With new cases of COVID-19 outside China rising, the chances of a pandemic and global recession have increased recently. What are the implications for the gold market?

Coronavirus Spreads Over the World

Unfortunately, the new coronavirus remains the hottest topic of the news. Although the COVID-19 epidemic has been slowing down in China since the beginning of February, it has quickly spread to several other countries. The WHO’s situation report from February 26 says that the infections of the new coronavirus has been reported in 37 countries. Actually, for the first time since the beginning of the epidemic on December 8,

there have been more new cases reported from countries outside of China than from China. With so many countries, including the Western ones, struggling with the disease, the COVID-19 ceased to be Asian issue and has become a truly global issue. As world inches closer to the real pandemic, the financial markets could become even more nervous, so

we could see more safe-haven flows into the gold market.

Recessionary Odds Increase

Although the COVID-19 outbreak has not evolved yet into the full-blown and officially declared pandemic,

it has already infected the global economy. This is because the new coronavirus has hit not West Africa (as Ebola) or China’s from 2003 (as SARS), but the very second biggest economy in the world (according to nominal

GDP; according to the

PPP, the largest!) which is the center of manufacturing and global supply chains. And although it is true that the COVID-19 is less lethal than previous viruses, investors should acknowledge that the majority of the economic costs associated with epidemics comes not from the increased mortality or morbidity, but from the behavioral changes of people who fear the infection, so they reduce their activities.

The world’s economic growth in 2019 was barely above the recessionary threshold of 2.5 percent. The recent increase in cases in Japan and Italy, which are both large economies already on the brink of recession, should hamper the global growth. Instead of the recovery,

we could, thus, see even bigger slowdown.

Although the US has looked Teflon-like so far,

the recent IHS Markit report casts doubt about the resilience of American economy. According to the survey, business activity in the U.S. contracted in February for the first time in since the

Great Recession (with the exception of the

government shutdown in 2013) due to the disruptions caused by the new coronavirus. What is important, is that the decline was driven not only by the deteriorating manufacturing performance (yet still expanding), but also by the decline in the service sector.

Moreover,

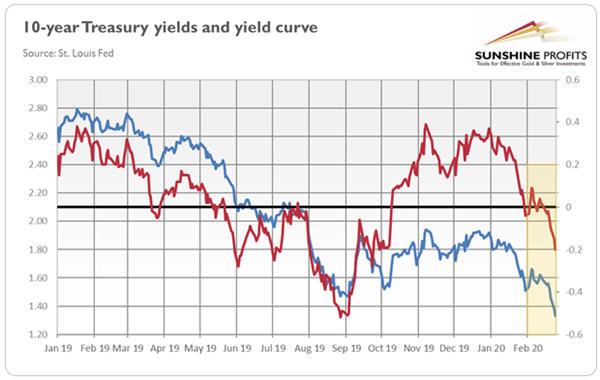

the long-term interest rates have declined, as the chart below shows. The 10-year Treasury yield has plunged below 1.4 percent,

pushing the spread between long-term and short-term bond yields into negative territory again. The inversion of the

yield curve increases the odds of

recession. It also makes the

Fed more likely to step in and cut the

federal funds rate, you know, “just in case”. Indeed, the markets expect the

dovish move as early as in April.

Chart 1: 10-year Treasury yields (blue line, left axis) and the spread between 10-year Treasuries and 3-month Treasuries (red line, right axis) from January 2019 to February 2020.

Implications for Gold

Implications for Gold

What does it all mean for the gold market? Well,

the COVID-19 is beneficial for gold’s outlook. Even before the epidemic started, the gold’s prospects were positive due to the easy

monetary policy and increased recessionary risk. The outbreak of the new disease may only strengthen these tendencies, i.e., slowing down already fragile global growth and push central banks to adopt an even more accommodative stance.

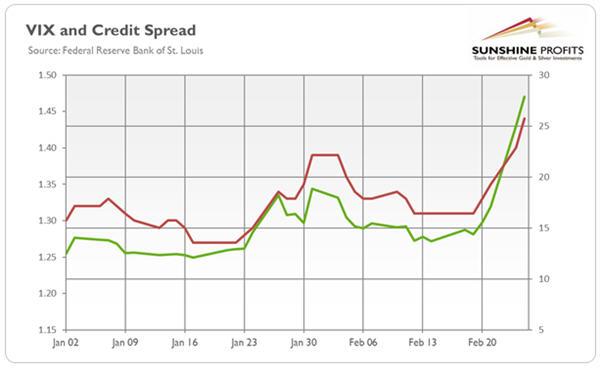

Moreover, as the chart below shows, the

stock market volatility and the

credit spreads have increased. Meanwhile, the US dollar has weakened recently,

which makes the macroeconomic environment even more friendly to gold.

Chart 2: CBOE VIX Index (green line, right axis) and ICE BofAML US Corporate BBB Option-Adjusted Spread (red line, left axis) in 2020.

Now, the key question is, of course, how persistent the effects of the coronavirus shock will be. If it is contained quickly, the risk-appetite comes back to the markets and investors may withdraw somewhat from the gold market. However, with new cases rising outside China, it is likely that the new virus would stay with us for some time, affecting the global economy beyond the first quarter of 2020, and, thus,

supporting gold prices.

If you enjoyed today’s free

gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly

Gold Market Overview reports and we provide daily

Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to

subscribe today.

If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits – Effective Investments Through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Trading Alerts.