There are times I want to grab the average investor by the stacking swivel and give them a good hard shake. While the shares are up about 35% since the first of the year, they took a 15% tumble on Friday when the company announced the first deep hole.

Strong investors in Irving should wave at the weak hands and remind them to not let the swinging door bang them on the butt on their way out.

On January 17thIrving Resources Inc. (IRV:CSE; IRVRF:OTCBB)released results from seven holes drilled at the Omui Mine. Six of the holes delivered significant results. These were shallow holes and not expected to hit much. The intercepts exceeded expectations.

Hole 10 was the first deep hole drilled on the project at either the mine or the sinter. It was intended to intercept an attractive target revealed by the CSAMT program conducted by Newmont's top guys. Quinton Hennigh has always wanted to drill deep, believing the goodie locker would be located deeper than 350 meters.

Quinton did give some hints in the press release about Hole 10 saying numerous quartz veins were intercepted and at least nine revealed particles of electrum. When the Hole 10 results came out on Friday, the company reported having intercepted 21 individual Au-Ag veins. Hole 10 was actually the very first hole to reach the primary target zone.

The weak hands promptly sold the shares down 15%. Sometimes you just can't fix stupid.

Hole 9 was another shallow hole and it had results worthy of mention. The assays from 9 and 10 came back together so they were released together.

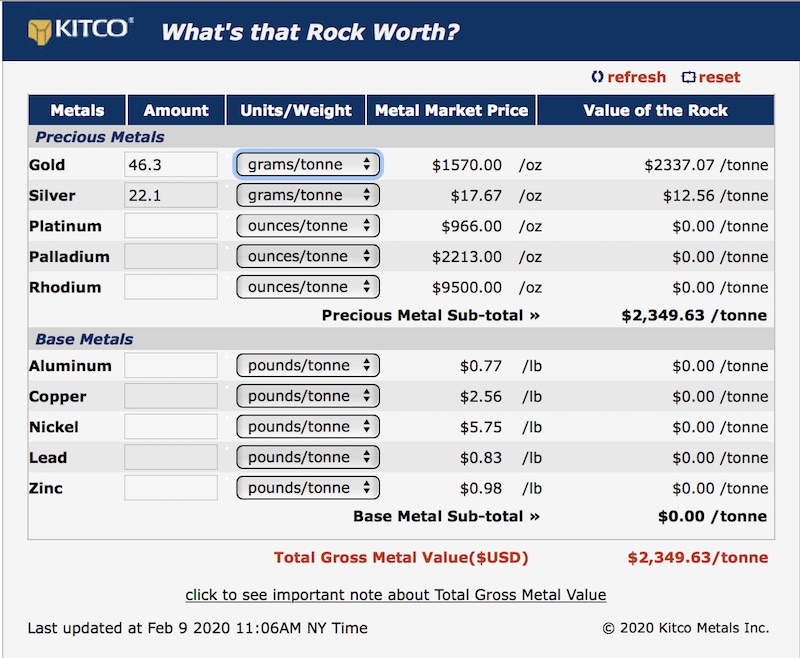

From 190.0 to 190.8 meters down hole results over the 0.80 meters showed 46.3 g/t Au and 22.1 g/t Ag. That's $2350 per ton rock.

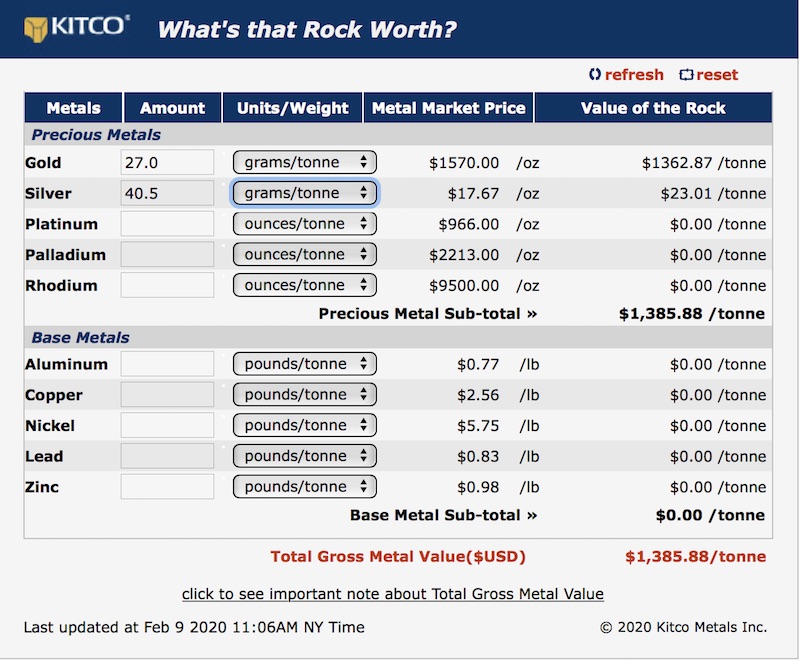

Hole 10 started off with a bang with the first three meters from surface showing 27.0 g/t Au and 40.5 g/t Ag. That's $1386 rock.

From 117.0 to 118.1 meters down hole came up with 29.6 g/t Au and 36.5 g/t Ag over 1.1 meters. That's $1515 rock.

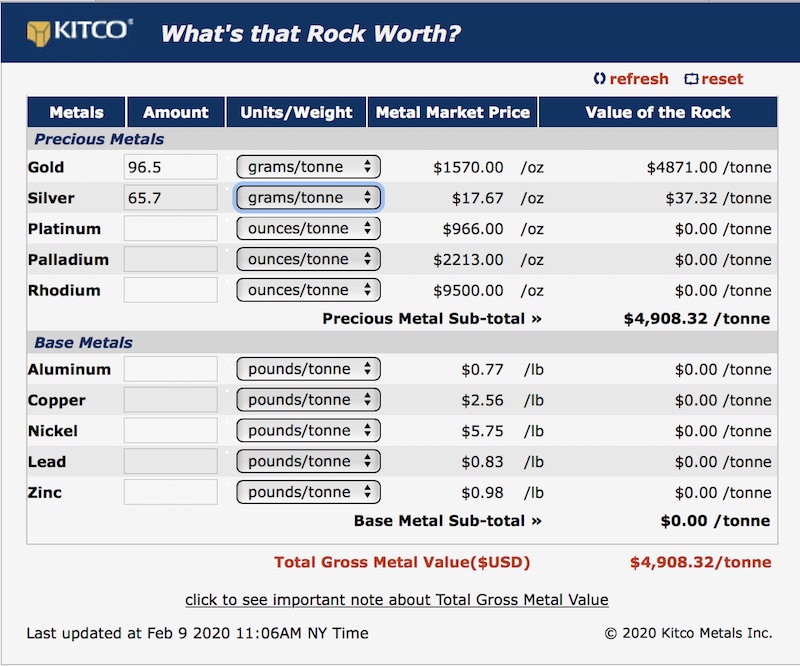

That last intercept included 0.30 meters of 96.5 g/t Au and 65.7 g/t Ag worth $4,908 rock.

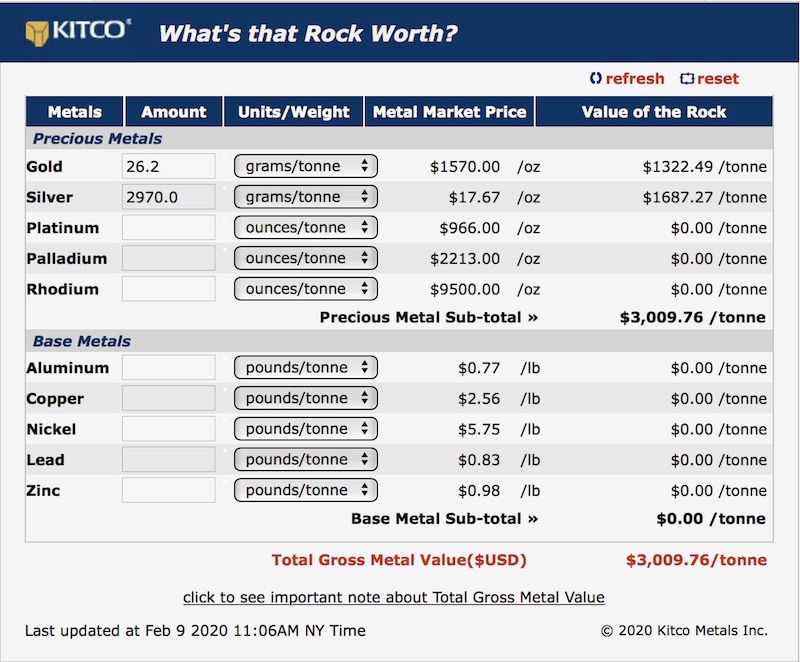

The system appears to have a silver rich pulse as well as the gold rich pulse. From 454.8 meters to 455.1 meters assays showed 26.2 g/t Au and 2970 g/t Ag over 0.30 meter. That's $3,010 rock.

You will never make money in investing by being smart. You make money by realizing when others are being stupid.

This is the best initial drill program that I have ever seen. But the adventure is still ahead of Irving. At some point these numbers will get really boring. That might be a good time to sell.

My numbers indicate that 90% of the shares are in the hands of the top dozen shareholders. What goes down will go up. And quickly.

Irving is an advertiser. I have bought shares in the open market and in every private placement. Naturally I am biased.

Meanwhile I have been making belt buckles out of slabbed material that Quinton sent me.

Irving Resources

IRV-C $3.85 (Feb 7, 2020)

IRVRF OTCBB 53.4 million shares

Irving Resources website.

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Irving Resources. My company has a financial relationship with the following companies mentioned in this article: Irving Resources is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Irving Resources, a company mentioned in this article.