Advancing a Gold-Copper Project in Canada‘s Porphyry Hotspot: BC‘s Quesnel Terrane

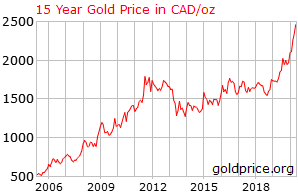

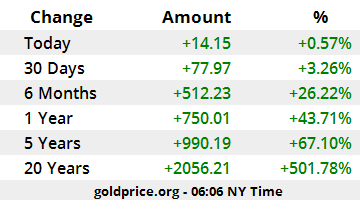

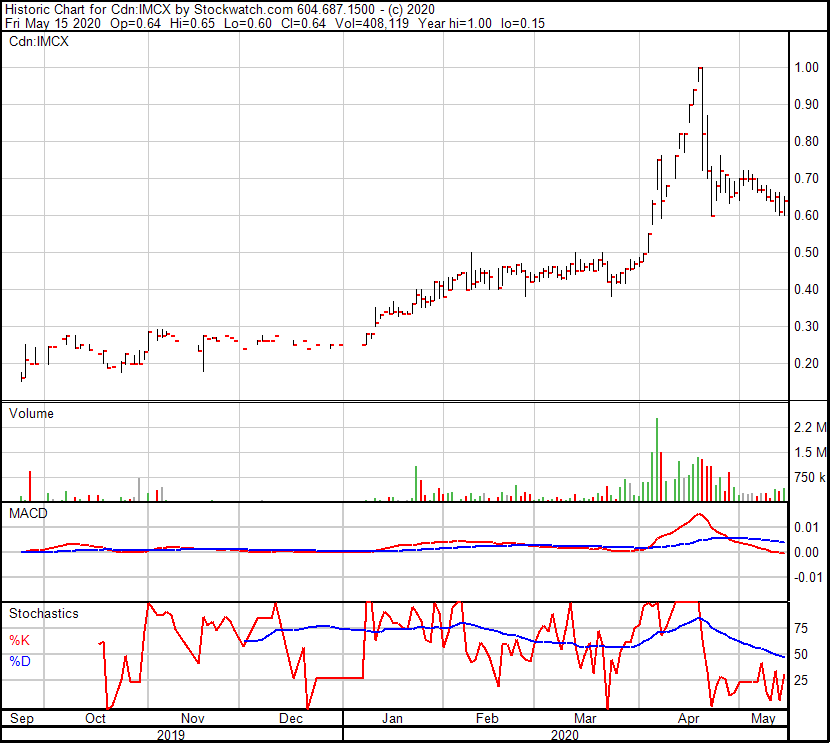

With today‘s spot price of $1,730 USD, gold has appreciated by 19% since December and needs to rise another 12% to break above its previous all-time high of $1,923 USD, which was marked 9 years ago in 2011. Even more impressively, the gold price in Canadian dollars (CAD) has appreciated by about 25% since December and has been trading above its 2011-high for 9 months already. Last at $2,405 CAD, an ounce of gold in Canada is now worth 33% more than at its peak in 2011. As such, some senior and junior gold stocks have been performing well recently, especially those with active projects in Canada. One of them is IMC International Mining Corp., whose share price has increased by about 160% since December.

Having closed a $1.76 million CAD private placement financing on Thursday last week, and having announced a ZimtuAdvantage contract with Zimtu Capital Corp. a day later on Friday, I am looking forward to cover IMC International Mining Corp. with its aggressive plans of advancing its flagship Thane Gold-Copper Project in British Columbia, Canada.

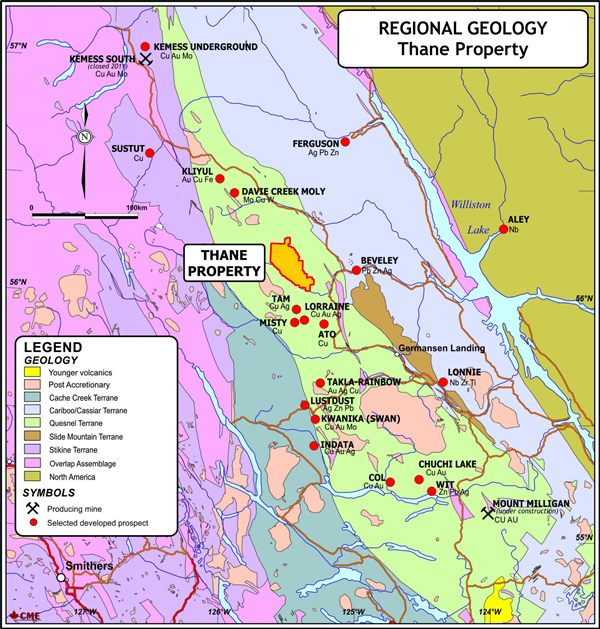

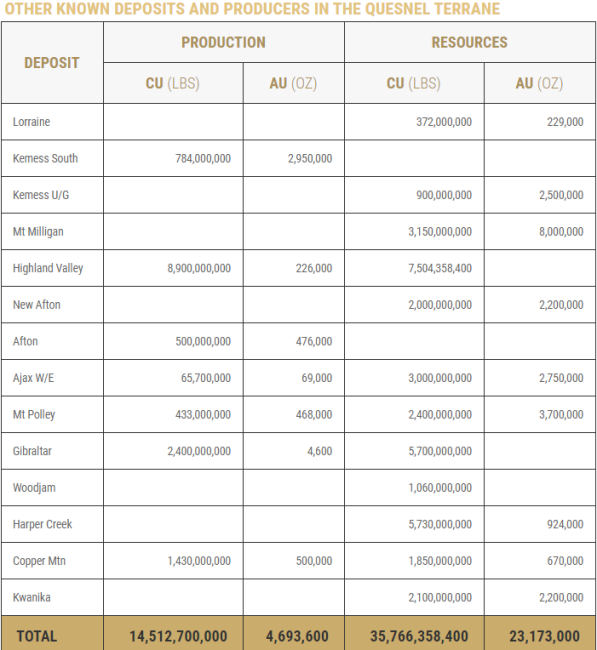

When taking a look at the Thane Property, its location in one of Canada‘s hottest exploration districts strikes the eye: The prolific Quesnel Terrane in British Columbia – home to about 16 producing and development projects, hosting an estimated 28 million ounces gold and 50 billion pounds copper of past production and resources.

It is noted that the results of nearby or adjacent properties are not necessarily indicative of the potential of the Thane Property and should not be understood or interpreted to mean that similar results will be obtained from the Thane Property.

The northern part of the Quesnel Terrane extends from south of the Mount Milligan Mine northward to the past producing Kemess Mine, with the Thane Property located midway between these two major copper-gold porphyries. The Thane Property includes several highly prospective mineralized areas identified to date, including the “Cathedral Area“ on which the company’s exploration is currently focused.

Today, IMC announced “significant gold and copper results from rock sampling“ at Thane‘s Cathedral Area. The company targets drilling this fall, but plans to be busy until then with sampling as well as detailed geophysics and mapping.

• IMC’s Thane Property covers 206 km2 (50,904 acres) and is located in a relatively unexplored portion of the northern Quesnel Terrane in British Columbia.

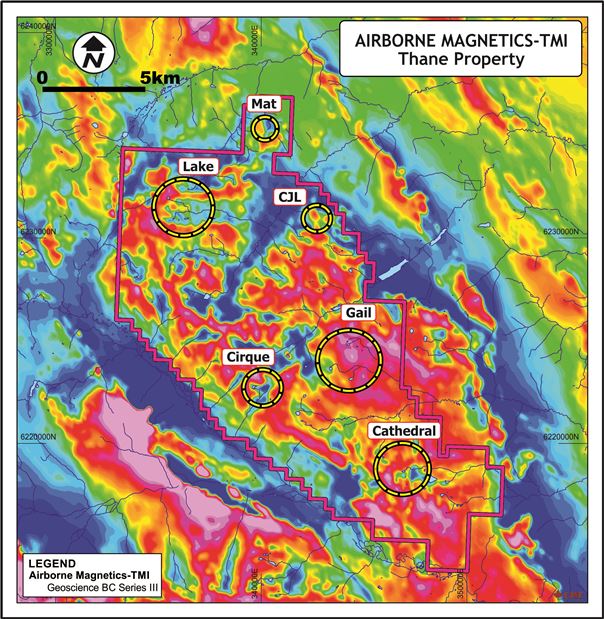

• The project offers blue-sky potential as numerous geophysical anomalies were identified with a 2015 survey, along with anomalous copper-in-silt samples outside key areas.

• To date, 6 areas with significant copper mineralization have been identified on the Thane Property, including areas with high-grade silver and gold mineralization. At Cathedral Area, a copper-gold alkalic porphyry has been identified.

Full size / Style of mineralization at the Thane Property includes stockwork and disseminated porphyry-type mineralization, vein-hosted high-grade mineralization, and late-stage magnetite-chalcopyrite veins. (Source: IMC International Mining Corp.)

• The Thane Property is located north of the Mount Milligan Mine, a world-class copper-gold porphyry deposit, which was acquired by Centerra Gold Inc. (TSX: CG; current market capitalization: $4 billion CAD) from Thompson Creek Metals Company Inc. for $1.1 billion USD in 2016.

• Centerra reports Mount Milligan to have a 9-year mine life, based on 191 million t of proven and probable reserves containing 2.4 million ounces gold (average grade: 0.39 g/t) and 959 million pounds copper (average grade: 0.23%).

• The Mount Milligan Mine is a conventional truck-shovel open-pit copper and gold mine and concentrator with a 60,000 tpd capacity copper flotation processing plant.

• In January 2018, Centerra completed the acquisition of AuRico Metals Inc. in a deal valued $310 million CAD. In 2016, AuRico published an Updated Feasibility Study on the Kemess Underground Project, part of a world-class copper-gold-silver porphyry, located north of the Thane Property.

• Centerra reports Kemess Underground to have 107 million t of proven and probable reserves containing 1.9 million ounces gold (average grade: 0.5 g/t), 6.9 million ounces silver (average grade: 1.99 g/t), and 630 million pounds copper (average grade: 0.266%).

• The proposed Kemess Underground Mine has now received all regulatory approvals and is just waiting on the Centerra board of directors to approve starting construction for the 11-year life of the mine, Prince George Citizen reported in February 2020.

Full size / It is noted that the results of nearby or adjacent properties are not necessarily indicative of the potential of the Thane Property and should not be understood or interpreted to mean that similar results will be obtained from the Thane Property. Note that the mineralogical qualities and indications of properties in the Quesnel Terrane, and nearby to the Thane Property, are not necessarily indicative of the qualities or potential of the Thane Property, and that such disclosure should not be relied upon by investors. (Source: IMC International Mining Corp.)

Porphyry Exploration Veteran Jeffrey Reeder Joins IMC

On April 15, 2020, IMC announced that Jeffrey Reeder (B.Sc., P.Geo., a qualified person as defined in NI 43-101) has been appointed to the company’s Technical Advisory Board, specifically in relation to the company’s Thane Property.

Mr. Reeder worked 5 years as an exploration geologist for the Hunter-Dickenson Group (1989-1993). He worked almost exclusively throughout BC and the Yukon on copper-gold porphyry deposits such as Mount Milligan, South Kemess, Fish Lake and Casino. This experience aided Mr. Reeder in the discovery of two porphyry deposits in Peru that resulted in NI43-101 resources, the Aguila Copper-Molybdenite Porphyry Deposit and the Pinaya Copper-Gold Porphyry Deposit.

Of particular interest to IMC is Mr. Reeder’s experience working at Mount Milligan and South Kemess. The Thane Property owned by IMC is located within the Quesnel Terrane along the northeast contact of the Hogem Batholith, an alkalic suite of rocks hosting porphyry copper-gold deposits. At Mount Milligan, Mr. Reeder was a drill site geologist and logged a significant amount of core from both the MBX and Southern Star zones. In 1991, Mr. Reeder’s focus was mainly on the delineation of the South Kemess zone where he logged the majority of the core drilled. IMC’s President and CEO, Brian Thurston, commented:

“I am pleased to have Mr. Reeder join IMC’s Technical Advisory Board. I worked with Jeff on the Casino copper-gold porphyry deposit in the Yukon early in my career, and later in Peru on several properties. Mr. Reeder’s technical strength as a geologist is his understanding of copper-gold porphyry systems. I look forward to seeing what value his extensive experience will add to the advancement and development of our Thane Property.”

Today’s News

Brian Thurston, CEO and President of IMC, commented in today’s news:

“Exploration results to date have shown the potential for a significant copper-gold alkalic porphyry system within the Cathedral Area. We are currently preparing to follow-up these exciting results with a detailed IP survey, geological mapping, and geochemical sampling as a Phase-1 summer program. Our goal is to determine the best targets for diamond drilling this fall. We look forward to compiling information from other mineralized Areas identified on our Thane Property and making all results public once completed.”

According to the news:

“IMC began an extensive compilation and synthesis of available data from the Property, which includes 359 rock samples collected by CME Consultants Inc. (“CME”), 1,098 rock samples collected by Thane Minerals Inc. (“TMI”), and soil sampling and Induced Polarization (“IP”) surveys completed by TMI. The Company is also pleased to announce that it has extended its investor relations agreement with Media Relations Publishing (“MRP”).

Work on the Property has identified six areas of significant gold ± copper ± silver mineralization. The results from IMC’s compilation work presented in this news release are for the Cathedral Area only. As compilation continues, future news releases will disclose results from the Gail, Cirque, CJL, Lake, and Mat Areas of the Property.

Full size / Figures [above and below] illustrating results of work completed in the Cathedral Area include geophysical and geochemical results from CME and TMI, as well as airborne magnetic results from Geoscience BC’s Quest program. (Source: May 19, 2020 Press-Release from IMC International Mining Corp.)

Cathedral Area

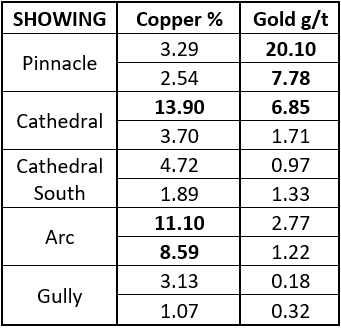

At the Cathedral Area, rock sampling identified five copper-gold showings that include the Pinnacle, Cathedral, Cathedral South, Arc, and Gully Showings. Select results from these showings include:

Full size

Rock samples from the Cathedral Area have revealed copper and gold mineralization in a variety of styles over a 2 km long by 1.5 km wide zone, all consistent with alkali porphyry systems. Geological studies undertaken in 2017 indicate the geological model for this area might best be represented as a post emplacement, westward tilted, alkalic porphyry. The high levels of gold mineralization sampled are considered significant, with samples returning values of up to 20.1g/t Au from the Pinnacle Showing, and 6.85g/t Au from the Cathedral Showing.

The Pinnacle Showing, located north of the Cathedral Showing, contains the highest gold grades on the Property and has been interpreted as a hydrothermal system of the alkalic porphyry. At the Pinnacle Showing, the gold bearing quartz veins contain arsenopyrite. Soil samples located approximately 750 meters along the inferred strike extension of the south-southeast gold-bearing structures contained anomalous levels of arsenic. Further along this inferred structural trend, silt samples have returned anomalous levels of gold suggesting arsenic can be used as a pathfinder element for gold exploration in this area.

Full size

In 2019, a reconnaissance 5-line, pole-dipole, IP geophysical survey was undertaken within the Cathedral Area using an electrode spacing of 100 meters. This survey identified three areas of interest that include a broad 600-meter wide anomaly extending to depth east of the Cathedral Showing, as well as areas representing potential narrow structures at surface at the Gully and Cathedral Showings. Rock samples from the areas of the narrow, near surface IP anomalies have exhibited copper and gold mineralization with values of up to 0.42 g/t Au and 3.13% Cu at the Gully Showing, and 0.32 g/t Au and 0.67% Cu at the Cathedral Showing. North and approximately 175 meters along the inferred strike of the anomaly at the Cathedral Showing, samples returned values of up to 1.71 g/t Au and 3.70% Cu. Although no rock samples occur around the broad, 600-meter IP anomaly, a contour soil line covering this area returned copper-in-soil anomalies at both the eastern and western edges of this anomaly. The soil-sampling program was completed to explore regions inside the Cathedral Area with little to no outcrop. Results from this program identified four broad in-line copper anomalies, and are described in the Company’s press release from May 6, 2020.“

Full size

The scientific and technical information disclosed in this news release was reviewed, verified and approved by Christopher O. Naas, P. Geo., of CME who is a “Qualified Person” as defined in NI 43-101. Mr. Naas is a shareholder of the Company and owner of CME.

Financial Backing

On May 14, 2020, IMC announced the closing of a brokered private placements of units and flow-through shares led by Gravitas Securities Inc. for total gross proceeds of $1,768,719.68 CAD.

On April 16, 2020, IMC announced to have entered into a draw-down equity financing of up to $8 million CAD with New York based private equity firm Alumina Partners LLC. It was noted that, “The purpose of the agreement is to allow IMC to continue its growth strategy through exploration and acquisition with complete financial flexibility and freedom. The financing is at the sole discretion of IMC, allowing for the ability to access funds when necessary. This strategy allows IMC to protect shareholder value while growing to meet demands of exploration expenditures.“ IMC‘s President and CEO, Brian Thurston, commented:

“We are very enthusiastic to be entering into such a major agreement, allowing us to better plan for future exploration programs. This agreement will allow IMC major financial flexibility in its operations. Such major investments are not common in the early stages of exploration properties such as we have on the Thane Property and we are excited to receive such a significant commitment from Alumina Partners, LLC. This serves as meaningful validation of our business plan and growth strategy.”

Alumina’s Managing Member, Adi Nahmani, commented:

“We are pleased to support IMC as they prepare to accelerate their exploration pipeline. We are very confident in management’s extensive experience and impressive collective track record, and look forward to getting more upside exposure to this early metals super cycle.”

“With the world economy heading into a recession amid the covid-19 crisis, gold prices are soaring to new heights every day... The metal has also emerged as one of the best performing asset classes for investors... No wonder the investment demand for gold has gone up substantially... There is a rush towards investing in gold globally.” (Source)

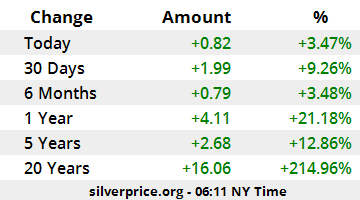

“Copper prices climbed on Monday [May 11, 2020], following global equities higher as economies reopened after coronavirus lockdowns, although demand from top consumer China is seen slowing this month. Summer weather is enticing much of the world to emerge from lockdowns as centers of the outbreak from New York to Italy and Spain gradually lift restrictions that have kept millions cooped up for months.” (Source)

Management / Directors

GREG HAWKINS (Chairman to the Board of Directors)

Mr. Hawkins holds a BSc in Geology from the University of Alberta and an MSc in Mineral Economics from McGill University. He has been involved in the Mining Exploration and Investment industries since 1969 and has been variously responsible for the identification and/or delineation of 10 mineral deposits in Canada, USA, Chile, Ghana, Mali and Zaire. Mr. Hawkins is currently a Director of New Pacific Metals Corp. and was the Founding Project Consultant and/or Founding Director of seven public and private Exploration/Development ventures and has participated in or been responsible for the definition of at least one resource/reserve in every case, with six of those cases resulting in production in the USA, Chile, Ghana, Mali and DRC, collectively accounting for over $2.1 billion in market cap at the companies’ respective peaks. In 1990 Mr. Hawkins started CME, an international full service consultancy and contracting firm with 100+ clients in 25 countries and 3000 employees. He has authored a number of papers on exploration, exploration philosophy and mineral economics since 1979.

BRIAN THURSTON (President, CEO, Corporate Secretary, Director)

Mr. Thurston is a professional geologist and holds an Honours Bachelor of Science degree in Geology from the University of Western Ontario. Mr. Thurston has over 26 years’ experience working as a geologist around the globe including North, Central and South America, Africa and India. He has experience working on projects from grass roots to feasibility level. Mr. Thurston was instrumental in the initial exploration, land acquisition and development of Aurelian Resources Inc.’s Ecuador grass roots exploration and held the position of Country Manager in Ecuador from 2004-2006. In 2008, Kinross Gold Corp. acquired Aurelian in a $1.2 billion friendly deal. Mr. Thurston transitioned from geologist to corporate positions in 2004 and has founded several public companies and held positions of director and officer, as well as served on multiple committees including audit, disclosure and corporate governance. In addition, he has been a director of Chemesis International Inc. since March 2017.

Faizaan Lalani (Director)

Mr. Lalani is an Accounting/Finance professional with over 10 years of experience covering auditing, financial reporting, corporate finance, and operations management. Mr. Lalani also founded his own apparel company, successfully selling the brand across North America over the last four years. Recently, Mr. Lalani was instrumental in a multi-million dollar raise for a privately held company through various US offerings. Prior to this, he worked in the audit and assurance group at PwC, where he obtained his CA,CPA designation, gaining experience in both the public and private sectors. Mr. Lalani currently is on several board positions for both private and public companies.

Mike Aujla (Director)

Mr. Aujla brings over 16 years of experience acting as a lawyer, director and officer for both public and private companies. He holds a Bachelor of Arts degree from the University of British Columbia and a Juris doctor from the University of Victoria. Mr. Aujla was previously a corporate lawyer who worked with international law firms. He has experience advising companies in financial services, corporate mergers and acquisitions and commercial real estate in various jurisdictions. Mr. Aujla is currently the Founding Partner of Hunter West Legal Recruitment since Sept 2017. Previously, Mr. Aujla worked for a private Legal Recruitment firm in Vancouver from 2011-2016. In addition, since July 2018, he has been a director of Chemesis International Inc.

Thane Property Acquisition

On April 2, 2020, IMC announced that it has completed the acquisition of 100% of the issued and outstanding share capital of Thane Minerals Inc., a company that holds a 100% interest in the Thane Property. As consideration for the Acquisition, IMC has issued to the former shareholders of Thane (the “Vendors“) an aggregate of $2 million CAD worth of common shares in the capital of IMC, at a deemed price of $0.38 per common share, for a total of 5,263,158 IMC shares, which will be escrowed and released over a 36-month period. In addition to the foregoing, if, through additional exploration programs, a resource calculation of at least 800 million pounds of copper-equivalent, as determined based on a National Instrument 43-101 (Standards of Disclosure for Mineral Projects) (“NI 43-101“) compliant resource estimate, is determined to be indicated within the Cathedral prospect area, then IMC will issue an additional aggregate of $2-million CAD worth of common shares (or cash in lieu, at IMC’s option) to the Vendors.

As per IMC‘s news-release of March 19, 2020:

“Mineralization at the Cathedral Project area occurs within a structurally controlled, moderately west-dipping (tilted) alkalic porphyry system. The system is dominated by stockwork, disseminated and vein hosted porphyry-type mineralization within a propylitic and sodic-calcic altered quartz monzonite (Cathedral and Cathedral South Showings) that has been thrusted onto shallower high-grade vein systems (Gully and Pinnacle Showings) located to the east and northeast.

“As a result of the post-emplacement tilt, thrusting and subsequent erosion, an almost 2 km extent of the hydrothermal, alteration and mineralization system has been exposed. Styles of mineralization include stockwork and disseminated porphyry-type mineralization, vein-hosted, high-grade mineralization, late stage magnetite-chalcopyrite veins, and late stage quartz-chalcopyrite veins.“

Company Details

IMC International Mining Corp.

#2710 – 200 Granville Street

Vancouver, BC, V6C 1S4 Canada

Phone: +1 604 588 2110

Email: ir@imcxmining.com

www.imcxmining.com

ISIN: CA45250W1014 / CUSIP: 45250W101

Shares Issued & Outstanding: 42,318,550

Chart

Canadian Symbol (CSE): IMCX

Current Price: $0.64 CAD (05/15/2020)

Market Capitalization: $27 Million CAD

Chart

German Symbol / WKN (Frankfurt): 3MX / A2PPAQ

Current Price: €0.432 EUR (05/19/2020)

Market Capitalization: €18 Million EUR

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, IMC International Mining Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to IMC International Mining Corp.´s and IMC International Mining Corp.s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through the their profiles on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, currently does not hold any equity position in IMC International Mining Corp., however he holds an equity position in Zimtu Capital Corp. and is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital holds a long position in IMC International Mining Corp. Note that IMC International Mining Corp. pays Zimtu Capital Corp. to provide this report and other investor awareness services. The cover picture (amended) has been obtained and licenced from Fransys.