IMF predicts deeper global recession and slower recovery, just as I expected. Good news for gold.

The June edition of the IMF’s

World Economic Outlook Report Update is out! The main message is that the IMF predicts now even a deeper recession than two months ago.

As a reminder, in April edition of the

World Economic Outlook Report,

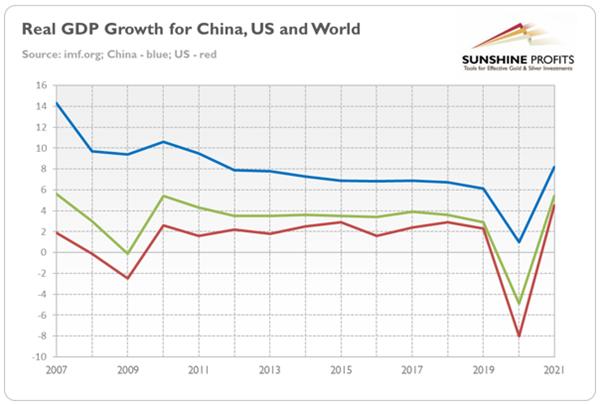

the IMF projected that the global economy would contract sharply by 3 percent this year, while the U.S. economy would plunge 5.9 percent. When it comes to 2021, the IMF projected 5.8 percent growth for the global economy and 4.7 percent for the U.S.

Many analysts cheered the vigorous pace of recovery expected by the IMF. I did not. I remembered that the IMF’s projections are always too optimistic, so I remained skeptical. That's I wrote:

If something seems too good to be true, it probably is. To be sure, there are many reasons for optimism. In some countries, the number of new cases has come down. And the unprecedented pace of work on treatments and vaccines also promises hope. However, the IMF’s base scenario assumes basically the V-shaped recovery, which is not likely to happen.

As long the society does not have herd immunity, the economy will not simply return to normal, pre-pandemic life. And if history of previous deep downturns is any guide, the reduced investment, employment and commercial bankruptcies will leave long-term scars on the economy.

It turned out that the IMF was wrong and I was right. In the newest report, the Fund expects that the global economy will drop 4.9 percent this year (almost two percent below the April’s forecast!) and that it will expand only 5.4 percent in 2021. When it comes to the U.S. economy, the IMF projects that it will plunge 8 percent (more than two percent below the April’s forecast!) and that it will recover just 4.5 percent in 2021.

It means that the global and the U.S. economies are likely to experience their worst

recessions since the

Great Depression, far worse than the

financial crisis of 2007-2009, and that they will turn out to be deeper than previously expected, while the pace of recovery will be more gradual than previously forecasted.

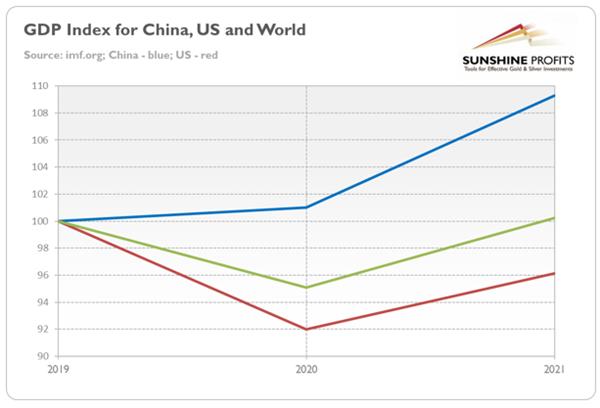

Indeed, as the chart below shows, the U.S. GDP will not return next year to the pre-pandemic level. It will happen in 2022 or maybe even in 2023. So, please forget about the V-shaped recovery, especially since that even these projections may be too optimistic.

Implications for Gold

Implications for Gold

What does it all mean for the gold market? Well, deeper recession and slower recovery are good news for gold, which shines the most during the period of

economic crises and subdued economic growth, especially in the early stages of expansions.

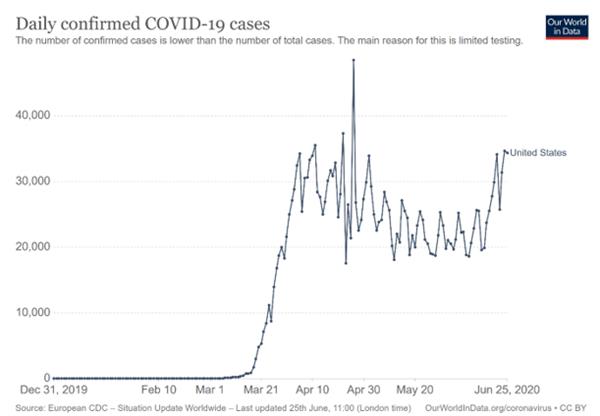

Moreover, the grimmer IMF’s report, combined with the rising number of daily new cases of Covid-19 in the U.S. (see the chart below), could decrease the risk appetite and increase the demand for

safe-havens such as gold.

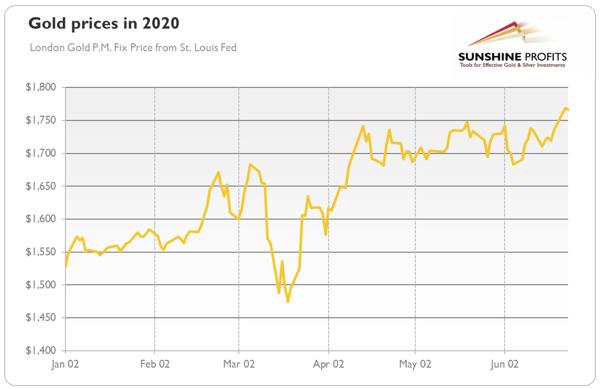

Indeed, the

S&P 500 Index declined yesterday, while the price of gold surged to its highest in nearly eight years (as the chart below shows). The downward revision of economic projections and the resurgence of

coronavirus in America clearly show that “we are definitely not out of the woods”, as Gita Gopinath, the IMF’s chief economist, put it.

And the coronavirus crisis will also generate medium-term challenges, as we repeated many times. In particular, the already high indebtedness will become even higher. According to the IMF, the public debt will reach this year the record high level, in both developed and developing countries. The global

public debt is forecasted to jump above 101 percent, almost 20 percentage points above 2019 level. Such an abrupt rise increases the odds of a

sovereign debt crisis and pressure for

interest rates to remain at ultra-low levels.

Such environment looks fundamentally positive for the gold prices.

If you enjoyed today’s free

gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly

Gold Market Overview reports and we provide daily

Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to

subscribe today.

If you’re not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.