The disruptive forces of the Internet, technology, streaming and OTT [over-the-top] services are well known. They have not only created new industries but forced existing entities to change their business models in order to survive. This is particularly true of the media and entertainment industry, which has seen a tremendous shakeup over the last two decades.

One of the major disruptors has been the onset of streaming music. This industry is still in its relative infancy but has sent shock waves across both the recording and the distribution sides of the business.

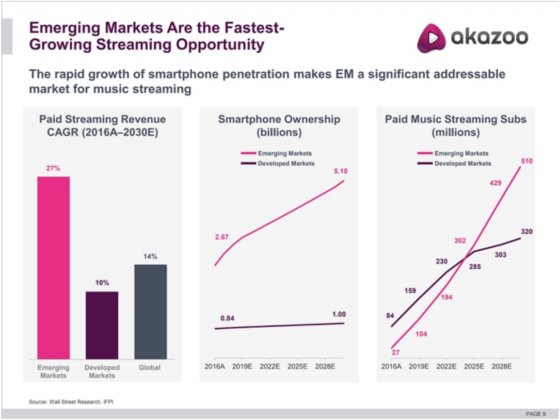

After over a decade of decline, the global music industry is now one of the fastest-growing segments in media and entertainment, with digital music streaming the driving force behind this. Streaming revenues are projected to grow at a 14% CAGR [compound annual growth rate] globally for the next decade, according to Wall Street research/Goldman Sachs research, with the CAGR for emerging markets expected to be nearly double that, at 27%.

Akazoo (SONG:NASDAQ) is a music-streaming and technology company with a core competency and strategic focus on emerging markets. After the initial public offerings (IPOs) of Spotify and Tencent Music in the last two years, Akazoo became the third publicly listed pureplay music streamer in the US.

Akazoo is led by its founder and CEO Apostolos Zervos. After graduating from Yale, he moved to Europe and begin working on some of the earliest mobile marketing campaigns. He later joined a London-based mobile VAS [value-added service] company listed on the London Stock Exchange, where he served as Chief Strategy Officer and created Akazoo in 2010. In 2015, after growing the company to one million subscribers, Apostolos spun the company out and raised outside capital from ToscaFund's Tosca Penta Capital. Unlike most music-streaming executives, Apostolos comes from the telco side, where he cut his teeth developing consumer mobile propositions for telcos. This is important because the ability to monetize a mobile service through telcos is key to competing successfully in emerging markets.

In September last year, Akazoo merged with veteran media exec Lew Dickey's Modern Media Acquisition Corp. Lew cofounded and built Cumulus Media over 18 years into the second largest radio company. He understands the secular shifts in music and cosponsored Modern Media Acquisition Corp. to capitalize on them. After looking at over 140 companies, Modern Media Acquisition Corp. selected Akazoo, and the company agreed to become its merger partner, enabling them to go public through a reverse merger. He stated that Akazoo was the best fit for his merger criteria of a well-positioned company, ready to be public with strong competitive moats, high secular growth and an excellent management team.

Akazoo is growing rapidly and is well positioned at the confluence of several major trends in media. Its positioning in the industry, along with unique aspects of the business model, have Akazoo primed to continue its rapid growth for the foreseeable future while making it a likely acquisition candidate longer term.

Akazoo Streaming to Emerging Markets

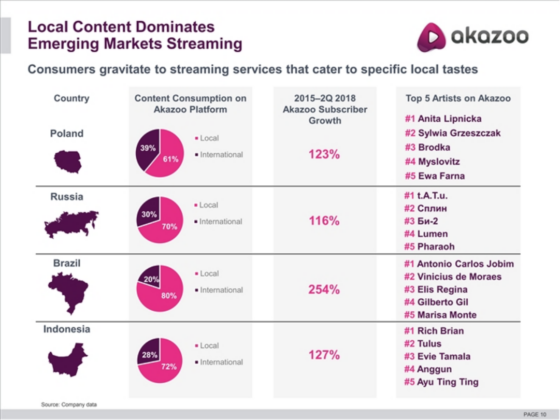

Akazoo is a global music streaming platform with a "hyper-local" strategy that focuses on delivering local and international music in over 25 markets across the world. The company's platform allows users access to Akazoo's expansive library of over 45 million songs, however the key to its success in each market has been the large amount of localized content available. Akazoo's app is tailored for each market, including language and local artists.

Source: Akazoo

The hyper-local focus is a key differentiator for Akazoo when competing in a market dominated by larger competitors. Here in the U.S., when one thinks about streaming music, the typical names that come to mind are Spotify, Pandora and Apple. These are big companies with many users, in mostly Western markets, and deep pockets. That's the good news.

The bad news for these companies is that the developed market is much more mature. Growth is slowing and there is strong competition. Meanwhile, their platforms' use, functionality and focus is driven by and designed to meet the demands of the large audiences in their primary developed markets. This makes them less adaptable and enjoyable for users in developing or emerging non-English speaking markets.

This is not to say that the market for streaming in the U.S. and Europe isn't growing. Streaming music is still in the relatively early days of adoption. The millennials have taken it up quickly, but the boomers are only slowing catching on. There is room to grow.

However, the growth opportunity in the emerging markets is substantial. According to Wall Street Research and IFPI [International Federation of the Phonographic Industry], in 2016 there were 86 million paying music streamers in developed markets versus 27 million in emerging markets. Predictions are for the number of paying users in emerging markets to surpass developed ones by 2022, and it doesn't stop there. By 2028, they forecast 510 million paying users in emerging markets. That's almost 20X growth over the 12 years starting in 2016.

Source: Akazoo

Akazoo should be well positioned to benefit from the growth in emerging markets. Of the 25 markets in which Akazoo operates, it is a top three player in over half. So, while Spotify, Apple and Pandora are tough competitors here in the U.S., in Akazoo's markets, which have 90%+ Android phones and hardly any IOS, they are less so.

Akazoo's Telco Relationships Will Drive Growth and Are a Key Differentiator

Operating in emerging markets comes with its own challenges. The streaming music business models that work in the U.S. and western European markets sometimes don't apply to places that differ economically and culturally and where common payment methods aren't broadly used. For instance, all U.S. premium music subscribers pay with credit or debit cards—cards that many people don't have in some markets.

In these emerging markets, the smartphone is rapidly becoming the most common payment device. Users will prepay their phone companies and then use that money to pay for some services. This is an area in which Akazoo excels and is important for multiple reasons.

Akazoo has billing relationships with over 80 telecom service providers. This means that, on their prepaid phones, they can stream music over Akazoo's network and Akazoo bills via the telco. In emerging markets, these relationships allow Akazoo to profit where others might struggle.

The partnerships with telcos has the added benefit of driving growth. One of the conundrums facing companies with many users is how to keep them engaged and to monetize the base. OTT is stealing business from them. As this article (4 Monetization Opportunities for Wireless Operators) says, they need to start embracing OTT. Bringing their customers to Akazoo would be a win/win in that situation.

Investors should expect to see the telcos become much more involved partners in the space. They are also getting active on the mergers-and-acquisitions (M&A) side, as witnessed by Sprint's acquiring 33% of Tidal, Jay-Z's streaming service. Sprint realizes that their customers are going to stream music; they would like to be the preferred supplier to them.

This effort to monetize users also extends beyond traditional telecom companies to others with large bases. One of the biggest announcements for Akazoo last year was its partnership with Viber, announced in November. Here's what Viber's chief revenue officer had to say about this partnership:

"Viber's mission has always been to bring fun and valuable solutions to users in the palm of their hands. We are loving the experience we've created with Akazoo to give users a more natural and conversational way for them to discover new music and enhance their experience directly within the Viber app."

Viber has over a billion users of their messaging platform. By combining social networking with music, Viber hopes to have a deeper engagement with their users. Meanwhile, a billion potential users could be game-changing for Akazoo.

I don't think investors should underestimate the importance of Akazoo's telco relationships. Not only do they provide them with access to users in emerging markets where the payment platforms differ, but Akazoo has an opportunity to be a value-added partner for mobile network operators. It's a major advantage over their competitors.

Yet Akazoo Trades at a Discount to Its Peers

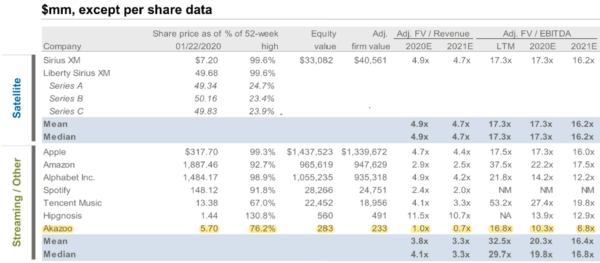

Despite being in the more rapidly growing emerging markets; and despite having a hyper-local focus that has made them a top player in most of their markets; and despite having a barrier to entry through their telecom partnerships and patented technology, Akazoo trades at a discount to its competitors.

Some might suggest that a discount is warranted due to the nature of being in emerging markets instead of the more developed ones. However, Tencent Music is operating in China and has a higher multiple than even Spotify. In lieu of focusing on the faster growth, some investors might be concerned about the per user revenue generation opportunity. This is a valid comment as Akazoo does indeed generate less on a premium member than most of its peers who are in developed markets.

However, that metric is rather meaningless until the market is saturated. While it's growing rapidly, with greater upside in the raw number of users, I would suggest that investors should focus on Akazoo's growth rate, its gross margins, and its ability not only attract, but retain, paying members. In each of these instances, Akazoo is on a par with or ahead of its competition, which means lifetime value is often at par with peers in developed markets

After the company published strong Q3 results in December, it took its revenue guidance up for 2019 to €136 million. The Street has estimates for 2020 of around €200 million. This would result in growth rate of over 45%, if the company can hit those numbers. Compared with companies like Spotify, which is growing at around 25%, Akazoo is blowing the field away.

It is also inline to do better than its peers in terms of gross margin, which is to be expected in a streaming business. However, looking at customer churn, one can see that Akazoo is obviously doing something right as it has a relatively sticky service. Its churn rate is close to 3% monthly, far below that of Spotify, which runs at 4.6% globally.

Best-in-class financial performance and growth should translate into a higher valuation, but this is where the opportunity comes in with Akazoo. As I mentioned, despite being faster growing with more upside, Akazoo trades at a substantial discount to their peers.

As the above valuation slide from a Wall Street bank clearly demonstrates, Akazoo has been valued by the market at a great discount to the competition on almost every metric. At the current share price it is trading well below 1x 2020 revenues and less than 10x EV/EBITDA [enterprise value/earnings before interest, taxes, depreciation and amortization].

Interestingly, this discount is despite Akazoo being one of the few profitable players in the space. Its profit margin is solid at 8% EBITDA margins, which should be able to climb to around 15%, with the continued double-digit topline growth expected over the next few years.

Driving this profit is a better LTV:CAC ratio than its peers. LTV is the long-term value of each premium customer and CAC is the customer acquisition cost of a new customer. Akazoo has a LTV:CAC ratio of 3-4x, meaning every dollar invested in customer acquisition (i.e., marketing) returns $3–4 over the life of the customer. Despite this, and the great upside in potential users, Akazoo trades at a lower value per subscriber than peers as shown below.

This is a slide from an Akazoo presentation in early 2019, so obviously a little dated, but it shows another metric at which it is undervalued. At the current share price and subscriber numbers the metric is closer to EUR 45 per premium sub.

IP Provides More Potential Upside

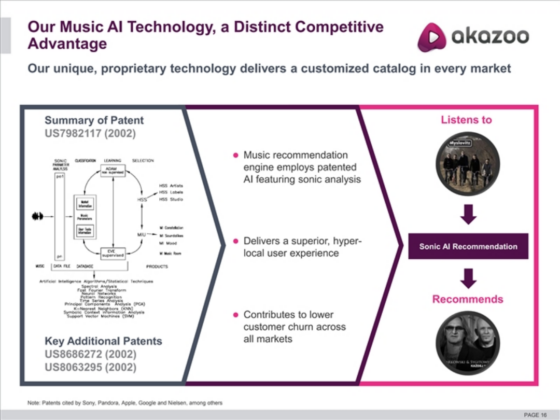

Akazoo's patent portfolio is almost like an aside to the investment story of an emerging markets streaming company, but intellectual property (IP) provides an interesting angle for investors in Akazoo. How so? In its presentation, Akazoo discusses how its "unique, proprietary technology delivers a customized catalogue in every market."

But, that doesn't sound too exciting. Don't all music companies make recommendations and provide customized playlists? They certainly do. What is not so well known, nor publicized too much by the players in this space, is that Akazoo owns the only sonic recommendation patents in the world. These patents are cited by major players such Amazon, Pandora, Sony and Echo Nest (later acquired by Spotify).

I don't believe investors should be buying Akazoo based on these patents or the potential future royalty streams alone. It's got a long way to play out and one never knows how these things end. But, let me just state that the patents owned by Akazoo have never been enforced by the company and one of the use of proceeds on its going-public financing is to put a valuation on these patents and implement a framework for royalty streams. Royalties could generate millions of dollars in IP licensing revenue per annum. Investors need to stay tuned to this.

Management Will Deliver

I started this article by speaking about Lew Dickey. Lew was a cofounder of Cumulus Media. At its peak, Cumulus was the second largest radio broadcast corporation in America. Lew is a mogul in the media business and will be extremely helpful to Akazoo in its future organic and inorganic growth.

Beyond Lew, the rest of the management team is smart and committed. CEO Apostolos Zervos founded Akazoo in 2010 and has broad prior experience working with telcos. The CFO, Pierre Schreuder, has an excellent background in banking and has led many M&A deals in the past. I have spoken with management multiple times and am very impressed across the board.

It's also important to note that the markets in which Akazoo operates are ripe for smaller, tuck-in acquisitions. I would expect to see this management team rely upon their experience to accelerate growth even faster by purchasing some of the smaller, but well-positioned, competitors that exist in emerging markets. If acquisitions take place, I would expect them to be highly accretive to the company.

But, as it is with all companies, execution is what matters most. The streaming industry is young, dynamic and growing. Fortunes are being made and lost as the world shifts to a streaming model. The emerging markets are growing rapidly and there will be consolidation in this space. Akazoo has itself well positioned to benefit from these changes and has the right team in place to execute on this vision.

The company is in high growth markets. It is profitable and have a very strong balance sheet ($45 million in cash; no debt) to attack these markets. The management has a track record of building companies and engaging in M&A. And, shares are trading at a discount to its competition. I don't suspect that the company will be at a discount, or even a standalone entity, within a couple years.

Wall Street forecasts are for the company to achieve over $220 million in revenue in 2020. With a very strong Q3 announced in December, along with positive guidance, 2021 numbers should show a dramatic increase; Macquarie has already published a $268 million estimate, which is over 20% growth.

This kind of growth and a leadership position in the market should command a higher multiple. It should also attract interest from the larger players in the space, who will soon enough need to look beyond established markets to maintain their growth. Akazoo could very well be on the radar screen of larger companies within the next year or two.

Also, the company is well positioned to be a near term consolidator with highly accretive acquisitions across its territories. This is certainly within the style of Lew Dickey and his lengthy M&A background.

I'm buying shares in Akazoo for many reasons. I like the space, I like its approach, and I like the management. I also love the valuation and expect that only to improve through both organic and acquisition growth. With strong numbers continuing to come through I don't expect to see it here for too long.

Daniel Carlson is the founder and managing member of Tailwinds Research Group and its parent company DFC Advisory Services, which is a licensed registered investment advisor (CRD # 297209). Tailwinds is a microcap focused research company that provides research on and consults to over 20 emerging growth companies in the technology and life sciences arenas. DFC Advisory Services is an RIA that manages money dedicated to investing in the companies covered by Tailwinds. For more information on these two companies and their track record, please see www.tailwindsresearch.com. Prior to founding these two entities, Dan spent many years working with small public companies, having been CFO of two public companies and helping finance many others. A 1989 graduate from Tufts University with a degree in Economics, Dan’s formative years in business were spent as an equity trader, first on the Pacific Coast Stock Exchange then on the buyside at several multi-billion dollar firms.

This article was submitted by Tailwinds Research. For more information on Tailwinds Research or on Akazoo, please visit www.tailwindsresearch.com.

Tailwinds owns stock in Akazoo. For a complete list of disclaimers and disclosures, please click here.

Disclosure:

1) Daniel Carlson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Akazoo. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies referred to in this article: Akazoo. Additional disclosures and disclaimers are above. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Tailwinds' Disclaimers & Disclosures: For a full list of disclaimers and disclosures, please visit https://tailwindsresearch.com/disclaimer/.