I was pacing around the house this lovely but cold Friday afternoon (after finally having the water supply restored after our well filed for unemployment benefits), trying desperately to think of a topic to write about in this weekly missive, when it suddenly occurred to me that there is not exactly a great deal of fuel for the fire right now. After we got the "20.5 million unemployed" and a 14.7% unemployment rate at 8:30 a.m., the New York Fed proceeded to do the following:

- juice the S&P futures;

- slam gold; and

- crush VIX futures.

The resulting trading action was about as bizarre as one could ever have imagined, as stocks roared out of the gate and never looked back, going out on the highs with traders saying their prayers while bowing in the direction of the Eccles Building in Washington, D.C. They then laid floral bouquets at the entrance to 133 Liberty Street, in an homage dutifully paid to the portfolio-saving efforts of the New York Fed.

As the four o'clock bell rang and the screens on my three quote monitors settled down to nothingness, I found myself staring blankly at the picture of Federal Reserve Chairman Jerome Powell holding court with the financial media earlier in the week, thinking, "That guy is no economist; he is a former investment banker turned carnival barker pitching the world on Wall Street banking's vision of the future."

Despite enjoying one of the most profitable years (thus far) of my forty-plus-year career, I find myself saddened by the events of 2020, not only for the heartbreak and hardships brought on by the pandemic, but also—and even greater than the loss of life and jobs and wealth it has caused—because of an even greater tragedy: the final destruction of the free market.

I am hard-pressed to find one market in the world today where prices are determined by the unimpeded and unmanipulated forces of demand and supply. Whether it is the floor of the Chicago Mercantile Exchange or the livestock auctions in Spain or estate sales at Sotheby's in London, the fruits of our labor—the purchasing power of our savings—is being systematically destroyed.

There is no mechanism anywhere to be found that can undo the damage done by the panicking, terror-stricken elites as they scramble to reboot the global economy. To the masses out there under the age of fifty, they look at the bespectacled Fed chairman, so elegantly attired in the classic grey suit and purple tie, as a grandfatherly figure, uttering words of assurance and encouragement in a manner that would have listeners believe that the Fed has it all under control. In a few months, the virus will have lost its virulence and thanks to the Fed's actions, citizens of the world will have their lives "back to normal."

And as I stare at the screen, I cannot help but remember the words of Ben Bernanke: "The Fed does not print money." And Janet Yellen: "To me, a wise and humane policy is occasionally to let inflation rise even when inflation is running above target." And, finally, Jerome Powell, who stated last fall, when the repo activities began: "This is not QE" (quantitative easing). After listening to these people—these academics (who put their trousers on the same way as do you and I)—tell these lies day after day, and year after year, and crisis after crisis, I must tell you that it has me ready to man the pitchforks and torches.

To the youngsters out there reading this, you have to understand that I have listened to this constant drivel since the arrival of the "Maestro" Alan Greenspan in 1987, who pontificated mysteriously for nineteen years as Fed chair while orchestrating two of the most enormous bubbles in U.S. history.

This serial money-printer and the godfather of behavioral finance has received every honor imaginable, including "Knight Commander of the Order of the British Empire," presumably for his role in navigating the FTSE (Financial Times Stock Exchange) to bubble status—and similar kudos from the French, as well as the highest honor given to any U.S. citizen, the "Presidential Medal of Freedom." I simply ask, "For what?"

Central banking had a role over time that was best executed in minimalist measures; today it is akin to a drunken meth addict having the keys to Fort Knox. They know no boundaries; there are no limits to their monetary power; and they are bereft of supervision because the elected officials are completely compromised by way of political self-interest.

Imagine that you are a farmer. You live in rural North America, and you have worked the land and fields since a boy, raised a family, educated your children, and now you are sitting on $350,000 of savings looking forward to retirement. You are not a financially sophisticated person; you place your savings into the bank account and hope to live comfortably for the rest of your life.

Then suddenly, without explanation, the cost of living begins to inflate and, through no fault of your own, the wealth you thought you had saved is no longer "wealth." Some unelected bureaucrat has issued five hundred times as many units of the same currency that you saved, and the purchasing power of your retirement nest-egg has been totally and unmercifully trashed. That unelected bureaucrat arbitrarily determined that the loan books of banks and the stock portfolios of the elite class were of greater importance than the purchasing power of a pool of "money" that represents sixty years of hard work and prudent spending patterns (and an ingrained fear of debt) that was drilled into you by your forefathers.

As I sit here contemplating the future of our North American societies on a Friday evening with a glass of wine in hand, titillating the artistic juices in Hemingway-esque fashion, I ask two questions:

- Who gave them the right to debase our money?, and more importantly,

- Where is the outrage?

I recognize that this missive should not be a forum for political dissent, but as a sexagenarian, I have a limited number of years left on the planet to watch this hyperinflationary nightmare unfold. It is my children and their children for whom I fear. These economist-academics at the Fed, the Bank of Canada, the European Central Bank and all across the globe simply have no idea of the outcome of all of this "stimulus" or "assistance" or "payroll protection," and it is the arrogance with which they address the voting public that gets my wick. They are no smarter than the farmer with the $350,000, and they are no more visionary than you or I, and they are allowed to digitally violate and cheapen a lifetime of conservative behavior. And that's wrong.

I remain a long-term bull on precious metals, and am currently 50% invested, with emphasis on the junior developers with ounces in the ground. The reason I am is that while there is the potential for a deflationary tsunami arriving from just over the horizon, there is just as much the chance of a supply-shock spike in food and basic staples prices of a hyperinflationary nature.

Not being a central banker, I do not pretend to know for certain the outcome. The central bankers are opting for the former, because the risk to those that own the Fed—the consortium of leviathan banks—are infinitely more vulnerable to a deflationary collapse in their loan collateral than the farmer with cash in hand and no debt. Sadly, these central bankers do not care about anything other than the sanctity of the banks' equity, and that is why Sikorski Steve Mnuchin said, "Nothing is more important than the American economy," when referring to his priorities concerning the pandemic, which is sad.

Near term, as I wrote at the onset, I fear that the same forces elevating stocks and buying junk bonds and mortgage-backed securities and soon-to-be equity exchange-traded funds (ETFs) are in the process of capping the current advance in gold. Sure, I can see what physical demand is doing in the cash markets and I can appreciate the arguments as to why "it's different this time," but last Friday at 8:30 a.m. was too familiar to have been a simple case of too few buyers and too many sellers.

How many times have we seen a great employment report result in a carpet bombing in the Crimex gold pits? I would say that 20.5 million job losses and a 14.7% unemployment rate was anything but "great," so when every other unemployment "miss" has resulted in a spike in gold, the US$20 gap down with oil, silver and copper all up, was most certainly not "different this time." It was "more of the same," and that is why I remain cautious. These are dangerous times, and after a terrific four-month stretch, I will be damned if I am going to let the boys at the New York Fed steal back any of our 2020 profits.

However, I have added to silver for this reason: There could be a scenario where gold simply corrects by trading sideways between now and August (the seasonally strongest month of the year), but where the GSR (gold-silver ratio) normalizes by dropping back to 80 or so. That would be inline with the notion of industrial demand being in charge of the price, rather than its monetary role. Since the White House, the Fed and the Treasury are all spewing the "back to normal" paradigm, silver could be allowed to advance with the economic restart while gold remains capped. It's a bet and I have tight stops.

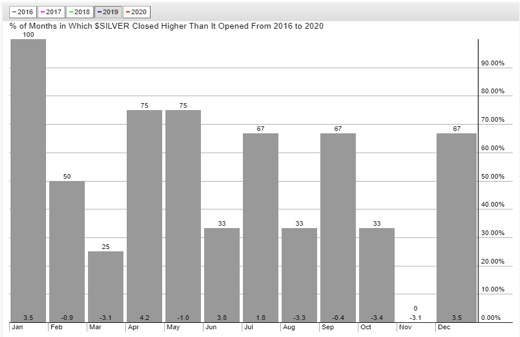

Also, because I might be wrong and overly cautious considering the current wave of precious metals enthusiasm, silver is still cheap relative to gold and copper and oil, and remains my personal hedge against a runaway summer move in the metals. Silver seasonality since 2016 is shown below, so while June is tricky, May should give us an edge.

The highlight for the week was the news release by Getchell Gold Corp. (GTCH:CSE), whereby investors were given a glimpse of drill results from Fondaway Canyon—actually available in 2017 but not part of the predecessor company's resource calculation, which came in at 1,069,000 ounces (469,000 Indicated and 600,000 Inferred).

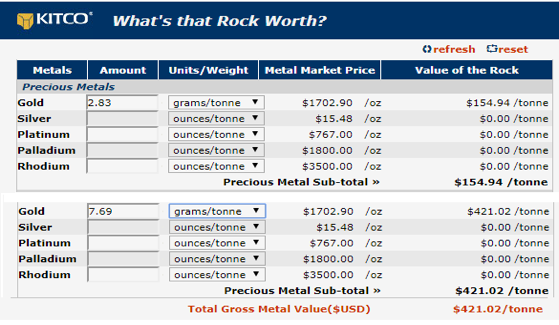

I had gone into SEDAR and searched through the predecessor's 2017 MD&A (management discussion and analysis), and was blown away by the grade and width of some of these intercepts. I sent subscribers an email alert, and showed them how profitability leverages up with this rising gold price using Detour Gold Corp.'s (DGC:TSX) 2019 Q2 and Q3 MD&As. This open pit operation had a head grade of 0.93 g/t Au with an average sale price of US$1,309/ounce and still earned $16 million sporting a 4.3:1 strip ratio. Getchell's highlights included "7.69 g/t gold over 9.8 m and 5.28 g/t gold over 7.9 m within a longer interval of 2.83 g/t Au over 65.4 m".

In the graphic included below, the ore value calculator shows that the long intercept was 65.4 meters of rock valued at US$154.94/tonne, within which they had "bonanza-style" mineralization of 9.8 meters running US$421.02/tonne. These are world-class intercepts and they have most certainly not been factored in by the market when you consider that Getchell is trading at a fully-diluted market cap of ~US$15 million and already has over a million ounces.

The bullish case is presented as follows:

- Cipher Research pegs "ounces-in-the-ground" at US$40/ounce with Getchell valued at US$14.2/ounce, implying a lift of 2.81 times current prices.

- The current gold resource is understated due to the exclusion of the data released last week from Pack Rat and Colorado (i.e., more ounces).

- The new zones are wide open along strike and to depth, which provides tangible blue-sky potential. (i.e., drill hole excitement).

This remains my number one holding in the GGMA 2020 portfolio. The combination of undervalued ounces in the ground and low-risk exploration upside makes Getchell a relatively low-risk, high-reward potential story looking out to the balance of 2020 and beyond. There is more to the story than I have discussed, here but management has done a great job and deserves a nod.

Originally published May 8, 2020.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Getchell Gold. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold, a company mentioned in this article.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.