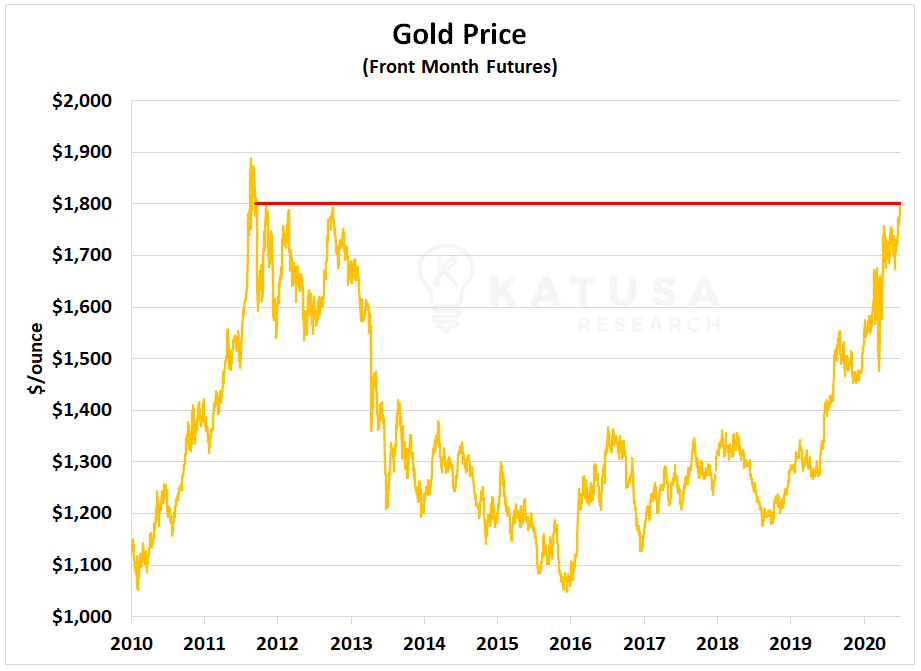

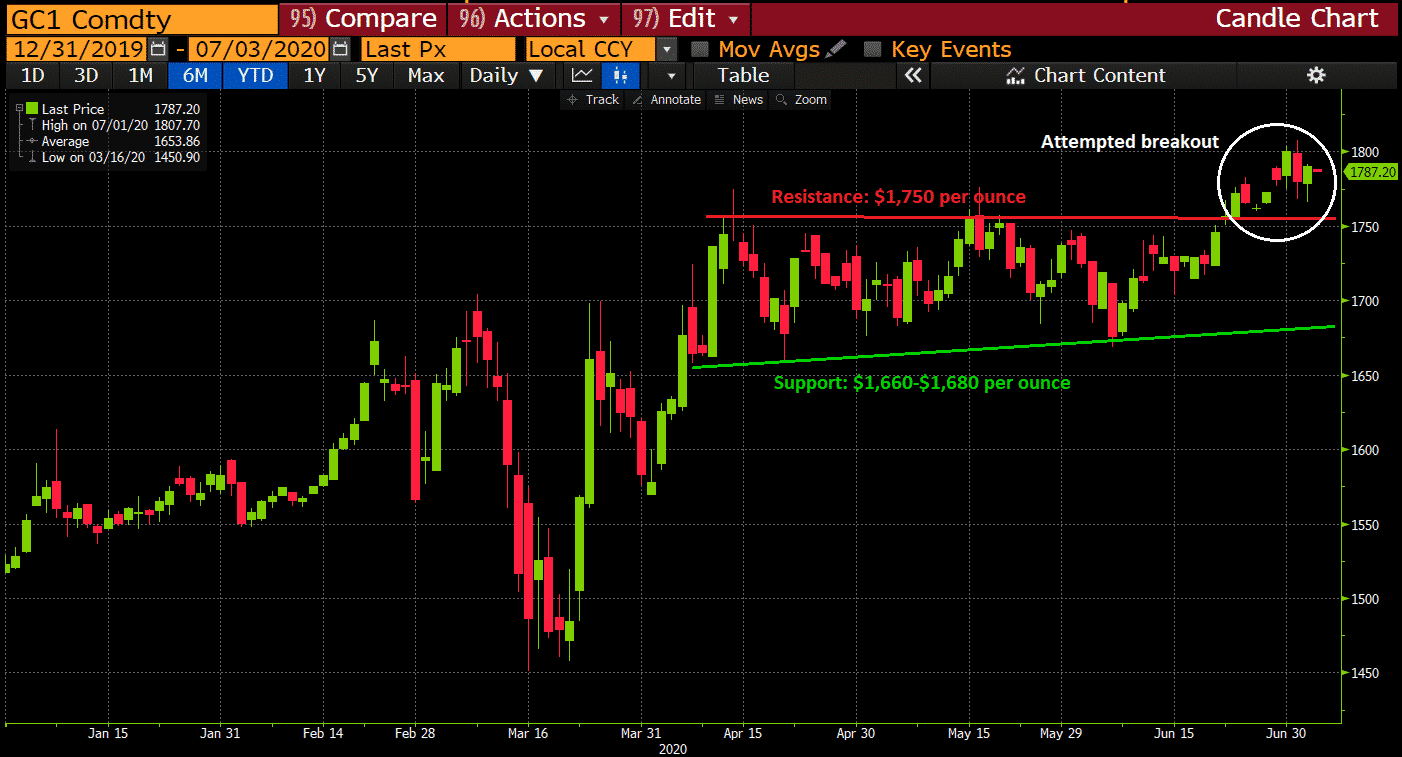

For the first time since November 9th 2011, front month gold futures traded hands above $1,800 per ounce. It’s now knocking on the door of a major technical resistance level.

Naturally, this has every goldbug and self-proclaimed expert on YouTube shouting from the rooftops.

Naturally, this has every goldbug and self-proclaimed expert on YouTube shouting from the rooftops.

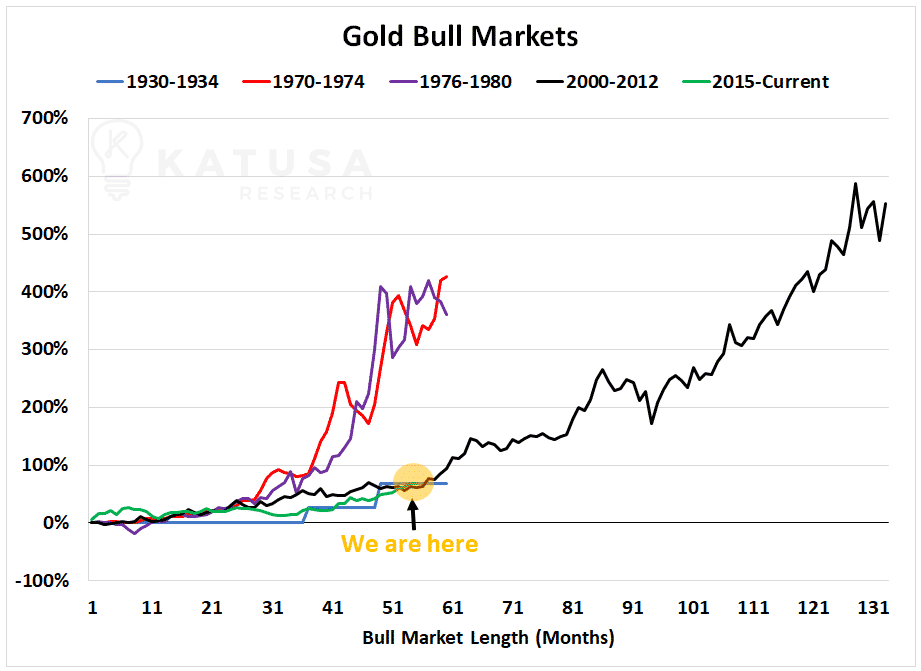

Before we jump into what is going on in the current gold markets, lets first take a look at past gold bull markets…

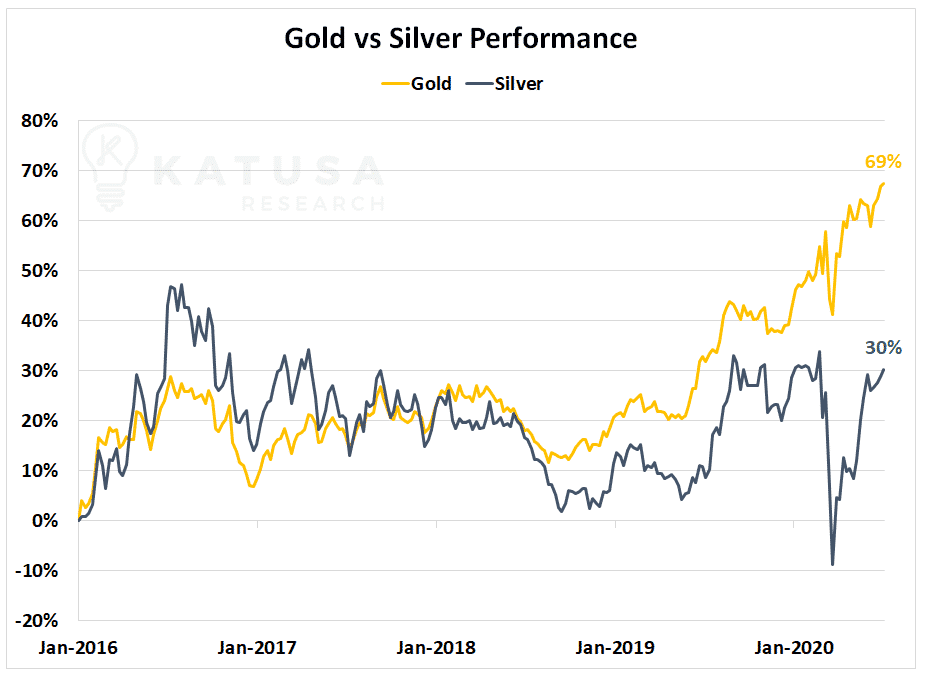

Below is a chart which shows the previous major bull markets in gold. You will see that all but 1 of the major gold bull markets resulted in gold appreciating at least 400%. Using January 2016 as the low point for the current gold bull market we are in, gold is up 69% from its lows.

History may not repeat itself but it’s critical to understand what is driving the gold price right now.

History may not repeat itself but it’s critical to understand what is driving the gold price right now.

What is Driving the Gold Market Higher?

Right now, there are several major economic factors driving gold higher.

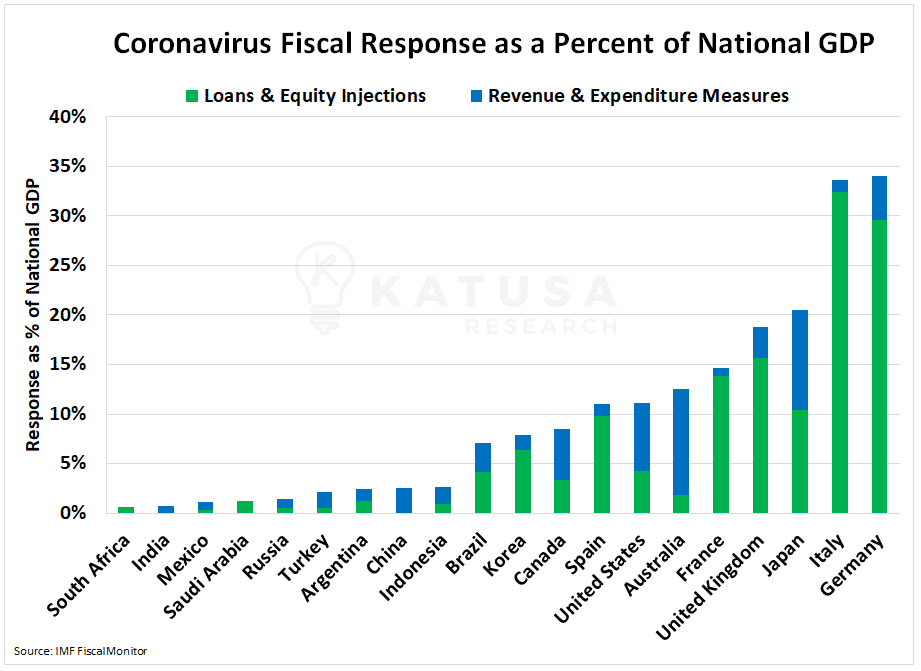

1) Large Government Stimulus Packages Around the World

This leads to currency devaluation. The global fiscal policy response to Coronavirus is $9 trillion to date, and likely to climb further. This is supportive of assets like gold which are a store of value.

Below is a chart which shows the fiscal policy response for major economies around the world. The fiscal policy response is illustrated as a percentage of the countries GDP.

2) NIRP – Negative Interest Rate Policy

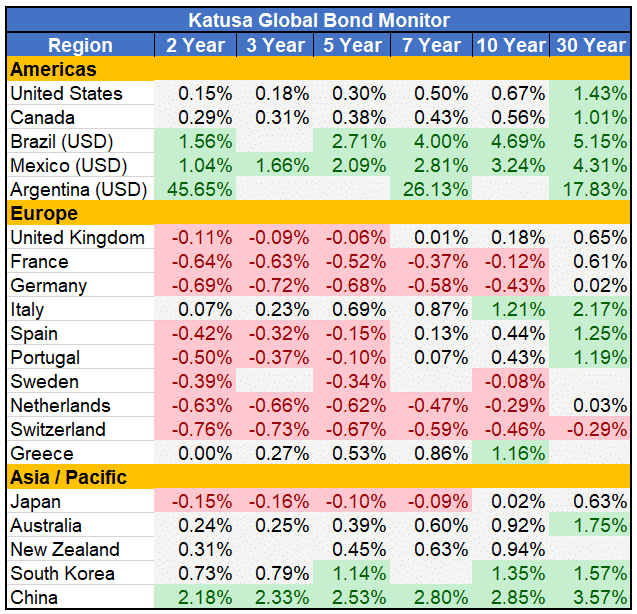

Around the world, Central Banks are cutting interest rates while starved for yield investors clamor for any bond trading with a reasonable yield. This drives bond prices higher and bond yields lower.

Low interest rates discourage investors from investing in government bonds, and forces them to look elsewhere for safe haven investments such as gold.

Below is a chart which shows government bond yields around the world.

You’ll notice that Europe is nearly all red.

You’ll notice that Europe is nearly all red.

The combination of investors starving for yield and central bank NIRP (Negative Interest Rate Policy) has driven most government bond yields into negative territory.

The rest of the developed world is not far behind.

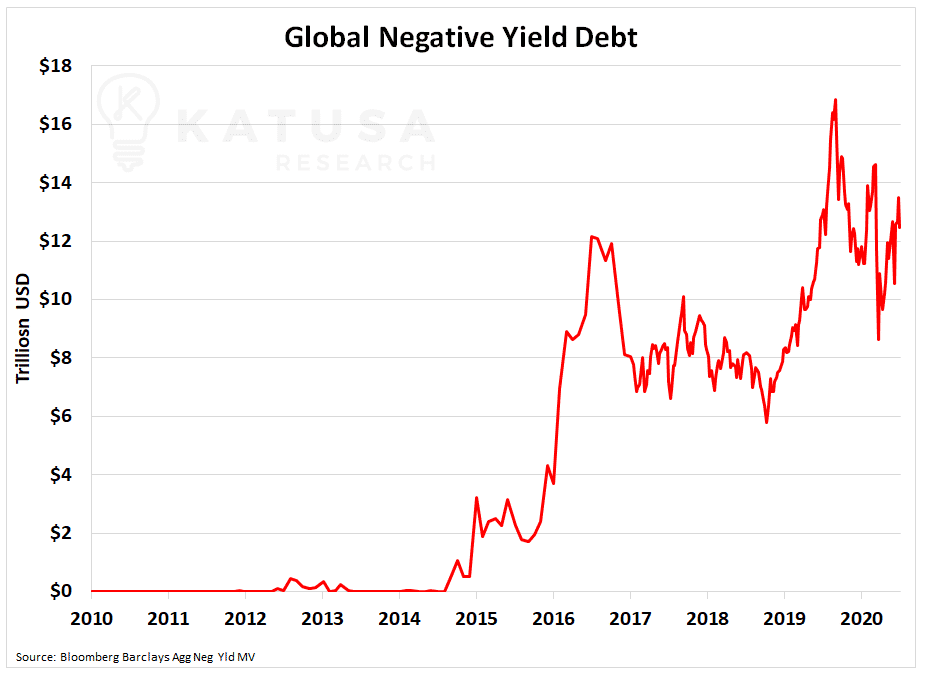

These low rates have driven the total amount of negative yielding debts to levels we’ve never seen before.

- In the past 5 years, global negative yield debt has soared from zero to over $12 trillion.

3) The Deflation and Stagflation Trade.

3) The Deflation and Stagflation Trade.

I have written extensively about this weak productivity and GDP, high unemployment and high costs of primary goods (food, water, shelter).

This type of economic environment incentivizes investors around the world buy safe haven assets which are stores of value.

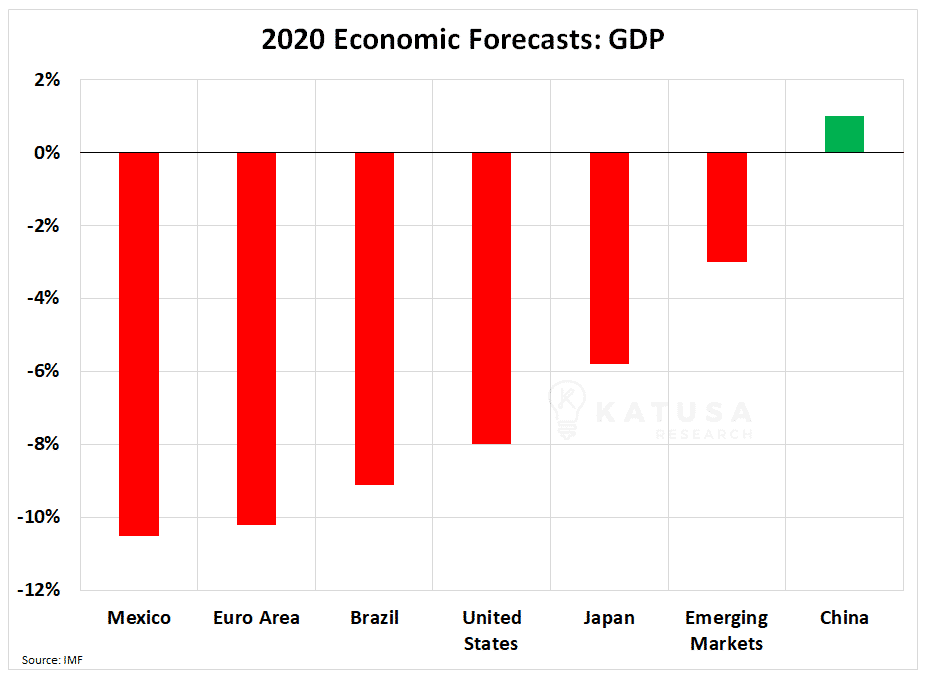

The International Monetary Fund (IMF) is projecting a deep recession and slower recovery…

In its most recent remarks on June 30th, the IMF revised its forecast for global GDP to -4.9%.

More worrisome is that its developed nations forecast, comprised of powerhouse nations like the United States, Germany, China, which the IMF forecasts to contract by 8%. In addition, the IMF projects total business losses will be over $12 trillion.

Below are the 2020 projections for the Gross Domestic Product of major economies. Let’s not forget that Mexico is a very important trading partner for the U.S. There are a lot of troubling signs in the market.

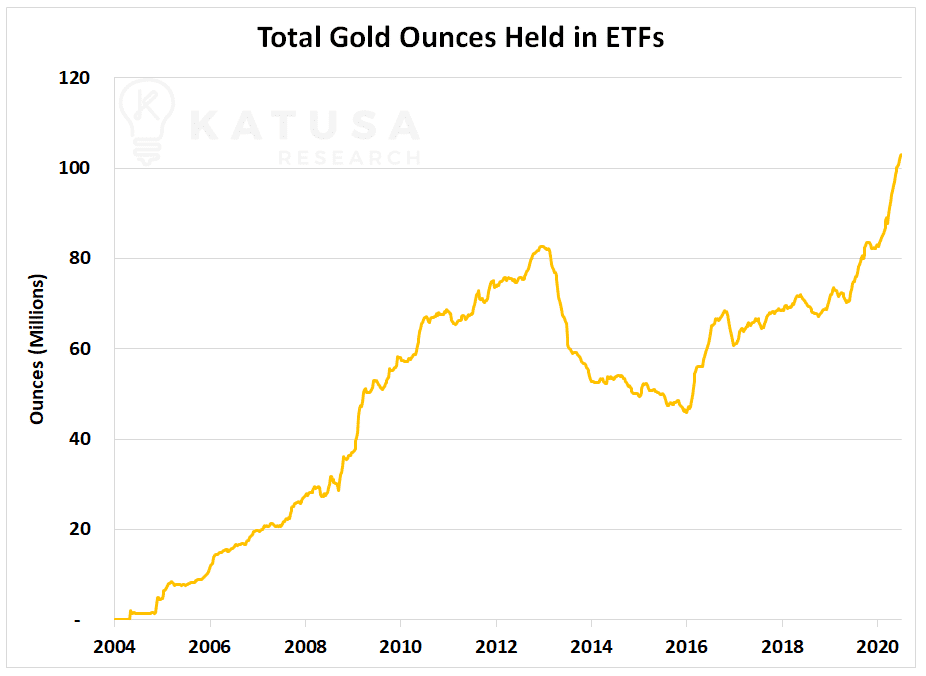

4) ETF Inflows Continue to Hit New Highs.

4) ETF Inflows Continue to Hit New Highs.

Gold backed ETFs have seen record inflows for weeks on end now as investors clamor for exposure to the metal.

As ETFs create new units, each of which is backed by gold, this requires the ETF to purchase more gold…

What’s Next for Gold?

What’s Next for Gold?

I don’t see the US central bank, or any other major Central Bank around the world slowing down the money printing presses.

Nor do I don’t see any developed nation’s central bank have the ability to raise interest rates right now. This type of currency devaluation provides a solid long-term thesis for gold.

I do think gold needs more time to consolidate in this upper range before making a sustainable move higher.

Could Silver Play Catch Up?

Could Silver Play Catch Up?

Using January 2016 as the start of this bull market move, silver has drastically underperformed gold. The chart below shows silver is only up 30% from January 2016, versus gold which is up 67%.

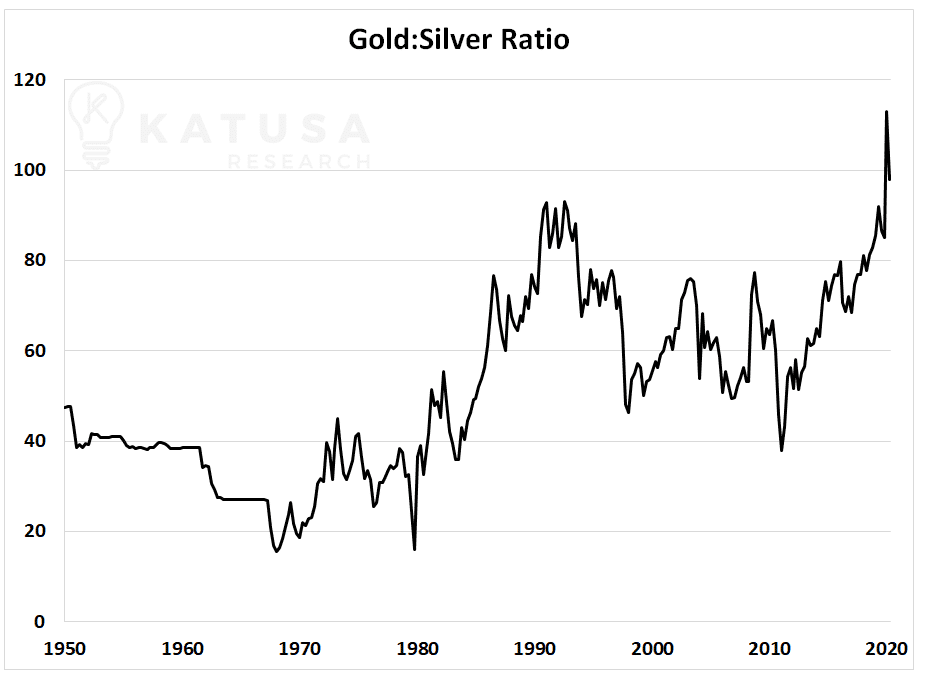

This has led to a record diversion between the valuation of gold and silver. And this is commonly shown through the gold to silver ratio.

This has led to a record diversion between the valuation of gold and silver. And this is commonly shown through the gold to silver ratio.

Much to the chagrin of silverbugs, the ratio has continuously made new highs meaning that gold is taking off and leaving silver behind…

I have never been one to use the gold-silver ratio as an investment tool. In fact, I don’t think its particularly helpful.

I have never been one to use the gold-silver ratio as an investment tool. In fact, I don’t think its particularly helpful.

The gold-silver ratio always reminds me of the oil to natural gas ratio of the mid 2000s…

For decades, the oil to natural gas ratio was fixed at 6 to 1 because the pricing was fixed on an energy equivalent basis.

The shale revolution changed that, and long time subscribers will know when in 2007 I stated that the shale will produce so much gas that the ratio will be irrelevant.

Silver is an industrial metal with some (and I say some generously) precious metal attributes.

- Don’t forget there is very little primary silver production compared to secondary production.

That means, a lot more silver is produced as a by-product of existing mines.

Also, a slower global economy does not bode well for industrial metals. Silver will do O.K., but gold is where the action is and will continue to be.

How is Marin Katusa Investing in Gold?

I have spent 2 decades in the resource space as a professional fund manager and investor. And I make 99% of my income from investments within the resource space.

I’ll let you in on a simple formula for achieving big success in resource markets…

Two of my most important criteria are:

A bad management team can screw up a good deposit and can’t fight the burning match that is most junior resource companies.

On the other hand, a good management team possesses both intellectual and physical capital. This allows them to create situations with exceptional upside and less risk.

- My old rule used to be to avoid the AK-47 nations. Those are nations where AK-47s required to feel safe, both travelling and as a local.

Having travelled to over 100 countries, strapped on the bulletproof vests and hired ex-military guys as our security teams, I can say I avoid all that now.

It might sound cool and make for a good story, but in reality, it’s not worth it.

I’ve taken my thesis a step further during this COVID-19 pandemic, coining the +SWAP and -SWAP Line Nations argument.

This suggests that nations with access to US dollar SWAP lines will receive preferential treatment and trade agreements versus those without access to US dollar SWAP lines.

I think this is a situation that will build over the next 3-5 years before coming to fruition.

Positioning yourself in the resource game requires more than throwing a dart at the board.

Buying an ETF like the Jr Gold Miner ETF gives you some exposure, but not a lot. The sniper approach is simply the best.

It’s the act of completing 1,000s of hours of due diligence, taking site trips, and talking to the best experts in specific fields.

This is not for everyone.

And it’s why I have created the Katusa Resource Opportunities portfolio, which provides subscribers with all my thoughts and investments.

Subscribers get to buy before I do and sell before I do, and I don’t take any fees.

Our most recent gold stock has just shot up for a 460% return in just 3.5 months.

Profits like that are sexy for sure. And the fact is that most people don’t know how to build a position or look for a company with that potential.

If you want to know the next stocks, companies, and deals I’m looking that fit the bill…

And where I’m putting my own money on the line… it’s all in my premium research service. Click here to learn more.

Regards

Marin