Feeling Good

All engines stop. After a week like the last, it is important to exit the fright train. Bombarded by news that leave you at best concerned but more likely rather frightened, it is key to change ones state. No good decisions are made from a low energy state. However, you are confronted with many more high priority choices to be made. The whole world lost nearly a quarter of its wealth and the blood bath does not seem to be over just yet. How can you avoid making to many mistakes? Above all, stay ahead, rather than being glued to various news sources? Not feeling overwhelmed? Not being forced to react like a lemming in an environment fostering so easily scarcity thinking? How can you be all that you can be for your family and friends instead? Moreover Feeling Good in times like these?

We provide a free telegram channel, where we compress information to a high quality news stream. That is not enough! We post high probability low risk entry and exit points alongside good long term investing advise. That still doesn’t cut it. Without you feeling good the most likely scenario is that you sit shell shocked after being bombarded for weeks or months with negative energy unable to pull the trigger. Yes, there will be great opportunities in the market revealing themselves, but the hardest part will be to act upon them in an adequate fashion.

Here is one thing that you can do.

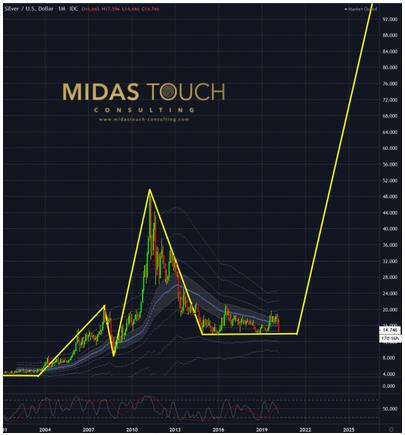

Silver Weekly Chart – Prices At Bottom Of Sideways Range:

Silver in US Dollar, weekly chart as of March 13th, 2020

Fridays session of Silver prices closed at US$14.75. Now it is speculative what the precise amount of the cost to mine an ounce of silver is, but it is fair to say this number is in the teens. So silver is trading somewhat near its value.

What if:

- You take the money that you would have spent on a weekend getaway that you now are not taking and buy a bullion of physical silver. Take the equivalent for the gym membership that you just canceled and have a box of silver coins delivered to your front door.

- You give yourself a gift. A tangible one. One that has low risk to lose its equivalent of dollar value. One that is a true currency of barter should things become even uglier and one that might as well with a quite good probability work out to be a good investment over years to come.

- You, giving yourself the gift of feeling more secure, feeling good.

Silver Monthly Chart – Feeling Good Towards A Bright Future:

Silver in US Dollar, monthly chart as of March 13th, 2020

Looking at the monthly chart it shows that there is certainly a good chance your investment paying of in the long run. Lets not forget we didn’t say to bet the farm. We merely said what you had planed to spend on yourself for fun on the next Las Vegas trip, spending money, might find a good place in your home instead. There were times in the past where you could after extreme crisis buy a house for a few hundred ounces of silver. Does it really matter for very small amounts like these invested if they quadrupled or quintupled or whatever multiplier. Is it really necessary to pinpoint the absolute lows. May be it is ok if not every market participation needs to be a maximized profit event. Sometimes it is also a good investment by investing into Feeling Good. In our opinion this is a prerequisite to place the big bucks at the right time with the right mindset.

Feeling Good

You might have been deprived going to your favorite gym or your freedom to travel anywhere you like. There might be fear to lose ones job or health. You find yourself in a situation that you certainly have not chosen. However, no one can take your freedom of how you feel. Feelings are your own interpretation of your reality and as such You are in control of how you feel. We are not suggesting you have to buy silver, but we are suggesting that no circumstance should disable you to see opportunities and act upon them properly in times when it is tough to embrace and overcome obstacles.

We post real time entries and exits for the silver market in our telegram channel. Follow us in our telegram channel.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.