Go big or go home!

This corporate battle-cry is proving particularly effective for a select few enterprising Canadian gold explorers that realize the importance of amassing “district-scale” land positions to maximum the prospects of unearthing a few million ounces of gold, commonly referred to as “elephant-sized” discoveries.

To boost the odds of such world-class discoveries, these uber-ambitious companies have proven adept at piecing together large swathes of mineral claims within well-established gold belts.

Accordingly, this provides the opportunity to generate multiple large drill targets over large areas. Each one of which might prove to be a company-maker discovery. Alternatively, a cluster of smaller deposits strung out along a gold belt like beads on a pearl necklace might collectively amass into a multi-million-ounce jackpot.

Either way, it’s a dynamic formula for success that has worked out very fortuitously for

Great Bear Resources (TSX.V: GBR). I first began covering Great Bear at around $0.30 over two years ago. At the time, the company had just painstakingly amassed an expansive, district-scale land position in Ontario’s fabled Red Lake gold camp – consolidating ownership of a vast patchwork of mineral claims for the first time ever.

The gamble paid off. Market analysts suggest that Great Bear is well on its way to proving the existence of at least several million ounces of gold, probably more. In fact, the company has unearthed two separate high-grade discoveries in close proximity to one another – each of which has the potential to be a world-class gold find in its own right.

Also, only about 40% of the property has been drill tested to date. So there is still scope to make other sensational discoveries within the same land holdings. This all helps explain why Great Bear’s share price is fast closing-in on $10 a share.

How Success Breeds Success

How Success Breeds Success

Now a corporate stablemate from the Discovery Group of companies is looking to emulate a measure of Great Bear’s extraordinary success.

Genesis Metals Corp. (TSX.V: GIS) (

OTCQB: GGISF) is the latest contender for a company-maker discovery.

Fortunately for Genesis, the Discovery Group is led by John Robins and Jim Paterson. These renowned mining industry financiers/developers have outperformed over the past couple of decades, being responsible for several of the best-known Canadian gold exploration success stories in recent memory.

Among them is Kaminak Gold Corp., which was sold to Goldcorp for an attention-grabbing CDN $520 million. Other standouts include Northern Empire, which was sold to Coeur Mining for CDN $117 million in late 2018, as well as Underworld Resources, which was acquired by Kinross Gold for CDN $140 million dollars in 2010.

Additionally, Rob McLeod, former Chairman of Genesis, and Adrian Fleming, Executive Director, were also driving forces behind Underworld’s company-maker discovery. So too was Jeff Sundar, who was a vice president and director of Underworld. A seasoned mining industry executive with over 20 years experience, he was until recently Genesis’ CEO but has now stepped into the very hands-on executive role of Chairman of the Board.

In so doing, he has appointed a new CEO, David Terry, PhD Geo – a seasoned mineral explorationist who has worked in senior roles for the some of the best-known mining companies in the world, including Hemlo Gold Mines Inc., Cominco Limited and Gold Fields Mining Corporation. Dr. Terry is also a director of Great Bear. All told, he has been involved in a number of significant gold discoveries over the past 25 years throughout the Americas.

With Terry now at the helm and with the advisory talents of Robins and Paterson also benefitting Genesis, the company is now well positioned to make a name for itself among some of the most geologically fertile gold fields in North America.

Zeroing-In on “Elephant-Sized” Discovery Opportunities

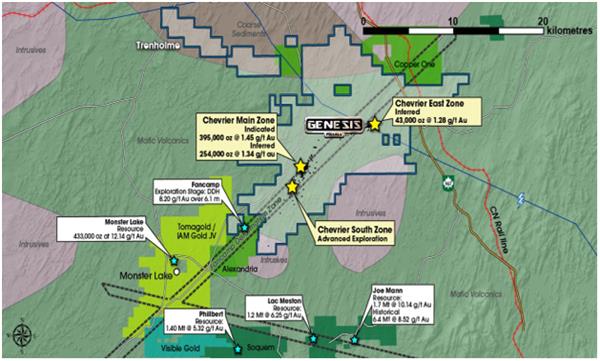

Genesis has already outlined one modestly-sized gold deposit – known as the Main Zone – on its sprawling land package, known as the Chevrier Gold Project, which is located near Chibougamau, Quebec.

At the conclusion of 2019’s drilling season, a new mineral resource estimate was calculated, consisting of 395,000 ounces of indicated gold averaging 1.45 grams per tonne (g/t), as well an inferred resources of 297,000 ounces gold averaging 1.33 g/t.

However, the discovery area only covers a tiny fraction of a sprawling property that encompasses nearly 300 square kilometres, spanning the length and breadth of an under-developed, emerging gold belt that has already yielded around 7 million ounces of gold to date.

In fact, the property straddles the 15-kilometre extent of the Fancamp deformation zone (an emerging gold belt that traces a geological fault or fissure), which also hosts the proximal high-grade Monster Lake gold project and the new 3-million-ounce Nelligan gold discovery that belongs to Iamgold and Vanstar Mining.

Due to its size, Genesis’ project area has the potential to host any number of important gold discoveries to build upon an albeit modest 300,000 resource base. Which is why a 2020 Phase I drill program – temporarily interrupted by Quebec’s COVID-19 lock-down – has been so important to the company’s future.

So far, about 25% (8 holes) of a planned 8,000-metre program has been completed. And the company is anxious to get back to work because of the potential to sweeten the overall grade of this emerging deposit by focussing on in-fill drilling into known high-grade zones, known as “shoots”. But most of all, Genesis is highly motivated to see if it can increase the overall footprint of this deposit with this summer’s step-out exploratory drilling.

In fact, more than a dozen large high-priority targets dispersed over a 15-kilometre trend running the length of the company’s property are being investigated this summer – some of them by way of drilling.

Each target is sizeable, ranging from one to three kilometres in length. And each of them attests to the fact that district-scale opportunities for multiple gold discoveries may exist within Genesis’ sprawling land package.

Ultimately, Genesis’ efforts to upgrade the Main Zone deposit and even discover new satellite deposits could go a long way towards making it an attractive takeover target. This is mindful of the fact that the project area is conveniently located in close proximity to several gold mines and mines in-the-making.

Winning Over Top-Tier Investors

Big-league investors in the stock market tend to be far more successful than small retail speculators. This is because they have the competitive advantage of amassing expert knowledge about the industries that they invest in.

With this mind, Genesis has received plenty of validation so far by way of the caliber of investors making up its share structure. They include gold investment guru, Eric Sprott, who is a significant shareholder (7.2%), as well as several high-profile mining investment funds – namely, Gold 2000, US Global Investors, Medalist Capital and Delbrook Capital.

Also, two Quebec government-sponsored investment funds, SIDEX Limited Partnership (SIDEX) and La Société de Dévelopement de la Baie-James (SDBJ), represent two “generalist” blue-chip institutional investors who are likewise on-board.

Investment Summary

The still-emerging Main Zone deposit is a tangible asset that provides a solid underpinning for Genesis’ share price. Plus, the beefing-up of the company’s management team and its advisory board also adds accretive intrinsic value to the company’s share price.

However, the sizzle in the steak going forward comes in the form of all the “blue sky” potential for company-maker discoveries due to the district-scale size of Genesis’ land holdings. After all, it’s worth reiterating that the Chevrier project area sits at the heart of an emerging gold belt that has yielded over seven million ounces of gold to date; it is also where new economic discoveries continue to be made.

Furthermore, the in-development Main Zone deposit and prospective future discoveries are all ideally located in the politically stable, mining-friendly jurisdiction of Quebec, where there is already plenty of mining infrastructure already in-place.

The Discovery Group’s prescient decision to expand and enrich the Chevrier gold project’s gold inventory and to go “elephant hunting” during a powerfully resurgent bull market for bullion prices may be about to pay off in a big way – just like it did with Great Bear.

To this point, the advent of a steady stream of exploration and development results in the coming months, matching with buoyant bullion prices, should help power the company’s share price to higher levels. (This is predicated on the assumed re-commencement of exploration work within the next couple of months as restrictions are eased on Canadian businesses.)

Don’t take your eye off this stock. 2020 promises to be a breakthrough year for Genesis.

ABOUT THE AUTHOR: Marc Davis has a deep background in the capital markets spanning 30 years, having mostly worked as an analyst and stock market commentator. He is also a longstanding financial journalist. Over the years, his articles have appeared in dozens of digital publications worldwide. They include USA Today, CBS Money Watch, The Times (UK), Investors’ Business Daily, the Financial Post, Reuters, National Post, Google News, Barron’s, China Daily, Huffington Post, AOL, City A.M. (London), Bloomberg, WallStreetOnline.de (Germany) and the Independent (UK). He has also appeared in business interviews on the BBC, CBC, and SKY TV. Marc Davis is also an enthusiastic shareholder of Genesis Metals.