Overnight, Natural Gas broke above the $2.00 price level as we expected. On April 6, 2020, we published our research that Natural Gas was setting up a bottom pattern and that our seasonal analysis suggested April and May should prompt a price rally in Natural Gas pushing price levels above $2.40.

The current rally has broken above a price resistance level near $2.00 and the rally up to $2.40 may happen faster than we expect. Currently, our Daily Fibonacci price modeling system is suggesting the $2.35 area is the first area of resistance. Beyond that, the next level of resistance would be near $2.90. Beyond that incredible upside target, the Fibonacci Weekly data is projecting an upper target near $3.60.

We are not suggesting that Natural Gas could rally 90% over the next few weeks, but we are alerting you that a move to $2.40 seems highly likely after our incredible bottom call on April 6, 2020.

Before you continue, be sure to opt-in to our free market trend signals

before closing this page, so you don’t miss our next special report!

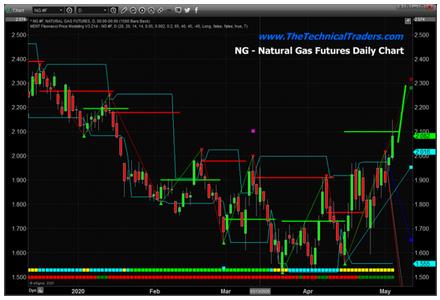

Daily Natural Gas Chart

This Daily Natural Gas chart highlights the rounded bottom setup that prompted us to make the bottom warning. Skilled traders will see an inverted Head-n-Shoulders pattern where the head consists of a double-bottom pattern near the end of March and into early April. The opportunity to buy into Natural Gas below $1.70 presented a very clear opportunity with little risk.

Weekly Natural Gas Chart

This Weekly Natural Gas chart highlights the Fibonacci Price Modeling system’s projected upside targets. The first target, near $2.40, is an easy target for a first profit level. The next upside target level for-profits should be near the RED LINE, near $2.55. Beyond that, if Natural Gas continues to rally, the next area for skilled traders to pull profits would be the $2.95 level. Any move higher beyond that level would be a gift with a target level near $3.60.

Concluding Thoughts:

Overall, this has been an excellent trade. We got our members into this trade fairly early and are already pulling profits and trailing stops. It certainly helps to have the modeling systems and seasonal analysis tools we use to find these setups for our members – but you can do it too. All it takes is a bit of skill and understanding of how certain markets operate within seasonal trends and setups. Otherwise, if you don’t have the time to research every chart we can do it all for you and just send you the trades we are taking.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is an incredible year for traders and investors. Don’t miss all the incredible trends and trade setups.

Subscribers of my Active ETF Swing Trading Newsletter had our trading accounts close at a new high watermark. We not only exited the equities market as it started to roll over in February, but we profited from the sell-off in a very controlled way with TLT bonds for a 20% gain. This week we closed out SPY ETF trade taking advantage of this bounce and entered a new trade with our account is at another all-time high value.

Ride my coattails as I navigate these financial markets and build wealth while others watch most of their retirement funds drop 35-65% during the rest of this financial crisis going into late 2020 and early 2021.

Just think of this for a minute. While most of us have active trading accounts, what is even more important are our long-term investment and retirement accounts. Why? Because they are, in most cases, our largest store of wealth other than our homes, and if they are not protected during the next bear market, you could lose 25-50% or more of your net worth. The good news is we can preserve and even grow our long term capital when things get ugly like they are now and ill show you how and one of the best trades is one your financial advisor will never let you do because they do not make money from the trade/position.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Passive Long-Term ETF Investing Signals which we issued a new signal for subscribers.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.