eResearch is pleased to publish an update Equity Research Report on

Peak Fintech Group (PKK) (

CSE.PKK,

OTC: PKKFF,

Forum) pertaining to the recent release of its revenue & EBITDA guidance.

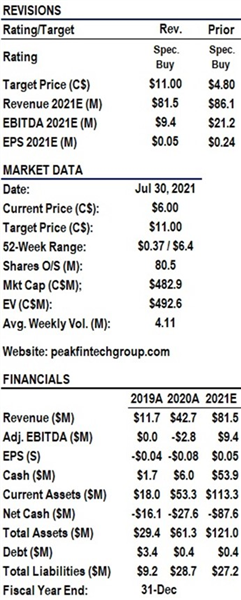

We are maintaining our Speculative Buy rating and increasing our one-year price target to $11.00 from $4.80.

You can download our 23-page Update Equity Research Report by clicking on the following link: eR-Peak_PKK-UR-2021_07_30_FINAL

Company Description:

Peak Fintech Group Inc. (Peak or “the Company”)

Peak Fintech Group Inc. (Peak or “the Company”) is the parent company of a group of financial technology (Fintech) subsidiaries operating in China’s lending industry.

Peak provides an investment vehicle for investors looking to participate in China’s

Fintech industry.

Peak’s subsidiaries use technology, analytics, and artificial intelligence (AI) to provide loans, help small and medium enterprises (SMEs) obtain loans, help lenders find clients, and also minimize lending risk.

Peak accomplishes this through an ecosystem of lenders, borrowers, brokers, and other participants that have come together around its Cubeler Lending Hub platform.

(Click image to enlarge)

Investment Highlights:

(Click image to enlarge)

Investment Highlights:

- NASDAQ listing imminent. Peak’s management believes that the NASDAQ listing will attract new tech-centric institutional shareholders. It expects the shares to begin trading on the NASDAQ soon.

- Peak recently closes $52.6 million financing. The Company believes the financing will “unlock” new expansion and partnership opportunities, and new revenue streams, both inside and outside of China.

- Peak releases Revenue & EBITDA guidance. It forecasts revenue of $104 million in 2021 with EBITDA of $12.5 million, ramping up to $624 million of revenue in 2023 with EBITDA of $155 million.

- Model impacts. Due to the lower Q1/2021 revenue results, we reduced our 2021 revenue estimate to $81.5M from $86.1M. Incorporating Peak’s recent guidance, we have significantly increased our 2022 revenue estimate to $258.2M from $103.6M and $516.3M from $113.9M in 2023, approximately 85% and 83% of Peak’s guidance, respectively.

- Share Consolidation: The share count has been adjusted to accommodate the 1-for-2 share consolidation that took effect on July 27.

Financial Analysis & Valuation:

- The revised revenue and EBITDA estimates for 2021-2023 are:

- 2021: Revenue $81.5 million; EBITDA $9.4 million;

- 2022: Revenue $258.2 million; EBITDA $47.6 million;

- 2023: Revenue $516.3 million; EBITDA $95.8 million.

- To reflect increased confidence in the business, we have raised our revenue multiple to 5x from 4x, increased our EBITDA multiple to 12x from 10x, and raised the DCF terminal EBITDA multiple to 12x from 10x. We estimate an equal-weighted price per share target of $11.30.

We are increasing our one-year target price to $11.00 from $4.80 and maintaining our Speculative Buy rating.

You can download our 23-page Update Equity Research Report by clicking on the following link: eR-Peak_PKK-UR-2021_07_30_FINAL

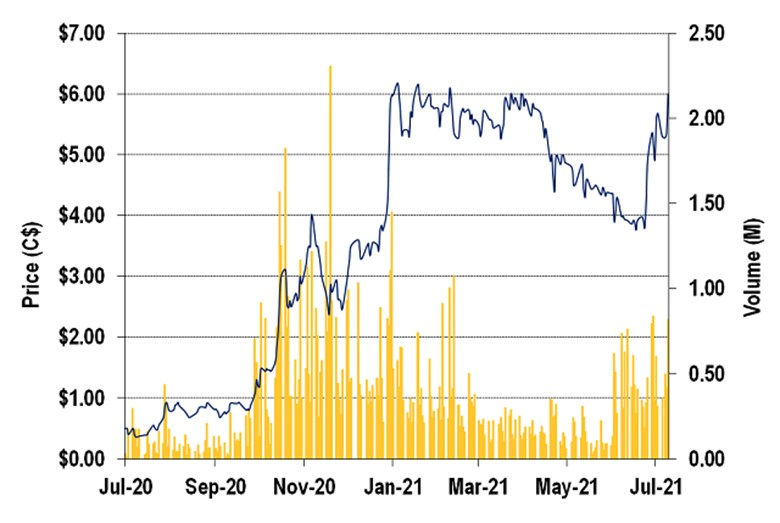

FIGURE 1: PKK 1-Year Stock Chart – Up 700% Year-over-Year

Source: S&P Capital IQ (Click image to enlarge)

Source: S&P Capital IQ (Click image to enlarge)

Notes: All numbers in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article and may have been paid by a company mentioned in the article or research report. eResearch offers no representations or warranties that any of the information contained in this article is accurate or complete. Articles on eresearch.com are provided for general informational purposes only and do not constitute financial, investment, tax, legal, or accounting advice nor does it constitute an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this information should consult with a financial advisor. The article may contain “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements are based on the opinions and assumptions of the Company’s management as of the date made. They are inherently susceptible to uncertainty and other factors that could cause actual events/results to differ materially from these forward-looking statements. Additional risks and uncertainties, including those that the Company does not know about now or that it currently deems immaterial, may also adversely affect the Company’s business or any investment therein. Any projections given are principally intended for use as objectives and are not intended, and should not be taken, as assurances that the projected results will be obtained by the Company. The assumptions used may not prove to be accurate and a potential decline in the Company’s financial condition or results of operations may negatively impact the value of its securities. Please read eResearch’s full disclaimer.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.