M2 Velocity is the measurement of capital circulating within the economy. The faster capital circulates within the economy, the more that capital is being deployed within the economy to create output and opportunities for economic growth. When M2 Velocity contracts, capital is being deployed in investments or assets that prevent that capital from further circulation within the economy – thus preventing further output and opportunity growth features.

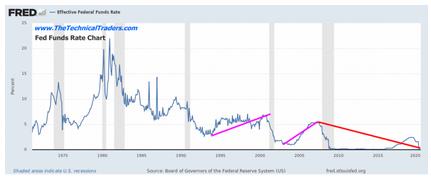

The decline in M2 Velocity over the past 10+ years has been dramatic and consistent with the dramatic new zero US Federal Reserve interest rates initiated since just after the 2008 credit crisis market collapse. It appears to our researchers that these extended periods of zero interest rates deflate the capability of money circulating throughout the economy and engaging in real growth opportunities for investment and capital inflation.

It also suggests that the US Federal Reserve, while attempting to support the US economy and global markets, maybe destructively engaging in policy that removes the capital function from the markets in a systematic process. Eventually, something will break related to M2 Velocity and/or the global economy. As more capital pours into less liquid assets and/or broader investment funds and Bonds, this process ties capital up into assets that take investment away from Main Street and the lower/middle class. There is less capital available to support the ground level economy as more and more capital ends up buried in longer-term investment assets.

Before we continue, be sure to opt-in to our free market trend signals

before closing this page, so you don’t miss our next special report!

VELOCITY OF M2 MONEY STOCK

US FEDERAL FUNDS RATE CHART

We believe the collapse of the M2 Velocity rate is similar to a slow decline of economic capacity and output over a longer period of time. We believe this process will likely end in a series of defaults and bankruptcies as a result of capital being stored away into longer-term assets and investments (pensions, investment funds, and other types of longer-term assets). As this capital is taken away from the core engine of economic growth (main street and startups), the process of slowly starving the economy begins.

We believe we’ve already entered a period of decline that has lasted at least 15+ years and the “blowout process” that ends this decline will be somewhat cataclysmic. One way or another, the function of capital must return to levels of activity that supports a ground-level engagement of economic growth and opportunity. A healthy balance of capital available to all levels of society and deployed in means to support growth and opportunity is essential for the proper health and future advancement of global economies.

It appears that after 2008-09, the global economy disconnected from reality as investors began relying on institutional level investments and speculation in large scale assets instead of ground-level investments and core economic function. This translates into a very euphoric mode for stocks and commodities where capital chases capital around the planet seeking out undervalued and opportunistic investments… until…

Pay attention to what happens over the next 4 to 5+ years related to the COVID-19 virus event. We believe this virus event could be a “monkey wrench” in the capabilities and functions of the global economy over the next 5+ years. Pay attention to what is really happening as capital plays the “dog chasing its tail” routine and the central banks attempt to stimulate economic activity by printing more and more money. If you understand what we are trying to suggest in this article – printing more and more money at this stage of the game is like saying “diving our of the 20th-floor window is not enough – let’s go up to the 50th floor and give it a try”.

Hang tight, there are going to be some very interesting and big price swings over the next 4+ years in the US and global markets. Skilled technical traders should prepare for the opportunity of a lifetime if they understand what to watch for and how to protect assets.

You don’t have to spend days or weeks trying to learn my system. You don’t have to try to learn to make these decisions on your own or follow the markets 24/7 – I do that for you. All you have to do is follow my research and trading signals and start benefiting from my research and trades. My new mobile app makes it simple – download the app, sign in and everything is delivered to your phone, tablet, or desktop.

I offer trading signals for active traders, long-term investors, and wealth/asset managers. Each of these services is driven by my own experience and my proprietary trading systems and modeling systems. I have a small team of dedicated researchers and developers that do nothing but research and find trading signals for my members. Our objective is to help you protect and grow your wealth.

Please take a moment to visit www.TheTechnicalTraders.com to learn more. I can’t say it any better than this… I want to help you create success while helping you protect and preserve your wealth – it’s that simple.

Chris Vermeulen

Chief Market Strategist

www.TheTechnicalTraders.com