It has all the makings of a perfect storm of opportunity, in spite of the recent onset of a long-awaited cyclical bear market for North America’s capital markets.

A surging market for platinum prices and other platinum group metals (PGMs) over the past several years is proving to be a godsent for the world’s handful of platinum miners. And as global demand for this “green” precious metal begins to outstrip supply, a new generation of aspiring PGM miners are starting to get the attention of prescient investors.

ValOre Metals Corp. (TSX.V: VO) is one such company. Its Pedra Branca project in northern Brazil is fast becoming an increasingly valuable strategic asset for this forward-thinking mineral exploration company, which is also developing uranium and gold projects in Canada.

I am initiating coverage of ValOre due to the prospective upside value of its emerging PGM deposit – which already benefits from an “inferred” (initial) resource estimate of 1.067 million ounces of PGM and gold combined. Now, recent exploration developments suggest that the picture may yet become even rosier by way of the prospect of unearthing considerably more near-surface tonnage at a proximal new discovery area. More on this in a moment.

Beyond the prospect of boosting the company’s resources, there are also compelling market tailwinds favouring ValOre’s commitment to unlocking the value of Pedra Branca. To this point, the global demand for PGM metals is destined to continue at an accelerated pace, in spite of the onset of a year-on-year supply deficit. Hence, the mining industry will become increasingly incentivized to bring in-development greenfield projects on-steam. Pedra Branca could be one of them.

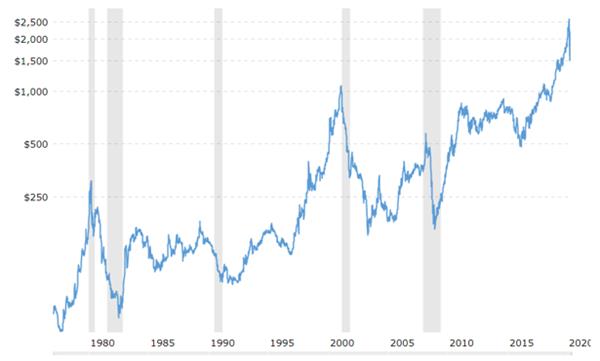

Historic prices for palladium show how demand is outpacing supply, leading to surging spot prices

Historic prices for palladium show how demand is outpacing supply, leading to surging spot prices

Additionally, I see another key value driver in the fact Pedra Branca is one of the very few PGM deposits anywhere in the world that is situated in a politically stable nation state. In stark contrast, in excess of 80% of global platinum and palladium production takes place in such politically problematic countries as Russia and South Africa – neither of which can be relied upon to guarantee uninterrupted long-term supplies of these strategic metals to end users.

Therefore, I believe that the scarcity value of this emerging, underdeveloped discovery will provide considerable intrinsic value to the company’s share price during the balance of 2020 – and beyond.

From a Stable of Winners

Interestingly, I have been covering a stable-mate of ValOre since it was trading in a similar range – around $0.25 – less than two years ago, Yet it has recently traded as high as $9.57, representing a return of over 2,000% for many early-stage investors.

I am referring to Great Bear Resources (TSX.V: GBR), which has made a world-class gold discovery in Red Lake, Ontario. In fact, Great Bear is the flagship exploration company within Vancouver’s renowned Discover Group – a mining consortium that has over the years served as an incubator for a succession of mostly gold-oriented “junior mining” exploration companies, including some very notable success stories.

To this point, the Discovery Group has created over $1 billion worth of value in the projects that it has groomed for acquisition by big-league mining companies. They include Kaminak Gold, which was scooped up by Goldcorp for a princely $520 million and Northern Empire Resources, which was bought by Coeur Mining for $117 million.

Great Bear is the most successful Canadian gold exploration company is recent memory with a world-class find in Red Lake, Ontario

Great Bear is the most successful Canadian gold exploration company is recent memory with a world-class find in Red Lake, Ontario

Then there’s Great Bear, which is too early in the discovery cycle to have generated a resource estimate as yet. So it has yet to become a bona-fide takeover candidate. Nonetheless, the capital markets have lately assigned valuations of up to $375 million for Great Bear – a figure that could soar higher in the eventuality that a drill-defined resource estimate attests to the presence of millions of ounces of gold.

Having personally covered the mineral exploration business as a stock market analyst and commentator for over 25 years, I have found that companies with the best management (and mentors too) typically come up trumps in the end. With this in mind, I consider ValOre to be a standout candidate for the kind of M&A success that the Discovery Group is well known for.

This perspective is underscored by the fact that ValOre’s Chairman and CEO is Jim Paterson, a seasoned mining industry financier and company builder who co-founded the Discovery Group along with John Robbins -- an award-winning, well-regarded geologist who has developed something of the Midas Touch over the past 30 years.

An Increasingly Lustrous PGM Project

ValOre’s sprawling 38,940-hectare Pedra Branca PGM property exhibits the kind of attributes that the Discovery Group looks for:

- district-scale opportunities (high-quality airborne and ground geophysics attest to this reality at Pedra Branca, especially with the discovery of a new cluster of several large PGM targets)

- well-established mineral prospects that benefit from prospects) extensive exploration ($35 million has historically been spent at Pedra Branca)

- extensive past drilling (over 30,000 metres of historic drilling data to inform future drilling)

- an initial near-surface high-grade (open pittable) resource estimate to build upon (over one million ounces of PGM/gold outlined to date)

Pedra Branca checks off all of these boxes – and more. In fact, it has been shown so far to host five distinct PGM discovery zones extensively probed by way of 385 drill holes, including the discovery of plenty of near-surface high-grade mineralization.

An independently calculated NI 43-101 compliant inferred (preliminary) resource estimate shows that Pedra Branca hosts 1,067,000 ounces PGM/gold in 27.2 million tonnes, with an average grade of 1.22 grams PGM+Au (gold) per tonne.

Furthermore, much of this mineralization outcrops at surface, attesting to the fact that these inferred resources may be amenable to inexpensive, quarry-like mining operations. This also appears to be the case among a cluster of several new PGM prospects to the north of the known deposit – with all of them exhibiting a strike length of at least one kilometre each.

Collectively known as Mendes North, these new large-scale discovery zones may yet prove to be a considerably valuable new source of additional open-pittable PGM resources.

An exquisitely beautiful metal, palladium is as dazzling as gold but its surging spot price easily outshines its less expensive rival

An exquisitely beautiful metal, palladium is as dazzling as gold but its surging spot price easily outshines its less expensive rival

Additionally, ValOre has discovered the previously undetected presence of rhodium in past drill core – all because previous project operators never before tested for this valuable platinum group metal. Notably, rhodium’s spot price has risen dramatically over the past couple of years from below US $4,000 per ounce in mid-2019 to recent prices as high as US $11,500.

What’s Driving the Supercharged PGM Metals Market

We have apparently already reached “peak palladium”. To this point, the planet’s 10-million-ounce per annum palladium market is set to experience a significant deficit in the coming years due to a steady decline in output since 2004, as well as a scarcity of new mines coming onstream.

This supply squeeze is being exacerbated by surging demand for PGM metals in the automobile industry, with 90% of palladium supplies being used in emissions-regulating catalytic converters. In particular, there has been a spike in demand for PGM metals, particularly with millions of new automobiles being manufactured each year in the emerging economic superpowers of China and India. Because of this, platinum is also experiencing a long-term supply deficit, too.

The high price of PGM metals, matched with open-pit mining methods, make these mines some of the world’s most profitable ones

PGM M&A Activity Heats Up

The high price of PGM metals, matched with open-pit mining methods, make these mines some of the world’s most profitable ones

PGM M&A Activity Heats Up

South Africa’s dominant PGM miners are aggressively expanding their operations into a handful of less politically and economically fraught nation states that also benefit from PGM mineral assets.

This includes North America. For instance, Sibanye Gold paid US $2.2 billion for Stillwater’s USA assets in May 2017 and in December 2019 Impala paid US $750 million for North American Palladium’s Canadian assets. This means that other in-development assets are also expected to be on the auction block sooner or later. And as ValOre continues to build upon its initial PGM resource at Pedra Branca, the company is increasingly likely to become a prospective future M&A target.

Investment Summary

The global demand inelasticity for PGM metals is sure to increase as governments continue to focus on reducing emissions. Against this backdrop, ValOre has acquired a partially-developed PGM asset that benefits considerably from its scarcity value.

With so few greenfield PGM projects coming on-stream in recent years, ValOre is surely in the right place and at the right time. The prescience of the Discovery Group in helping to acquiring the Pedra Branca PGM deposit is sure to infuse a new lease on life for ValOre in a buoyant market for all precious metals, including the PGM sector.

In fact, Pedra Branca is a tangible asset that has all the right (previously outlined) attributes that the Discovery Group looks for in an under-developed and under-valued exploration opportunity. Investors should expect ValOre do aggressively advance this deposit to an eventual production decision.

On a technical note, ValOre has 89 million shares outstanding (103 million fully diluted), which ordinarily translates into sufficiently liquid trading volumes each day. This is mindful of the fact that at least a third of all the shares outstanding are tightly held by insiders and advisors.

With this in mind, the company has an relatively undiluted “float”. Such a reality, when matched with a steady flow of upbeat exploration news, typically acts as a powerful catalyst to higher share price valuations. On this note, I fully expect ValOre to be an impressive performer during 2020.

ABOUT THE AUTHOR: Marc Davis has a deep background in the capital markets spanning 30 years, having mostly worked as an analyst and stock market commentator. He is also a longstanding financial journalist. Over the years, his articles have appeared in dozens of digital publications worldwide. They include USA Today, CBS Money Watch, The Times (UK), Investors’ Business Daily, the Financial Post, Reuters, National Post, Google News, Barron’s, China Daily, Huffington Post, AOL, City A.M. (London), Bloomberg, WallStreetOnline.de (Germany) and the Independent (UK). He has also appeared in business interviews on the BBC, CBC, and SKY TV.