Just when you might think that the key action to comment on is Friday’s reversal, it’s the opening of today’s overnight session that gets the prize. The development is yet another Fed’s pre-FOMC move. This time, it coupled the rate cut to 0% with a $700bn QE. And how did the stock market react?

First though, let’s jump right into the weekly chart to see the week just gone (charts courtesy of

https://stockcharts.com).

These were our

Thursday’s observations:

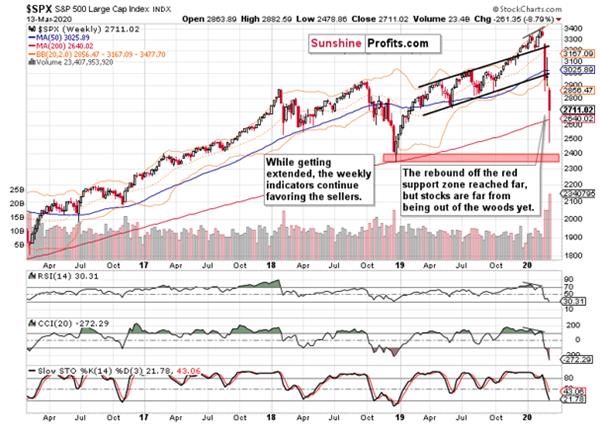

(…) The sizable bearish gap remains unchallenged, and the bears keep the reins. (…) This week’s volume is on track to beat that of the either two preceding weeks, lending more support to the bears. And so do the weekly indicators. The bottom clearly appears not to be in yet.

(…) New 2020 lows are very likely ahead of us – that’s a pretty safe bet to make as the nearest strong S&P 500 support is at the December 2018 lows at around 2400.

And indeed, the S&P 500

volume was one for the record books. But did the candle’s shape mark a profound turnaround? That’s unlikely – it look more like a partial retracement of the earlier furious slide. Did that though prevent us from making money on it? Not in the least,

we easily snatched 61 points of Friday’s upswing.

Let’s take a look at Friday’s action on the daily chart and then dive into the Fed firing its bazooka.

These were our

Friday’s observations:

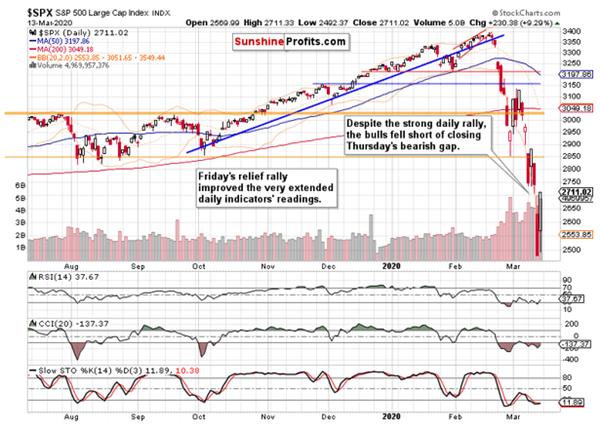

(…) While the daily indicators are very extended on the downside, a temporary rebound would not surprise us in the coming days as the bulls are likely to build upon today’s gains so far.

Would it make sense to chase it? In our opinion, it’s worth it.

And what a bounce we got, especially in the final hour of trading! The bulls almost reached Wednesday’s closing prices. Well, almost – and as a result, Thursday’s bearish gap continues supporting the sellers, regardless of another turn higher in the daily indicators and Stochastics being in the oversold territory and on the verge of flashing its buy signal.

Drums please now – it’s high time to dive into the key overnight development. The Fed just pushed the panic button again, bringing

Fed funds rate to the zero bound. It also brought in a $700bn QE program. That comes on top of the expansion of

repo operations. While this is certainly no drop in the bucket, stocks plunged on the news. Having hit the circuit breakers on the downside, futures trading stopped at 2555. The logical conclusion is that the limits of

monetary policy tools have been reached, and each bigger bang buys less of a buck.

The implications for stocks are bearish – both in the medium and short-term.

How shall we trade the current setup? The selling pressure is heavy, and whenever everyone leans on the same side of the boat, the market turns the other way – at least temporarily.

Selling into the current slide at 2440 wouldn’t give us a great entry point from the risk-reward perspective. Remember that the sharpest rallies happen in bear markets. Therefore, we'll let our subscribers know once it becomes justified to act - and how exactly, to be precise.

Summing up, the bears remain firmly in control, and that’s true despite Friday’s sizable bounce for it hasn’t changed even the short-term outlook one bit. With the overnight gap lower, it appears more than likely that Friday’s rebound won’t get follow-through. The weekly chart examination also puts the technical upper hand over to the bears.

We encourage you to sign up for our daily newsletter - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Stock Trading Alerts as well as our other Alerts.

Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.