accelerating inflation, the U.S. central bank keeping interest rates on hold is positive for the gold prices.

Second,

the Fed’s Beige Bookshows that the U.S. economic activity continued to expand “modestly” over the last six weeks of 2019. What is important is that

the expectations of the near-term outlook “remained modestly favorable”. However, the Beige Book reports also job cuts in manufacturing, transportation and energy sectors, which is in line with the last report on the

nonfarm payrolls.

Third, when it comes to the industrial sector,

industrial productionfell 0.3 percent in December, the third decline in the past four months. In the whole last year, the output fell 1 percent. It shows that the sector is still weak, hurt by the

trade wars, but excluding the motor vehicle sector, factory output rose 0.5 percent, so we could perhaps see revival in the near future.

Fourth,

retail sales increased 0.3 percent in December and 5.8 percent in the whole 2019, slightly above the average for the past 30 years. It shows that the consumer spending remains solid.

Last but not least, the privately-owned housing starts in December

came at a seasonally adjusted annual rate of 1,608,000,

which was 17 percent above November and 41 percent above December 2018. The new residential construction reached a 13-year high, but it was mainly because of the warmer-than-usual temperatures. The change in building permits, which are less sensitive to weather, was weaker.

Implications for Gold

Leaving the industrial production aside, last week’s economic reports were generally positive, showing that the U.S. economy is still solid. It keeps looking like a

goldilocks economy: inflation is low, the pace of economic growth is moderate, the retail sales and the housing market are solid.

Theoretically, gold should suffer in face of positive economic news.

Indeed, as we have seen last week not only good economic reports, but also two important developments for the global economy. First, the potentially dangerous conflict between the U.S. and Iran deescalated as quickly as it appeared. Second, the U.S. and China signed the ‘phase one’ accord in their trade dispute. In consequence,

the U.S. stock market reached a new all-time record.

So, one could reasonably expect the

bearish trend in the gold market. However, the yellow metal held steady, which is a solid performance given the headwinds that occurred last week. Why was gold so resilient? One explanation might be that

investors worry about the long-term consequences of the recent ultra-easy monetary policy. After all, even central bankers worry! Dallas Fed President Robert Kaplan said last week that the recent Fed’s actions were contributing to elevated risk asset valuations as they have given investors green light to buy risky assets and this is a concern. Anyway,

gold’s resilience in face of headwinds might be a bullish sign.

If you enjoyed today’s free

gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly

Gold Market Overview reports and we provide daily

Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to

subscribe today.

If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits – Effective Investments Through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Trading Alerts.