Gold rally goes on, reaching almost $1,700 per ounce. What the heck is just happening in the precious metals market?

Gold Rallies Above $1,680

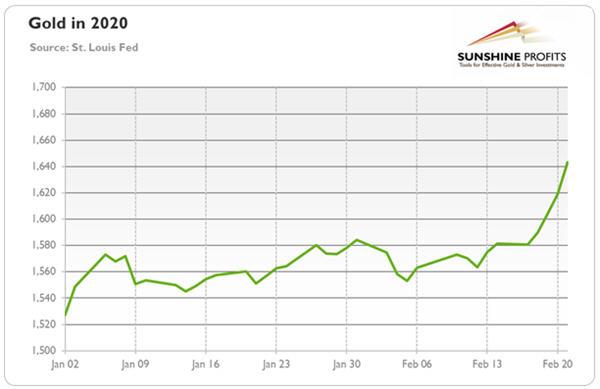

Wow, what an escalation! On Thursday, we reported that gold jumped above $1,600. On Friday,

its price surpassed $1,640, as the chart below shows. And today morning, it has rallied even further,

reaching $1,684.

Chart 1: Gold prices in 2020 (London P.M. Fix).

It means that the price of gold has already risen about 11 percent this year, and more than 8 percent since the coronavirus epidemic outbreak in China. It confirms that

gold is a safe-haven asset.

Coronavirus Fears Mount

The new coronavirus, which has been officially named “COVID-19”, caused a real emotional roller-coaster among investors. They alternately panic and calm down. When Apple announced lower profits than expected due to the coronavirus and disrupted manufacturing production in China, the stock markets plunged. But they rebounded later.

And they plummeted again, because of the multiple outbreaks beyond China.

As of today’s morning, there were 77,150 confirmed cases in mainland China and 79,434 confirmed cases in the whole word. The total death toll was 2,620, among which 27 deaths occurred outside mainland China. This number is still very low, especially compared to the grave situation in the country of origin, but one week ago, only five deaths had taken place outside China.

Major outbreaks were reported in Iran, South Korea and Italy, where, respectively, eight, seven and three people died.

In South Korea, 70 additional coronavirus cases have been confirmed on Monday, bringing the country’s total number to 833. Italy reports 157 total cases, while Iran 43. The government of South Korea has increase its anti-virus alert to the highest level, allowing temporary closures of schools and limiting flights to and from the country. Meanwhile, Italian authorities have put about a dozen towns in the northern part of the country into quarantine, closed public buildings, and banned public gatherings, including carnival events in Venice, in order to contain

the biggest coronavirus outbreak in Europe.

The increase in cases in Iran, South Korea and Italy renewed fears that the new coronavirus is spreading globally despite all the travel restrictions.

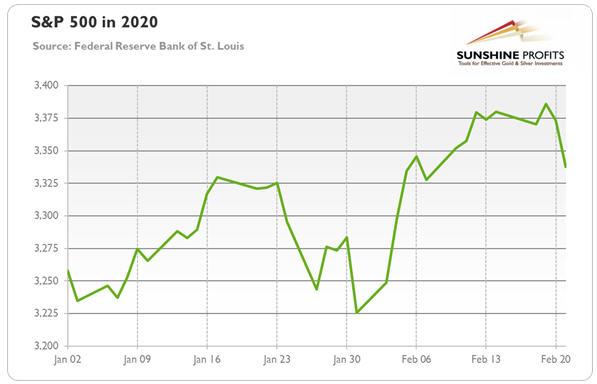

These concerns led to the sell-off in the global stock markets. Indeed, the Stoxx Europe 600 Index dropped 3.4 percent, while the South Korea’s benchmark dropped 3.9 percent. Meanwhile, futures on the three main U.S. stock indexes were all down more than 2 percent, while the long-term

bond yields sank to their lowest level since 2016. The

S&P 500 has dropped around 1.4 percent since its peak, as the chart below shows.

Chart 2: S&P 500 Index in 2020.

Implications for Gold

Implications for Gold

What does it all mean for the yellow metal? Well, the renewed fears are clearly positive for the gold prices. However,

these fears may be a bit overblown. The coronavirus is slowing in China. Although it may be gaining traction elsewhere right now, it should be contained ultimately. So, when the fears recede, the demand for the safe-haven assets might decrease. The correction is, thus, possible. But correction does not imply the

bear market. Actually, I am of the fundamental opinion that the

bull market in gold has begun some time ago. And, importantly, the recent fears have pushed the long-term

interest rates down. The

yield curve has inverted again. This inversion will revive the recessionary fears and push the

Fed to cut the

federal funds rate at least once this year. After all, we would have already had a full-blown

recession, but Fed quickly adjusted its

monetary policy in a response to the inverted yield curve, providing additional accommodation. With fears mounting and yields declining, the US central bank could be forced to intervene again.

In such an environment,gold should shine.

If you enjoyed today’s free

gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly

Gold Market Overview reports and we provide daily

Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to

subscribe today.

If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits – Effective Investments Through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Trading Alerts.