Technical expert Clive Maund explains why he believes gold and silver are powering up for a stratospheric advance.

The deflation and depression is right here, right now, and if you don't believe that, try asking some of the 30 million people who just lost their jobs in the U.S., or those who (used to) work in the catering and tourism industries.

The Federal Reserve is reacting to this situation by working to create hyperinflation, because it finds it preferable to a deflationary implosion. There are two reasons for this. One is that it enables the Fed to continue to fulfill its time-honored role, which is to transfer wealth from the rest of society to the 1%, and the other is it defers complete systemic collapse for a little longer.

The Fed has created a staggering amount of new money since this crisis started a few months ago to feed the debt monster. Its balance sheet has gone exponential and is expanding vertically, guaranteeing hyperinflation, which will begin the moment the velocity of money starts to pick up. Currently there is no velocity of money because the economy is dead, but if you print enough money to throw at it, as in countless trillions, you can get things moving again.

At the risk of sounding old-fashioned, I want to point out here, for the benefit of those who perhaps have a hard time understanding certain basic truths, that creating more money does not actually create wealth. If you, say, triple the amount of money, all that happens is that you have three times the amount of money competing for the same amount, or a reduced quantity, of goods and services, which inevitably drives prices up, hence the trend to hyperinflation.

The manic money creation by the Fed has already driven stocks back up, so they have recovered most of their losses triggered by the virus scare, and the Fed will keep on pumping until it gets things moving again, in order to banish the specter of deflation.

But no matter how much they create to satisfy the immediate cravings of the debt monster, it will never be enough, and it will continue to threaten to jack up rates unless it is fed ever greater quantities of cash. Money creation has already gone into the vertical blow-off phase, and the quantity of money will continue grow at an accelerating rate until it becomes worthless.

Thus, it is no surprise that gold is starting to power up for an advance that will take it to the stratosphere, or more likely the moon. Silver hasn't "got the memo" yet, or maybe it did just last Friday, judging from its price action.

One of the key points to understand is that this crisis will not end until all the gargantuan debts that have built up, and associated derivative positions, are written off as worthless. Corporate debt, government debt, municipal debt, junk bonds and all bonds, right up to Treasuries, are intrinsically worthless, and are going to be forcibly marked to market by one of two methods: default; or hyperinflation—as in, "Here's your money back—oh, I'm awfully sorry, it's now worthless."

If you own any of this garbage, you should move swiftly and resolutely to get rid of it, before its value declines to a big fat zero. The crisis cannot end until the overhang of this atrophying sludge, which is like a huge ball and chain hanging around the neck of the world economy, is eliminated. The creditors will end up with nothing. One of the main reasons for the recent huge money creation by the Fed is to backstop the credit markets in order to stop rates rising, which would cause debt to compound at a catastrophic rate. They seem to be alright, however, with the idea of eliminating the debts by taking the hyperinflationary route.

The Fed is to other central banks around the world what the Corleone family was to the Mafia in the "Godfather" series, which is to say that they had better follow the Fed line unless they want to get "wasted." Thus, we can expect them to engage in the same manic money creation.

With fiat around the world now heading at an ever-rapid rate toward its intrinsic value of $0, the choices for those wanting to preserve their wealth are rapidly narrowing down toward just two things: gold, which is real money; and silver. While various scarce collectibles like old cars and paintings hold their value and increase in price during periods of high inflation, they are not a very practical means of exchange. You cannot imagine wandering around a street market with a painting and stopping at a stall and saying, "I'll swap this old Rembrandt for that cabbage and a couple of parsnips," and that's assuming that you get that far without being mugged.

Gold and silver are more transportable and more practical—silver especially for more minor transactions, which makes its recent poor performance relative to gold somewhat puzzling. Not that we are complaining, since it is giving us more time to load up before it does take off.

With respect to silver's relatively rotten performance compared to gold in the recent past, this is a good point at which to draw your attention to an excellent article by Jeff Clark on the subject entitled Why Is Silver Stagnant and When Will It Start Moving? I'm sure you will agree that this is most encouraging article for silver investors.

A reason why we have been rather "backward with coming forward" to make investments in the precious metals sector in the recent past was the serious risk that markets would tip into another severe bear market down-wave, but this danger is now believed to be passing due to relentless and massive money pumping by the Fed designed to backstop the credit markets and pump the stock market, especially the darling FAANG (tech) stocks, which are now "organs of the state."

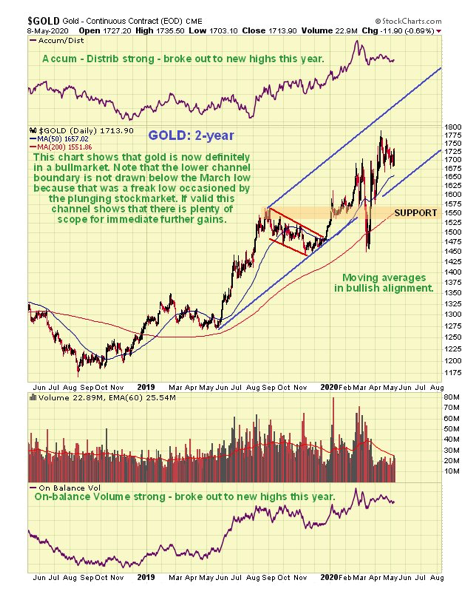

We can see on gold's latest 6-month chart that the recent pattern could have been a top following its arrival at a trendline target, but now it is looking increasingly like a bull pennant.

On the 2-year chart, we can see that gold is definitely in a bull market. There are a couple of interesting points to observe on this chart. One is that the quite strong advance in the middle of last year broke gold out of the multiyear base pattern that we can see on the 10-year chart lower down the page. Another is that the action into mid-March this year demonstrates that if the stock market crashes it will take gold down with it, although as set out above, rampant Fed pumping is greatly reducing this risk. Although it looks like gold could further medium term on this chart, we can equally see that the rate of rise could now accelerate, especially the accelerating rate of money creation.

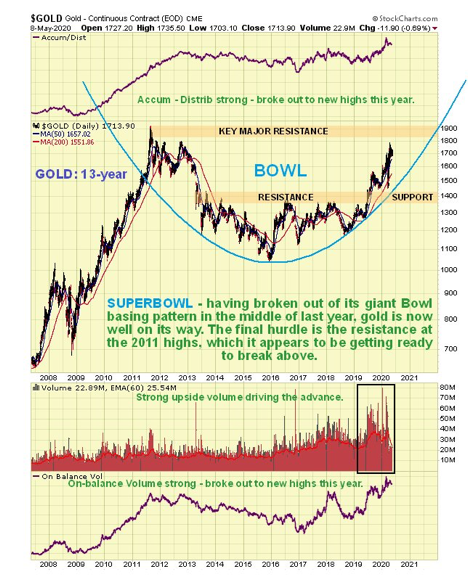

On the long-term 13-year chart, we can see the big bowl base pattern that formed between 2013 and last year, and how, following last year's breakout above the upper boundary of this pattern, it is forging ahead in readiness for a breakout to new highs. Of course, gold has already broken out to new highs against most major currencies. A strongly bullish point to observe, which bodes well for the future, is the strong upside volume driving the advance, which has taken both volume indicators shown to new highs.

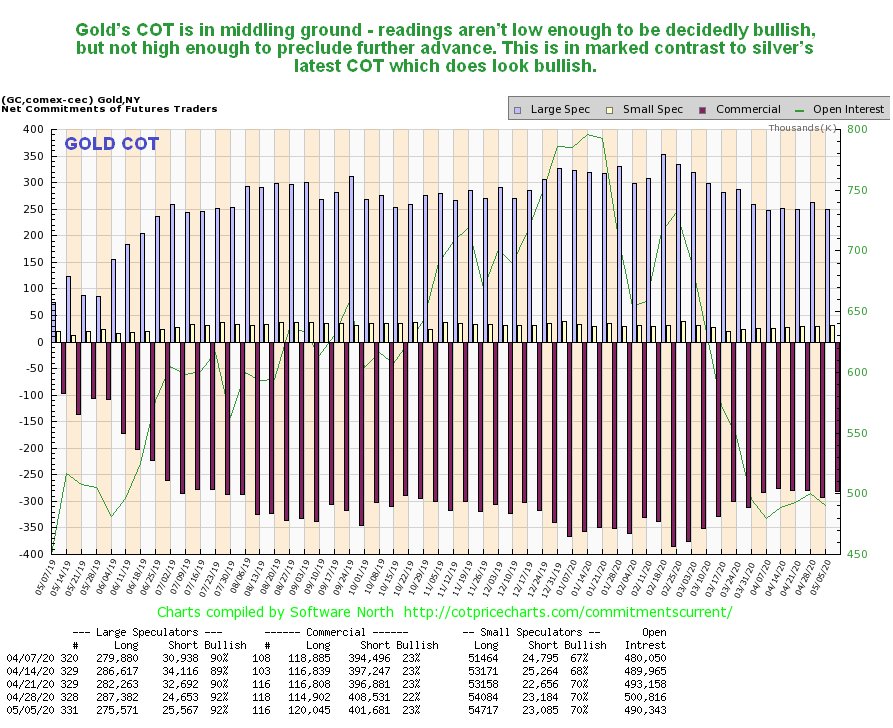

Gold's latest COT shows readings in middling ground—not low enough to be decidedly bullish, but not high enough to preclude further advance. This is in marked contrast to silver's latest COT, which looks much more positive.

A final point worth making relates to the now big gap between the paper price of gold and the prices for physical metal, which is becoming increasingly hard to obtain. This is viewed as a very positive sign, and it is hardly surprising considering what is going on in the world. If you are interested in buying physical metal you should not less this put you off, because the gap is likely to widen much more as the price advances before physical metal becomes unobtainable except at very high prices.

Originally published on CliveMaund.com on Sunday, May 10, 2020.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.