If you think that yesterday’s session in stocks was a bloodbath, don’t look at today’s overnight trading. It would be an understatement to say that the markets didn’t buy into stimulus package contours or the 30-day Europe flights ban. What about today’s ECB monetary policy statement, can that really lift the bulls? Enjoy the wild ride and despair not, as we’re profiting on it.

Let’s jump right into the weekly chart to see the shape of the week-in-progress (charts courtesy of

https://stockcharts.com).

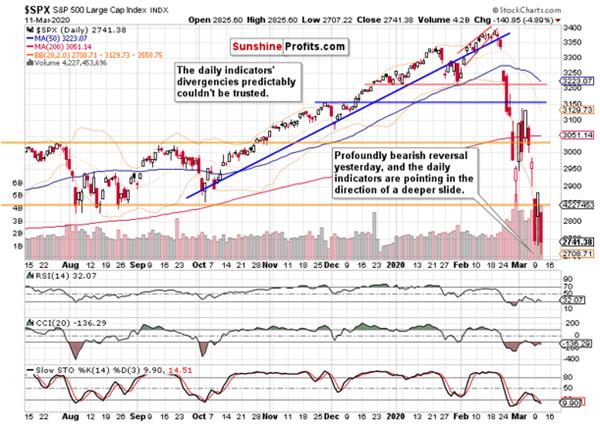

The sizable bearish gap remains unchallenged, and the bears keep the reins. More details about the stimulus package or any other measure (the Europe flight ban or Fed repo operations) didn’t exactly instill confidence, and stocks keep reacting to the bad incoming

coronavirus-related news.

This week’s

volume is on track to beat that of the either two preceding weeks, lending more support to the bears. And so do the weekly indicators. The bottom clearly appears not to be in yet.

While a strongly bearish reversal in itself, yesterday’s closing price doesn’t paint the full picture. The plunge continued overnight unabated, and the current fix at below 2535 means that

our open short position is already over 300 points in the black! New 2020 lows are very likely ahead of us – that’s a pretty safe bet to make as the nearest strong S&P 500

support is at the December 2018 lows at around 2400.

Summing up, the bears are firmly in control, and the current policy response hasn’t been a game changer. Both the weekly and daily charts keep sending bearish messages. The downswing appears likely to have further to go on the downside before the market regains some confidence – especially with stocks in a bear market already as they gave up more than 20% from their February highs. Therefore, keeping open the profitable short positions is justified.

We encourage you to sign up for our daily newsletter - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Stock Trading Alerts as well as our other Alerts.

Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.