Just last month, North American financial markets were chugging along, setting multiple all-time highs in February. A lot has changed in the past 30 days due to the rapid rise and global spread of the novel coronavirus (COVID-19). The way of life we once knew has changed dramatically for the time being.

COVID-19 originated in Wuhan, China, in late 2019. The virus has since spread globally, effectively bringing the world's supply chain to a halt and, more recently, causing schools, restaurants and many businesses to close. It's affected nearly every company in some way, with many employees forced to work from home until the pandemic runs its course. President Trump stated recently that the coronavirus crisis could last all summer.

As we've seen throughout history, every major economic crisis also brings with it great opportunities for investors. In response to the massive disruptions to the North American economy, the stock market has corrected in record-setting fashion. Since reaching a new all-time high of 29,568.57 on Feb. 12, 2020, the Dow Jones Industrials Average (DJIA) has plummeted as much as 9,686.31 points (–32.76%) in just over a month. Canada's main index, the TSX Composite Index (TSX), didn't fare any better, as it shed as much as 6,086.85 points (–34.15%) since peaking at 17,970.51 on Feb. 20, 2020.

The unprecedented drop in the financial markets has dragged the valuations of nearly every company down with it. With so much uncertainty still surrounding the COVID-19 situation, it's difficult to predict where the market will bottom, but with the broad market down over 30% in such a short period, it could be close. The market is now trading at deeply oversold levels, and many experts are predicting a massive snap back once the situation becomes clearer. For example, an announcement regarding the successful development of a COVID-19 vaccine could spark an enormous stock market rally.

For those with the stomach and appropriate risk tolerance, it may be time to start looking at buying certain stocks. The new work-from-home economy that has become a reality for many has also created an excellent opportunity for individual companies to thrive. Many of these companies have already begun to rebound as investors come to the same realization.

With that said, here is our list of technology stocks that could thrive in the new coronavirus-induced stay-at-home/work-from-home economy.

1.Datable Technology Corp. (DAC:TSX.V; TTMZF:USOTC)

Datable is a small tech company that has flown under the radar for a while now. PLATFORM3 is the company's proprietary, mobile-based, consumer marketing platform, which is sold as a software-as-a-service subscription to consumer packaged-goods companies.

Companies utilize PLATFORM3 as a marketing tool to engage consumers and reward them for making purchases, as well as collect valuable consumer data. Many of the world's largest and most successful consumer brands have incorporated Datable's PLATFORM3 into their marketing strategies. Leading brands that have used PLATFORM3 include Universal Pictures, Proctor & Gamble, Kroger, Jack Link's, Snickers, 7Up, Dr. Pepper, Doritos, Molson Coors, Unilever and Toro. Red Bull was just added to that list after Datable announced the signing of a three-year master service agreement with the top energy drink maker.

Datable's business remains largely unaffected by the COVID-19 pandemic, which the company explained in detail in a recent press release. In fact, Datable is actually in a unique position to thrive in the current economic environment. Most of the company's leading consumer-brand clients sell essential products such as food, beverages and household products. During times of crisis, the demand for essential products rises typically. In response to the coronavirus crisis, the company announced that it is expanding shop-from-home options on its PLATFORM3 rewards and loyalty platform.

Datable is the smallest tech play on our list, but due to the company's extremely low valuation, it has, by far, the most upside potential. The company anticipates that it will report revenue of approximately $1.5 million for 2019, and is projecting its sales will more than double in 2020.

Datable is off to a terrific start in 2020, with the company announcing roughly $2.1 million of baseline contracted licenses for PLATFORM3 in just the first two months of the year. The company expects to recognize approximately 64% of the $2.1 million as revenue in 2020, with a gross margin of around 70%. The remaining 36% is will likely be recognized the following year.

Rob Craig, CEO of Datable, commented on the company's bullish start to 2020: "February 2020 was a record month for Datable, driven by the renewal and upsizing of long-term licenses with customers who have purchased PLATFORM3 as a long-term solution to engage and reward consumers for extended periods of time. In February, we also signed a number of short-term licenses with new and existing customers that use PLATFORM3 for product launches and seasonal marketing campaigns. We expect to generate additional revenues from many of these agreements from transaction fees, and to expand the scope of our relationships with the customers that signed short-term licenses."

With a market cap under $2 million and potential 2020 revenues of over $3 million, Datable's stock is a tremendous bargain at current levels. Investors should take full advantage of this opportunity while it lasts.

Learn more about Datable Technology: Website | IR Website | PLATFORM3 | DAC Chart

2. Microsoft (MSFT:NASDAQ)

Microsoft is a company that everyone is familiar with. The company offers a variety of products and services, which include operating systems for computing devices, servers, video games, phones and the very popular communication app Skype. Microsoft also offers a range of business solution applications like Microsoft Teams, which allows users to chat, meet, call and collaborate from anywhere all on one platform.

Learn more about Microsoft: Website | IR Website | Investor Deck | MSFT Chart

3.Netflix (NFLX:NASDAQ)

Netflix is a leading internet streaming entertainment company with millions of subscribers in nearly 50 countries. Netflix subscribers have access to an ever-expanding library of TV shows, movies, docu-series and documentaries. Netflix also creates its own high-quality shows and feature films that are available on the platform. The company's streaming platform gives subscribers the ability to watch what they want, anytime, anywhere, on nearly any internet-connected screen. With so many people around the world stuck at home during the pandemic, the company could see its subscriber count rise substantially as more people decide to "Netflix and Chill" to kill time.

Learn more about Netflix: Website | IR Website | Investor Deck | NFLX Chart

4. Citrix Systems (CTXS:NASDAQ)

Citrix Systems is a digital workspace company that provides businesses with a platform and the tools for their employees to work virtually from any location. Currently, over 400,000 businesses use the Citrix platform, which includes 99% of the Fortune 500 companies. According to the company's website, over 100 million individuals are using the platform, and due to the new coronavirus economy we now live in, these numbers could skyrocket dramatically.

Learn more about Citrix Systems: Website | IR Website | Investor Deck | CTXS Chart

5. RingCentral (RNG:NYSE)

RingCentral is a leading provider of global cloud communications, collaboration and contact center solutions for businesses. RingCentral's platform allows businesses and their employees to work together and collaborate on projects from any location and any device. The company offers global services that are now in very high demand, such as unified voice, video meetings, team messaging, digital customer engagement and integrated contact centers.

Learn more about RingCentral: Website | IR Website | Investor Deck | RNG Chart

6. Teladoc Health Inc. (TDOC:NYSE)

Teladoc Health is the only technology company that offers a comprehensive virtual care solution that's capable of serving organizations and people anywhere in the world. The company provides a variety of virtual healthcare services for general medical, mental health and complex care.

Learn more about Teladoc Health: Website | IR Website | Investor Deck | TDOC Chart

7. Slack Technologies (WORK:NYSE)

Slack provides companies with the tools and technology to work remotely through its collaboration hub. Millions of people around the world use Slack to connect their teams, unify their systems and drive their business forward. Slack gives its users the ability to stay productive even while working from home—another company with technology that is now in high demand.

Learn more about Slack Technologies: Website | IR Website | Investor Deck | WORK Chart

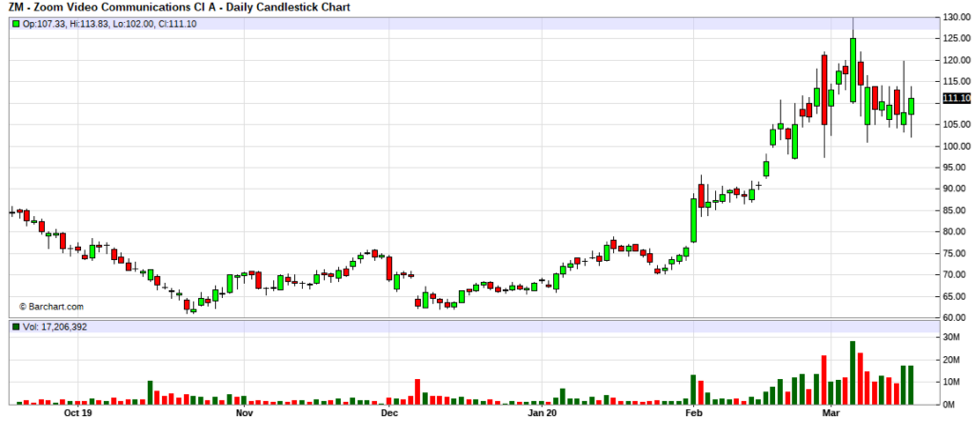

8. Zoom Video Communications (ZM:NASDAQ)

Zoom is a provider of video and web conferencing technologies. The company offers an online platform that features services such as cloud video conferencing, online meetings, group messaging and a software-defined video conference room. Zoom's all-in-one platform will undoubtedly see a sharp rise in users as more and more employees are working from home.

Learn more about Zoom Video Communications: Website | IR Website | Investor Deck | ZM Chart

9. 9. DocuSign (DOCU:NASDAQ)

DocuSign is a technology company that provides e-signature solutions for businesses. The company's services are used regularly by professionals in a wide range of industries such as healthcare, government, insurance and real estate. DocuSign's product portfolio allows organizations to manage electronic agreements virtually. Agreements between parties can be signed electronically on a variety of different devices, eliminating the need for face-to-face meetings.

Learn more about DocuSign: Website | IR Website | Investor Deck | DOCU Chart

Ryan Troup is the editor-in-chief of The Cannabis Investor and Psychedelic Profits financial media outlets. Ryan has 15+ years of investing experience and is also the president of Circadian Group.

Disclosure:

1) Ryan Troup: My company owns roughly 900,000 options in Datable. My company currently does not hold any shares nor do I personally or any of my family members. My company was previously compensated under a 1-year agreement, which has since expired. My company does not hold a position in any of the other stocks mentioned in the article. I personally don't own a position in any of the other stocks mentioned in the article, nor do any of my family members.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Datable Technology. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Datable Technology, a company mentioned in this article.

Charts provided by the author.