Maurice Jackson: Today we will discuss the 2020 financial crisis and investment opportunities for your portfolio. Joining us for a conversation is Brien Lundin, the president of Jefferson Financial.

Mr. Lundin, investors are in a state of confusion and they're looking for some sound guidance. These are truly unique times. For someone who says, "We've been here before, it's going to be all right," can you please share what are the primary differences between the global financial crisis of 2008 versus 2020?

Brien Lundin: Well, two things really. The primary difference, first off, is the degree of monetary accommodation and stimulus efforts. We always predicted this would happen to a greater degree this next time around. But the second big difference has been the rapidity of the move. We expected—and I had been predicting in Gold Newsletter for a couple of years now—that the next crisis would come, they would find some excuse to demand more easing from the Federal Reserve, and the patient would demand more of the drug this time, so they would have to do more than they did before. But I expected all of this to play out over, say, five years. I did not expect it to play out over veritably five days, as it has. That's been the big difference. Time has been compressed, everything's on turbo, it's all coming at us very quickly. That is why I believe that investors have to just really focus and leap ahead, and think ahead about all of the ramifications.

Maurice Jackson: Are you surprised at the responses from the Congress, the Treasury and the Fed?

Brien Lundin: No, not at all. As I mentioned, I had expected it to come—really this year at some point; I expected it later in the year. And more a function of the passage of time, because this market has been built on the adrenaline of easy money—and by this market, I mean the stock market, which, in turn, now means the economy. It had all been built upon this foundation, a very shaky foundation of the historic accommodation from the Federal Reserve. And then, at some point, I predicted. . .the market was going to throw a hissy fit and start correcting and demand that the Fed come back and start this whole rate cutting cycle again.

And what I had been saying was that this time around, it would have to do more quantitative easing—go back to zero again on interest rates, but do more quantitative easing—than they had ever done before, and that this time around they would have to actually get into some fiscal measures, stimulus spending, direct aid and spending to the economy infrastructure and that sort of thing. So none of this came as a surprise. I knew the market was going to look for some excuse.

As it happened, COVID-19 was the excuse, it was the perfect excuse. It's a very valid excuse in my mind. But all of this happened anyway, but later and at a much slower pace. So no, I'm not surprised at their reaction and I think it's only the beginning. I think they're going to do much, much more.

Maurice Jackson: All three of the aforementioned are going to be extremely resilient in their efforts to solve problems that they and their predecessors created. When you hear the Fed chairman state that now is not the time to worry about debt, but use the great fiscal powers of the U.S. to avoid deeper damage to the economy, does that signal to investors that everything is going to be OK?

Brien Lundin: Well, I think it signals to investors that it's whatever it takes—in that all of the rules, all of the restrictions have been thrown out the window; in that the Fed will overshoot, if anything, in its mitigation efforts.

So I think what that tells investors is that we're going to see the Fed's balance sheet soar to the sky. We're going to see money printing of a degree we've never seen before out of war time, and probably even including that. And they're not going to be restrained in any way. So I think that's telling us that everything we expected is going to happen, but it's going to be almost exponential to what we would have realistically expected.

Maurice Jackson: Speaking of the national debt, where do we currently stand and where do you think it'll be by the end of the year?

Brien Lundin: Well, we were pushing $23 trillion, in terms of the gross federal debt before this crisis. And I think by the end of the year, or by the time this crisis runs its course, will be in excess of $26 trillion.

And when Donald Trump was elected, I made the remark that, judging on past history, every eight-year term, eight-year presidential administration, typically doubles the debt of the previous administration. And if that was going to happen, in this case, we would have a federal debt of $40 trillion. At the time I admitted that sounded absurd, but this was the pattern and I just wanted to bring to everybody's attention. Now, it doesn't seem so absurd anymore—that by the time we get out of this, we'll be approaching a federal debt of $40 trillion.

But at some point it doesn't much matter anymore because we've already reached the point of no return. We've already reached a level in the federal debt where we can no longer have real interest rates, at least above zero. Now that is interest rates adjusted for inflation. And the debt is so large now that it must be depreciated away more quickly than the debt service costs are being paid on that debt, otherwise, the federal budget would collapse.

There's no way we can't afford to pay, and no way politically that I think American citizens would agree to pay a trillion dollars or more on debt service costs every year. And that's where we're getting to, that's where we would be if we had interest rates at any appreciable level, so we simply cannot have interest rates at those levels. Again, the debt will have to be depreciated away, moreover through the devaluation of the dollar, and that's going to happen, I think, to greater effect and at a greater speed than we expected before or that we've seen before.

Maurice Jackson: The big elephant in the room that many investors may be overlooking, is GDP (gross domestic product). How does GDP factor into this discussion?

Brien Lundin: Well, in terms of this crisis, it's going to take a big hit. It already took a big hit, down 4.5–4.8%, I believe, in the first quarter. The second quarter is going to be absolutely abysmal. I mean, there are economists predicting 20–30% declines in GDP for the second quarter, and that's going to be shocking.

I think that may be the impetus for that second dive down in the stock market that everybody's talking about. So we may see all of that play out.

But again, I think that the policy response, which you'll see from the Fed, which you'll see from Congress and the administration, is a redoubling of their efforts to rescue the economy, to stimulate the economy. And we'll see the money printing, we'll see the fiscal spending, the stimulus programs, the infrastructure spending. Really, it'll be a blank check mentality.

Maurice Jackson: Our government representatives must not be students of monetary history, as they appear to have no regard for the unprecedented inflation of our currency. When do you foresee the effects of inflation to begin impacting us all?

Brien Lundin: Well, it's going to happen. First off, this time I think we need that. In 2008, post-2008, we did not see much, we didn't see all of that money printing translated into retail price inflation, which is what the general public and the general investing public perceives as real inflation. We didn't see that because it was all encapsulated within the financial system and, of course, the rescue efforts back then were aimed more toward rescuing the financial system.

So this time around. it's a bit different. It's not a crisis within the financial system and a lot of the rescue efforts, a lot of the stimulus, is being aimed more at Main Street rather than Wall Street.

So I think we're going to see is more real-world effects of this monetary stimulation. We're going to see inflation perk up this time around. I think. . .to keep gold on a bull market path this time around, we'll actually have to see that kind of inflation.

But the good news for gold bugs is I think we will see it. I think it's, at this point, unavoidable, because there's so much. . .helicopter money this time around, checks being sent to American citizens directly. With that kind of monetary stimulus, I think inflation is unavoidable.

Maurice Jackson: Turning our focus to the stock market: With the declining currency, what kind of impact do you foresee in the general equities? Is this the time to get out?

Brien Lundin: Well, I haven't been a big stock bear. I don't think that you can look at, say, gold and the stock market as being contra-cyclical. I think everything right now—the metals, commodities, the stock market, the bond market—everything's being driven by central bank stimulus. It has been to great degree since 2008, and really over the decade or so before that, as we've seen the Fed become more and more involved in trying to manage the downturns in the economy. We've had these boom-and-bust cycles over and over again, but with all of this liquidity being thrown into the market, all of these typical inverse correlations or uncorrelated assets—all those correlations tend to go toward one.

So what happens is this kind of monetary stimulus is bullish for not only gold and precious metals, but also equities, also the bond market. So I don't think that the stock market necessarily will falter in the days ahead, I don't think it has to. Now, I think initially, all of this stimulus will be bullish for the stock market.

Maurice Jackson: And I'm assuming that includes mining and junior mining companies. Is that correct, sir?

Brien Lundin: Oh, absolutely. Absolutely. Because they're going to be supported by two big trends, by a bullish environment for equities in general, and by a bullish environment for the precious metals.

Maurice Jackson: And I guess oil would also factor in that discussion as well, lower oil prices, correct?

Brien Lundin: Yeah. Oil prices for the producers help tremendously, because energy is one of the primary input costs into gold production. Not only that, but we're going to see the CPI [consumer price index]—the public, the readings of inflation—drop a bit because of lower energy prices over the next few months.

But as we see supply destruction on oil, and we see the CPI get to lower levels because of lower oil prices, when oil prices do rebound, it's a lot easier to see a rebound in oil from say, $15 to $25 a barrel, and that's a tremendous. On a percentage basis, that's a tremendous increase. So we're going to see, once we get some economic recovery and some demand recovery in oil, we're going to see oil prices bounce, not to necessarily the $45, $50, $55 level, but to a significant degree, to where it will really boost the inflation readings. And I think that's going to come as a shock to the markets.

Maurice Jackson: Speaking of mining and junior mining companies, which ones have your attention at the moment and why?

Brien Lundin: Well, a lot of them, Maurice. I tell my readers that they need to buy the companies that are either in production or getting ready to get into production, and or have large established resources, because these kinds of optionality plays will be the first to benefit.

So that's the general advice I've been giving my readers. I haven't necessarily been taking that advice personally, because I know a lot of these companies very well. They have great exploration programs and great drill targets, and I've been pecking away at that myself and recommending them to my readers, at some of these very low levels.

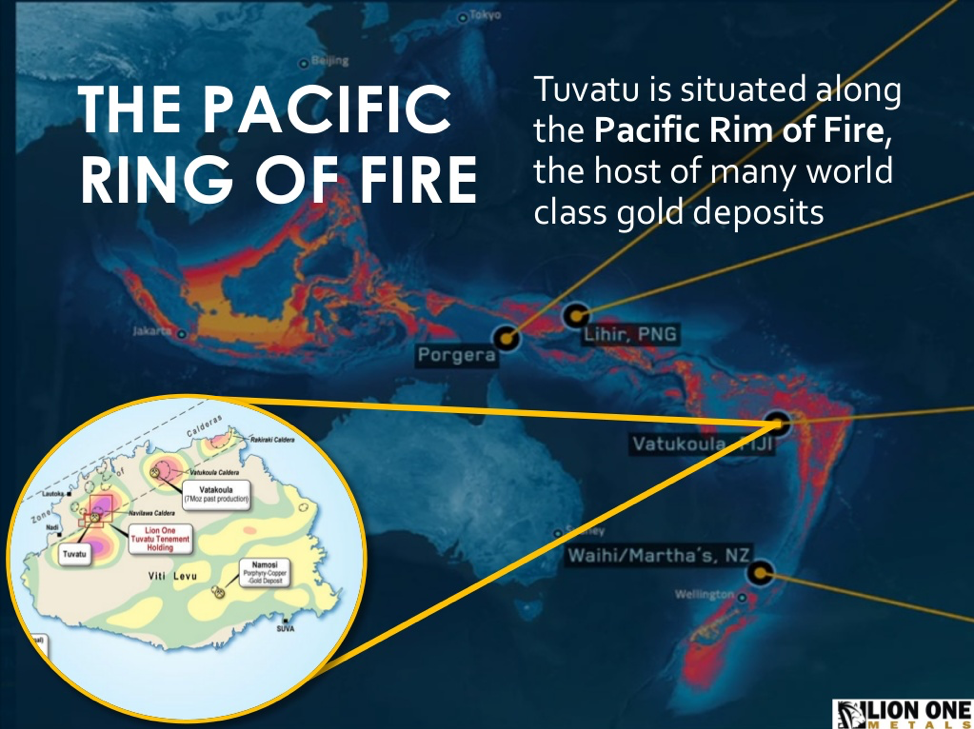

Some of the companies I like out there—I had a chance recently to talk with the management of the geologic team of Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX) and I really liked their project in Fiji, in particular the Caldera target. I think it's one of the most spectacular exploration targets you'll find in the world today.

And I'm also very familiar with Fiji and I think that's because I'm the chairman of Thunderstruck Resources Ltd. (AWE:TSX.V; THURF:OTC.MKTS), which is a exploration company with a drilling program ongoing in Fiji. I'm very familiar with that regime and I think a lot of investors aren't familiar with it. It's a blossoming new frontier for mining and metals exploration.

Maurice Jackson: And if I may interject there, with Lion One Metals, the CEO there is Walter Berukoff and their flagship project is the Tuvatu, and it's an alkaline deposit (VRIFY). That's what's very interesting here—it's an alkaline deposit, so we're looking at some significant tonnage and grade here, potentially.

Brien Lundin: Gold deposits, specifically alkaline deposits of that sort—the list of those kinds of deposits that have not become world-class mines approaches zero. The odds dramatically increase if it's a major discovery. So yeah, you bring up a very good point for that deposit. That's why I like it a lot; that's why I'm a shareholder personally.

Maurice Jackson: And was there another company you were about the reference? I'm sorry I interrupted you.

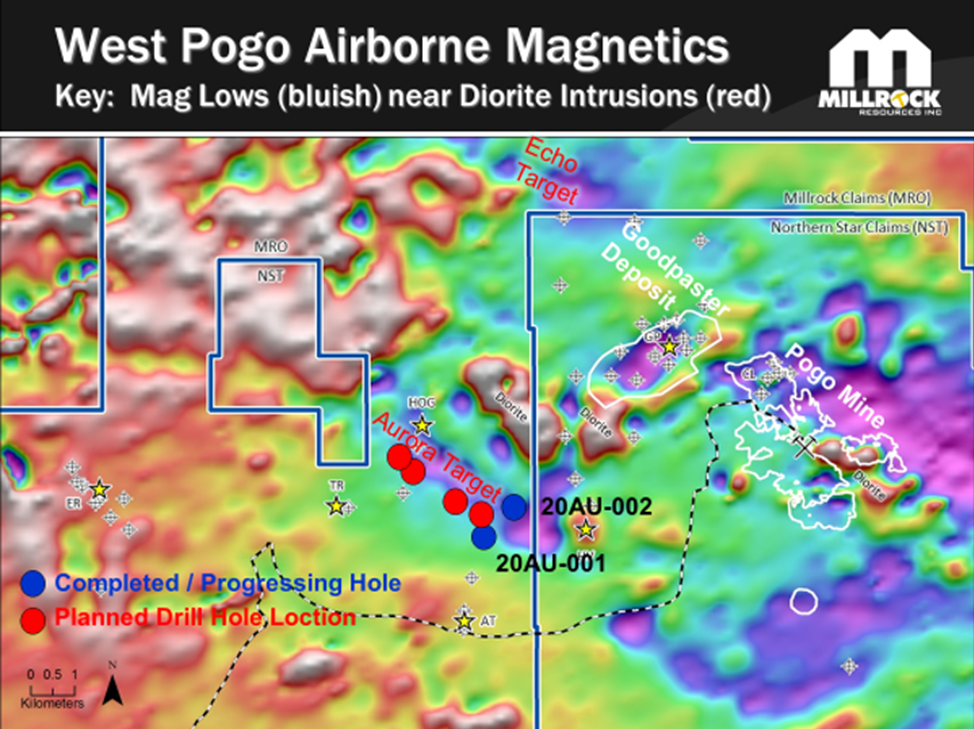

Brien Lundin: I've been recommending Millrock Resources Inc. (MRO:TSX.V; MLRKF:OTCQB), because their project adjacent to, on trend with, and surrounding the Pogo deposit in Alaska, is just amazing. They did an extraordinary joint venture agreement with an Australian company, where they will have $5 million of drilling accomplished this year.

They were just cut off by the COVID crisis and had to halt drilling after one-and-a-half holes. Now they got the results back from that first one and a half holes and they were disappointing.

And, in fact, the second hole didn't reach the targeted depth, so it was really just one of the holes, and it didn't turn up with good gold grades at all. So the stock has taken a hit.

But the key here is that the Pogo deposit—the new drilling on the Pogo deposit—trends onto their ground in two directions, and with $5 million of drilling upcoming, the chances that they're going to vector into what could be a world-class deposit are very good. So, I still like that one and I think it's a bargain right now.

Maurice Jackson: And likewise, the CEO there is a Gregory Beischer. You were discussing the 64North Project and the Aurora targets and yes, they only got about 25% completed there, but you couldn't be in a better location. And again, the gold wasn't high, correct, but the indicator minerals, they're there, that's what's remarkable. It was identical, basically, to the Pogo mine, which is Northern Star Resources Ltd. (NST:ASX) by the way, that's their neighbor there. But they're within walking distance of that mine. Strategic location, you couldn't beat it.

Brien Lundin: And the drilling of Northern Star kept going, progressing step by step closer to their property boundaries and essentially reached the property boundaries. And yes, the indicator minerals are there. The geology is just what they were looking for. The gold grades are barely anomalous at this point.

But with $5 million of drilling being done, they can vector in to where the higher grades are potentially, where you hope the higher grades and a deposit would be. It's hard to vector, though, with one drill hole, because it's just a point. But with $5 million worth of drilling, again, I have great confidence that they'll be able to find what they're looking for.

Maurice Jackson: And they have two strategic partners, Resolution Minerals Ltd. (RML:ASX) and EMX Royalty Corp. (EMX:TSX.V; EMX:NYSE.American) and they've done their due diligence.

Brien Lundin: And they always do: some of the smartest people in business.

Maurice Jackson: Absolutely. All right. Germane to this conversation, if the U.S. currency is going to lose purchasing power, how does money—i.e., gold and silver—factor into one's portfolio?

Brien Lundin: As you can imagine, I've gotten a lot of inquiries, and people are generalist investors, and we're publishing a newsletter called Gold Newsletter that really is the preeminent, the longest-lasting, the first of the precious metals advisories out there. I get a lot of people coming to me and asking, "How do I get started?" And I tell them all the time, "You have to start with a physical allocation of precious metals, physical metals, either in your possession or accessible to you." And you can build on that later and you can store more elsewhere, but you need to ensure your wealth with physical precious metals holdings.

You can then look into other ways to leverage these things we're talking about—of higher rising prices for gold and silver, which seem inevitable, and those are investments—but I tell them they need to have insurance for their wealth, insurance for everything they've worked for all their life, by holding physical gold and silver.

Maurice Jackson: Very, very responsible words. Thank you for sharing that. What does the current spot price of gold suggest to you, as the number of golden investors have been expecting a more robust response in the price?

Brien Lundin: When I began writing our May issue of Gold Newsletter, I was thinking, gold's really got to get moving. And then I started reading the previous month's issue, and then looked at the gold price. And said, "Damn, gold was $100 cheaper a month ago."

And it's $100 higher today, but it doesn't seem like it's really got that momentum and that's because it had a really torrid run the first two weeks of April, and spent the last two weeks of April and now early May, just digesting those gains. It hasn't fallen, it hasn't really resumed the rally yet, but it's been bouncing around that $1,700/ounce level.

I think it's completely normal. I think gold's waiting for the next shoe to drop, and the next indication that we're going to have more and more of the stimulus—and it's going to get that because, as I said, the second-quarter GDP numbers are going to be absolutely horrendous. And Congress just has to get back to trying to fill the trough once again.

And they're going to do that. We're going to have more and more stimulus programs, the most accommodative Federal Reserve we've probably seen in history, and we've only just begun.

Maurice Jackson: I'm not a big fan of the big banks, but Bank of America recently shared that they expect the gold price to reach $3,000/ounce. So it's not just you sharing this.

Brien Lundin: Yeah, yeah. And that's a very staid, credible institution. They tend to be a little bit more dramatic than the other banks and the other big institutions. But still, that's something that I'm even loath to say in interviews, without sounding crazy.

But that said, I fully expect it at some point and I think their logic is absolutely accurate and impeccable.

Maurice Jackson: We all have our favorites—gold, silver, platinum and palladium. May I ask, what are you buying right now and why?

Brien Lundin: I am buying more silver than gold. I am buying silver because it has not caught up to gold yet. It typically takes a while to catch up to gold in a long-term monetary-based gold bull market, which is what we're in. It typically takes silver longer to respond, but then it outperforms gold. We haven't really gotten to that outperform process yet, or stage yet, and I think we're going to get there. So I'm buying physical silver; have been buying physical silver. And in general the mining stocks, I'm buying the exploration plays that I know a lot about.

Maurice Jackson: Can you share your outlook on all four of the metals referenced?

Brien Lundin: Yeah, I'm very bullish of gold. I tell people, if you like gold, you have to love silver, so they are one in the same, as far as the big drivers.

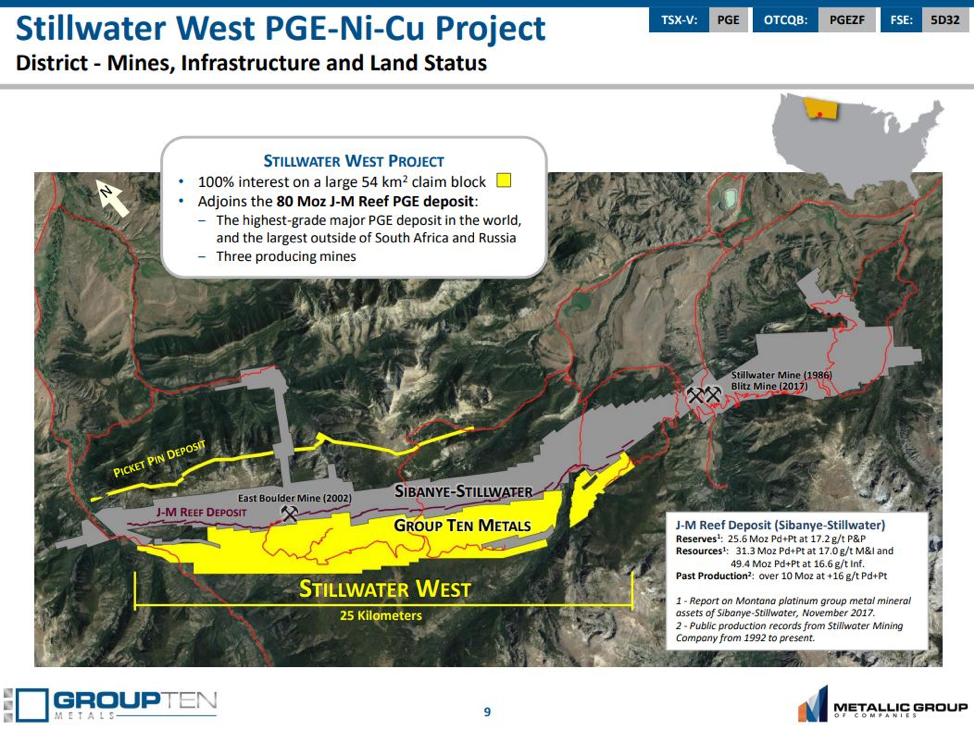

Platinum and palladium, I'm bullish on them but for different reasons. I think that there are genuine supply-demand dynamics in play for both of those metals that are inescapable. Right now. . .those precious metals had been abated a little bit, because a lot of the demand is driven by automobile demand and catalytic converter demand. So that will take a while to come back. But in the meantime, there are real supply issues with both of those metals, and I can tell you that the major producers are very bullish for the long term, and they're looking to invest in new projects.

I just recommended Group Ten Metals Inc. (PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE) recently. It's another one of my platinum-palladium plays, and I think the majors are going to be aggressive. Over the next couple of years, there's a window of opportunity for some of these PGM [platinum group metal] juniors are going to be taken out. And I know that those juniors are working toward that opportunity.

Maurice Jackson: And the CEO for Group 10 Metals is Michael Rowley. We had an opportunity to do a live webinar with him two weeks ago (click here). And the flagship project is the Stillwater West, located in Montana.

Switching gears, sir: you're the host of the New Orleans Investment Conference, the world's greatest investment event. For someone new, can you please introduce us to the New Orleans Investment Conference?

Brien Lundin: The New Orleans Investment Conference is the original retail investment conference, or really investment conference of any stripe. It was started in 1974 by Jim Blanchard, to teach American citizens how to invest in gold, and that right to invest in gold was something that Jim was instrumental in helping get back to American citizens. It had been taken away by Roosevelt in the 1930s.

So the modern gold bull market. . .has to thank the New Orleans conference for bringing that market to the populace, and showing retail investors how to buy gold, how to buy precious metals.

It's not your typical conference. We cover all of the sectors, all of the asset classes, but we do have a golden thread that runs through our event, or golden theme that's run through it over the decades, and we feature a lot of conservative/libertarian speakers. We feature a lot of big-name speakers that you won't find at other events.

And the camaraderie of our attendees, and the intelligence that they're willing to share, because they're all generally very successful investors in their own right—it's just an experience that you have to be there to really understand it. And we encourage anyone interested, whatever level of interest or experience they may be, if they're interested in preserving their wealth and building it during uncertain times, they really do need to attend the New Orleans Conference.

Maurice Jackson: And speaking of attendance, what are the dates this year?

Brien Lundin: October 14 through 17, and we're planning for a live event down here in New Orleans. It's always a lot of fun. And we're hopeful and actually expecting that all of this pandemic crisis and nervousness will be behind us—well behind us—by then.

Maurice Jackson: Who are some of the featured speakers this year and the discussion topics?

Brien Lundin: Well, we're featuring the best of the experts in gold, silver and alternative investments, and how to protect your wealth, and again, how to build it during these uncertain times. We've invited most of the major newsletter writers and commentators on the economy and on precious metals and mining stocks, because I really feel like this is an opportunity that only comes around once or twice in our investing careers. We've been very fortunate to be on the cutting edge of every bull market in the metals, and the results have just been stupendous for investors who come to our conference, who get the hottest picks from the world's top experts and get to meet a lot of the companies in our exhibit hall.

Maurice Jackson: I've had the opportunity to attend five years at the New Orleans Investment Conference, and I must say it is very welcoming experience. No matter what your background is or level of investment experience is, you are welcome there with open arms and you have the opportunity to learn, not just from the speakers but from fellow investors, to share intellectual ideas and take them back home. The relationships that I've created in these last five years I still have today, and I thank you for that, sir.

Brien Lundin: Yes. And these attendees are my clients, but they grow to be, over the years have grown to be close friends, and it's like an old-home week. Every year everybody gets together and makes new friends and greets old friends, and everyone is so willing to share their ideas and thoughts and strategies.

And I tell people every year, as we open the conference: "Y'all going to be looking at the stage, going to see some extraordinary speakers come up to the podium and give you their ideas over the next three, four days, but look around you in the audience. There's just as much to be gained from the people that come to this event." Because by coming to the New Orleans conference, they've already identified themselves as very smart, very active, intellectually curious, successful investors and there's so much to be learned and shared amongst all of us.

Maurice Jackson: Speaking of clients, Mr. Lundin, please introduce us to Jefferson Financial and the Gold Newsletter.

Brien Lundin: Jefferson Financial is essentially the holding company that operates both the Gold Newsletter and the New Orleans Investment Conference, and publishes our very special reports and other special projects.

So Gold Newsletter is the first precious metals advisory. We're now in our 50th year of helping investors navigate gold. In the first few years, Gold Newsletter was primarily involved in advocating for the legalization of gold ownership. That's how long we've been around. The New Orleans Conference, as we've just said, is where we all get together every year and share ideas and our predictions for the future.

And I can tell you that in times like we're in right now, it is not only not unusual, it's expected for us to find companies and get stock recommendations of companies that go on to go up four or five, 10, 20 or more times in value. This is where you find opportunities like that. This is where you find investors that have that kind of potential.

Maurice Jackson: Before we close, sir, what keeps you up at night that we don't know about?

Brien Lundin: Oh, well, lately maybe the pandemic, but really nothing keeps me up at night these days.

In regards to the economy, et cetera, I think that what we're seeing play out right now in the economy has been inevitable for some time. And if I do have any worry, I guess it's that not more investors know how to protect themselves through gold and silver.

You buy fire insurance, but you don't really expect your home to catch on fire. But gold and silver are the insurance for an event that you know is going to happen, that you know the dollar is going to be depreciated over time. It's insurance you only have to pay the premium one time, to get some protection. So it's a thing that more people need to know about, and they need to do, and they need to do it now. We're still in the very early stages of this game and we have literally years to come, of watching these trends play out and people really need to own gold and silver now, while they still can.

Maurice Jackson: And we're proud to have an affiliation with the Gold Newsletter. Mr. Lundin, I think, are we not in the Gold Newsletter as a licensed representative for Miles Franklin?

Brien Lundin: Yes, actually we have an investor's guide to gold and silver that tells people every way to invest in the precious metals, from physical metals, through mining stocks, even futures and options and more. But we also list the best dealers, the best conferences to go to, the best newsletters to subscribe to. So it's all there in one stop shop, a 30-page special report that explains it all, and which also lists you, Maurice Jackson, as a recommended dealer.

Maurice Jackson: Well, we're honored to be part of that elite team, sir. Last question. What did I forget to ask?

Brien Lundin: Well, I guess you forgot for me to give you a specific price prediction over a specific timeframe, which I would not have done anyway. But a lot of people try, a lot of people try.

Maurice Jackson: No, I think that's responsible, because we don't know where the currency is going to go and we don't know the government's response. So that's a moving target.

But I think you said the most responsible thing—the prudent thing to do as a cornerstone for your investment portfolio is to own some physical precious metals. It's insurance, and that's the most responsible way I can approach it and I think you've covered well, sir.

Brien Lundin: Yes. It gives you peace of mind, so you can sleep at night knowing that you have that working for you.

And again, these trends are undeniable, they're inevitable. People have gone through them throughout human history. It's going to happen again—the dollar will be depreciated, so people need to own gold and silver.

Maurice Jackson: Mr. Lundin, for someone listening that wants to get more information on your work, please share the contact details.

Brien Lundin:www.goldnewsletter.com and www.neworleansconference.com.

Maurice Jackson: And as a reminder, I am licensed representative for Miles Franklin Precious Metals Investments, where we provide a number options to expand your precious metals portfolio, from physical delivery, offshore depositories and precious metals IRAs. Call me directly at (855) 505-1900 or you may e-mail maurice@milesfranklin.com.

Finally, please subscribe to www.provenandprobable.com; subscription is free.

Brien Lundin of Jefferson Financial, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.