Continuing our research into the Real Estate market and our expectations over the next 6+ months or longer, we want to point out the disconnect between the current US stock market rally and the forward expectations related to the real economy. Our researchers believe the current data from Realtor.com as well as forward expectations suggest a major shift related to “at-risk” real estate (both commercial and residential).

Unlike the 2008-09 credit crisis, the COVID-19 virus event is quickly disrupting consumer engagement within the global economy and disrupting spending activities. Spending is shifting to online, fast food, and technology services for those that still have an income. For those that have lost their jobs, spending is centered around surviving the COVID-19 virus event and hoping to see new opportunities and jobs when things open back up.

The coronavirus-fueled economic downturn is hitting homeowners hard. And the worst may be yet to come.

Before you continue, be sure to opt-in to our free-market trend signals

before leaving this page, so you don’t miss our next special report & signal!

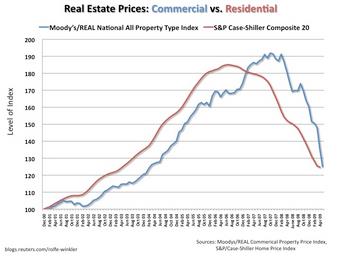

2008-09 Real Estate Price Collapse Chart

The biggest difference between 2008-09 and now is that the Real Estate sector is not the driving force behind the economic collapse – it is part of the collateral damage of the COVID-19 virus event related to failed consumer businesses, loss of jobs, disruption to the consumer economy and the destruction of income for many. Yes, for a while, some people will be able to keep things together and “hold on” while hoping the economy comes back to life quickly. Others won’t be so lucky.

The one aspect of all of this that people seem to fail to understand is the shift in consumer mentality related to the shifting economic environment. Right now, consumers are dealing with the shock of job losses, the virus crisis itself and what the future US and global economy may look like. Many people fail to understand that we really don’t know what the recovery process will become or when it will start. Yes, we are making progress in trying to contain the COVID-19 virus, but the process of rebuilding the global economy to anywhere near the early 2020 levels is still many months away and full of potential collateral damage events.

Multi-Sector Price Trend Chart (Daily)

To help illustrate how the markets are reacting to the optimism of capital being poured into the global economy vs. the reality of the Consumer and Financial sectors, this chart highlights the SPY (BLUE) current price activity vs the NASDAQ 100 Financial Sector (GREEN) and the Consumer Discretionary sector (GOLD). The SPY recently disconnected from a very close correlation to the other sectors near mid-April – about 2 weeks after the US Fed initiated the stimulus program. The S&P, NASDAQ, and DOW Industrials have benefited from this disconnect by attracting new investments while the Consumer and Financial sectors have really started to come under moderate pricing pressure.

Concluding Thoughts:

We believe this disconnect is related to the perceived reality of certain investors vs. other types of investors. Institutional traders may be pouring capital into the US major market indexes while more conservative traders are waiting out the “unknowns” before jumping into the global markets. We believe the extended volatility will create waves of opportunity as capital rotates between sectors attempting to find new opportunities for quick gains.

We also believe the unknown collateral damage processes will present very real risks over the next 6+ months as the markets seek out a real bottom.

A recent MarketWatch.com article suggests a new mortgage crisis in inevitable given the disruption to the US economy and consumer’s ability to earn income and service debt levels:

Pay attention. These recent rallies in the US major indexes may not be painting a very clear picture of the risks still present in the US economy. It is almost like speculation is driving prices higher while economic data suggest major collateral damage is still unknown. We suggest reviewing this research article for more details:

If you want to improve your accuracy and opportunities for success, then we urge you to visit www.TheTechnicalTraders.com to learn how you can enjoy our research and our members-only trading triggers (see the first chart in this article). If you are managing your retirement account or 401k, then we urge you to visit www.TheTechnicalInvestor.com to learn how to protect your assets and grow your wealth using our proprietary longer-term modeling systems. Our goal is to help you find and create success – not to confuse you.

In closing, we would like to suggest that the next 5+ years are going to be incredible opportunities for skilled traders. Remember, we’ve already mapped out price trends 10+ years into the future that we expect based on our advanced predictive modeling tools. If our analysis is correct, skilled traders will be able to make a small fortune trading these trends and Metals will skyrocket. The only way you’ll know which trades to take or not is to become a member.

Chris Vermeulen

Chief Market Strategist

Founder of Technical Traders Ltd.