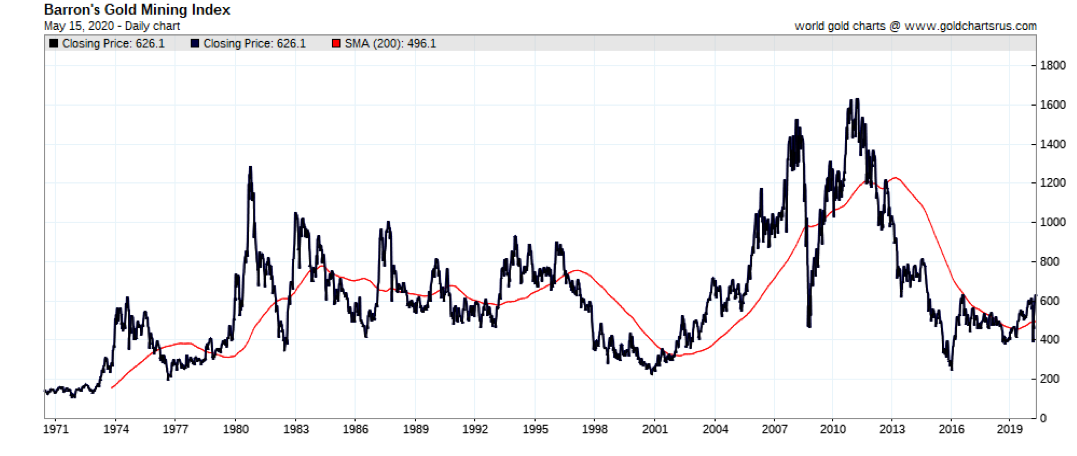

We are entering into a new gold and gold mining bull market. I expect this will go down as the biggest gold bull market in history, with record paper currency printing. It is coming off the bottom of the worst mining bear market in history.

This long-term chart of the Barron's gold mining index reveals the bear market bottom of late 2015 was around the same level as the 2001 and 1976 bottoms—simply amazing, since gold was three to four times higher than those past bottoms in the index. The March crash sent the index to 400, and it fully recovered by the end of April and hit new highs in May. There is a lot of upside left and I expect the index to go well above the 2011 high.

To get maximum benefit from this new bull market, my plan is to buy a basket of quality juniors in good jurisdictions like Mexico, Canada, Australia and Nevada, a state that is a gold country in its own right. Consider this about Nevada:

- Gold is the state's top overseas export by value, accounting for $4.9 billion, or 44%, of the state's $11 billion of exports in 2018. A year earlier, gold accounted for more than half the total. The top destinations are Switzerland and India, where Nevada-mined gold is refined.

- The state produces more than 80% of the gold mined annually in the United States. If it were a separate country, Nevada would be the world's fifth-largest producer, behind China, Australia, Russia and Canada.

- Over the past decade, gold production has averaged about 5.5 million ounces per year. The value of that production in 2018 was just over $7 billion, representing 84% of all mining production in the state.

This next pick, ProAm Explorations Corp. (PMX:TSX.V), has an excellent Nevada property.

I met with one of the principals behind ProAm at the PDAC, and I have known a recent addition to the board, Al Fabbro, for many years. Al Fabbro was a major factor behind Roxgold Inc. (ROXG:TSX), which has done well since we bought it in 2012, although we ended up stopped out in 2013 at breakeven. Al Fabbro would not come on the board of just any company. ProAm has a Nevada project that is a great jurisdiction for gold exploration. It is rare to find good properties there, but a ten-year bear market has helped.

ProAm Explorations

Recent Price: $0.11 per share

52-week trading range: $0.05 to $0.12

Shares outstanding: 7.1 million; management = 30%

Highlights:

- New company with tight share structure

- Well experienced management team with past success

- Property in a great jurisdiction; Nevada has very good infrastructure

- Surface sampling revealing high-grade silver up to 6.99 opt, and copper to 8.84%

- Property has never been drilled, so a maiden drill program

- 5 drill holes to test a 4.5-mile (7,250-meter) rhyolite dyke system.

Management (from the company website)

Donald MacDonald, president and CEO: Mr. McDonald graduated from the University of Manitoba in 1970 with a B.Com (Honours) degree. He has held several senior management positions in the securities brokerage industry. Mr. MacDonald's education and experience provide him with the relevant knowledge to act as a member of the Audit Committee.

Al Fabbro, director: Mr. Fabbro has over 30 years' experience in both the finance and mining industries. From 1984 to 1990, Mr. Fabbro headed the retail trading department of Yorkton Securities, followed by six years with Yorkton's Natural Resources Group. After working for 10 years as an investment advisor with Canaccord Capital, specializing in the natural resource sector, Mr. Fabbro left to become Lead Director of Roxgold Inc., which was named the top company on the TSX Venture 50 and raised in excess of $60 million in equity financing during his tenure.

David L. Trueman (Ph.D, P.Geo.) Director: Mr. Trueman brings 54 years of exploration and mining experience to ProAm Explorations. He has spent time in academia, government and industry, and in the last 41 years specialized in the rare metals field. He has since worked on rare metal deposits through the Arctic in Canada, Greenland, the U.S. and Russia, and his work has taken him to Australia, Namibia, South Africa, India, the PRC, Brazil, Argentina, Chile, Saudi Arabia, Spain, France, Wales, Denmark and East Germany. He has held a number of directorships on various exploration and mining companies and has authored or co-authored some 70 papers in various professional journals.

Bruce W. Downing (M.Sc., P.Geo, FGC, HON FEC) Consultant: A graduate of Queens University and the University of Toronto (M.Sc.), Bruce Downing has over 30 years of experience as a senior geologist working for several corporations, and as a consultant on surface and underground gold and base metal exploration and production projects in British Columbia and around the world. Mr. Downing was involved in the exploration and pre-production at the Windy Craggy open pit and underground massive copper sulphide deposit; wrote reclamation and closure plan for an open pit copper-gold mine (British Columbia) [and] was involved in several acid rock drainage studies.

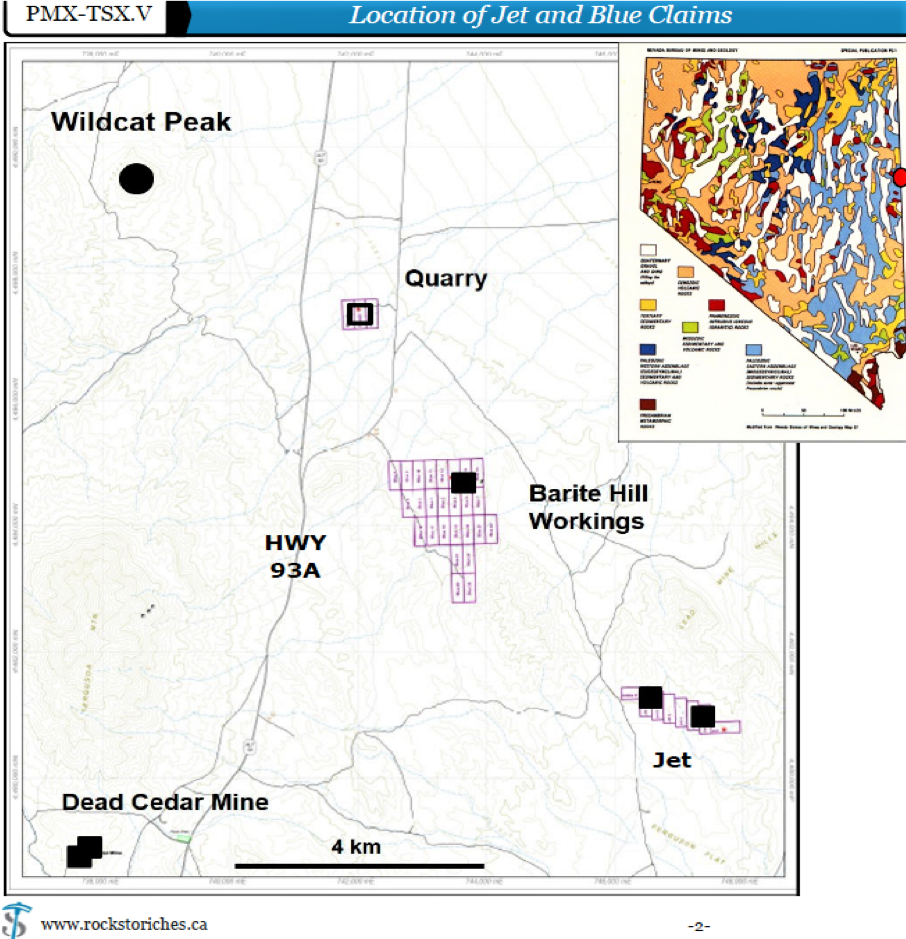

Jet Property, Nevada, 100% Earn-In

The property consists of three main areas, known as Jet, Barite Hill and Quarry. The infrastructure is great, with Nevada Highway 93A bisecting the property, with secondary roads to the claims. There has been very little modern exploration and little historical data. Some exploration in the early 1920s was probably focused on precious metals.

PMX is earning a 100% interest in the Jet property, subject to a 2.5% NSR [net smelter return], in return for staged payments totaling US$452,000 cash, 1.5 million shares and US$700,000 on exploration, culminating in a NI-43-101 resource report by fourth anniversary of the agreement (2023).

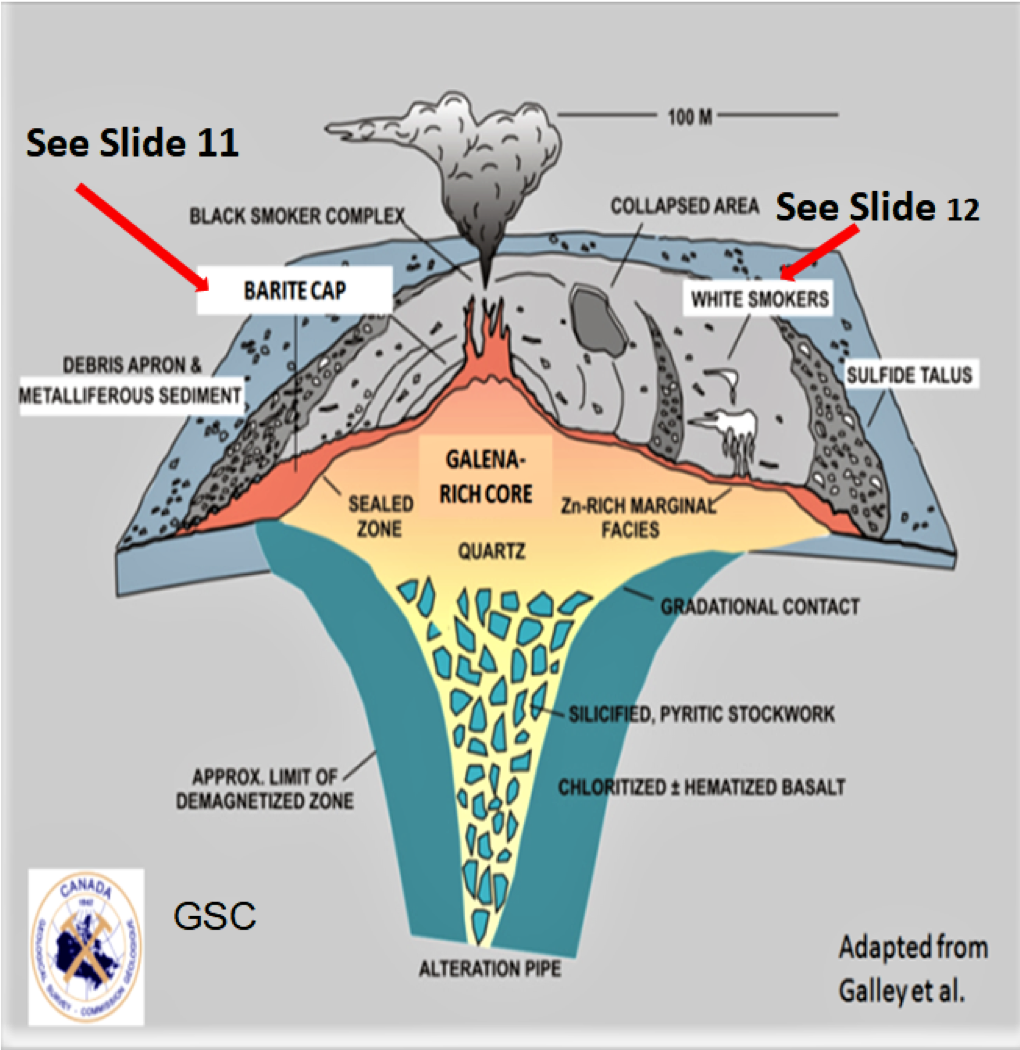

The geological model is called a black smoker. Black smokers are underwater hydrothermal vents that emit jets of particle-laden fluids. The particles are predominantly very fine-grained sulfide minerals formed when the hot hydrothermal fluids mix with near-freezing seawater. These minerals solidify as they cool, forming chimney-like structures. These black smoker complexes can host rich concentrations of copper, zinc, lead, silver and gold.

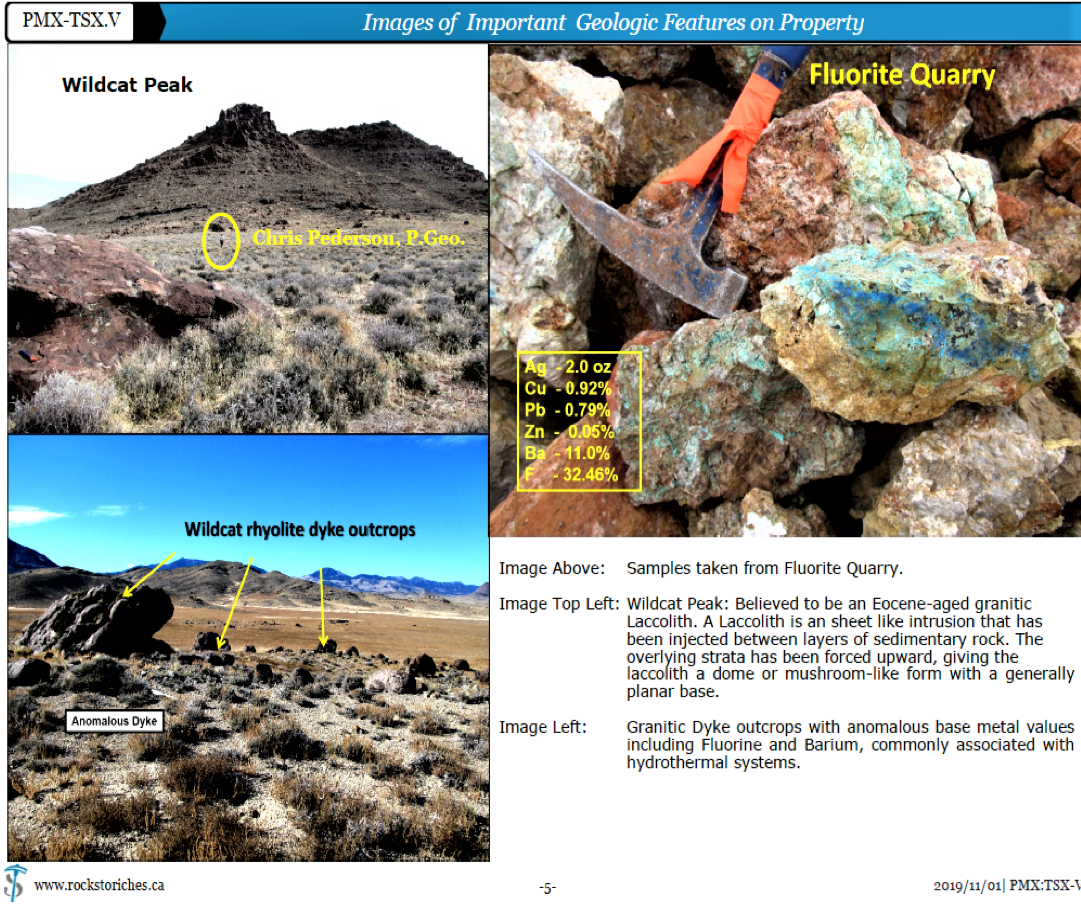

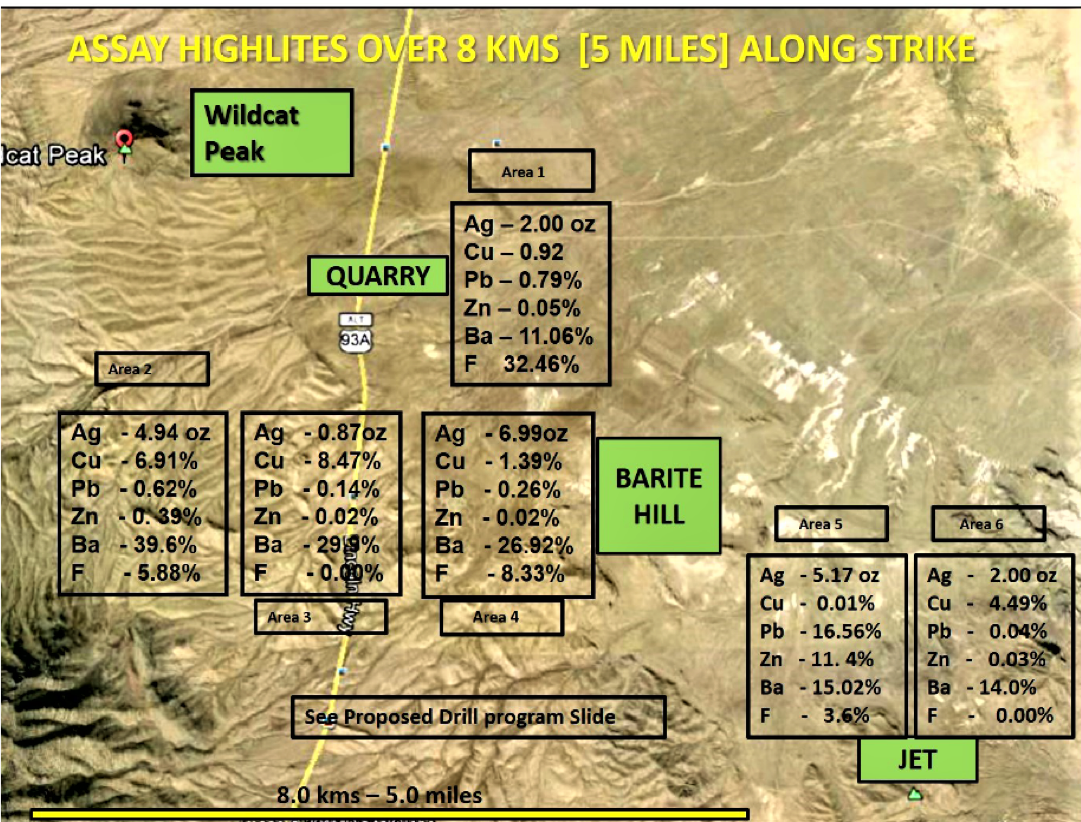

This next graphic is a combination of a few pictures to give you a good idea about the property.

Barite and silica are found in abundance at the Jet property, and these minerals are commonly associated with hydrothermal volcanogenic deposits. ProAm believes that circulating groundwater dissolved the metals associated with the nearby Wild Cat intrusion and potentially formed a carbonate-hosted Manto-style deposit. Geologist Chris Pedersen collected a series of samples from intermittent outcrops parallel to a 4.5-mile (7,250-meter) rhyolite dyke system.

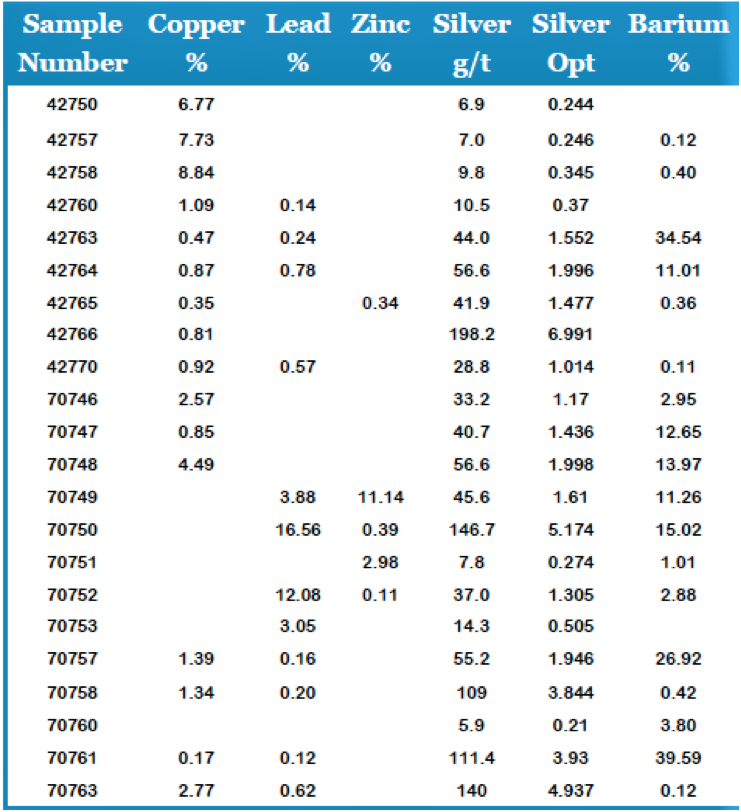

These samples contained sulfate, oxide and carbonate minerals that are indicative of weathering and leaching of original metallic sulfde minerals. Highlights from the different areas on the property are shown in the next graphic.

In addition, a significant 6- to 8-kilometer-long gravity anomaly is coincident with the mineralization and may indicate an intrusive "heat source," and in some areas potential metal sulfide mineralization. There is evidence of historical mining, such as this adit.

This is a table of the grab samples and cannot be construed as representative of wider areas of mineralization, but what I notice is the higher grades seem to be copper and silver. There might be a lot of silver in this system.

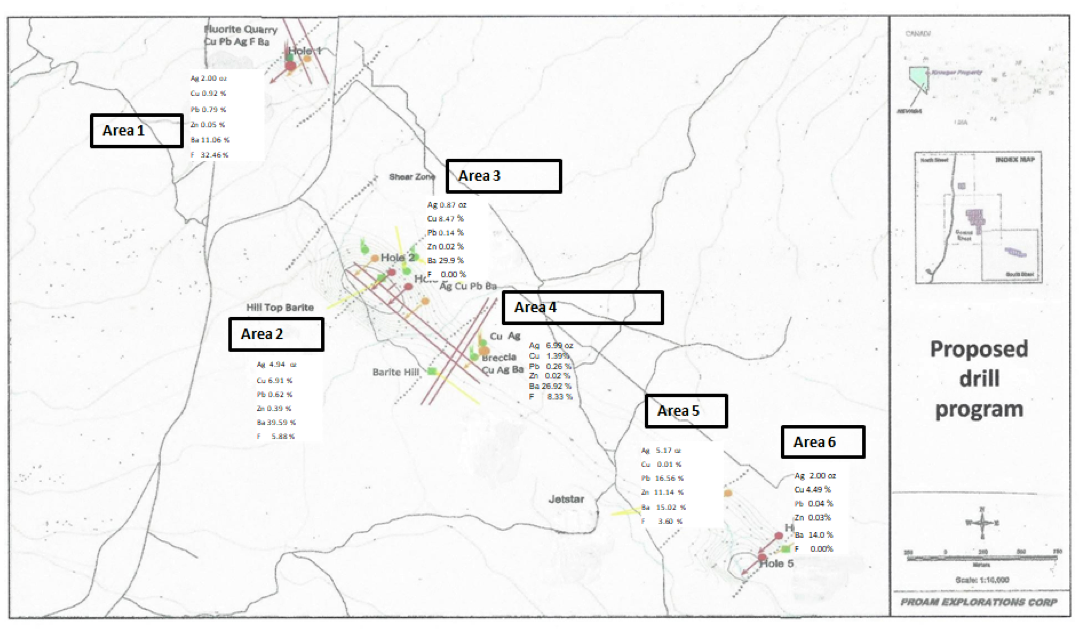

Next is a map of the proposed five-hole drill program that will test three areas on the project, Quarry, Area 2 and 3 (Barite Hill), and Area 6 (Jet).

Financials

Last financials reveal little cash and no debt. The current $250,000 financing at $0.07 per share will fund the company's planned drill program.

Conclusion

ProAm is a new company with very few shares outstanding and a tight share structure. After the planned financing there will be only 10.7 million shares out, approximately. At $0.15/share this would only be a market cap of about $1.5 million, so there is a lot more upside than down from these prices.

Despite all the gold being mined in Nevada, new discoveries continue to be made. A new deposit, known as Goldrush, will start producing in 2021, and the adjacent Fourmile will follow sometime after 2025. They are located roughly 20 miles west of Elko, and each could produce 5 million ounces of gold over a decade.

Corvus Gold Inc. (KOR:TSX), near Beatty, Nevada, is still growing its Mother Lode and Bullfrog deposits, with the most recent preliminary economic assessment projecting 282,000 ounces produced per year over the mine life. Blackrock Gold Corp. (BRC:TSX.V; BKRRF:OTCMKTS), another Nevada junior on our list, has been on a tear since March, as it has begun drilling in Nevada.

I believe ProAm's Jet project has very high odds of hitting some strong drill intersects and being successful. I expect we could see a much high share price with drilling on this project. With positive drill results on the upcoming drill program, management plans to raise more funds at higher prices for the next phase of exploration. There is a lot of interest in junior miners now that show results of a possible discovery, so I expect ProAm will have little problem raising further rounds to advance the project. The time to buy is now, ahead of the crowd and drill results.

You can see on the chart that this company has been quiet, and is not known yet. There was a cross of 2.5 million shares on May 14, and since then, trading activity has come to life a bit, but is still pretty quiet. I am not sure how much stock will come out at these prices, but there is some time before drilling, so do not chase it too high. I would go no higher than $0.15/share for now.

Ron Struthers founded Struthers' Resource Stock Report 23 years ago. The report covers senior and junior companies with ample trading liquidity. He started his Millennium Index of dividend stocks in 2003 - $1,000 invested then was worth over $4,000 end of 2014 and the index returned 26.8% in 2016. He retired from IBM after 30 years in customer service, systems and business analyst, also developing his own charting software. He has expertise in junior start-ups and was a co-founder of Paramount Gold and Silver.

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: ProAm Explorations. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: ProAm Explorations is a paid advertiser at playstocks.net. Additional disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and images provided by the author.

Struthers Disclosure: All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.