Maurice Jackson: Joining us for a conversation is Bob Moriarty, the world-renowned, bestselling author and founder of the websites 321gold and 321energy.com.

Bob Moriarty: Hi, Maurice. It's good to talk to you.

Maurice Jackson: Always a pleasure, sir. I was revisiting our last interview entitled, "He Nailed It," where you discuss virtually all that's come to fruition in the last 60 days. And I have to give credit where credit is due, sir, you absolutely nailed it, which is precisely why we're delighted to speak to you today.

Bob, let's begin with a phrase that you've cautioned readers about: when a financial guru states, "This time, it's different." As we look at the world today, is it different this time?

Bob Moriarty: Absolutely.

Maurice Jackson: Bob, in what regards is it different?

Bob Moriarty: We have the stock market hitting new highs, and we have 30 or 40 million Americans out of work. And if that isn't different, I don't know what is.

Maurice Jackson: Beginning with COVID-19, what has your attention regarding the virus that many people may be overlooking and need to really consider?

Bob Moriarty: Everybody's lying and has an agenda. You're not being told the truth by anybody, and there are some fairly simple questions that anyone can ask and they can come up with conclusions for themselves. That's one of the points that I try to make in my books: It was to teach people how to think for themselves. So, I'm going to put it to you. Do you believe the United States are reporting the number of deaths in the United States? Do you believe that's accurate information? Too high or too low?

Maurice Jackson: I don't believe it's accurate information. I believe they may be tying other deaths into that number. So I believe maybe that the numbers probably would be lower.

Bob Moriarty: So let me ask another question that'll make it a lot clearer. The population of the United States is 4% of the world's population. If the numbers that are being reported are accurate, is there any way the United States could represent 33% of the cases?

Maurice Jackson: No, that doesn't seem logical to me.

Bob Moriarty: Absolutely not. Couldn't possibly happen. Here's what's happening. Even Dr. Deborah Birx admitted what's true. You can die with the coronavirus or you can die of the coronavirus. If you die with the coronavirus and it's written down as pneumonia, the hospital gets $13,000. If you die of the coronavirus, then obviously we cured your pneumonia, but you just happened to die, it was the virus. The hospital gets $39,000. They have a financial incentive to over-report the numbers. The CDC [Centers for Disease Control and Prevention] came out with some statistics showing the difference between dying of the virus and dying with the virus, and the numbers are overstated by about 500%.

Maurice Jackson: That's truly a shame that there's that financial incentive in that regard. When you hear of normalcy, do you foresee us being able to return to a pre-COVID-19 way of life? Or is this the new normal?

Bob Moriarty: No, we will be able to return it, return to a pre-COVID-19.

Maurice Jackson: When do you foresee that coming?

Bob Moriarty: Ten years.

Maurice Jackson: Ten years?

Bob Moriarty: I always try to justify my opinion with facts. The stock market hit a high in September of 1929. I'm sure you're aware of that. When did it get back to the same number that it was in September of 1929? How long did it take?

Maurice Jackson: The 1960s, or am I completely wrong here?

Bob Moriarty: You're pretty close. It was 1954.

So there's two issues you should be talking about. Now you're addressing the COVID-19 issue or the coronavirus issue. The depression is far more important—the depression that you and I were talking about a year ago, that I said was going to start in October, and we talked about in January (interview here), when I reiterated that we were going to go into a depression. Everybody was going to get hurt. It's here. If we come out of it inside of 15 years, it will be pretty remarkable.

Maurice Jackson: You and I had a discussion prior to this interview and you inquired about my background on classical education, which I didn't have any, but to my amazement, based off of our discussion, you referenced someone named Cassandra. Can you fill us in on that?

Bob Moriarty: One has to go back to the Iliad and the Odyssey, Greek mythology. Cassandra was the daughter of King Priam. She was gifted with the ability to predict the future. However, she was cursed in that nobody believed her. And strange enough—and you and I were talking about this—I make a lot of predictions that people think I'm crazy, and a lot more of them come true than people want to admit. But I'm looking at a consensus, and when everybody says the stock market's going to go up, I know that it's going to go down. And when everybody says gold is going to go down, I know that it's going to go up. I pay great attention to natures of psychology and consensus. And if you do that, you'll be right a lot of the time.

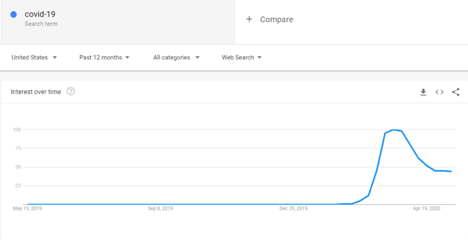

Maurice Jackson: Speaking of psychology, I have a chart before us from Google Trends that my son, Brayden, and I were reviewing. And we noticed that when we put it in the search term COVID-19, it spiked to 100 in March and it has fallen off dramatically. Now, although he's nine, he drew a conclusion that people were getting relaxed and there was a greater potential in his view for more infections. Now, I hope we're incorrect. Sir, you're a big advocate of using Google Trends. What does this chart indicate to Bob Moriarty?

Bob Moriarty: People are bored.

Maurice Jackson: And if they're bored, what kind of situation does that really create for us?

Bob Moriarty: Well, we don't really know. And your son is absolutely correct that having a recurrence of the virus is certainly a possibility.

But there are three issues that we need to think about, one issue being how dangerous is the virus? The secondary issue [is] how dangerous is the depression that we're in? And the third issue that, quite bluntly I absolutely missed, is being quarantined for a period of time, you eventually get to a point you start going stir crazy and you can absolutely see it. There has been a lot of social unrest in the last month and quite bluntly it's because everybody is bored silly being at home. They want to do something else.

So it's certainly possible that there's a recurrence in the virus. My big problem with the virus is, it's been going on for five months. We still don't know how deadly it is. We don't know what the cures are for it. They've got all these agendas. You have any idea what the average age of the people in Italy who died was?

Maurice Jackson: I'm going to assume, not knowing that number, in the 60s?

Bob Moriarty: Seventy-nine and a half.

Maurice Jackson: Well that's—I mean, you're close to your expiration date and I hate to say it in that regard, but I mean, there's a number of factors that go into that number of mortality.

Bob Moriarty: When you're 79.5 years old, don't go to the store and buy green bananas.

Maurice Jackson: Might be a good way to put it. Well, let's discuss the stock market. And again, it fits into the narrative of the depression. The Dow hit an air pocket in March and it descended fast, and last month it's been trying to climb again. Is this the right time for investors to get back into general equities?

Bob Moriarty: Anybody who invests in the general stock market in the next 15 years is begging to give their money away. There's only one safe haven.

Maurice Jackson: And we'll get to that here shortly. So let me ask you this, coincidentally. If general equities are not the place to be, how about the contrarian sector of the stock market—resource stocks and, in particular, junior mining companies. Is this a place where someone should have some exposure?

Bob Moriarty: Yes.

Maurice Jackson: Speaking of the junior mining companies, are there any that have your attention at the moment, and why?

Bob Moriarty: A whole bunch of them. First of all, commodities in general are at the lowest price they've been in 55 years relative to the stock market. So commodities—all of them, soy beans, wheat, corn, copper, lead, zinc, gold, silver, platinum, palladium—everything is cheap in relative terms. And even in the depression, you still need commodities.

But the real key is, for the mining stocks, it is such a small door that when people try to fit through it, it's going to get very crowded. So overall, I like the market. You had mentioned some stocks, tell me which one you'd like me to cover.

Maurice Jackson: Let's begin with Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX).

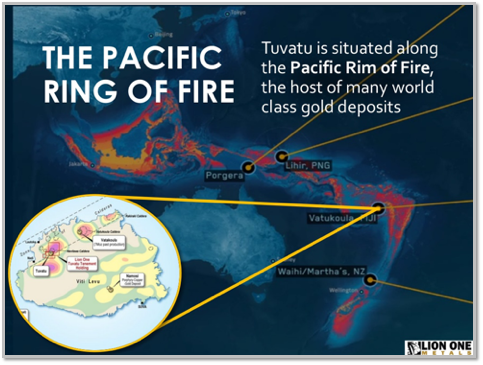

Bob Moriarty: Lion One is a junior that has 100% ownership of the only alkaline deposit in the entire world owned by a junior, the Tuvatu Gold Project (3D Vrify). It's on the Ring of Fire in Fiji. The Tuvatu is approximately 20 kilometers away from a mine that has produced 7 million ounces of gold. LIO is currently drilling, and assay results should be coming in from Australia soon. Lion One Metals has a number of holes that are in for assaying.

This stock has all the potential of being a home run, and they currently undervalued in my opinion. I think people will do very, very well owning Lion One. If gold and silver do what Lawrence Lepard says I agree: The production stories and pre-production stories are going to be the best investments you could make. Now, I've talked in the past about stocks that have tenfold potential. Lepard and I both believe that gold and silver, they go into hyper-inflation, so there are a lot of stocks that you could be buying mow that have hundred-fold potential.

Maurice Jackson: How about Hannan Metals Ltd. (HAN:TSX.V; HANNF:OTCPK)?

Bob Moriarty: Hannan Metals is down in Peru, and they have an unusual form of silver-copper sedimentary deposit. I think it's going to be a giant district—I mean literally hundreds of kilometers—and Hannan is very cheap. I think they're $0.20 a share. They have a CA$14 million market cap. Quinton Hennigh, who is my best friend, is an advisor to the company. I own shares. I think it's a great company. I think it will do very well.

Maurice Jackson: Speaking of Dr. Hennigh, he's also affiliated with Lion One Metals, the aforementioned company, and speaking of his companies, how about Novo Resources Corp. (NVO:TSX.V; NSRPF:OTCQX) and Irving Resources Inc. (IRV:CSE; IRVRF:OTCBB)?

Bob Moriarty: They're moving right along. Quinton has been very quiet about Novo Resources. We know that he's trying to do a deal on the Millennium Mill. Millennium was very poorly run, very poorly managed. I wrote about that years ago and said so. They went into bankruptcy. Their main creditor has taken control of the mill. It costs them $30,000 a day to keep the electricity turned on. So I think there's a lot of incentive for the creditor to do a deal with Novo, and it would turn Novo into a producer, literally immediately.

Irving Resources is drilling. They are drilling at the Omu Project and have sent the core off for assaying, which is now en route to Canada. Akiko Levinson is doing a remarkable job there. And I think it's going to be another home run.

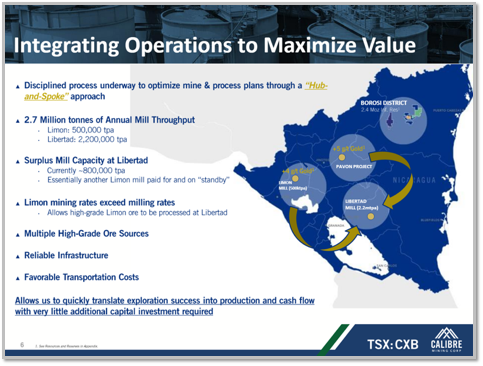

Maurice Jackson: We were just in Peru. Let's go to Nicaragua. How about Calibre Mining Corp. (CXB:TSX.V; CXBMF:OTC.MKTS)?

Bob Moriarty: Calibre is in production. They've picked up two mines from B2Gold Corp. (BTG:NYSE; BTO:TSX; B2G:NSX), which was a fantastic acquisition. They have really good management. B2 Gold released the two newly acquired project to Calibre as they were expanding their portfolio and efforts in the Far East and Africa, so they didn't need their Nicaragua assets. Calibre's in production, and they're absolutely going to get enormous benefit from the price of oil going down by two-thirds.

Maurice Jackson: One more. How about GSP Resource Corp. (GSPR:TSX.V)?

Bob Moriarty: GSP Resources is a really interesting stock. I own some. I participated in a placement, and their advertisers. When I looked at it, I couldn't quite believe the numbers. The Alwin Project is next to the Highland Valley copper mine in central British Columbia, and Highland Valley is drilling toward the Alwin Project, and they have very similar geochemical signatures. I believe that Highland Valley will eventually do a deal with them. GSP Resources has only have 12 million shares outstanding, with a market cap of $2 million. And in Vancouver, if you've got a secretary and a three-line phone, you should be worth $5 million.

Maurice Jackson: All right, sticking with investment opportunities, let's discuss the physical precious metals. Are you surprised at the precious metals price response in the last 60 days?

Bob Moriarty: No. I've been saying that same thing for years. Why would I be surprised? This is what I said was going to happen.

Maurice Jackson: Well, I think what a lot of investors were looking at, with all the printing and devaluation of the currency, the immediate response was silver should jump, gold should jump. And gold has actually made a little move, but silver has kind of remained stagnant. Which metals have your attention, at least, and why right now?

Bob Moriarty: In 5,000 years, the highest the gold-silver ratio ever got to was 101 ounces of silver to buy one ounce of gold. In the middle of March, it went up to 131:1.

Silver is the easiest call for an investment that I have ever seen. Period. I don't care that gold's at the top. I don't care if gold stays sideways and I don't give a care if gold goes down. Silver is going to gain value substantially against gold. It literally is the best time in 5,000 years to be buying silver. And I am not a silver bug. Silver bugs are nuts. I mean, they're bat crazy. They worship silver. Gold and silver are not something to be worshiped. They represent real value, and I believe that we will go back to a gold and silver standard, but there's nothing you need to worship about it. But as an investment, silver is a good deal.

Maurice Jackson: There's another metal that you and I like, and that is platinum. What are your thoughts on platinum right now?

Bob Moriarty: Same thing with platinum, but it's not as extreme. Platinum's in the same position today that rhodium was in three or four years ago. Everybody hates it. Nobody wants it. I'm going to eat a worm.

Maurice Jackson: Just for some giggles here, rhodium, as you referenced, three years ago was $600 an ounce. And as of March, rhodium reached up to $13,000. Readers can view our call on rhodium (here).

Bob Moriarty: Yes.

Maurice Jackson: Look at those numbers. And again, I don't know of any of my online peers, then and or now, referencing the move that rhodium has made. It's just remarkable. This is that classical education Cassandra call.

And as a reminder, I am licensed to buy and sell physical precious metals through Miles Franklin Precious Metals Investments. I would be honored to have an opportunity to earn your business. The contact details are available below.

Sir, what keeps you up at night that we don't know about?

Bob Moriarty: Strange enough, what kept me up last night was the power went out and I couldn't sleep without some lights on.

Maurice Jackson: Well, you would think you'd want it dark. OK, but you needed some lights. Everyone's different. OK.

Bob Moriarty: When the lights go out in this little town, it is really, really dark.

Maurice Jackson: I can imagine. All right, last question, and that is, what did I forget to ask?

Bob Moriarty: I think you pretty much covered it.

Maurice Jackson: Awesome. Well, great to hear that. Bob, for someone listening that wants to get more information about your books and your work, please share the website addresses.

Bob Moriarty:321gold and/or 321energy. Readers can find my work on Amazon and put in Robert Moriarty; I published a number of books. I'm working on another one right now. And one of them, Basic Investing in Resource Stocks, is perfectly timed. If you do not own some resource stocks right now, you understand neither economics nor history. And I stole that line.

Maurice Jackson: Well, before you make your next bullion purchase, make sure you call me. I'm a licensed representative for Miles Franklin Precious Metals Investments, where we provide a number of options to expand your precious metals portfolio from physical delivery, offshore depositories, and precious metal IRAs. Call me directly at (855) 505-1900 or you may e-mail maurice@milesfranklin.com.

Finally, please subscribe to www.provenandprobable.com. We provide mining insights and bullion sales. Subscription is free.

Bob Moriarty of 321gold and 321energy, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.