The markets went risk-on last week following better-than-expected economic data releases, as China virus fears eased. This week we will have a lot of Fed talk and another pretty important set of economic data releases. Let’s take a look at the details.

The week behind

The

corona virus fears eased last week, as financial markets reacted to better-than-expected economic data releases, U.S. quarterly corporate earnings. Overall, we’ve seen a risk-on trading action. The stock market has reached new record highs, but

gold fluctuated following recent advances. Friday’s

Nonfarm Payrolls,

Unemployment Rate were the most important economic data releases of the week. However, they were pretty much mixed and the markets were going sideways.

Let’s take a look at 30-minute chart of the

S&P 500futures contract. The market was advancing following Friday’s Nonfarm Payrolls release, but then it has quickly reversed lower. However, we didn’t see that much of changes. And later in the day stocks were declining ahead of weekend’s pause and some China virus uncertainty:

The week ahead

The week ahead

What about the coming week? We will have a lot of so-called

Fed talk this week, including Tuesday’s-Wednesday’s Testimony from

Powell. Then the markets will be focusing on two important economic data releases: Thursday’s

CPI and Friday’s

Retail Sales number. On Tuesday we will get the

GDP number in the U.K. Investors will continue to react to

quarterly earnings releases. Let’s take a look at key highlights:

- Friday’s U.S. Retail Sales number will be the most important economic data release this week.

- We will also have Jerome Powell’s Testimony on Tuesday and Wednesday.

- The U.S. Consumer Price Index will be released on Thursday.

- Tuesday’s U.K. GDP number release will be important for the British Pound currency pairs.

- There will also be some quarterly corporate earnings releases this week.

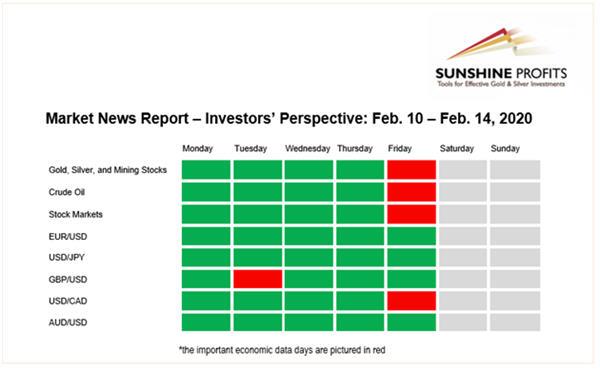

You will find this week’s the key news releases below (EST time zone). For your convenience, we broken them down per market to which they are particularly important, so that you know what to pay extra attention to, if you have or plan to have positions in one of them. Moreover, we put the particularly important news in bold. This kind of news is what is more likely to trigger volatile movements. The news that are not in bold usually don’t result in bigger intraday moves, so unless one is engaging in a particularly active form of

day trading, it might be best to focus on the news that we put in bold. Of course, you are free to use the below indications as you see fit. As far as we are concerned, we are usually not engaging in any day trading during days with “bold” events on a given market. However, in case of more medium-term trades, we usually choose to be aware of the increased intraday volatility, but not change the currently opened position.

Our Market News Report consists of two different time-related perspectives. The investors’ perspective is only suitable for the long-term investments. The single economic data releases rarely cause major outlook changes. Hence, we will only see a handful of bold markings every week. On the other hand, the traders’ perspective is for traders and day-traders, because the assets’ prices are likely to react on a single piece of economic data. So, there will be a lot more bold markings on potentially market-moving news every week.

Investors’ Perspective

Gold, Silver, and Mining Stocks

Gold, Silver, and Mining Stocks

Tuesday, February 11

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

Wednesday, February 12

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

Thursday, February 13

- 8:30 a.m. U.S. - CPI m/m, Core CPI m/m, Unemployment Claims

Friday, February 14

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

Crude Oil

Tuesday, February 11

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

- 4:30 p.m. U.S. - API Weekly Crude Oil Stock

Wednesday, February 12

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

- 10:30 a.m. U.S. - Crude Oil Inventories

Thursday, February 13

- 8:30 a.m. U.S. - CPI m/m, Core CPI m/m, Unemployment Claims

Friday, February 14

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

Stock Markets

Tuesday, February 11

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

Wednesday, February 12

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

- After Close U.S. – CSCO Quarterly Earnings

Thursday, February 13

- 8:30 a.m. U.S. - CPI m/m, Core CPI m/m, Unemployment Claims

- After Close U.S. – NVDA Quarterly Earnings

Friday, February 14

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m, Import Prices m/m

- 9:15 a.m. U.S. - Industrial Production m/m, Capacity Utilization Rate

EUR/USD

Tuesday, February 11

- 9:00 a.m. Eurozone - ECB President Lagarde Speech

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

Wednesday, February 12

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

Thursday, February 13

- 8:30 a.m. U.S. - CPI m/m, Core CPI m/m

Friday, February 14

- 2:00 a.m. Eurozone - German Preliminary GDP q/q

- 5:00 a.m. Eurozone - Trade Balance, Flash GDP q/q, Flash Employment Change q/q

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

USD/JPY

Tuesday, February 11

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

- All Day, Japan - Bank Holiday

Wednesday, February 12

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

Thursday, February 13

- 8:30 a.m. U.S. - CPI m/m, Core CPI m/m

Friday, February 14

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

GBP/USD

Tuesday, February 11

- 4:30 a.m. U.K. - GDP q/q

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

- 10:35 a.m. U.K. - BOE Governor Carney Speech

Wednesday, February 12

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

Friday, February 14

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

USD/CAD

Tuesday, February 11

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

Wednesday, February 12

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

Thursday, February 13

- 8:30 a.m. U.S. - CPI m/m, Core CPI m/m

Friday, February 14

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

- 9:15 a.m. U.S. - Industrial Production m/m, Capacity Utilization Rate

AUD/USD

Tuesday, February 11

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

Wednesday, February 12

- 10:00 a.m. U.S. - Fed Chair Powell Testimony

- 7:15 p.m. Australia - RBA Governor Lowe Speech

Thursday, February 13

- 8:30 a.m. U.S. - CPI m/m, Core CPI m/m

Friday, February 14

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

We hope you enjoyed reading the above free analysis, and we encourage you to read today's Market News Report - this analysis' full version. The full Alert includes also the

Traders’ Perspective which is very useful for the people who trade within shorter time frames. There's no risk in subscribing right away, because there's a 30-day money back guarantee for all our products, so we encourage you to

subscribe today.

Check more of our free articles on our website – just drop by and have a look. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts.

Sign up for the free newsletter today!

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Paul Rejczak and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Paul Rejczak and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Rejczak is not a Registered Securities Advisor. By reading Paul Rejczak’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Paul Rejczak, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.