Stocks indeed experienced a down day yesterday, and the credit markets say it might not be over just yet. With today's premarket upswing rejected at recent highs, will the bears smell an opportunity? While I continue to think it'll turn out to be a blip on the screen, I have my guard up.

S&P 500 in the Short-Run

Let’s start with the daily chart perspective (charts courtesy of

http://stockcharts.com ):

The string of daily gains in one row was broken yesterday, and the first knock on the late-Feb bearish gap's lower border failed. The extended daily indicators are still a cause of short-term concern.

With stocks back at the bearish wedge, these were

my yesterday's thoughts:

(…) Sure, the bears can force a test of the upper border of the rising red wedge – but will they be able to bring prices much back below that lastingly? Is such a reversal of fortunes on the cards right now?

Unless the Fed missteps tomorrow, that's not likely. And I don't really expect them to rock the boat in any meaningful way.

That's still the case, and I don't expect a truly hawkish surprise. If Powell calls again for more fiscal stimulus while saying that monetary policy alone can't save the day, that would facilitate a dip in stocks – regardless of reiterating that the Fed stands ready to act should the recovery run into headwinds. As he's unlikely to offer new programs or broaden existing ones, the bulls may become disappointed at no new additions to the punch bowl, and stock could have a bad day.

Today's

intraday Stock Trading Alert captures why I've turned short-term cautious earlier today:

(…) But it's the two leading credit market ratios that are short-term concerning.

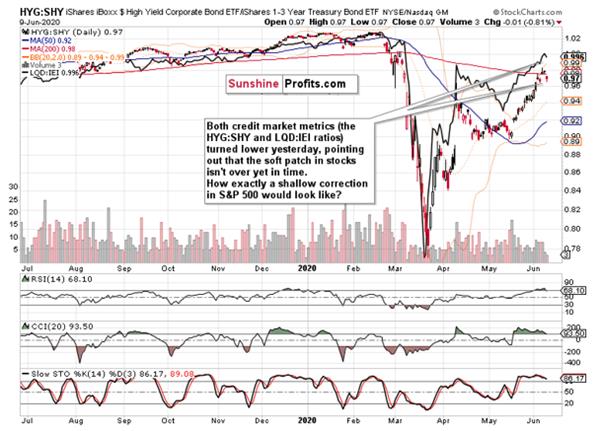

Both the high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) declined yesterday, leaving stocks overextended in the short-term.

And the current very short-term price action in the S&P 500 (issues around the 3225 level) doesn't favor the bulls exactly.

Let's see the credit market action then.

The Credit Markets’ Point of View

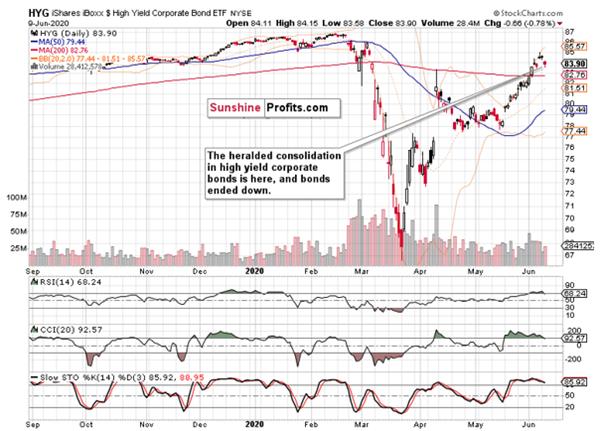

The sideways consolidation in high yield corporate bonds (HYG ETF) gave way to a daily downswing on higher volume than was the case on Monday. Does it mean that the correction is almost over, or that it has a bit further to run? While the jury is out, I think that given yesterday's session, we have still a bit more to go before seeing corporate bond prices above Friday's highs.

This is the shape of both the above-mentioned leading credit market ratios.

They weakened yesterday, and the more risk-on one (HYG:SHY) is leading the downswing, and that's a watchout. The animal spirits are thus likely to get tested relatively soon, with perhaps today's Fed

monetary policy statement and conference being the catalyst. Or Friday's inflation expectation figures could play that role.

Either way, unless credit markets recover, stocks are in the short-term danger zone. This is how I mean it:

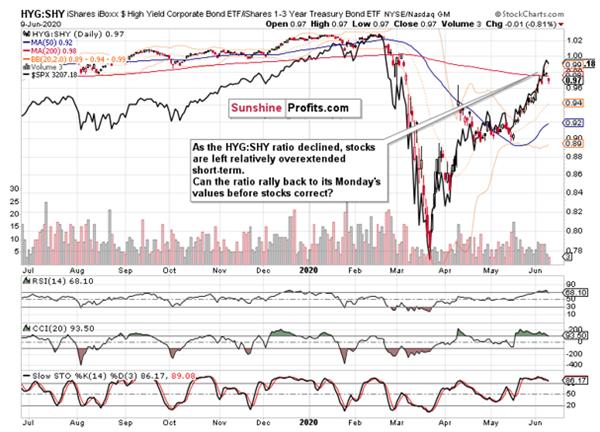

Stocks are kind of hanging out there in the short run, and the degree of relative extension makes me think that the stock upswing isn't likely to proceed with its previous momentum before taking a pause first.

Or will the ratio stage a sharp recovery and erase earlier losses fast? Given the action in short-term Treasuries (IEI ETF), I don't think such a move is immediately likely:

Buyers showed up in force yesterday, and the momentum will probably support these Treasuries as we approach the Fed statement later today.

Longer-dated Treasuries (TLT ETF) also gapped higher yesterday, but couldn't extend their gain. As they closed near their daily lows and on average volume, the conclusion is clear – the market place expects higher inflation down the road. And while today's CPI data haven't showed that playing out in the present just yet, Friday's inflation expectations likely will.

Would the Fed make noises about getting cautious with balance sheet expansion then? That would spoil the signals they've been sending up till now, which is why I don't expect any kind of their sharp U-turn this soon. Should we hear them hedging their positions (e.g. very closely watching the inflation data), we would need to turn cautious even more – after all, stocks generally don't take too well to any tightening (remember the 2013

Taper Tantrum?), and a mere slowdown in money printing can do the trick this time around as well. But it's still too early for a policy misstep of this proportion, I think.

What about the S&P 500 sectoral moves?

Key S&P 500 Sectors in Focus

Technology (XLK ETF) closed higher still, but healthcare (XLV ETF) gave up all of its Monday's gains. Financials (XLF ETF) closed where they opened – lower, that is.

With energy (XLE ETF) and materials (XLB ETF), it's been the same story as with financials. Industrials (XLI ETF) acted weaker than the other two stealth bull market sectors, which coupled with the heavyweights' performance means that some chop in stocks is probably ahead.

And unless the credit markets get their act together, the short-term risks for stocks are getting skewed to the downside. That could be amplified by the USDX taking a breather after the recent sea of red.

The caption says it all, and is one more reason for caution in the short run.

Summary

Summing up, stocks reversed lower yesterday, and signs are this correction isn't over just yet. That's because the move lower in both leading credit market ratios (and also in HYG and LQD ETFs themselves) is about to provide more of a headwind for the stock bull run in the short-term. The mixed sectoral performance highlights the risks ahead for the stock bulls, and so does the Russell 2000 (IWM ETF) trading close to Friday's open. This means that smallcaps are leading the downside move. While my medium-term bullish outlook remains unchanged, it's the short-term outlook that's problematic.

I encourage you to sign up for our daily newsletter - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts.

Sign up for the free newsletter today!

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.

* * * * *

All essays, research and information found above represent analyses and opinions of Monica Kingsley and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Monica Kingsley and her associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Ms. Kingsley is not a Registered Securities Advisor. By reading Monica Kingsley’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Monica Kingsley, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.