When I think of a region with truly great silver deposits, I instantly think of central Mexico.

Historically, Mexican silver production dates to the Spanish conquests. Over the past 500 years, more than 10 billion ounces of silver have come out of the ground in the region. The fortunes are legendary.

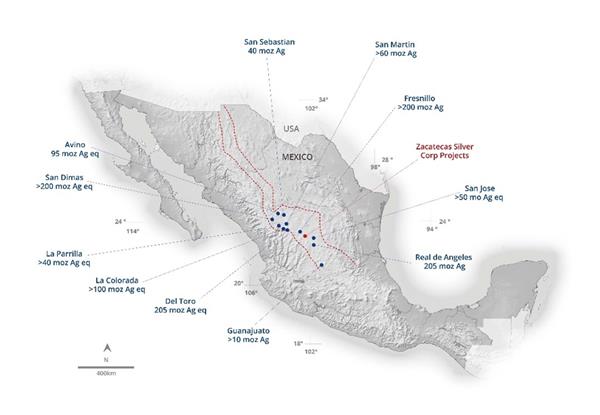

The short version of the story is that, for all manner of geological reasons, there’s a gigantic, northwest-southeast mineral trend that nearly bisects Mexico and hosts a long list of great mines and famous old names in the mining world.

More specifically there’s a feature called the Fresnillo Silver Belt, nestled within the rocky spine of that country. Just this district alone has yielded over 6.2 billion ounces of silver.

We could spend all day reviewing great companies that have delivered silver and profits to investors.

For now, though, add a new name to the list,

Zacatecas Silver Corp. (ZAC: TSX-V).

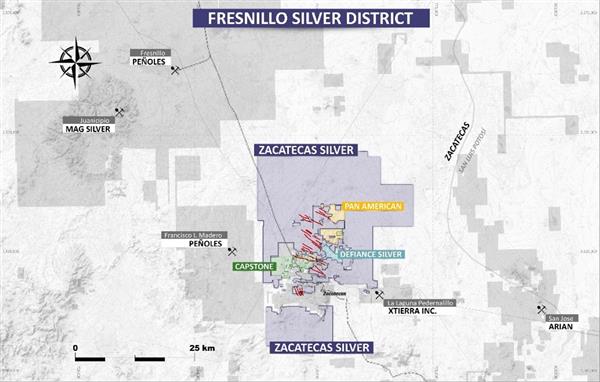

After an aggressive effort at land acquisition, Zacatecas has locked up a large block of mineral rights surrounding some of the best names in the region, as you can see here:

Much of the land package is directly on trend with producing mines and has zones with high silver grades.

In just a small part of the land package, the previous owner reported a historical inferred resource estimate of 19,472,901 ounces of silver-equivalent (Ag Eq., using a data cut-off 100 g/t). There’s much more detail at the company website, but for our purposes here, the math is 3,954,729 tonnes at 153.2 g/t Ag Eq (136 g/t Ag, 0.14 g/t Au, 0.012% Pb, 0.11% Zn).

Here’s the thing. This is an impressive number in and of itself.

But it’s still very much preliminary considering the exploration upside.

Indeed, the known silver trends under Zacatecas control are open in terms of strike and depth.

To exploit the impressive high-grade silver upside, Zacatecas has assembled a superb team to apply a comprehensive, wide-ranging exploration program to the acreage. The project leader is professional geologist Chris Wilson, formerly of the highly regarded Ivanhoe group.

Zacatecas plans to revise the current model for the resource estimate. Expect to see additional mapping, geophysics and drilling. Then, it is more than likely that the company will grow the silver resource from its historical baseline.

In fact, there are numerous known trends, including named veins and outcroppings, that have never been properly explored or fully mapped, let alone drilled for depth and grade.

To accomplish this work, Zacatecas is already well financed, with early investment by high net worth individuals including Canada’s Eric Sprott. The company bank balance sits currently at $9 million in liquid cash with no need to raise capital at this stage.

Share structure is tight, with 56.9 million fully diluted shares outstanding.

The management team includes several names that are familiar in the “junior” company investment space, including CEO Bryan Slusarchuk, who was co-founder and former President of K92 Mining and John Lewins who is the CEO of K92 and brought the gold miner from startup stage to a fully running, highly profitable mining play.

The team also includes James Hutton, well known for arranging beneficial mergers and acquisitions.

Zacatecas is going public, and has immediate plans to build on the historic resource, with the goal of growing the numbers significantly.

More broadly, we’re in the early innings of an investment migration into hard assets, including silver. Industrial reasons are driving the move, along with well-understood monetary tides.

Definitely, you want to be invested in the best-of-class within the silver space.

Zacatecas is well positioned to deliver significant exploration upside, from right in the heart of one of the world’s great mining districts.

This is a ground floor story for investors, with bright days ahead.

Best wishes for great success:

Byron W. King

Geologist & Newsletter Writer.

FULL DISCLOSURE: Zacatecas Silver Corp. is a client of Stockhouse Publishing.