Founded in 1846, Laurentian Bank is headquartered in Montreal and is one of the largest and most respected banks in the country, with a market capitalization of approximately $2 billion CAD and 3,600 employees. (Source / Image)

Today, Ximen Mining Corp. released an update on the planned bulk sampling and subsequent production start at its 100% owned Kenville Gold Mine near the city of Nelson in southern British Columbia, Canada. At the end of the press-release, there is, however, a brief announcement that is letting the Kenville Gold Mine plan shine in a new brilliance.

Ximen Mining Corp. has engaged Laurentian Bank Securities Inc., a highly regarded institution in Canada, to act as strategic financial advisors and to assist the company to source capital and evaluate potential merger and acquisition opportunities. Having such an experienced and financially strong advisor at its side is could literally be worth ”gold” for Ximen and its goal to move into production as quickly as possible.

Laurentian Bank Securities (LBS) already have some of the who-is-who of the mining industry under contract, providing first-grade analyst coverage on strictly selected, up-and-coming mining ventures. Currently, LBS has 24 junior and senior mining companies under coverage with an average market capitalization of $605 million CAD, such as Detour Gold Corp. (market cap.: $4.5 billion), Alamos Gold Inc. ($2.9 billion), Wesdome ($1.3 billion), Champion Iron Ltd. ($1.1 billion), New Gold Inc. ($908 million), Fortuna Silver Mines Inc. ($817 million).

Considering that Ximen currently has a market capitalization of $17 million and was able to attract renowned Laurentian Bank Securities as strategic financial advisors, the Ximen management deserves the utmost respect.

“Laurentian Bank Securities is an integrated full-service investment dealer, focusing on six lines of business. The well-respected Institutional fixed income division has a strong presence in Government and Corporate underwritings, as well as in secondary markets. In addition, the Institutional equity division focuses on serving clients through research, trading and investment banking in the small capitalization sector. The fast-growing Retail division and Discount Brokerage division currently serve clients through 13 offices in Québec. Furthermore, as a carrying broker, LBS provides complete back office support to a wide range of customers. LBS also offers the Immigrant Investors program. In the institutional market as in the retail market, Laurentian Bank Securities places above all, its expertise, experience, and sense of innovation to ensure its position and bring added-value to all of its activities.“ (Source / Image)

Chris Anderson (CEO and President of Ximen Mining Corp.) at a recent site visit at the Kenville Gold Mine Property on January 18, 2020. (Source: Ximen Mining news of January 22, 2020)

According to today’s news:

“In 2019, Ximen acquired the former producing Kenville gold mine along with all existing permits, infrastructure and equipment. The Company then initiated permitting to develop a new 1200 metre decline and do underground drilling. Once this work gets underway, the Company will move toward extracting a bulk sample for offsite processing. To date, surface buildings and roads were rehabilitated, the portal site for the decline was stripped, a transformer for hydro power supply was installed, and a new mine compressor was purchased. Water and waste rock quality surveys were completed, showing that the mine drainage water is high quality and the waste rock is non acid generating. The Company intends to be extracting a bulk sample this year and then be in a position to move toward continuous production. Historically, the Kenville mine produced 65,381 ounces of gold from 158,842 tonnes processed.”

“Compressor #1 on site at the Kenville Gold Mine. 600 v, 200 hp, 1000 cfm, extra high efficiency. Its’ ready and waiting.” (Source: Ximen Mining news of January 22, 2020)

The Kenville Gold Mine Property is connected to cheap and environmentally friendly hydropower.

On November 7, 2019, Ximen issued a shareholder letter on its plans to develop the Kenville Gold Mine Project into a mining business as clean and eco-friendly as can be. Kenville is known as the first underground gold mine in British Columbia and soon it could be making headlines again as Ximen aims to differentiate itself from other mining projects by going green.

The mining industry is a gigantic energy consumer and almost every stage of the mining process requires a tremendous volume of water. In fact, current statistics indicate that the mining industry is eating up almost 20% of the world’s water supplies. On top of that, mining typically has a large environmental footprint, oftentimes requires large amounts of chemicals to extract the minerals and leaves behind toxic waste.

Heightened concerns about global warming and pollution put pressure on institutional and private investors to focus on clean, eco-friendly and environmentally sustainable businesses. Ethical investing is on the rise globally and those mining companies adapting the fastest to this new reality are poised to benefit the most.

Ethical investing does not mean sacrificing returns, especially if it can be combined with “green mining”. Many industry experts believe that the gold market is on the verge of a long-term bull market and that 2020 will be “a golden year” for mining companies and investors alike. However, those companies reducing the environmental impact of mining may gain even more attention from investors, and support from governmental authorities in respect of developing and permitting new mines.

Going green in the mining industry is limited by what mother nature provides. In this respect, some projects are more fortunate than others – and Ximen is remarkably lucky to develop a mining project where mother nature offers vast opportunities to go green.

Ximen not only owns 100% of the surface and underground rights (royalty-free) of the Kenville Property but also owns relatively new underground equipment including a new underground mine scoop loader and drilling equipment, as well as transformers, compressors, power lines, and housing for mining staff. (Image)

Local labour force surrounds the Kenville Mine Property as being located around 10 km from the city of Nelson, one of the three cities forming the commercial and population core of the West Kootenay region in southern British Columbia. The Kenville Property is accessible by paved road (called the “Kenville Gold Mine Road“) and just off the Highway #3A, which goes into Highway #3 going straight to Grand Forks and Greenwood in southern British Columbia.

Full size / The 560 hectares Kenville Mine Property near Nelson, BC. (See GoogleMaps)

Kenville has recently been connected to the power grid, with electricity coming from the near-by Kootenay Dam / BC Hydro‘s Kootenay Canal Generating Station. Hydroelectricity is not only cheap but also an environmentally friendly source of renewable energy. Ximen‘s underground drilling development equipment is pneumatic, powered from air compression and drawing electricity from the Kootenay hydropower plant.

Ximen‘s President and CEO, Chris Anderson, drinking water from the Kenville mine discharge; September 6, 2019. (Image)

The run of water from the mountain, which dispenses out the main portal, is not only some of the best drinking water in the province but may also provide an excellent power source for some surface and underground activities as it flows under high pressure. Ximen aims to use this natural flow of mountain water to power its underground lighting system using low-voltage, long-life LED lights. Ximen also plans to install solar power on site, e.g. for its site management and security system.

Metal mines oftentimes generate highly acidic discharges containing toxic metals, such as copper or iron. These, combined with reduced pH, have a detrimental impact on the streams aquatic environments. Acid rock drainage occurs naturally as part of the rock weathering process but is exacerbated by large-scale earth disturbances characteristic of mining and other large construction activities, usually within rocks containing an abundance of sulfide minerals. The rock that Ximen intends to mine is actually acid neutralizing and is also highly sought after as composite rock for dam filtration among many other eco-friendly usages.

Ximen has a composite drill data base going back to the 1940s and includes the 4 years of drilling by the previous operator which was supervised by Mr. Lloyd Penner who now works for Ximen. Watch a recent interview with Lloyd Penner here.

Looking at the Kootenay River from the Kenville Gold Mine Property. (Image)

In mid-2010, the previous owner said that the Kenville Mine was “in production-ready state”, but the concurrent beginning of a bear market in gold appears to have put an end to that plan.

However even more importantly, the previous owner did not have a processing facility, not to speak of a tailings pond which would be difficult or impossible to get permitted as the mine property is located on the slope of a mountain, likely to even make the alternative of dry stack tailings unfeasible/unpermissable. This missing key might have been the main reason why the previous operator could not succeed into production.

With gold prices on the rise again, the time could be ripe now for Ximen to write history in one of Canada’s most prolific gold mining districts, especially if an opportunity with an existing processing facility in southern British Columbia evolves.

Full size / The Greenwood Processing & Tailings Facility from Golden Dawn Minerals Inc.

Milling & Processing Opportunity

Recently in October, Ximen announced that it is initiating work with Golden Dawn Minerals Inc. to do metallurgical test work on material from the Kenville Gold Mine Project.

Golden Dawn Minerals Inc. (TSX.V: GOM) owns the Greenwood Processing & Tailings Facility located near the city of Greenwood in southern British Columbia, a 2-hour drive on Highway #3A and #3 from the Kenville Gold Mine Property. This lightly used plant, which includes a permitted 400,000 tonnes tailings pond, was built in 2007 and used in 2008 for only 9 months. It’s a modern processing facility with a throughput capacity of 212 t/day (72,000 t/year), upgradable to 424 t/day with the addition of a second primary grinding mill and modifications to existing rougher flotation circuit.

The mill‘s conventional processing can produce a gold gravity concentrate and copper-gold flotation concentrate, both marketable to smelters for immediate cash-flow generation.

Full size / The planned method of mining at Kenville could be such that every tonne mined is almost pure vein material (e.g. with a targeted dilution of less than 20%). By doing so, Ximen could be trucking vein material with minimal dilution, greatly reducing the tonnage needed to be trucked and milled.

As per Ximen‘s October 7 news-release:

“In the coming year, the Kenville Gold mine is expected to produce gold bearing material from planned mine development and bulk sampling. Ximen is therefore working with Golden Dawn Minerals now to collect a sample for metallurgical testing to evaluate the possibility of custom milling at Golden Dawn‘s mill facility at Greenwood, BC.

“A representative sample of gold mineralization from the Kenville mine will be collected from historic drill core and submitted for metallurgical characterization. The test work will investigate the mineralogy and chemistry of the mined material and process tailings, investigate gold recovery using gravity concentration and bulk sulphide floatation, and characterize the acid generating potential of the tailings product. (The tailings from Kenville material is anticipated at this stage to be non-acid generating and benign based on historical information.) The results will be used to determine if Kenville run-of-mine material can be custom milled at the Greenwood process plant.

“Presumably, the gold in the Kenville material could be recovered using the gravity and floatation process in the Greenwood mill. Free-milling gold would be recovered in the existing centrifugal concentrator, and a gold-pyrite concentrate would be produced by bulk floatation concentration. At this stage it looks like major modifications to the existing treatment facility will not be required.

“Once the metallurgical test work is complete, the Greenwood mill will need to be permitted for custom milling. The next step would be refurbishment of the mill prior to starting operations.“

Perfect Match

The previous owner of the Kenville Mine Property, who, as mentioned earlier, did not have access to a processing facility, initiated a metallurgical scoping study in 2009 demonstrating that standard flotation technique recovered 98% of the feed gold into a concentrate of 155 g/t gold, 355 g/t silver, 12% lead and 2.5% copper. By combining the gravity and flotation techniques, the result was a 93% gold recovery with an average concentrate grade of 200 g/t gold, 18% lead and 3.3% copper. As such, the Greenwood Mill appears as a suitable site for processing material from Kenville.

Note that Ximen‘s President and CEO, Chris Anderson, is also the CEO of Golden Dawn Minerals.

Watch the latest interview with CEO Chris Anderson here or below:

More information on the Kenville Gold Mine Project can be found here, here, here, here and here.

Full size

Full size

Full size

Full size

Technical Perspective

Link to updated chart (15 min. delayed): https://schrts.co/nVvegNqV

Company Details

Ximen Mining Corp.

888 Dunsmuir Street – Suite 888

Vancouver, BC, Canada V6C 3K4

Phone: +1 604 488 3900

Email: office@ximenminingcorp.com

www.ximenminingcorp.com

Shares Issued & Outstanding: 47,586,086

Chart

Canadian Symbol (TSX.V): XIM

Current Price: $0.365 CAD (01/21/2020)

Market Capitalization: $17 Million CAD

Chart

German Symbol / WKN (Tradegate): 1XMA / A2JBKL

Current Price: €0.25 EUR (01/21/2020)

Market Capitalization: €11 Million EUR

Previous Coverage

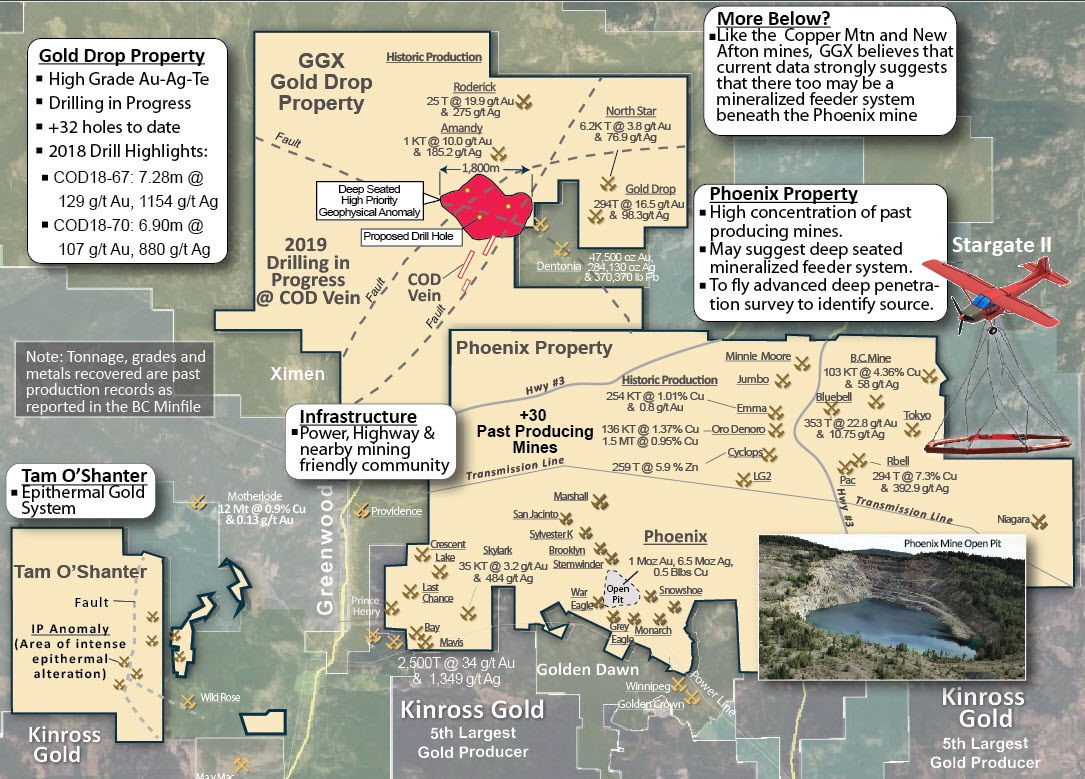

Report #17: "Shallow and deep drilling at Gold Drop produce highly promising results and findings"

Report #16: "The Drill is Turning to Uncover the Stargate II Anomaly: A Large Gold Pipe?"

Report #15: "Ximen targets first gold bar pour this year from bulk sampling at Kenville"

Report #14: "All Eyes on Gold Drop and Stargate II: Deep drilling to test for a large gold deposit near Greenwood in British Columbia"

Report #13: "Ximen is pressing ahead aggressively with its goal of becoming a gold producer: Mining plan now revealed"

Report #12: "Ximen frees Kenville Gold Mine from royalty burden, making it more attractive for development"

Report #11: "The Beauty of High-Grade Gold (and Silver!): Ximen Cuts to the Chase, Expands Work Efforts on Multiple Properties in Southern British Columbia"

Report #10: “Ximen Mining: Paving the road(s) to success“

Report #9: “Ximen takes a shot at history, focuses on acquiring the Kenville Gold Mine“

Report #8: “Industry inquiries persuade Ximen‘s partner to re-assay drill core for tellurium“

Report #7: “Ximen Hires B.C. Mining Expert Dr. Mathew Ball“

Report #6: “Location is Key for Ximen‘s Treasure Mountain Project in Southern British Columbia“

Report #5: “The Unprecedented Gold-Silver-Tellurium Strikes in the Historic Greenwood Mining Camp Continue“

Report #4: “Record-Breaking Gold Hit in Southern British Columbia“

Report #3: “Strong drill results and appreciating precious metals prices may herald golden times for Ximen Mining“

Report #2: “Ximen Mining reveals striking drill core observations ahead of assays“

Report #1: “Ximen Mining: Hunting for Multi-Million Ounces in British Columbia“

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Ximen Mining Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Ximen Mining Corp.´s and Zimtu Capital Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through the Ximen Mining Corp.´s and Zimtu Capital Corp.´s profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds a long position in Ximen Mining Corp., Golden Dawn Minerals Inc. and Zimtu Capital Corp. and is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital also holds a long position in Ximen Mining Corp. Note that Ximen Mining Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services.