With a key acquisition underway, SMG Industries' revenues are set to jump exponentially.

Oil prices may be in a holding pattern lately, but that's helped set the stage for a huge opportunity in one particular area. That subsector is the midstream and oilfield services.

These are the guys who sell and service the "picks and shovels" of the pipeline, drilling and fracking industries.

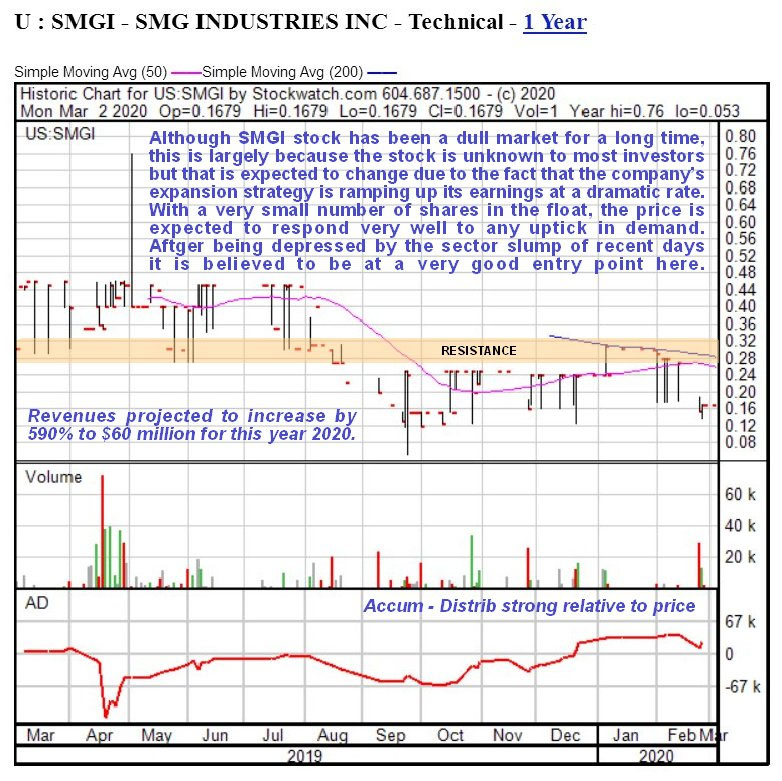

"It is clear that the upside for this stock is very considerable from here." - Clive Maund

Right now, one player in this field is using a unique strategy to both grow and diversify its business.

In fact, that approach is so transformational, its revenues are set to jump exponentially.

Keith Kohl, editor of the Pure Energy Trader investment newsletter, told his subscriber base to buy this company's shares, explaining, "…there's a huge opportunity in consolidating small, profitable companies, specifically in areas like the Permian Basin."

Technical analyst Clive Maund wrote on March 3, "it is clear that the upside for this stock is very considerable from here."

And that makes now an exceptionally ripe moment for early investors to claim their stake.

Buy and Build: A Unique Path to Growth

Headquartered in Houston, Texas, SMG Industries Inc. (SMGI:OTCQB) is a midstream and oilfield services company operating in the Southwest United States. That's ideal, since nearly half of North American rigs are currently in Texas due to favorable economics in its resource basins, like the Permian.

But SMG is not your garden variety midstream and oilfield services company. Instead, it is on a rapid growth path, thanks to its unique "buy and build" strategy. That means it targets middle and lower-middle market owner-operated companies that service the drilling, completions and production markets.

Many of these are well run and boast great reputations, but their growth remains stalled. Often that's because their owner-operators get bogged down by the daily administration side of the business.

Enter SMG.

Management identifies quality acquisition targets that are ideal candidates for consolidation, where SMG finds synergies by removing what they call "business constraints." This usually means allowing existing management to stay on and focus on more efficient operations and sales, while SMG helps provide working capital and equipment, and boosts sales through cross-selling customer bases.

Latest Acquisition: A Transformational Event

In the last three years SMG management has successfully executed its "buy and build" strategy a number of times. But its most recent move promises to be massively transformational for the company.

SMG has just announced the acquisition of 100% of the membership interests of 5J Oilfield Services LLC and 5J Trucking LLC (together "5J"), its largest transaction to date. 5J is an industry recognized player, with $55 million in annual revenues. What's more, acquiring 5J helps SMG diversify into midstream and logistics with compressor, heavy haul, and drilling rig move services.

That's significant, because while fracking activity is consolidating, midstream spending continues aggressively ramp up.

Studies by the INGAA Foundation, which represents the natural gas pipeline industry, support that view. Their research concludes that a whopping $44 billion needs to be spent in North America every year until 2035 on new energy infrastructure.

That's hundreds of billions in spending over the next 15 years. And roughly half of 5J's $55 million in annual revenues are focused in the pipeline/Midstream market segment.

Funding for SMG's 5J buyout looks like this: a line of credit (LOC) lender with a $10 million LOC with approximately $6 million drawn at close, an equipment lender $12 million term loan, a $1.6 million mezzanine note and $6 million in a Series B Convertible preferred stock that has a fixed exercise price of $1.25 per share.

But taking over 5J means an eight-times instant growth in revenue. That will push the post-acquisition SMG from its current $8 million in revenue to a whopping $63 million.

And the beauty of the acquisition is that it's immediately accretive to consolidated earnings. SMG's customers will have instant access to 5J's fleet of assets and services, while 5J's sales force will be able to immediately promote SMG products.

5J's Locations

Where the New SMG Is Headed

Post transaction, the new SMG will reduce its overall exposure to drilling, completion and production segments, while growing its midstream segment. These midstream pipeline customers, such as Kinder Morgan (KMI), Enterprise Products (EPD), Energy Transfer (ET), Mark West and others, have increasing capital expenditure budgets this year mostly in the southwest U.S., including Texas. Multi year projects represent increasing spend for 5J and SMGI to perform service work and grow with them.

5J is a logistics and transportation business that uses 120+ trucks, 250+ heavy haul trailers/equipment and 20 cranes to move large compressors utilized in pipelines. Customers pay 5J to move these giant compressors hundreds of miles to build out pipeline infrastructure at terminals and stations.

The other half of 5J'ss revenues are in 'Rig Move,' moving drilling rigs for oil companies and their drilling contractors such as Nabors (NBR), Patterson (PTEN) and Helmerich & Payne (HP). This drilling market segment correlates to oilfield activity and the domestic onshore drilling rig count.

Interestingly, oil companies are actively trading rigs out—meaning an Oxy, Concho or Chevron may replace its Nabors contract and hire Patterson in order to get a better rate—all of this transition produces heavy logistics movement for the new SMG as drilling rigs transition from one customer to another.

SMG's rig moves take place in Texas, average 10 miles, and cost $130,000. This equates to $4 million of monthly revenues, and is likely to jump 50% to $6 million monthly during fiscal 2020 through an increased focus on midstream following positive customer spend.

The new SMG will also benefit from a high degree of geographic operational overlap, with strategically located operations in five facilities, capitalizing on each main exploration and production producing region in the Southwestern U.S.

Matt Flemming, CEO of SMG Industries, stated, "SMG views this acquisition as immediately accretive and strategic to its business. Many midstream pipeline customers are increasing their spend and capex this year and represent a major growth area for 5J and SMGI. This acquisition will provide additional access into the midstream sector and bring about 100 new MSAs or customer agreements for cross-selling. SMGI's buy and build strategy includes current plans for additional midstream and other strategic acquisitions in 2020."

Recent Past is Prologue

One of SMG's initial acquisitions was MG Cleaners, in July 2017. MG provides contract drilling companies and oil and gas operators with proprietary branded products including detergents, surfactants and degreasers (such as Miracle Blue®) as well as equipment and services crews that perform on-site repairs, maintenance and drilling rig wash services.

In the year following acquisition, MG Cleaners saw its revenues up 100%.

Then, in December 2018 SMG made its move on Momentum Water Transfer Services. Momentum is an oilfield water source and transfer service company that operates throughout Texas. Momentum designs, installs and operates custom water transfer jobs. It provides no-leak lay flat hose, high volume pumps, manifolds, road crossings, connectors and experienced crews that safely manage the process of transferring water for hydraulic fracturing.

SMG's next target was Trinity Services, which performs drilling pad development, and pits and lease access roads through its heavy equipment like excavators, tractors, compactors and motor graders. In its production market segment, Trinity does work-over and swab well site services.

When SMG acquired Trinity it was a big move, as Trinity's revenues were about the equivalent of SMG's then market cap. That roughly doubled SMG's revenues at the time.

A Major Transformation for SMG and Shareholders

Here's what investors need to keep top-of-mind.

SMGI shares are closely held, and have a relatively small trading float. So keep in mind that daily trading volumes are low. But don't let that deter you.

SMG's latest acquisition of 5J is literally a multiple of its former self, a testament to management's ability to do not just big, but transformational deals. It could even become the catalyst to have company shares uplisted to either the Nasdaq or NYSE.

Peering into the future, SMG has already identified other midstream acquisition targets to continue to follow customer growth, and benefit from capex spending in this sector.

Management is keen on moving forward with its "buy and build" strategy.

Given how well it has served them so far, odds are excellent that approach will help make SMG an increasingly dominant player in the midstream and oilfield services sector in the Southwest United States.

In my view, wise investors should stake their claim in SMGI at this juncture, with shares likely to trade at a multiple of the recent price. That way they can be successful at "buy and build" for their own investment portfolios.

Technical analyst Clive Maund had this to say about the SMGI shares on March 3: "right now it is a very good price having been beaten down over the past week or so by the market crashlet and the drop in the oil price, and yesterday's reversal candle in oil that we just looked at means that it should now have some tailwind from a rising oil price as well. With this kind of growth in revenue we cannot expect it to remain off the radar of almost all investors for much longer. SMG Industries is therefore rated an immediate buy here." Maund's chart follows:

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in energy, metals and mining stocks. He has been editor of a widely circulated resource newsletter, and contributed numerous articles to Kitco.com, BNN Bloomberg and the Financial Post. Krauth holds a Master of Business Administration from McGill University and is headquartered in resource-rich Canada.

Disclosure:

1) Peter Krauth: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: SMG Industries. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with SMG Industries. Please click here for more information. Within the last six months, an affiliate of Streetwise Reports has disseminated information about the private placement of the following companies mentioned in this article: SMG Industries. An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of SMG Industries. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of SMG Industries, a company mentioned in this article.

Additional disclosures

Clive Maund does not own shares of SMG Industries and neither he nor his company has a financial relationship with the company.

Pure Energy Trader disclosures

No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Neither the publisher nor the editors are registered investment advisors; nor have either publisher or editors been compensated for this publication, or ongoing coverage. The publisher and/or the editors may or may not have a position in the securities mentioned.