On Wednesday, WHO declared the current outbreak of COVID-19 as a global pandemic, while the US stock market entered the bear market as it had fallen over 20% from its peak. What’s next in store for the yellow metal?

It’s Global Pandemic Now

We are now officially in the pandemic stage! Although I have long written about the COVID-19 as a pandemic, not an epidemic,

the WHO has finally admitted that situation is much worse. As WHO Director-General, Dr. Tedros Adhanom Ghebreyesus

said yesterday:

WHO has been assessing this outbreak around the clock and we are deeply concerned both by the alarming levels of spread and severity, and by the alarming levels of inaction. We have therefore made the assessment that COVID-19 can be characterized as a pandemic.

It is the first pandemic sparked by a coronavirus. Surely, SARS and MERS were also of international character, but

COVID-19 has spread wider. As of today’s morning,

the new coronavirus cases were reported in 118 countries. More than 124,000 people were infected, and 4,607 died. The situation is indeed serious. And, as you can see on this

very informative website, the numbers are growing. But the geographical is not the only difference between an epidemic and a pandemic – another is that “we have never before seen a pandemic that can be controlled”. Wow, Dr. Ghebreyesus can lift the spirit, can’t he?

Not surprisingly,

the stock markets did not welcome the move. The

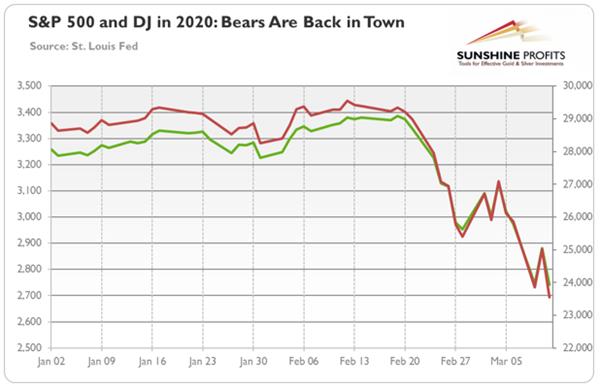

S&P 500 fell almost 5 percent yesterday. And, as the chart below shows, the index has already fell below 2,800 points, or 20 percent below its intraday record high from February 19, crossing the threshold for a bear market. Similarly, the

Dow Jones Industrial Average also plunged 20 percent below its intraday record high reached on February 12, or below 24,000 points, confirming that

the US stock market has entered the bear market for the first time since the Great Recession.

Chart 1: S&P 500 (green line, left axis) and Dow Jones (red line, right axis) from January 2 to March 11, 2020.

Recession: Not If, but How Deep.

Recession: Not If, but How Deep.

As the spectre of COVID-19 is haunting the globe, the analysts, economists and investors are shifting the conversation from whether there will be a

recession in 2020, to the debate how severe the contraction will be and what shape the recovery will take. Yes, the epidemic in China is on the decline and the country is returning to its normal economic potential. However, as the novel coronavirus spreads across the globe, more governments take drastic steps to limit its reach, which will negatively affect the supply chains and economic activity. For example, yesterday Italy added new restrictions to the lockdown, closing all shops except supermarkets, food stores and chemists. The negative effects of such shutdowns are going to linger, making a quick, V-shaped recovery less likely.

The more prolonged the recession, the better for gold.

To support the badly hit economies,

the governments and central banks are pumping money into economy. The New York Fed increased the maximum offering of its daily operations in the market for repurchase agreements, or repo, to $175 billion. Meanwhile, Britain and Italy have already announced multi-billion-dollar programs to fight the COVID-19. The UK government has announced 30 billion pounds of fiscal stimulus and pledged 600 billion pounds by 2025 for infrastructure. And the Bank of England, following the

Fed and the Bank of Canada, cut its

interest rates by 50 basis points, from 0.75 to 0.25 percent.

It remains to me a mystery

how the rate cut is supposed to help if at the same time, people are encouraged to stay at home and, what goes with it, limit their economic activity. Which companies are supposed to cheer the lowered interest rates in times of reduced consumer demand and disrupted supply chains?

Let’s repeat: as the easy

monetary policy did not manage to revive the economy after the Great Recession,

it will neither help now, especially that coronavirus impacts the economy mainly through the changed human behavior – and the central bank actions will not alter them.

It is good news for the gold market.

Some investors can complain that gold should rally higher given the current turmoil. It’s true that the somewhat limited reaction seems to be disappointing. But people should remember two things: first, gold’s relative performance versus other assets (think about equities or oil) is actually great; second, there are many margin calls on the marketplace right now and some panicked investors sell gold in order to raise much needed cash, just as we saw in the immediate response to the

financial crisis –

gold initially fell, only to rally later.

If you enjoyed today’s free

gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly

Gold Market Overview reports and we provide daily

Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to

subscribe today.

If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits – Effective Investments Through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Trading Alerts.