Like a Diamond in the Rough

Full size / The niobium-bearing mineral pyrochlore, with the typical brown colour and, like diamonds, an octahedral habit (i.e. “square bipyramid” shape) was recovered from a piece of drill core from Saville Resources‘ Mallard Prospect within its Niobium Claim Group Property in Québec.

In light of Trudeau and Trump shaking hands as the U.S. seeks Canada‘s aid to break China‘s dominance on rare earths and other critically deemed commodities, Commerce Resources Corp. has started to shine* bright like a diamond. On the other side of the fence, the overlooked diamond in the rough is clearly Saville Resources Inc. as today‘s news shows in a brilliant fashion. (*Actually, diamonds don‘t “shine“ by themselves, but reflect, refract and disperse light in a glorious display.)

The share price of Commerce Resources Corp. has more than doubled from its low in the last 2 months amid rare earth elements (REE) making headlines globally. However, the share price of its joint venture partner for an adjacent property, Saville Resources Inc., has remained flat, yet deserves a fresh look as the company is making significant progress ahead of its plans for an aggressive exploration program.

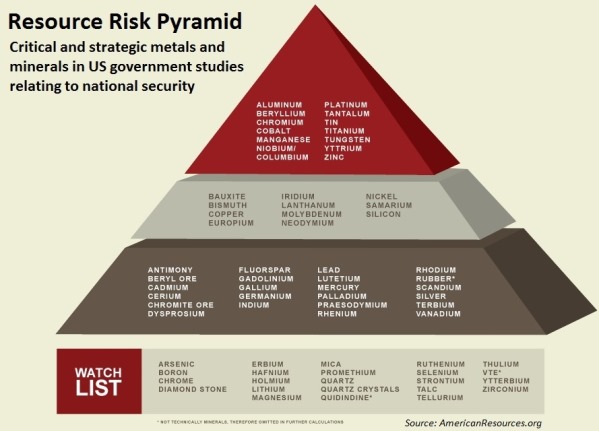

While REEs have clearly been the media‘s focus since Canada and the U.S. finalized and signed a Joint Action Plan on Critical Minerals Collaboration (January 9, 2020), other critically deemed commodities, such as niobium and fluorspar, should not be overlooked for the following reasons:

“Canada is an important supplier of 13 of the 35 minerals that the U.S. has identified as critical to economic and national security“ and “Collaboration in this area could attract investment to Canadian exploration and mining projects“, the Canadian Government stated. The Government also emphasized that “We have the potential to become a reliable source of other critical minerals, including rare earth elements... Canada is currently ... the second-largest supplier of niobium, tungsten and magnesium [to the U.S.]“

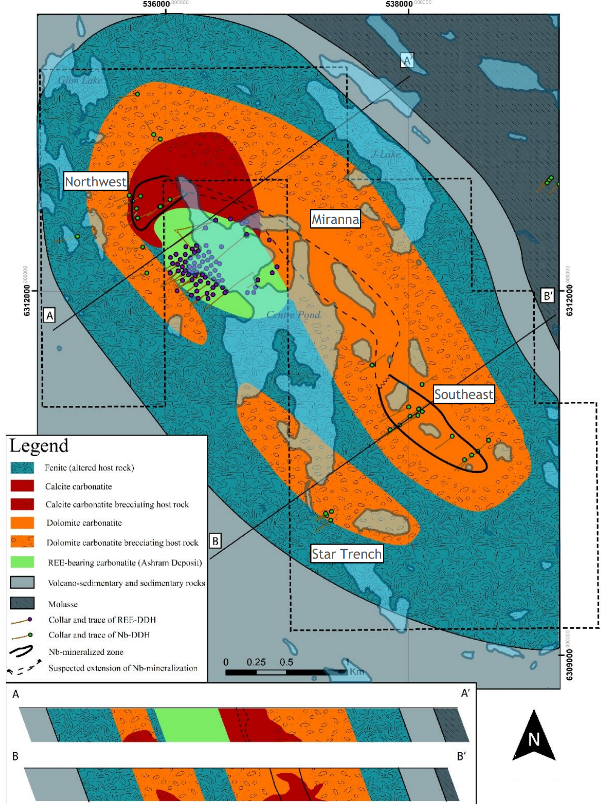

As Saville pointed out in today‘s news, its niobium project shows initial “Parallels to the Niobec Deposit“, Canada‘s only niobium mine, currently accounting for 8-10% of global production.

Full size

The U.S. Department of Defence has declared niobium as one of its top strategic metals as it is not mined domestically, is a matter of national security and is important to the nation’s economy. The U.S. imports all of its niobium from Brazil (83%), Canada (12%) and others (5%). With only 3 primary niobium mines globally – all of which have Chinese stakeholders, including a controlling interest at Canada‘s Niobec Mine – a more reliable, long-term niobium supply in North America is needed to secure critical minerals supply chains for strategic industries.

Niobium – an extraordinary and highly versatile superalloy material – is a critical and strategic material essential to many defense and civilian applications (e.g. as an alloying element in high-strength and stainless steel, as a superalloy for aerospace and land-based power generation, and in superconductors). It‘s role in industry is so vital that niobium exhibits demand inelasticity, i.e. demand tends to remain stable even as prices rise. The niobium market is witnessing a growing usage in the automotive industry as lightweight materials and designs are key to enhance fuel economy in ICEs (Internal Combustion Engines) as well as in EVs (Electric Vehicles).

University of Windsor makes significant findings

As announced today by Saville, the University of Windsor completed mineralogical analysis on a suite of rock samples from the Mallard Prospect. This work is part of a research project related to the genesis of the Eldor Carbonatite Complex and its niobium mineralizing event(s). As per the press-release, the main highlights indicated from the preliminary work are as follows:

1. Pyrochlore and columbite are the dominant niobium minerals present

2. There are indications that niobium has been mobilized – a mechanism that could potentially enhance the grade of a deposit

3. Mineralogy supports the model of a continuous niobium mineralized trend through the complex

Saville explained that “Pyrochlore and columbite are the dominant source minerals for niobium globally, and all the work to date by the Company indicates that these are also the primary niobium-bearing minerals present on the Property. In addition, grain sizes for the niobium minerals in the samples analyzed are estimated to range from 0.03 mm to 3 mm, and are most commonly between 0.05 mm and 0.4 mm. These grain sizes are encouraging from a commercial mineral processing perspective (see Figure 1).“

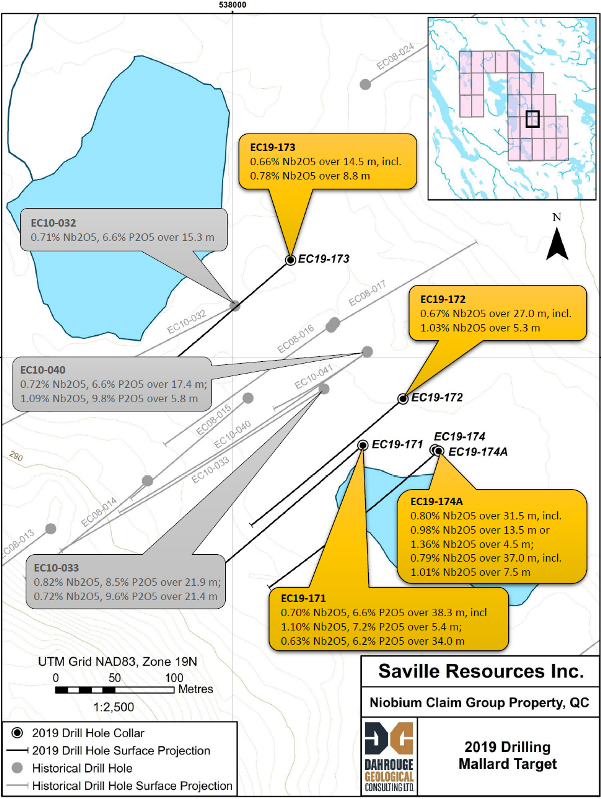

Figure 1: Pyrochlore minerals in carbonate matrix from drill hole EC19-172, which “returned 0.67% Nb2O5 over 27.0 m, including 1.03% Nb2O5 over 5.3 m“ and “bottomed in mineralization at a depth of 240.0 m (core length) with the final sample assaying 0.78% Nb2O5 over 1.5 m“. This drill hole, In combination with other recent and historical holes, “indicate a large and robust niobium mineralized system is present at Mallard“. (Source: Saville news-releases of February 6, 2020, and June 6, 2019)

Roskill (2018) asserted that “Almost all ferroniobium supply is from three industrialised producers, two in Brazil and one in Canada, and is derived from the mineral pyrochlore. Little, if any, pyrochlore enters international trade as it is converted into ferroniobium and other products before export.“

Saville also noted that “From an exploration perspective, the mineralogical work on the Mallard core samples reported herein is very encouraging and supports the prior work completed on surface rock and drill core samples from other niobium-bearing areas of the complex, notably; the Northwest, Miranna, Spoke, and South Mallard areas. Moreover, collectively, the data supports a continuous niobium mineralized trend connecting through these areas, whereby Mallard, and potentially other targets/prospects, form key zones of higher grade – potentially outlining areas where the niobium has preferentially mobilized to augment the grade.“

These preliminary results are great news for Saville, because it underscores the great potential for a major niobium deposit that the company aims to delineate with an upcoming exploration program. Moreover, these results show potential for Saville‘s property to host a similar mineralogy to the Niobec Deposit, also located in Québec.

Parallels to the Niobec Deposit

In today‘s press-release, Saville made the following, highly interesting remarks based on the mineralogical results from the University of Windsor:

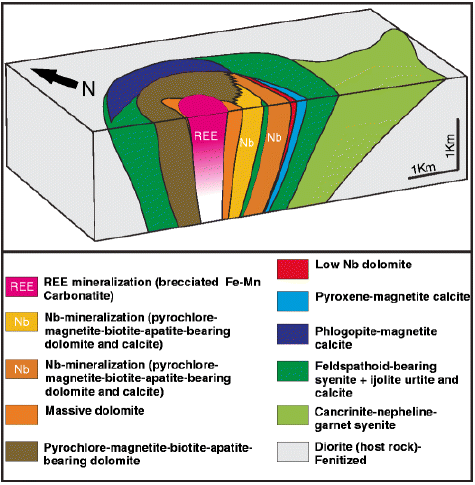

“Numerous parallels may be drawn between the Company’s Mallard Prospect and the Niobec Deposit, part of the Saint-Honoré Carbonatite Complex, located approximately 45 km east of Lac Saint-Jean, Quebec. The Niobec Deposit started production in 1976 – now owned and operated by Magris Resources Inc. – and it currently accounts for 8 to 10% of global production (1, 2). Both Mallard and Niobec are carbonatites, a rock type dominated by carbonate minerals along with common accessory oxides, silicates, apatite, sulphides, fluorite, and barite. The niobium mineralization at Niobec is hosted by fine-grained (0.2 to 0.8 mm) pyrochlore and columbite minerals, while the recently completed mineralogical work reported herein indicate that pyrochlore and columbite are the dominant niobium-bearing minerals at Mallard and are also of similar grain-size to that of Niobec. In addition, at both Mallard and Niobec, the mineralization is present as moderate to steeply dipping elongate lenses. At Niobec, these lenses have been outlined to significant depth (up to 750 m), while at Mallard the lenses remain to be delineated, including at depth, having been drill tested to generally less than 200 m vertically (see news release dated September 16, 2019).“

Sources: (1) www.niobec.com (2) Vallieres, D. et al. 2013, NI 43-101 Technical Report, Update on Niobec Expansion, December 2013. IAMGOLD Corp., 203 pgs.; Management notes that mineralization/operations at Niobec may not necessarily be indicative to the mineralization, or potential for development, of the Company’s Mallard Prospect. To date, no resource has been determined nor economic studies completed for the Mallard Prospect.

Full size / The above cross-section (Simandl & Mackay, 2014) of Québec‘s Saint-Honoré Carbonatite, which hosts the producing Niobec Mine, illustrates that the general geology is similar to the Eldor Carbonatite, which hosts the high-tonnage Ashram Rare Earth and Fluorspar Deposit and the adjoining Niobium Claim Group Property. Also note that the Saint-Honoré Carbonatite not only hosts the Niobec Mine but also a large REE Zone of more than 450 million tonnes at a grade of 1.65% TREO (inferred resources). In other words: It was the niobium deposit which went into production first, although the core of the carbonatite consists of REE mineralization. Who sees a striking resemblance with the Eldor Carbonatite?

Full size / The above figure shows the Eldor Carbonatite, which includes Saville‘s Niobium Claim Group Property (black-dotted; currently under Earn-In Agreement from Commerce Resources for up to 75% interest) surrounding the Ashram Deposit (highlighted in green; 100% owned by Commerce Resources. Saville has renamed the Southeast Area as the Mallard Prospect, where the company‘s maiden drill program (Phase-1) took place in 2019. Several other targets exist on the property, such as Miranna, Spoke, Moira, Northwest, and Star Trench, whereas Saville plans to continue drilling Mallard, and other targets, in Phase-2 in 2020. Miranna is a high-priority and drill-ready target, where prior boulder sampling in the area showed “5.93% Nb2O5 and 1,220 ppm Ta2O5“ with significant phosphatepresent. (Source)

In 2014, IAMGOLD Corp. sold the Niobec Deposit for $530 million USD to Magris Resources Inc., CEF Holdings Ltd. (a Hong Kong based investment company owned 50% by the Chinese conglomerate CK Hutchison Holdings Ltd. from Hong Kong) and Temasek Holdings Ltd. (an investment company owned by the Government of Singapore).

As the Niobec Mine in Québec is the only major niobium producer in North America, with grades averaging 0.42% Nb2O5 (probable reserves), the benchmark for Saville is clear.

As announced by Saville on June 11, 2019, the entire hole EC19-174A returned “0.48% NB2O5 over 265 m“, whereas “Starting from only 17 m depth (core length), results include 0.80% Nb2O5 over 31.5 m, including 0.98% Nb2O5 over 13.5 m or 1.36% Nb2O5 over 4.5 m, as well as a second sub-interval of 1.04% Nb2O5 over 7.7 m. This near-surface mineralization is followed by a second well-mineralized interval, starting from 96.5 m depth (core length)“. A week earlier on June 3, 2019, Saville announced hole EC19-171 assaying “0.51% Nb2O5 over 175.9 m“ (from 6.23 m to 182.16 m core length), whereas hole EC19-172 was announced on June 6, 2019 with assays of “0.40% Nb2O5 over 237.25 m“ (from 2.75 m to 240 m).

Saville‘s niobium project is also attractive thanks to mineralization identified to date indicating a carbonatite host rock, which is also the dominant niobium source globally, making cost-effective conventional processing possible.

Moreover, note that all 3 primary niobium mines currently in production globally have Chinese stakeholders and that an escalating trade war with China may impact niobium supply to the U.S.

With only 3 primary niobium mines currently in production worldwide, the time appears ripe for new supply, especially on the North American continent as the U.S. is still 100% import-reliant for niobium while having classified this superalloy metal as critical for its economic and national security (used e.g. in military aircraft engines, rockets, gas turbines, superconducting magnets).

Niobec (Québec, Canada)

• Deposit: Carbonatite

• Share in world supply: ~7%

• Average grade: 0.35-0.44% Nb2O5

• Owners (purchased from IAMGOLD Corp. for $530 million USD in 2014): Magris Resources Inc., CEF Holdings Ltd. (a Hong Kong based investment company owned 50% by the Chinese conglomerate CK Hutchison Holdings Ltd. from Hong Kong) and Temasek Holdings Ltd. (an investment company owned by the Government of Singapore)

Catalao (Brazil)

• Deposit: Carbonatite

• Share in world supply: ~7%

• Average grade: 0.87-1.48% Nb2O5

• Owner (purchased from Anglo American PLC for $1.5 billion USD in 2016): China Molybdenum Co. Ltd.

Araxa (Brazil)

• Deposit: Carbonatite

• Share in world supply: ~85%

• Average grade: 1.6-2.48% Nb2O5 (but with a low recovery of ~50%)

• Owners: CBMM as well as Chinese, Japanese and Korean consortiums

How to free 4 birds with 1 key

Or, to put it differently: How to solve 4 problems with 1 joint project

Out of the 35 minerals that the U.S. has identified as critical to economic and national security, four are present on Commerce Resources‘ and Saville Resources‘ neighboring properties in Québec: REEs, niobium, tantalum, and fluorspar.

Commerce Resources‘ Ashram Deposit is not only one of the world‘s largest REE deposits but is also one of the largest fluorspar deposit globally. Saville Resources‘ Mallard Prospect “is characterized by numerous drill intersections of high-grade niobium, along with variably associated high grades of tantalum, phosphate, and fluorspar,“ as the company stated in today‘s press-release. As a matter of fact, historical drilling in 2008 on Saville‘s property showed higher fluorite grades (e.g. “31.6% CaF2 over 20.79 m“ in hole EC08-016) compared to Ashram.

In late January 2020 at the Vancouver Resource Investment Conference, the President of Commerce Resources, Chris Grove, gave a presentation with the following remarks:

“In regards to the Canada-U.S. Joint Action Plan, I was asked to come to Montreal last week to present to all of the major Québec funds. This was arranged by Bryan Coates, the outgoing President of Osisko, who has been the Québec Government‘s main liaison between Québec and the U.S. Government... I had a meeting following that with the U.S. Department of Commerce. We will certainly keep you up to date on how this Action Plan may positively be a benefit to Commerce Resources.“

Any success for Commerce Resources in this respect may also be of great benefit for Saville Resources and the development of its niobium-fluorspar project in the same neighborhood.

Chris Grove´s presentation at this year´s VRIC: https://youtu.be/aJntZtXM-f8

The Niobium & Tantalum Chapter within the USGS study “Critical Mineral Resources of the United States“ states the following: “The average abundance of niobium and tantalum in bulk continental crust is relatively low—8.0 parts per million (ppm) niobium and 0.7 ppm tantalum... Niobium and tantalum do not occur naturally as pure metals but are concentrated in a variety of relatively rare oxide and hydroxide minerals, as well as in a few rare silicate minerals. Niobium is primarily derived from the complex oxide minerals of the pyrochlore group ((Na,Ca,Ce)2?(Nb,Ti,Ta)2?(O,OH,F)?7?), which are found in some alkaline granite-syenite complexes (that is, igneous rocks containing sodium- or potassium-rich minerals and little or no quartz) and carbonatites (that is, igneous rocks that are more than 50 percent composed of primary carbonate minerals, by volume)... Brazil and Canada are the leading nations that produce niobium mineral concentrates, but Brazil is by far the leading producer, accounting for about 90 percent of production, which comes mostly from weathered material derived from carbonatites... Identified niobium and tantalum resources in the United States are small, low grade, and difficult to recover and process, and are thus not commercially recoverable at current prices. Consequently, the United States meets its current and expected future needs for niobium and tantalum through imports of mineral concentrates and alloys and through recovery from foreign and domestic alloy scrap that contain the metals... Demand for both niobium and tantalum is expected to increase... Increased demand for niobium is linked to increased consumption of microalloyed steel, which is used in the manufacture of cars, buildings, ships, and refinery equipment. Demand for these steels will likely increase with continued economic development in such countries as Brazil, China, and India. In addition, increased global demand for cars, cell phones, computers, superconducting magnets, and other high-tech devices will likely spur increased demand for both niobium and tantalum.“

Full size

Drill holes with assay summary for Saville‘s Mallard Prospect. (Source)

Company Details

Saville Resources Inc.

#1450 – 789 West Pender Street

Vancouver, BC, V6C 1H2 Canada

Phone: +1 604 681 1568

Email: mhodge@savilleres.com

www.savilleres.com

Shares Issued & Outstanding: 63,415,400

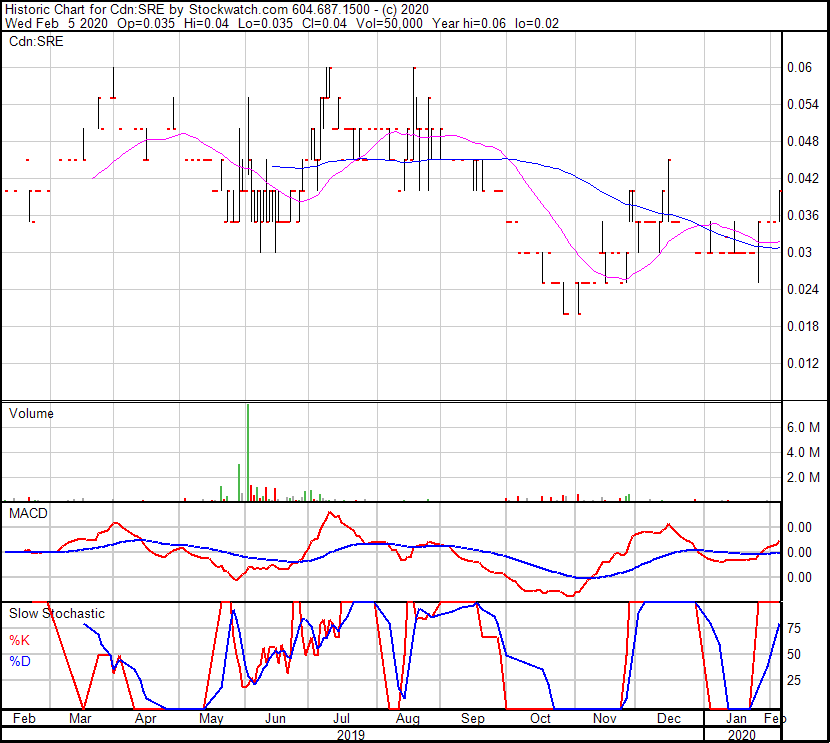

Chart

Canada Symbol (TSX.V): SRE

Current Price: $0.04 CAD (02/05/2020)

Market Capitalization: $3 Million CAD

Chart

Germany Symbol / WKN (Frankfurt): S0J / A2DY3Z

Current Price: €0.0175 EUR (02/05/2020)

Market Capitalization: €1 Million EUR

Previous Coverage

Report #10 “Fluorspar: The Sweet Spot for Quebec‘s Steel and Aluminium Industries“

Report #9: “Saville reports impressive niobium drill results from Quebec, outshining previous holes and many other niobium projects globally“

Report #8: “On A Winning Streak In The Midst Of Trade Wars: Saville Drills High-Grade Niobium In Quebec“

Report #7: “Saville to start drilling for a niobium discovery in Quebec“

Report #6: “Saville Discovers High-Grade Niobium-Tantalum Boulders, And Possibly The Source, Ahead Of Drilling“

Report #5: “Strong potential for discovery of niobium-tantalum deposit(s) of significance, says independent report filed today“

Report #4: “Saville Releases High-Grade Assays from the Niobium Claim Group“

Report #3: “Eager to Start the Treasure Hunt for Niobium in Quebec“

Report #2: “Win-Win Situation to Develop One of the Most Attractive Niobium Prospects in North America“

Report #1: “Saville Resources: Getting Ready“

Company Details

Commerce Resources Corp.

#1450 - 789 West Pender Street

Vancouver, BC, Canada V6C 1H2

Phone: +1 604 484 2700

Email: cgrove@commerceresources.com

www.commerceresources.com

Shares Issued & Outstanding: 41,476,083

Chart

Canada Symbol (TSX.V): CCE

Current Price: $0.315 CAD (02/05/2020)

Market Capitalization: $13 Million CAD

Chart

Germany Symbol / WKN (Tradegate): D7H0 / A2PQKV

Current Price: €0.207 EUR (02/05/2020)

Market Capitalization: €9 Million EUR

Previous Coverage

Report #32 “Already Big Ashram Gets Bigger And Bigger“

Report #31 “Fluorspar: The Sweet Spot for Quebec‘s Steel and Aluminium Industries“

Report #30 “Lean and Mean: A Fighting Machine“

Report #29 “Like A Phoenix From The Ashes“

Report #28 “SENKAKU 2: Total Embargo“

Report #27 “Technological Breakthrough in the Niobium-Tantalum Space“

Report #26 “Win-Win Situation to Develop One of the Most Attractive Niobium Prospects in North America“

Report #25 “The Good Times are Back in the Rare Earths Space“

Report #24 “Commerce Resources and Ucore Rare Metals: The Beginning of a Beautiful Friendship?“

Report #23 “Edging China out of Rare Earth Dominance via Quebec‘s Ashram Rare Earth Deposit“

Report #22 “Security of REE Supply and an Unstoppable Paradigm Shift in the Western World“

Report #21 “Commerce well positioned for robust REE demand growth going forward“

Report #20 “Commerce records highest niobium mineralized sample to date at Miranna“

Report #19 “Carbonatites: The Cornerstones of the Rare Earth Space“

Report #18 “REE Boom 2.0 in the making?“

Report #17 “Quebec Government starts working with Commerce“

Report #16 “Glencore to trade with Commerce Resources“

Report #15 “First Come First Serve“

Report #14 “Q&A Session About My Most Recent Article Shedding Light onto the REE Playing Field“

Report #13 “Shedding Light onto the Rare Earth Playing Field“

Report #12 “Key Milestone Achieved from Ashram’s Pilot Plant Operations“

Report #11 “Rumble in the REE Jungle: Molycorp vs. Commerce Resources – The Mountain Pass Bubble and the Ashram Advantage“

Report #10 “Interview with Darren L. Smith and Chris Grove while the Graveyard of REE Projects Gets Crowded“

Report #9 “The REE Basket Price Deception & the Clarity of OPEX“

Report #8 “A Fundamental Economic Factor in the Rare Earth Space: ACID“

Report #7 “The Rare Earth Mine-to-Market Strategy & the Underlying Motives“

Report #6 “What Does the REE Market Urgently Need? (Besides Economic Sense)“

Report #5 “Putting in Last Pieces Brings Fortunate Surprises“

Report #4 “Ashram – The Next Battle in the REE Space between China & ROW?“

Report #3 “Rare Earth Deposits: A Simple Means of Comparative Evaluation“

Report #2 “Knocking Out Misleading Statements in the Rare Earth Space“

Report #1 “The Knock-Out Criteria for Rare Earth Element Deposits: Cutting the Wheat from the Chaff“

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Saville Resources Inc., Commerce Resources Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Saville Resources Inc.´s and Commerce Resources Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through their respective profiles on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds a long position in Saville Resources Inc., Commerce Resources Corp. and Zimtu Capital Corp., and is being paid by Zimtu Capital Corp., which company also holds a long position in Saville Resources Inc. and Commerce Resources Corp. Note that Saville Resources Inc. and Commerce Resources Corp. pay Zimtu Capital Corp. to provide this report and other investor awareness services. Also, Zimtu Capital Corp. is an insider and control block of Saville Resources Inc. by virtue of owning more than 20% of Saville Resources Inc.’s outstanding stock.