We believe that the COVID-19 lockdown has been a catalyst for the TSX Venture index (TSX.V) to outperform. After a decade of underperforming the major equity indices the TSX.V has led returns from the March equity market lows, gaining 58.9% as compared to 36.3% and 36.6% for the TSX Composite and S&P 500 indexes, respectively. This is likely to continue for reasons outlined in this report.

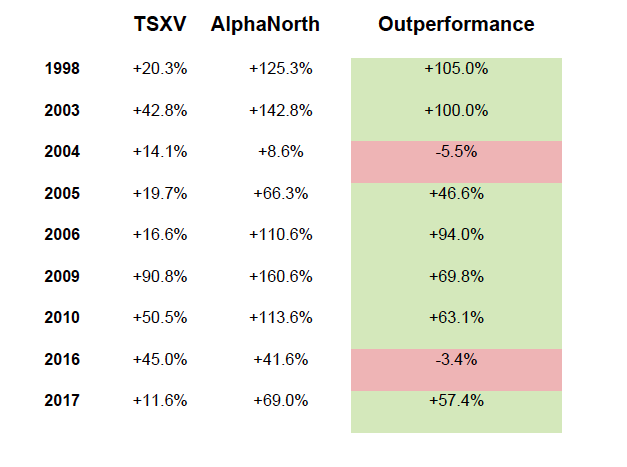

We do not often write special commentaries. However, when a situation becomes particularly compelling, we are prompted to provide a timely opinion, as we did in our special commentary in February 2016 titled, "Reasons to be Optimistic on Canadian Venture Stocks—What Is Recent Investor Sentiment Implying for Equity Markets?" This opinion piece was very timely and accurate, as the TSX.V was subsequently the best performing diversified equity index worldwide in 2016 increasing by 45% and 12% in 2017. The AlphaNorth Partners Fund, by comparison, returned 42% in 2016 and 69% in 2017.

The Impact of the COVID-19 Lockdown

As the fear regarding the COVID-19 pandemic spread in March, equity indices worldwide crashed. In only a few weeks indices erased substantial wealth. The S&P 500 index declined by 35.4% in just 23 trading days, from an all-time high on Feb. 19 to the low on March 23. Canada's indices, the TSX and TSX.V, declined in tandem by 37.8% and 44.1%,respectively, over the same period. However, since bottoming in March, these indices have rebounded strongly. The rally is being led by the TSX.V as shown in the following chart.

Why Is COVID-19 a Catalyst for Canadian Small-Cap Outperformance?

In our view, it makes sense that after the initial scramble for cash, the market concluded that many of the companies that comprise the junior market are not as negatively impacted as the large caps. Small-cap companies can more readily adjust costs to survive the recession/depression that we are now in because of the government-imposed lockdowns. For example, one CEO we spoke to recently indicated that he has not been paid for several months. He and others on the management team have made this sacrifice so the company can survive and "get to the other side." How many CEOs on the TSX Composite are willing to reduce their salary, let alone to zero? That is just not going to happen. These companies will go bankrupt before management in large-cap companies opt for reduced compensation.

Many of the companies in which we have invested have not been negatively impacted by the COVID-19 lockdown and some actually benefit from the situation. These companies are represented in biotech, junior resource (gold, silver, palladium, rare earth metals), e-gaming and technology (artificial intelligence [AI], software, hardware, security).

Many investors have invested in exchange-traded funds (ETFs) and bank-owned, large-cap mutual funds. which pretend to add value through largely investing in the same few stocks. The sector weightings for the TSX 60 index are indicated below as of April 30, 2020, with a brief outline of the challenges that these companies now face.

Financials (33%): The unemployment rate has spiked faster than ever before. Some surveys predict that there will soon be 25% unemployment. Generally, unemployed people do not buy houses, cars and other discretionary items. They redeem investments held at banks to pay bills. This causes default rates to increase. These things all negatively impact the outlook for banks. Recent bank earnings showed year over year average declines of 54%. Will the dividends be safe now that the payout ratios have increased materially?

Materials (13%): This sector is dominated by precious metal companies, which we believe will benefit from the current environment. Whether it is justified or not, an investor consensus that inflation is likely going to emerge as a result of the unprecedented government stimulus will be good for gold. There was strong performance in gold after the Financial Crisis. Gold has recently rallied strongly and we believe that we are in the early days of a similar move.

Energy (15%): Aside from the international price war for this sector, the COVID-19 lockdown will result in significantly reduced travel into the foreseeable future.

Industrials (11%): In this sector, several airlines will struggle not to go bankrupt in the current social distancing environment. Other constituents are closely tied to GDP [gross domestic product] growth and will also struggle.

Technology (9%): This sector is dominated by the 60% weighting in Shopify Inc. (SHOP:NYSE). The company will benefit from the current environment. However, the shares trades at an astounding price to earnings multiple of 1,174! The shares have recently vaulted past Royal Bank (RY:NYSE) to become Canada's largest company. If history is any guide, this often does not end well; previous examples of new market darlings that have achieved this honor include Nortel Networks in 2000, which subsequently went bankrupt, and Valeant Pharmaceuticals, which remains down more than 90 %from its 2015 peak and short honor as Canada's most valuable company. Research in Motion, now BlackBerry Ltd. (BB:NYSE), briefly achieved this title in 2007 before declining 96%. Further strong gains from this sector are unlikely.

Communications (7%): A recent Globe and Mail headline, "Telecom growth on hold as pandemic coos demand," says it all. The telecommunications companies have steady operations, but it remains to be seen how much consumers and businesses will cut back on services. Revenue forecasts have been reduced due to the recession reflecting negative growth. These businesses already offer pricing pressure as a result of the commodity nature of their products.

Utilities (3%): Do not expect stellar returns from this sector, particularly if we enter a period of rising interest rates. These are utilities after all, offering lower risk business models. However, valuations are tied to fixed income returns, which are now close to zero. As interest rates rise, utilities will need to offer more attractive yields to compete for investor capital, thus share prices will be under pressure.

Consumer Staples (5%), Consumer Discretionary (4%) and Real Estate (0.3%): These sectors will likely have mixed results over the short to medium term. Generally, staples will do well, while discretionary spending will decline due to the recession and high unemployment. Overall, these sectors are too small to move the needle for the TSX overall return.

Healthcare (1%): Unfortunately, this is the smallest weighting and comprised of companies that we do not even believe qualify as healthcare: cannabis. We have been negative on the cannabis sector for some time and we have not been surprised to watch it blow up in grand fashion.

Other factors that have contributed positively to large-cap equity performance in recent years have been share buybacks. Many of these programs will now be on hold over the short to medium term.

COVID-19 Impact on AlphaNorth Partners Fund

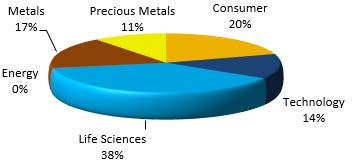

Many of our investments in the Fund have not been negatively impacted from the COVID-19 pandemic. Several companies have benefited because of the situation. Although the COVID-19 lockdown has severely impacted many businesses, we are continuing to add opportunities which are minimally impacted or stand to benefit. Fortuitously, many of our investments prior to the crisis already fit this category, and after the initial undiscriminating sell-off, have rebounded strongly. We had minimal exposure to the Energy sector, which has suffered the most devastation. Our largest sector weighting has been Life Sciences, which overall has benefited during this period.

Current Positioning of the AlphaNorth Partners Fund

We have maintained a diversified portfolio with a focus on Life Sciences (ex-cannabis), Technology and Precious Metals. These sectors have been largely unaffected by the COVID-19 crisis and many companies have benefited from the current environment. We have committed to several private placements in the coming weeks which will add 5% to our precious metals weighting.

The Importance of Warrants

Unlike the majority of Canadian investors, particularly the institutions that have survived and participate in the small-cap sector, we are not warrant clippers. Our investment strategy is to maximize investment returns as opposed to minimizing risk. Where the majority of Canadian investors are quick to monetize the value of warrants, we are often are the last to exercise. Instead, we let our profits run if a company is continuing to execute, the valuation is reasonable and the technicals indicate continued strength. The majority of our warrant positions are acquired at no cost as part of private placements. Our current portfolio has approximately 55% warrant coverage.

We value warrants conservatively at intrinsic value. Unless warrants are "in the money," they receive zero value. In previous bull markets our warrant portfolio has contributed significantly to returns. Investors get zero leverage from warrants investing in ETFs and minimal warrant exposure, if any, in mutual funds.

Conclusion and Outlook

We believe that large-cap equities have rebounded too strongly given the major headwinds facing the economy. It is likely that the sharp rebound in large-cap stocks in recent weeks is unjustified by fundamentals. There remains much uncertainty, and there is likely more bad news to come on the economy and corporate front. We believe that large-cap equities will retest the March 2020 lows. Once investors have more clarity in the coming months and the COVID-19 situation dissipates, large-cap equities will regain lost ground.

We believe that we have entered a period of Canadian small-cap outperformance. Canadian small-cap equities have taken over as the market leaders after a long period of underperformance. This is primarily a result of the numerous companies that are not significantly impacted by the COVID-19 lockdown, while the majority of large-cap companies face material challenges because of it. Years in which the TSX.V has outperformed, the AlphaNorth Partners Fund has been atop performing fund.

The following performance data is for years in which the Canadian small cap market returns were greater than 10%.*

Steve Palmer is a Founding Partner, President and Chief Investment Officer of AlphaNorth Asset Management and currently manages the award-winning AlphaNorth Partners Fund, AlphaNorth Growth Fund and AlphaNorth Resource Fund. Prior to founding AlphaNorth in 2007, Palmer was employed as Vice President at one of the world's largest financial institutions, where he managed equity assets of approximately CA$350M. Palmer managed a pooled fund, which focused on Canadian small-capitalization companies, from its inception to August 2007, achieving returns of 35.8% annualized over a nine-year period, which ranked it No. 1 in performance by a major fund ranking service in its small-cap, pooled-fund category. Palmer earned a bachelor's degree in economics from the University of Western Ontario and is a Chartered Financial Analyst.

Disclosure:

1) Statements and opinions expressed are the opinions of Steve Palmer/AlphaNorth and not of Streetwise Reports or its officers. Steve Palmer/AlphaNorth is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Steve Palmer/AlphaNorth was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. AlphaNorth disclosures are below.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

AlphaNorth disclosures: Data prior to 2009 used the BMO Small-Cap Index and institutional small-cap pooled fund managed by Steve Palmer and Joey Javier. 2009 and subsequent data uses TSX.V and AlphaNorth Partners Fund returns. The information contained in this document is not a solicitation to sell any investment products offered by AlphaNorth Asset Management. The information contained herein is for discussion purposes only. Please refer to the Offering Memorandum for complete details of any investment products offered by AlphaNorth Asset Management. There is no guarantee of performance and past performance is not indicative of future results. Returns are presented for Class A shares on an annualized basis except where noted and stated net of all fees. The inception date is December 1, 2007, for the fund. Returns prior to 2007 are based on growth of investment in institutional small cap pooled fund from inception August 1, 1998, to August 1, 2007, and growth of investment in AlphaNorth Partners Fund Inc. from inception December 1, 2007, to the current NAV.