Low acquisition and exploration costs and high-grade sampling are some of the reasons why two industry observers have a Buy rating on this company.

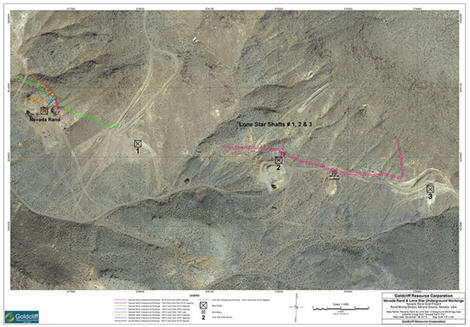

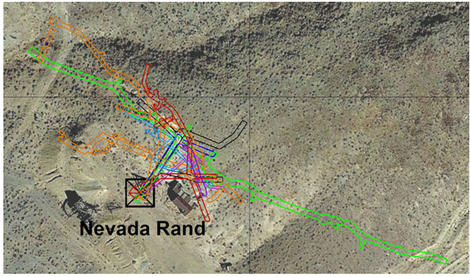

Goldcliff Resource Corp. (GCN:TSX.V; GCFFF:OTCBB) is exploring the Nevada Rand property in Mineral County, Nevada, not far from the town of Hawthorne. Located in the Walker Lane Structural Corridor, the property, which looks like something straight out of a Western movie set, saw production in the early 1900s. At that time, prospectors would sink shafts following mineralization from surface and abandon them when the vein became too small. The property is crisscrossed with these shafts.

"We knew that the district had a history of small production of bonanza grade gold and silver; that was of particular interest to us," George Sanders, CEO of Goldcliff, told Streetwise Reports. "When we went to visit it, a couple of things jumped out at us. One was the strength of the main structure along which a number of these old shafts and pits appear; I could see them lining up as a straight line, and this trend extends the entire length of the property. We could also see other parallel structures that suggest that there is a large mineralized system going through there."

"Evidence of 'bonanza-type' and moderately high-grade silver and gold was recently confirmed through an underground sampling program." - Michael Ballanger, GGM Advisory

Sanders explained that the hillside slopes down into a little valley and the vein is sloping in the same direction. "As you go lower, you're actually getting closer to the structure and could pierce it with short drill holes," Sanders explained. "We liked the shallow, near-surface mineralization; Nevada Rand is a high-grade to bonanza-grade setting that has really good leverage to the discovery of new mineralization. Plus to the best of our knowledge, the district has not had modern exploration techniques employed on it."

The old shafts are like inside-out drill holes, Sanders said, "a three-dimensional drill hole you can actually get down inside and you can see and feel and sample."

Nevada Rand shaft enlargement:

Nevada Rand is a low-cost acquisition. Goldcliff has an option to acquire 100% of the property from Ely Gold Royalties for $250,000 payable over four years; the upfront payment was $10,000 and the bulk of the payment occurs at year four and is cancelable at any time. "You are only going to make that last payment if you're still working on the property and you will only still be working on the property if you have found what you think might be there. The structure of the deal is very conducive to creating leverage for a new discovery," Sanders said. There is also a 2.5% net smelter return royalty of which 1% can be bought down for $1 million.

The expected phase 1 drill program is relatively low cost, coming in under US$350,000. The company expects to begin drilling this month, and assays should be back in March.

In a December 19 news release, Goldcliff noted that most of the drilling will be concentrated around the Nevada Rand shaft. A sample from the southeast end assayed 491 g/t silver and 5.6 g/t gold, while a sample from the northwest end assayed 356 g/t silver and 11.65 g/t gold.

The company has 41.2 million shares issued. Sanders is the largest shareholder with ownership of just under 13 million shares, and he was the largest purchaser during the company's last financing. All the board members combined own 38% of the shares, purchased using their own funds at prices not discounted to the market, so the group has serious skin in the game. "We feel that the market cap of around $5.3 million provides current shareholders or new shareholders with a lot of leverage to any rerating based on the successful discovery of additional high-grade chutes," Sanders stated.

"Great Bear Resources is a good example," Sanders said. "Before that company reported exploration success, the stock was in the 50 cent range. When the first high-grade assays were announced, the shares rose to $1.95, so more expensive, but still much less than its current $8.73 price."

Goldcliff has Buy ratings from several industry observers. Michael Ballanger, writing in the 2020 Forecast Issue of GGM Advisory on January 15, stated, "Goldcliff is a gold-silver developer of the Nevada Rand project located in west-central Nevada where drilling is expected to commence in early 2020. Historical records confirmed that direct shipping operations of precious metals were undertaken from this property situated within a trend that is known to host a robust mineralized system. I like the 1:1 ratio of gold-to-silver occurrence as well as the fact that while it was a past producer, it has never been systematically explored by way of modern methodology. Evidence of "bonanza-type" and moderately high-grade silver and gold was recently confirmed through an underground sampling program which yielded up to 1,415 g/t silver and up to 37.9 g/t gold.

"Catalysts for revaluation of the share price include a 2020 drill program intended to confirm the presence of high-grade Au-Ag intercepts which will serve to validate the direct shipping scenario. This will in turn allow the current USD $3.65 million market cap to be enhanced through a resource calculation and subsequent reranking. Suggested accumulation range: up to CA$0.20. 2020 Target: CA$0.50, US$0.36," Ballanger concluded.

Technical analyst Clive Maund, writing in November on CliveMaund.com, stated, "Goldcliff Resource Corp has a big hole in the ground, an old mine in Nevada, that contains A LOT of gold. In the old days, when they needed higher grades to make it economic, it was abandoned, but with modern mining techniques it is certainly economic now." He concluded, "We therefore stay long and Goldcliff is rated a buy here and especially on any further near-term weakness." At that time, the stock was priced at CA$0.11. It is currently trading at CA$0.14.

"We think this is one of the better leverage plays out there," Sanders concluded. "The property is levered because it's not well known and there's not a lot of recent geologic information on it. The property is levered because with the deal we have, almost all of the money goes into the ground and not into property payments. The share structure is perfectly levered because if you can go from a $5 million market cap to a $25 million market cap, and then with some follow-on success, an $80 or $100 million market cap, that's tremendous leverage."