There are times in my life where I am forced to fight the urge to do harm to people, something that I have never enjoyed, even when I was playing hockey in the violent Southern Hockey League in 1977. I have taken spears to the groin, butt-ends to the face, hooks to the throat and even suffered a slashed left eyelid over the twenty years I played but not once did I consider it anything "personal," because it was all part of "the game," and the choice I made to engage in "the game" was all mine and mine alone.

I can't tell you the number of times that a five-minute major for butt-ending resulted in two or three goals against the penalized team and victory for the victims because, despite the violence of the offense, there were still rules. While the '70s comprise an era of unprecedented violence in all leagues, broken rules affected outcomes, and there were many fearless players that would take the butt-end and commit no acts of retribution until late in the game, with their team comfortably ahead (or not at all, if the guy was 6'5", 245 pounds and from Chibougamau).

The reason I am bringing this up is that, after listening to Boston Fed governor Eric Rosengren on Friday, I wanted desperately to commit a horrendous act upon this pitiable excuse for a "free market capitalist." I actually snorted when I read the following:

"We should allow the central bank to purchase a broader range of securities or assets. Such a policy, however, would require a change in the Federal Reserve Act."

In other words, what Mr. Rosengren is promoting is that the rules should be changed to allow the Fed to buy stocks in order to prevent a crash. There are two things inherently wrong in Mr. Rosengren's demand. Firstly, there is no need to change the Federal Reserve Act, as this has been done four other times since it was first passed. The President's Working Group on Capital Markets, created by the Reagan Administration after '87 Crash, has been goosing stock prices for years, and most blatantly in December 2018, with the Mnuchin Christmas Eve "call to arms" of his private "plunge protection team" (PPT) that preceded a miraculous 1,000-point rebound in the Dow by New Year's Day.

If they change the Act, you will have the U.S. Treasury and the Fed both chasing stocks, at which point the illusion of "free markets" loses even greater substance (than it already has) and the cosmetic appearance of the current market is wiped away.

Second, dovetailing back to my hockey analogy, if there are no rules protecting players from butt-ends, then the sport devolves into a spectator-less exercise in chaos, which is what almost gutted the National Hockey League (NHL) in the '70s. If there are no rules deterring entities, especially government treasuries or government-sponsored entities (GSEs) like the Fed from illegally affecting stock prices, then there eventually will be no stock market participants left. No rules, no game, no spectators.

At the end of this past week, I watched a CNBC interview between the aging Wall Street cheerleader, Larry Kudlow, and anchor Carl Quintanilla, during which there occurred a number of revealing exchanges, the most shocking being the moment where the Quintanilla asked Kudlow why he would tell the American public a week earlier that COVID-19 was "largely contained," and that everyone should be "buying this dip in stocks."

That, in itself, was glaring proof that Kudlow was "in" on the actions of the U.S. Treasury as it would pertain to direct interventions in stock, bond, Forex, and precious metals markets. Further, it provided solid evidence that at least one member of the mainstream media (MSM) (Quintanilla) was/is willing to challenge the central planners that constantly intervene in financial markets to serve their own private agendas.

That stocks were rescued and gold bombed within a one-hour window in the early Friday trading session, and in the last forty-five minutes, remains a testimonial to a continuation of the status quo of incessant market interventions.

As investors, these blatant and often successful attempts at shaping sentiment through price control have had a numbing impact on behavior. After the criminal bailout of the U.S. banking thugs in 2008, investors were coddled shamelessly by constant interference. All stock market corrections were disallowed, and every advance in precious metals (gold) and alternative currencies (crypto) were crushed through the paper market facility known as the CME (or "Crimex," as it is more appropriately named).

This Pavlovian response to pullbacks in equities and advances in gold by the younger generation of investors is, however, gradually being scrutinized due to the introduction of the COVID-19 pandemic. Even the most ardent believer in "The Fed's got our backs!" school of thinking and investing is now being put to a very stringent test, and the reasons behind this are a) fear and b) common sense.

After forty-odd years of dealing in financial markets, I can safely say that there has always existed one overriding and overpowering stimulus to the impetus of investment decisions, and that stimulus is fear. In 2008, Ben Bernanke could tell the world that the financial crisis was "contained" until the point where collapsing stock prices and interbank lending freeze-ups finally sent the "dip-buyers" over the edge of the cliff of fear.

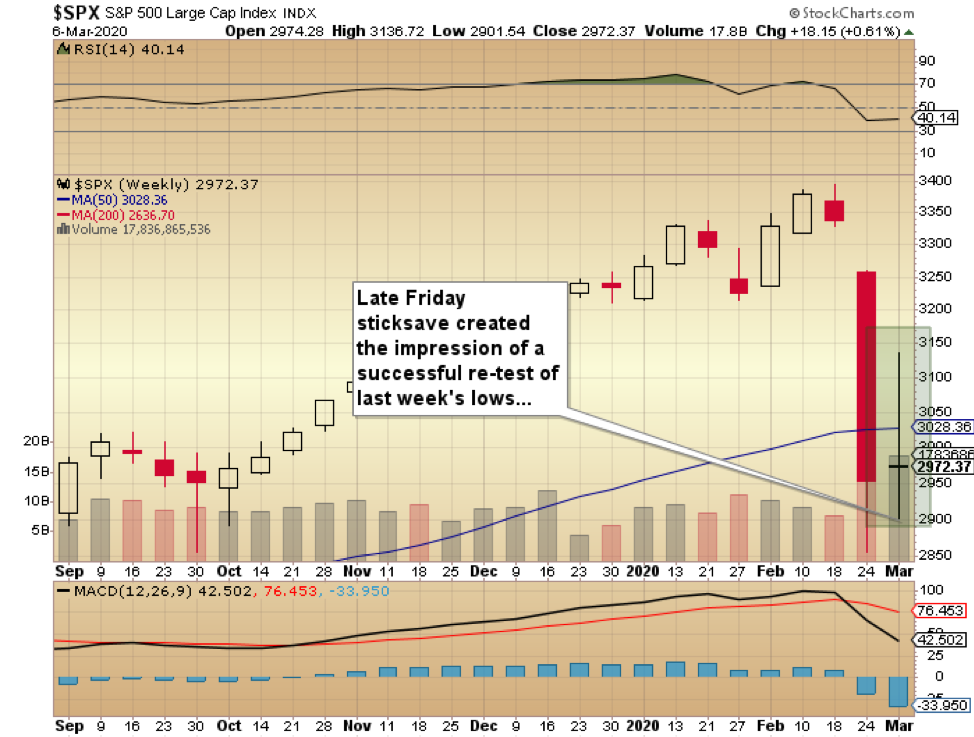

Likewise, here in 2020, not Donald Trump nor Jerome Powell nor Larry Kudlow could lift a finger to calm the markets so they resorted to not one, but two interventions on Friday, to first prevent a total collapse after a 108-point opening crash in the S&P, and then, with less than one hour to go in the week's trading, another 80-point levitation designed to create the illusion of a successful retest of the 2,885 low of the prior week.

So, while the fear of a market crash was alleviated by the shenanigans of the central planners, it did nothing to appeal to the second reason for challenging the consensus view that "stocks are cheap!", which is common sense. While the new generation of traders may have been infected with their own private virus called "blind faith in the Fed" for the past ten years, they now cannot dispute the helplessness of government or central bank actions to rectify the uncontained slowdown in business activity brought about by this pandemic.

The late rally on Friday may have soothed frayed mindsets over the weekend, but it surely failed to alter the spending patterns of millions upon millions of consumers and workers. No matter what Kudlow might say on a global cable channel like CNBC, he was surely shown the middle finger by a great many investors whose common sense prevailed.

As embarrassing as it was blatant, that last-minute intervention by the elites failed to recapture the 200 daily moving average (200-dma) at 3051, but it did succeed in moving the relative strength index (RSI) back above 30—so technically it is no longer in oversold territory, which is bad. The weekly chart shown below is even more significantly bearish on an intermediate-term basis, which means that rallies must be sold, and cash raised before succumbing to the pleadings of the banker-politico alliance.

You will recall the chart I provided a few weeks ago, where I asked you all to trust the actions in bond yields (and copper) as guideposts. The 10-year bond is now trading at levels never before seen—ever. What this means is that gargantuan pools of investor capital are swarming to the perceived safety of 1) the U.S. dollar, and 2) fixed income, in an attempt to evade the risks brought about by the pandemic.

Not surprisingly, bonds have a great deal of common sense as their ascent in price acknowledges the severe negative impact on the travel industry, tourism, manufacturing and all related subsectors by an adversary totally out of the purview and control of central bank/treasury intentions.

As investors, when you read Barron's or the Wall Street Journal over the weekend, you will find that COVID-19, stocks, and the 10-year yield will dominate. What you will not read about—at least until page 14 or so—is the safe haven performance of one other asset class—gold. Gold's year-to-date performance is now solidly black, and that is despite massive interventions, interference and manipulation by the banker-politico alliance. I am not going to speak about silver in this week's missive; the level of market interference, despite the U.S. Department of Justice's indictments of JP Morgan. continues to rise and the criminality is now beyond blatant. Further, a gold:silver ratio (GSR) above 95 is ridiculous when the ratio in nature is closer to 10. Farcical!

Gold closed out the week up 9.81% year to date (YTD), versus the 8% decline in the S&P. Underscoring the absurdity of the Kudlow coaxing to "buy the dip," some very large investors opted for the 20-year Treasury bond, whose performance claims the prize with a stunning 23.48% return YTD.

There is a strong possibility of another rebound early this week, just as I called for a week ago, and into which I shorted the SPY (at US$310) and bought the April $280 puts (at US$4.30). The SPY hit US$290.93, and the puts touched $13.59, before the late Friday PPT maneuver took us out at $297.50 and $12 respectively. The GGMA portfolio is in good shape, although the more aggressive trading model is ahead on 11 out of 12 trades, with silver the only loser thus far. (e-mail me at miningjunkie216@outlook.com for more info.)

I will end this missive with another hockey story. I was at the Saint Louis Blues' training camp in 1976, and one afternoon, while in the dressing room, a bunch of Blues' regulars were all sitting around after practice talking to a rookie about what the minor leagues were like. Derek Sanderson, Chuck Lefley, Larry Patey and Bruce Affleck were all talking about how brutal it was to play in the "I" (International) or the "NA" (North American) or the "E" (Eastern) leagues. They all knew buddies that had played or were playing in these leagues, and the stories of gouged faces and lost teeth and bench-clearing brawls every game were legendary.

Well, just as one of the veterans was scaring the jockstrap off the rookie with a horror story about "the toughest league in the world"—the "I"—veteran Stanley Cup winner and former Bruins netminder Eddie Johnston, who won First All-Star honors while toiling in the "E," jumped into the conversation and said, "You guys are all wrong. The toughest hockey league in the world is not any of 'em. The toughest league in the world ain't even a pro league. It's so brutal that there are not one, but three, Saint John ambulance guys there each night, and they all carry not one but three suture rolls."

The rookie, now shivering with the specter of being assigned to this bohemian battleground, says to Eddie, "Where is it, EJ?" And Eddie says: "It's the INCO Union League in Sudbury, Ontario!"

How about a playoff between them and the Bay Street banksters?

No rules, no game, lots of spectators.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.