Peter Epstein of Epstein Research discusses recent developments at the company.

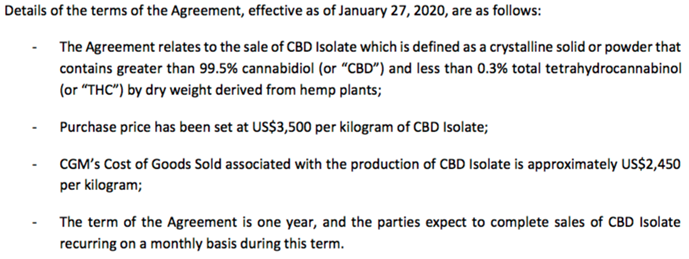

On January 29th, California Gold Mining Inc. (CGM:CSE; CFGMF:OTCQB) announced an agreement with a North Carolina-based hemp-CBD extraction company for the sale of CBD isolate produced by running CGM's 100%-owned, high-CBD hemp biomass through the private company's state-of-the-art extraction facility. CBD isolate is a crystalline solid or powder containing >99.5% CBD and <0.3% total THC.

The fixed purchase price is US$3,500/kg of CBD isolate, and CGM's Cost of Goods Sold (COGS) is expected to be US$2,450/kg, which would be a margin of US$1,050/kg. Up to 1,000 kg of isolate is expected to be sold in March. The company plans to make recurring sales for an initial one-year term.

California Gold's President & CEO, Mr. Vishal Gupta stated,

"The execution of a second sale agreement soon after executing the first is a testament to the high quality of CGM's refined products, and management's commitment to achieving positive cash flow in Q1 2020. CGM's board recognizes that diversification of the Company's revenue stream is critical to long-term sustainability of positive cash flow in the nascent hemp-CBD sector. With this in mind, management continues to explore additional avenues for revenue generation from the Company's hemp business segment."

If January and February operating activities are successful, CGM would likely acquire additional hemp biomass in North Carolina and/or neighboring Virginia to produce and offer for sale specialty refined products in partnership with the family-owned NC-based extraction company.

Readers may recall that on January 15th, California Gold announced an agreement with a California-based hemp-CBD brokerage firm for the sale of a specialty, high-end product, zero-THC distillate (zTd), produced from the company's wholly owned, high-CBD hemp biomass. zTd is an oil derived from hemp plants that contains 0% THC and >80% CBD by weight. The purchase is US$4,300 per liter of zTd. The initial term of the agreement is one year.

According to the press release, CGM's COGS associated with the production of zTd is expected to be US$2,400/liter, resulting in a margin of US$1,900/liter. After an initial batch of up to 500 liters is delivered next month, CGM hopes to execute additional sales of zTd over the remainder of the year.

CEO Gupta added,

"We are delighted to be in a position to deliver on our promise of realizing CGM's first revenues and achieving a healthy operating profit in Q1 2020. We are currently negotiating additional sales agreements with interested parties for our bulk, refined, hemp-CBD products. These products were generated from the initial batch of hemp biomass purchased from farmers in Virginia & North Carolina, along with hemp biomass harvested from our wholly owned Grove Road farm in Illinois."

Management believes there's higher operating margins and stronger demand for specialty, refined products such as zTd, than for commodity-like crude oil products. CGM's board is contemplating the purchase of additional high CBD-content hemp biomass to get converted into high-end refined products once the current inventory is sold.

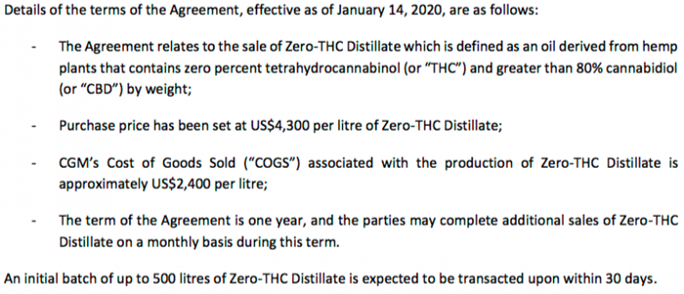

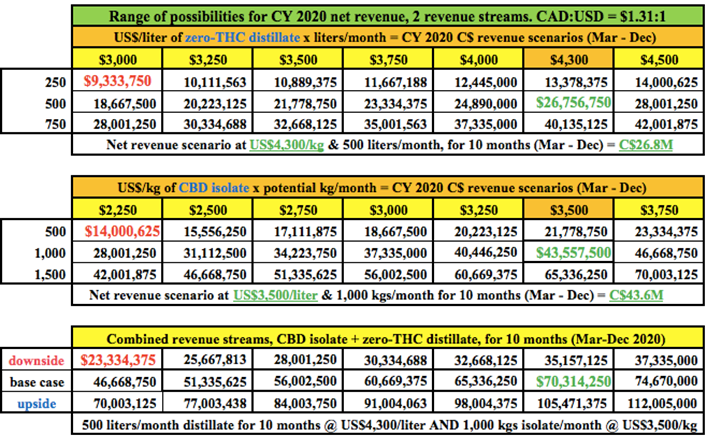

In the chart below are some CY 2020 net revenue (net of a 5% sales commission) scenarios (in CAD$ FX: 1.31:1). These are indicative figures only, based on press released data. Both the range of monthly production quantities (CBD isolate & zero-THC distillate), as well as the pricing for each product, could end up outside the ranges depicted in the chart.

The range of total net annual revenue from both products could approach or exceed C$100 million. To be more conservative, C$40-C$60 million might be a reasonable expectation, IF EVERYTHING GOES REASONABLY AS PLANNED. That was a big IF for most companies last year. Make no mistake, execution will be a major challenge again in 2020. Even if CGM's revenue comes in at the low end of the chart, around C$23 million, that would still be a great outcome.

The company's enterprise value (EV) [market cap + debt – cash] is C$20 million. California Gold is trading at under 1x 2020 (expected) net revenue. Readers should note that revenue could absolutely come in below the C$23 million mentioned above.

Two of the primary risks are 1) operating logistics—unexpected downtime, delays in permits, approvals or supplies, longer extraction runtimes, etc., and 2) lower pricing. Pricing has fallen >50% in the past nine months, but it seems to have leveled out.

If CGM is trading at under 1x 2020e net revenue, (a very low market valuation) it would be in the top 6% for that metric of the 302 names I'm tracking. Among the 18 trading under 1x revenue, some have share prices below $0.05, some are down >90% from last year's highs (CGM is down 59%), some are in cut-throat, low-margin competitive segments like cannabis delivery, beverages or the selling of supplies/equipment. By contrast, CGM expects strong margins.

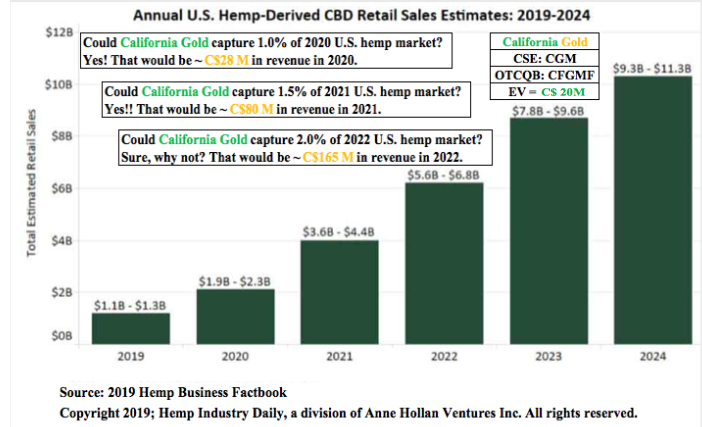

California Gold would be trading at under a 1x 2020e EV/EBITDA multiple if it were to generate $70.3 million in net revenue (see chart above). Now that CGM is on the cusp of revenue and positive cash flow, one can start to wonder about acquisitions, M&A. Readers should glance at the Annual U.S. Hemp-Derived CBD Retail Sales Estimates: 2019-2024 chart below. Could CGM capture just 1.0% of the 2020 hemp-CBD market? YES.

Will CGM be an acquirer or be the one taken out? I believe a takeout of CGM will not come before 2021. The company has too much going for it, they will soon be cashed up in an epic buyer's market of distressed assets.

On the other hand, once CGM has ramped up revenue and cash flow well into the tens of millions, it will become a prime takeover target itself. Management runs a tight ship, there are just five employees and minimal options / warrants or overhead. I expect that net revenue divided by employee will be 10x to 25x higher than that of the major MSOs and LPs. For example, Canopy Growth has over 2,700 employees, Aurora Cannabis over 1,600.

This is a very exciting time for California Gold and any company with ample cash liquidity. A lot of companies, large and small, blew up in 2019 or are in the process of blowing up this year. For instance, roughly 20% of the names I'm tracking have over 300 million shares outstanding, some over 500 million. CGM has 60 million shares outstanding.

Surprisingly, about 25% have negative working capital balances (more short-term liabilities than assets). Slightly over 100 companies (34%) have less than or equal to $500,000 in trailing 12-month revenue. Of course, some of these names will see revenue soar in 2020, but the vast majority won't achieve >$10 or $20 million this year. CGM could end 2020 with trailing 12-month revenue in the top 70 or 80, but it's currently ranked about #180 on my list.

Even more exciting, if the company can deliver strong margins, they could be in the top 50 or 60 in terms of annual EBITDA. Companies ranked #50 to #80 range in EVs from ~$75 million to ~$155 million, vs. CGM at $20 million. So, there's substantial upside potential (and still very significant risk) in the shares of California Gold Mining Inc. [CGM] (CSE: CGM) / (OTCQB: CFGMF).

Investors should know by mid-year how management is executing, if they run into any problems and if pricing holds up. This is all in the U.S., 100% hemp, no cannabis. There should be lots of news on existing operations and possibly acquisitions/joint ventures.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed below.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about California Gold Mining, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of California Gold Mining are highly speculative, not suitable for all investors. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Peter Epstein owned shares of California Gold Mining Inc. and the Company was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts, financial calculations, etc., or for the completeness of this interview or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company. [ER] is not an expert in any company, industry sector or investment topic.