• “Everything works – and will continue to work – as long as we have electricity. It’s what keeps the lights on, the oxygen flowing, the information going. Everything is the grid, the grid, the grid.” (Peggy Noonan, The Wall Street Journal, March 19, 2020)

• “Without change there is no innovation, creativity, or incentive for improvement. Those who initiate change will have a better opportunity to manage the change that is inevitable.“ (William Pollard)

• "Disruptive technology, where you really have a big technology discontinuity... tends to come from new companies." (Elon Musk)

Today, Zinc8 Energy Solutions Inc. has started to trade under its new corporate name. All open orders were cancelled after market close last Friday and the CSE reminded dealers to re-enter their orders.

New Symbol: ZAIR

New CUSIP: 98959U108

New ISIN: CA98959U1084

Also new: Last week, Shane Lasley, editor at Metal Tech News, published the article "Zinc8 lands NY energy storage installation: Second Empire State locale for zinc-air energy storage system".

As a follow up to the latest Rockstone Report "Death of an ill-fated bull market and birth of a clean energy infrastructure of resilience" (March 18, 2020), note the following media coverage on the impact of both the oil price crash and the COVID-19 pandemic on the renewables sector:

The world has changed overnight.

On the bright side, I´ve cultivated a deeper relationship with my lovely neighbors.

On the other side, which is fast-crumbling like a gluten-free cookie, I take only about seven steps a day and my muscles are most certainly atrophying.

Oh, and it looks like we´re headed into a recession.

"We are officially declaring that the economy has fallen into a recession," Bank of America economists led by Michelle Meyer wrote in a note to investors on Thursday.

What does that mean for the renewable energy industry?

Renewable energy stocks could be the first to recover from the virus-fueled crisis

That´s according to JPMorgan. In a note it shared with clients on Wednesday, it said "we can see justification for Alt Energy stocks to be first out once COVID-19 peaks."

Low interest rates make renewable energy cheaper

The "cost of capital" is the single most important driver of renewable energy projects, a Wall Street analyst told me earlier this week... In other words: Most of the costs are upfront. That means, low interest rates – which lower the cost of project funding – make renewable electricity cheaper, spurring demand as a result. And those rates are near zero today.

Cheap oil won´t undermine clean energy

Who are the losers?Oil companies, for sure...

Any winners?Renewable energy, maybe. "This shock, showing just how violent the oil market can get, will steer some management teams into looking at wind and solar because they´re not nearly as volatile or difficult to predict," Pavel Molchanov, an analyst at Raymond James, told me.

But overall, the price of oil has little bearing on the growth in renewables, analysts said – largely, because most economies don´t use it to make electricity...

The International Energy Agency is urging governments to include clean-energy investments in pandemic-related stimulus packages, the org´s executive director wrote. Renewable energy groups wrote a letter to Congress on Thursday asking them to extend the tax credit for wind and solar energy in the stimulus package, Axios reports.

First things first – we need to get the coronavirus pandemic under control and save lives. But as we work our way out of this global health emergency and begin shoring up our battered economy, there is a great opportunity to turn the virus into a virtue for the planet – and put people back to work.

Let´s leverage the public and private investment we are assembling to rescue the economy to also address climate change, a crisis that will continue to ravage the world when we defeat the virus.

Clean energy stimulus... With a recession at hand, let´s put another package together – and fast.

Infrastructure spending... We need a vast expansion of our electric grid, for example, to move wind energy from the plains states to east coast markets and solar energy from the desert southwest to west coast cities... We also need electricity storage projects – pumped storage, batteries etc. – to "firm up" intermittent solar and wind.

Energy technology commercialization – The federal government has had an on-again off-again commitment to moving key energy technologies out of the lab and into the marketplace.

We face a global health crisis and we must be laser-focused on resolving it. But as the coronavirus also takes down our economy, let´s use our response to address an even more potent – albeit slower-moving – threat called climate change.

Large-scale investment to boost the development, deployment and integration of clean energy technologies – such as solar, wind, hydrogen, batteries and carbon capture (CCUS) – should be a central part of governments’ plans because it will bring the twin benefits of stimulating economies and accelerating clean energy transitions. The progress this will achieve in transforming countries’ energy infrastructure won’t be temporary – it can make a lasting difference to our future...

There can be good reasons for governments to make energy more affordable, particularly for the poorest and most vulnerable groups...

This is why governments need to make sure they keep clean energy transitions front of mind as they respond to this fast-evolving crisis. IEA analysis shows that governments directly or indirectly drive more than 70% of global energy investments. They have a historic opportunity today to steer those investments onto a more sustainable path...

Governments can use the current situation to step up their climate ambitions and launch sustainable stimulus packages focused on clean energy technologies. The coronavirus crisis is already doing significant damage around the world. Rather than compounding the tragedy by allowing it to hinder clean energy transitions, we need to seize the opportunity to help accelerate them.

"Despite local reductions in pollution and improvement in air quality, it would be irresponsible to downplay the enormous global health challenges and loss of life as a result of the COVID19 pandemic," said WMO Secretary-General Petteri Taalas. "However, now is the time to consider how to use economic stimulus packages to support a long-term switch to more environmentally and climate-friendly business and personal practices."

"Past experience suggests that emissions declines during economic crises are followed by a rapid upsurge. We need to change that trajectory," he said.

"The world needs to demonstrate the same unity and commitment to climate action and cutting greenhouse gas emissions as to containing the Coronavirus pandemic," he said. "Failure in climate change mitigation could lead to greater human life and economic losses during the coming decades," he said.

[The] 2008-2009 global financial crisis was followed [by] strong emissions growth in emerging economies, a return to emissions growth in developed economies and an increase in the fossil fuel intensity of the world economy, according to a study in Nature Climate Change.

As lawmakers continue to hammer out legislation to address the impact of the coronavirus pandemic, House Democrats are looking to insert renewable energy tax credit provisions into a larger stimulus package aimed at stabilizing the economy.

The House Sustainable Energy and Environment Coalition co-chairs said in a joint statement to Morning Consult that they have an eye toward addressing “both the economic slowdown we are facing as a result of COVID-19 and the ongoing climate crisis” with these measures.

“Our members pushed for these credits in the [2019] end-of-year funding package and will continue to fight for them in this round of economic stimulus,” said Reps. Gerry Connolly (D-Va.), Paul Tonko (D-N.Y.) and Doris Matsui (D-Calif.).

The seven potential tax credit provisions were the subject of a Feb. 27 letter that 24 environmental advocacy groups and renewable energy trade associations sent to the leaders of the House Ways and Means Committee and the Senate Finance Committee. The groups pushed Congress to prioritize codifying clean energy tax incentives promoting the use and production of electricity storage systems, solar, wind and electric vehicles, among others.

Now, those same advocacy and trade groups have seized the opportunity to rally support for the measures as part of a potential economic stimulus package to address the coronavirus pandemic. They are in touch with members of the House sustainable energy coalition, as well as the Senate Climate Crisis Special Committee, the House Ways and Means Committee, the Senate Finance Committee and leadership in both chambers of Congress, according to Bill Parsons, chief operating officer of the American Council on Renewable Energy.

Lawmakers reportedly have two separate stimulus packages in the works: one that would attend to more immediate public health and emergency financial concerns of those impacted by the coronavirus pandemic, and one that would shore up the industries impacted by the anticipated economic downturn. Renewable energy tax credit provisions are currently being considered as part of the latter package...

The last time renewable energy tax credits saw a major extension was in the 2009 stimulus bill following the 2008 financial crisis...

“These stimulus packages offer an excellent opportunity to ensure that the essential task of building a secure and sustainable energy future doesn’t get lost amid the flurry of immediate priorities”...

One of the most painful busts in the history of crude oil happened just six years ago when a sharp price drop cost 200,000 roughnecks, almost half the entire workforce, their jobs.

And now, the spread of the coronavirus coupled with an oil-price war between Russia and Saudi Arabia threatens to devastate the oil services industry and its workers...

And this time around, the financial wreckage could permanently sink parts of an industry that were able to stay afloat half a decade ago thanks to bank loans.

"There´s definitely blood in the water," said Dan Eberhart, chief executive officer of the Denver-based Canary. "The weakest oil and gas companies, oilfield service companies and banks with heavy energy exposure might submerge beneath the waves before the end of the cycle never to surface again."

"The reality is sobering," Luke Lemoine, an analyst at Capital One, wrote this week in a note to investors. "Even before the coronavirus pandemic and the Russia/Saudi crude price war, a number of companies were teetering on the edge of survival."

The next four years will be critical for the services sector, with $32 billion in debt for North American servicers coming due between now and 2024, according to Moody´s Corp. "There´ll be huge reductions in spending and therefore customer fracking," he said. "This will bring structural change to the industry...“

A climate opportunity?

Activist groups are watching the oil bust closely, aware of an opportunity to highlight oil´s economic volatility and drive attention to climate action while oil´s volatility and economic risk is front and center.

"Perhaps ironically, it´s the real-world results of the Trump administration´s radical, utterly unreasonable approach to energy policy and denial of any responsibility to take climate action that´s making the best possible case for phasing out oil and gas production on our public lands and putting in place a Green New Deal," said Erik Schlenker-Goodrich, executive director of the Western Environmental Law Center.

Goodrich said this time period represents an opportunity to phase out oil and gas development, particular on federal lands – where Trump´s energy dominance agenda has largely paid out.

Others also note that the oil price bust has arrived at a moment of transition for the industry, with some investors backing off their support for fossil fuels...

Oil companies have long argued that renewables projects offer lower returns. “That argument no longer holds at $35 per barrel.”

A dispute between Russia and Saudi Arabia has sent a flood of cheap oil and gas into global markets just as the COVID-19 pandemic is stifling demand.

This market dislocation comes at a time when European oil majors including Shell, Total, Repsol and BP are embarking seriously down a path toward emission reductions and the diversification of their businesses into renewables, e-mobility and other energy services...

“Average returns from oil and gas projects are now the same as renewables projects and, in fact, renewables projects are much lower risk. Already, we have seen companies like Occidental cutting dividends by 90 percent. It´s a discretionary spend”...

The oil and gas sector currently accounts for just 2 percent of investment in renewables, according to Wood Mackenzie. So a slowdown in the near term would not derail the flow of finance to solar and wind projects.

This isn’t the first time that oil prices have suffered a shock. During such “black swan” events, many types of diversification strategies are used to protect against commodity prices, said Luke Fletcher, senior analyst for investor research at the environmental reporting nonprofit Carbon Disclosure Project...

“In the future, having exposure to other diversified energy assets, such as renewables, could provide a bit of a hedge against oil price volatility as well. They have fundamentally very different cash flow profiles and are obviously less reliant on oil and gas and other commodity prices,” Fletcher said...

“One thing is clear: The energy transition is not going to go away,” said [Valentina] Kretzschmar [director of corporate research at Wood Mackenzie], pointing out that this week’s U.K. budget announcement had climate change woven throughout. “It´s still a key priority for the government.”

France´s Total announced two significant wind deals in recent days, becoming the latest oil company to push into floating offshore wind as it builds on its existing momentum in the solar market.

Total this week bought an 80 percent share of the 96-megawatt Erebus floating wind project in the Celtic Sea from developer Simply Blue Energy.

Then on Friday, the company confirmed its Total Quadran subsidiary had acquired developer Global Wind Power (GWP) France from its Danish parent, adding a 1-gigawatt portfolio of wind projects in France.

Fellow European oil majors Shell and BP have built-up gigawatt-scale renewables portfolios, but the pace of Total´s recent activity could see it outshine them both.

US Department of Energy: "Clean Energy"Excerpts:

A clean energy revolution is taking place across America, underscored by the steady expansion of the U.S. renewable energy sector.

The clean energy industry generates hundreds of billions in economic activity, and is expected to continue to grow rapidly in the coming years. There is tremendous economic opportunity for the countries that invent, manufacture and export clean energy technologies.

Responsible development of all of America´s rich energy resources – including solar, wind, water, geothermal, bioenergy & nuclear – will help ensure America´s continued leadership in clean energy. Moving forward, the Energy Department will continue to drive strategic investments in the transition to a cleaner, domestic and more secure energy future.

According to the US Department of Energy´s section "Revolution Now":

For decades, America has anticipated the transformational impact of clean energy technologies. As the federal government and industry made long-term investments to support those technologies, some critics became impatient, claiming a clean energy future would "always be five years away." Today, the clean energy future has arrived.

The initiative is designed to be a comprehensive effort to accelerate the development of next-generation energy storage technology that will position the United States as a global market leader. This program represents a continuation of the administration´s efforts to improve U.S. infrastructure, energy independence, and reliability.

According to a statement from the Department of Energy, the vision for the Energy Storage Grand Challenge is to create and sustain global leadership in energy storage utilization and exports, with a secure domestic manufacturing supply chain that is independent of foreign sources of critical materials, by 2030. While research and development (R&D) is the foundation of advancing energy storage technologies, the Department recognizes that global leadership also requires addressing associated challenges.

Minimum Opacity: "Corona Math" (March 19, 2020) Excerpts:

• Corona is a virus – global warming increases viral transmission

• COVID-19 is a lung disease – air pollution increases the risk of contracting lung diseases

• Air pollution kills 9 million people every year

• Corona may cost up to $2 trillion USD this year

• +4°C global warming will cost $17.5 trillion every year

As explained in Rockstone Report #5:

To run the US grid on 80% solar+wind, 12 hours of energy storage would be required to smooth out the variability of both renewable power sources. An alternative would be building a massive, continental-scale transmission network. As the US currently uses about 3,900 TWh per year, a 12 hour chunk of that would be about 5.4 TWh. John Weaver, a solar power professional and editor at pv magazine USA, looked into these scientific findings and calculated: "At a cost of $350 per kilowatt-hour (kWh), that would cost $1.9 trillion." However, if the cost was only $45/kWh (as Zinc8 is offering), total required expenditures would shrink to $243 billion, a landmark cost reduction of 87%.

Certainly, $243 billion is not peanuts... however, put that figure into perspective with the above stated "Corona Math" numbers and it may become reasonable going forward.

"We´re coming to a very important point now where policymakers can ensure that this round of easing is not hugely biased towards keeping oil producers on a lifeline," Donovan said. Bailouts could, instead, be structured around a strategy of decarbonization and preparing countries for low-carbon transitions.

"To my mind those interventions need to be targeted towards structural investments and things like job retraining for people in industries that can no longer keep going," Donovan said.

Whilst over the short term, the process of developing low-carbon infrastructure is unlikely to stand in the way of a pandemic or a wildfire, over time such economies could prove more durable than those built on the back of finite, volatile hydrocarbons-and better able to withstand crises.

"It´s not that by having more wind turbines and solar panels we could avoid coronavirus," Donovan said. "But we [the major economies] have been like the frog in a pan of water that´s slowing warming up: the fire has just been turned up several notches, and the only thing we can do now is jump out of the pan. This is about building an energy infrastructure that creates resilience."

Previous Rockstone Coverage

Report #6: “DEATH OF AN ILL-FATED BULL MARKET AND BIRTH OF A CLEAN ENERGY INFRASTRUCTURE OF RESILIENCE“

Report #5: “First Private Sector Energy Storage Deployment Contract for Zinc8 Energy Solutions: Second Commercial Agreement in New York City“

Report #4: “Visiting the Zinc8 Energy Storage Development and Production Facility: The Dawn of the Utility-Scale Battery Era“

Report #3: “The Largest State-Owned Power Utility in the USA Announces Collaboration with Zinc8 Energy Solutions“

Report #2: “MGX Renewables becomes Zinc8 Energy Solutions“

Report #1: “Bridging the Renewable Energy Infrastructure Gap“

Company Details

Zinc8 Energy Solutions Inc.

#1 – 8765 Ash Street

Vancouver, BC, Canada V6P 6T3

Phone: +1 604 558 1406

investors@zinc8energy.com (Patrick)

www.zinc8energy.com

ISIN: CA98959U1084 / CUSIP: 98959U108

Shares Issued & Outstanding: 75,711,374

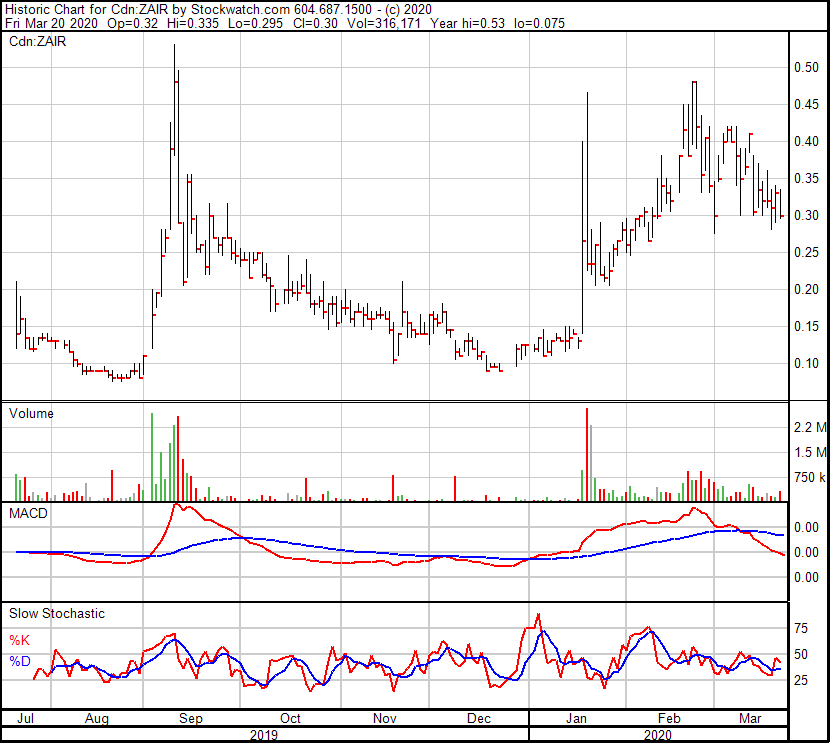

Chart

Canada Symbol (CSE): ZAIR

Current Price: $0.30 CAD (03/20/2020)

Market Capitalization: $23 Million CAD

Chart

Germany Symbol / WKN (Tradegate):

Current Price: €0.20 EUR (03/20/2020)

Market Capitalization: €15 Million EUR

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Zinc8 Energy Solutions Inc. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the iZnc8 Energy Solutions Inc.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through their profiles on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. Zinc8 Energy Solutions Inc. pays Zimtu Capital Corp. to provide this report and other investor awareness services.The author, Stephan Bogner, holds a long position in Zinc8 Energy Solutions Inc. and is being paid by Zimtu Capital Corp. for the preparation and distribution of this report, whereas Zimtu Capital Corp. also holds a long position in Zinc8 Energy Solutions Inc.