(Robson Square, Vancouver | Image via New Age Metals)

(Robson Square, Vancouver | Image via New Age Metals)

Two months ago, investors were dubbing palladium the

hottest precious metal as prices reached US $1,600/oz. Today, they’re above US $1,800/oz.

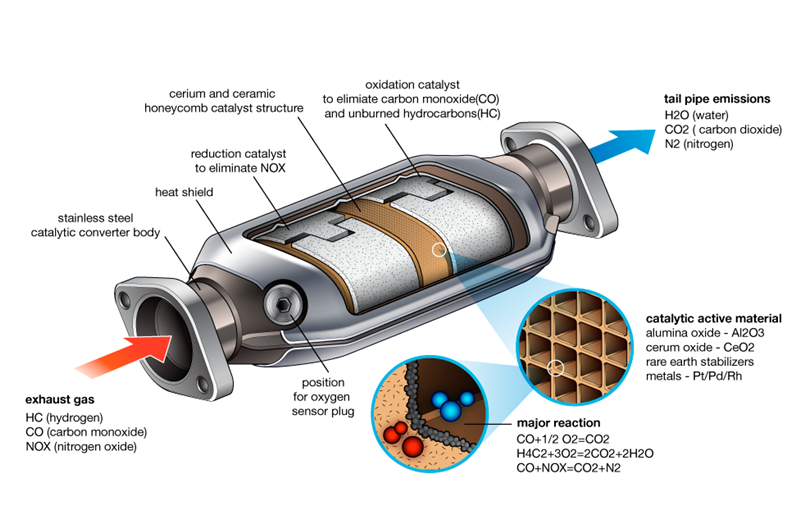

The continued upwards momentum for the metal is even causing noted gold-only investors to inject capital into the Palladium market. Palladium, one of the six platinum group metals (PGMs), is a

key component of the automotive industry, as most of its use comes in the form of catalytic converters that reduce harmful automobile exhaust.

As Palladium demand has gone up, key suppliers such as Russia and South Africa have been unable to keep up, leading to industry participants

looking elsewhere for lucrative deposits. The only two primary PGM producers in North America,

Stillwater Mining and

North American Palladium, have been acquired by South African companies over the past 3 years. When considering the ageing infrastructure, increasing wage costs and general political instability in Russia and South Africa, palladium deposits in North America look even more attractive.

One of the companies invested in the space is

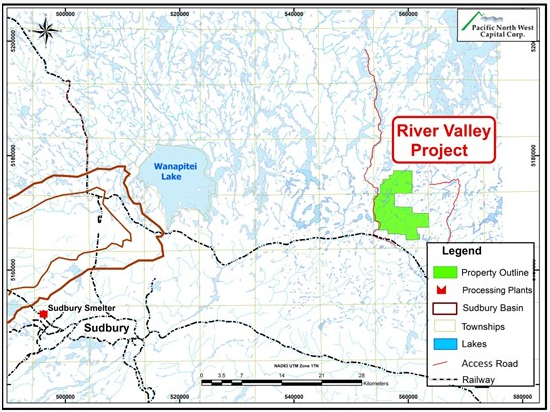

New Age Metals Inc. (

TSX-V:NAM, OTC:NMTLF, Forum), with two PGM deposits at different stages of the exploration and development cycle. The Company’s River Valley PGM Project is within 100km of Sudbury, Ontario and had a Preliminary Economic Assessment (PEA) completed over the summer, and last month, its Genesis PGM Project in Alaska was found to have

double the size of prospective mineralization.

(A worker washes away dirt to expose the underlying rock containing a Geophysical Anomaly on the River Valley Project | Image via New Age Metals)

(A worker washes away dirt to expose the underlying rock containing a Geophysical Anomaly on the River Valley Project | Image via New Age Metals)

Stockhouse readers may be familiar with New Age Metals from an

October feature that highlighted the Company’s unique position in PGMs and another “opposing” metal, lithium. While the automobile industry requires palladium for gasoline-powered vehicles, the rising demand for electric vehicles relies heavily on lithium.

In Manitoba, New Age Metals has 100% ownership of seven lithium and rare element projects, and last month the Company announced it

received a drill permit from the provincial government for its sizeable Lithium Two deposit which has a historical non-NI 43-101 compliant resource of 544,460 tonnes grading 1.4% Li2O.

Stockhouse Editorial recently had the opportunity to catch up with Harry Barr, the Chairman and CEO of New Age Metals. We discussed the strong market moves for palladium, the Company’s recent impressive results, and what’s on the docket for New Age Metals in 2020.

Thanks for joining us, Harry. When we last spoke, palladium prices were hovering around a record high of $1,700/oz, and now they’re above $1,800/oz. What’s driving the metal upwards?

There has been a repeating supply deficit of palladium annually since 2012, and there is widespread speculation that the deficit this year will be over a million ounces as it was in 2016 and 2018. Demand for auto-catalysts, which palladium is a key component of, is what’s driving prices as emissions standards tighten and increasing legislation worldwide is also increasing the palladium loading for the catalysts.

T

he Company’s flagship project, the River Valley PGM Project near Sudbury, Ontario, has already proven itself to the point of having its first Preliminary Economic Assessment completed over the summer. What’s next for River Valley?

As much as River Valley is definitely a development stage project, due to new technologies and/or methodologies related to geoscience and also our new discovery on the property which we call The Pine Zone, River Valley is still very much an advanced stage exploration project too.

The 2017/2018 IP geophysical program has outlined a number of new targets outside the Pine zone that need to be drilled out. We believe that the entire project needs to be covered by similar geophysical programs and the outcome may well be numerous new drill targets throughout the 16 km of mineralization. We hope to capitalize on our proven exploration model which involves conducting IP chargeability surveys and successive diamond drilling to further delineate mineralization on the project.

(Map of the River Valley PGM Project, Ontario | Image via New Age Metals)

There seems to be a lot of market focus on palladium at the moment, with the recent acquisitions of Stillwater Mining and North American Palladium being clear examples. What do these acquisitions mean for the market?

The global supply of PGM’s is relatively small when compared to gold or silver, and the principal supply markets for these metals have always been Russia and South Africa. The recent acquisitions of Stillwater Mining and North American Palladium showcases the lack of supply globally, as well as the long-term belief in Platinum Group Metals from these international producers. This, in turn, puts a spotlight on the handful of existing non-producing projects like River Valley near Sudbury. Automobile manufacturers in North America have expressed their interest in having local sources of PGM’s in the event that primary producers such as Russia and South Africa continue to experience disruptions.

Moving onto your sizeable lithium division, New Age Metals recently announced that your Lithium Two project in Manitoba received its drill permit. Can you elaborate on what this means for the Company?

Although lithium prices are currently depressed partially due to a lack of battery production capacity, analysts are predicting a recovery of prices in just the next few years as battery producers ramp up their production ability. NAM was fortunate to hire a very experienced lithium and rare earths geologist in Manitoba and with his help we began to acquire and stake a group of projects in close proximity to the Tanco mine. Since 1969, Tanco has been one of North America’s only producers of cesium, tantalum and at times, lithium.

To that end the company spent two summers undergoing exploration, and from those efforts we identified three of the projects as drill ready. The company recently announced a drill permit for its Lithium Two Project and is currently working through the process to acquire a second permit for the Lithium One Project. With the projects surrounding an operating mine site and having excellent infrastructure, management’s approach to funding the exploration and development is to seek a dedicated and capable option joint venture partner to allow the company to focus on its flagship River Valley PGM Project and to reduce corporate dilution and risk.

(Map of the River Valley PGM Project, Ontario | Image via New Age Metals)

There seems to be a lot of market focus on palladium at the moment, with the recent acquisitions of Stillwater Mining and North American Palladium being clear examples. What do these acquisitions mean for the market?

The global supply of PGM’s is relatively small when compared to gold or silver, and the principal supply markets for these metals have always been Russia and South Africa. The recent acquisitions of Stillwater Mining and North American Palladium showcases the lack of supply globally, as well as the long-term belief in Platinum Group Metals from these international producers. This, in turn, puts a spotlight on the handful of existing non-producing projects like River Valley near Sudbury. Automobile manufacturers in North America have expressed their interest in having local sources of PGM’s in the event that primary producers such as Russia and South Africa continue to experience disruptions.

Moving onto your sizeable lithium division, New Age Metals recently announced that your Lithium Two project in Manitoba received its drill permit. Can you elaborate on what this means for the Company?

Although lithium prices are currently depressed partially due to a lack of battery production capacity, analysts are predicting a recovery of prices in just the next few years as battery producers ramp up their production ability. NAM was fortunate to hire a very experienced lithium and rare earths geologist in Manitoba and with his help we began to acquire and stake a group of projects in close proximity to the Tanco mine. Since 1969, Tanco has been one of North America’s only producers of cesium, tantalum and at times, lithium.

To that end the company spent two summers undergoing exploration, and from those efforts we identified three of the projects as drill ready. The company recently announced a drill permit for its Lithium Two Project and is currently working through the process to acquire a second permit for the Lithium One Project. With the projects surrounding an operating mine site and having excellent infrastructure, management’s approach to funding the exploration and development is to seek a dedicated and capable option joint venture partner to allow the company to focus on its flagship River Valley PGM Project and to reduce corporate dilution and risk.

(Spodumene blades exposed at surface on the Silverleaf Pegmatite - Lithium One Project | Image via New Age Metals)

You’ve spoken in the past about New Age Metals’ unique position in PGMs and lithium, two essentially opposing metals in the automotive industry. What is your current outlook on the markets for these metals?

The outlook is still the same as it was a few months ago when we last talked. On one hand you’re looking at increasing demand for lithium as more automakers and governments look to grow the number of hybrid electric and fully electric vehicles in the market and on the road. On the other hand, even if the number of new gasoline powered vehicles being purchased starts to decline, rising emission standards globally are causing the demand for palladium to increase through higher loadings of the metals in catalytic converters.

With palladium’s price rise specifically, we’ve recently started hearing some investors expect a ramp up in palladium production, while others expect automakers to consider switching to the more-affordable platinum. What’s your outlook on the metal?

Well, palladium is most often mined as a by-product and there is only a handful of primary palladium mines which limits most producers’ ability to make meaningful increases in production. In terms of substitution, even the World Platinum Investment Council (which is very pro-platinum), stated in their most recent quarterly report that any potential for substitution with platinum is limited in scope mainly to automobiles with larger V6 and V8 engines or diesel engines. The fact is, the platinum market is even smaller than that of palladium meaning there is not much sense in substituting one metal for the other, just a rebalancing of the PGM content.

(Spodumene blades exposed at surface on the Silverleaf Pegmatite - Lithium One Project | Image via New Age Metals)

You’ve spoken in the past about New Age Metals’ unique position in PGMs and lithium, two essentially opposing metals in the automotive industry. What is your current outlook on the markets for these metals?

The outlook is still the same as it was a few months ago when we last talked. On one hand you’re looking at increasing demand for lithium as more automakers and governments look to grow the number of hybrid electric and fully electric vehicles in the market and on the road. On the other hand, even if the number of new gasoline powered vehicles being purchased starts to decline, rising emission standards globally are causing the demand for palladium to increase through higher loadings of the metals in catalytic converters.

With palladium’s price rise specifically, we’ve recently started hearing some investors expect a ramp up in palladium production, while others expect automakers to consider switching to the more-affordable platinum. What’s your outlook on the metal?

Well, palladium is most often mined as a by-product and there is only a handful of primary palladium mines which limits most producers’ ability to make meaningful increases in production. In terms of substitution, even the World Platinum Investment Council (which is very pro-platinum), stated in their most recent quarterly report that any potential for substitution with platinum is limited in scope mainly to automobiles with larger V6 and V8 engines or diesel engines. The fact is, the platinum market is even smaller than that of palladium meaning there is not much sense in substituting one metal for the other, just a rebalancing of the PGM content.

(A diagram of a common catalytic converter or 'auto-catalyst' | Image via New Age Metals)

New Age Metals is squarely in the palladium market with two PGM properties, and you’ve recently announced that the summer exploration program at the Genesis Project in Alaska has doubled the size of prospective mineralization. Could you elaborate on the findings?

The summer exploration program conducted at the Genesis Project was a success. Two independent evaluations were completed on the project that focused on mapping new targets to aid district-scale PGM-Cu-Ni sulfide exploration efforts. Our Alaskan geological consultant, Avalon Development, reviewed the results of these programs and concluded that the addition of various high priority exploration targets nearly doubles the size of mineralization at Genesis. Following these efforts, the next steps will include ground truth sampling and then the first ever drilling on the project, which will be a milestone for Genesis that we hope to complete with a partner who realizes the potential of this superbly located, road-accessible and highly prospective project.

(A diagram of a common catalytic converter or 'auto-catalyst' | Image via New Age Metals)

New Age Metals is squarely in the palladium market with two PGM properties, and you’ve recently announced that the summer exploration program at the Genesis Project in Alaska has doubled the size of prospective mineralization. Could you elaborate on the findings?

The summer exploration program conducted at the Genesis Project was a success. Two independent evaluations were completed on the project that focused on mapping new targets to aid district-scale PGM-Cu-Ni sulfide exploration efforts. Our Alaskan geological consultant, Avalon Development, reviewed the results of these programs and concluded that the addition of various high priority exploration targets nearly doubles the size of mineralization at Genesis. Following these efforts, the next steps will include ground truth sampling and then the first ever drilling on the project, which will be a milestone for Genesis that we hope to complete with a partner who realizes the potential of this superbly located, road-accessible and highly prospective project.

(Map of the Genesis Project, Alaska | Image via New Age Metals)

Looking now at the future of New Age Metals, what’s the Company’s focus for the rest of 2019 and the start of 2020?

With the recent completion of the River Valley Projects PEA, and its corresponding recommendations, the company is currently concluding an exploration and development plan for the Project in 2020. The main focus of the plan is to first improve the geological definition of higher-grade domains at River Valley and then to exploit the additional mineralized zone potential in the northern area of the project.

We have identified various IP chargeability targets in our last rounds of geophysics that need to be drilled out. We intend to work from North to South, starting in the new footwall discovery Pine Zone, where we hope to add to our robust mineral resource at River Valley to unlock the project’s true potential. We know that high grade PGM mineralization exists close to surface here and we plan to continue to delineate the limits of the Pine Zone and continue developing the northern area of the project.

Further to drilling in the northern area at River Valley, we intend to conduct advanced metallurgical testing with an objective of improving recoveries and concentrate grades. Latter phases of the River Valley work plan will include additional drilling to advance resource classification, and environmental baseline work in preparation for a future Pre-Feasibility Study. In Alaska, we plan to secure a partner and initiate a drill program on the Genesis Project.

In our Lithium Division in Manitoba, we plan to acquire the second drill permit for the Lithium One Project and are currently seeking joint venture partners to help develop our projects. The provincial government in Manitoba recently announced they have developed a Manitoba Mineral Development Fund of C$20 Million. This is an excellent initiative for the province of Manitoba and we intend to work with our First Nations partners to make an application to the fund in 2020. Our projects offer an excellent opportunity for community partnerships to assist in the development of Manitoba as a new North American battery metal frontier.

And as Chairman and CEO, what is your long-term vision for where New Age Metals is headed?

Platinum Group Metal deposits are rare, and earlier in this article we pointed out the fact that the only two producing assets in North America have recently been purchased by South African companies. Although PGM companies are not as clearly understood as gold and silver companies, the record price of palladium is attracting a new group of investors and major miners.

We anticipate sometime in the near future that the size of our River Valley Project (along with its tremendous exploration upside) will be noticed, and a significant partner will come forward to help us develop the project. The large-scale project is located less than 100km from Canada’s largest metallurgical complex in Sudbury, Ontario and the smelters there have significant capacity for new material which is another key aspect of the project.

(Map of the Genesis Project, Alaska | Image via New Age Metals)

Looking now at the future of New Age Metals, what’s the Company’s focus for the rest of 2019 and the start of 2020?

With the recent completion of the River Valley Projects PEA, and its corresponding recommendations, the company is currently concluding an exploration and development plan for the Project in 2020. The main focus of the plan is to first improve the geological definition of higher-grade domains at River Valley and then to exploit the additional mineralized zone potential in the northern area of the project.

We have identified various IP chargeability targets in our last rounds of geophysics that need to be drilled out. We intend to work from North to South, starting in the new footwall discovery Pine Zone, where we hope to add to our robust mineral resource at River Valley to unlock the project’s true potential. We know that high grade PGM mineralization exists close to surface here and we plan to continue to delineate the limits of the Pine Zone and continue developing the northern area of the project.

Further to drilling in the northern area at River Valley, we intend to conduct advanced metallurgical testing with an objective of improving recoveries and concentrate grades. Latter phases of the River Valley work plan will include additional drilling to advance resource classification, and environmental baseline work in preparation for a future Pre-Feasibility Study. In Alaska, we plan to secure a partner and initiate a drill program on the Genesis Project.

In our Lithium Division in Manitoba, we plan to acquire the second drill permit for the Lithium One Project and are currently seeking joint venture partners to help develop our projects. The provincial government in Manitoba recently announced they have developed a Manitoba Mineral Development Fund of C$20 Million. This is an excellent initiative for the province of Manitoba and we intend to work with our First Nations partners to make an application to the fund in 2020. Our projects offer an excellent opportunity for community partnerships to assist in the development of Manitoba as a new North American battery metal frontier.

And as Chairman and CEO, what is your long-term vision for where New Age Metals is headed?

Platinum Group Metal deposits are rare, and earlier in this article we pointed out the fact that the only two producing assets in North America have recently been purchased by South African companies. Although PGM companies are not as clearly understood as gold and silver companies, the record price of palladium is attracting a new group of investors and major miners.

We anticipate sometime in the near future that the size of our River Valley Project (along with its tremendous exploration upside) will be noticed, and a significant partner will come forward to help us develop the project. The large-scale project is located less than 100km from Canada’s largest metallurgical complex in Sudbury, Ontario and the smelters there have significant capacity for new material which is another key aspect of the project.

(Harry Barr, Chairman and CEO of New Age Metals | Image via New Age Metals)

In the meantime, we will also continue to seek out partnerships for our Alaskan Genesis PGM Project and our Manitoba Lithium Division.

In 2018, the USGS published a list of 35 critical minerals and both Platinum Group Metals and lithium were on this short list. Therefore, we are confident that our projects have a role to play as society moves forward with the objective of being “green.” New Age Metals intends to deliver value to our shareholders by employing our project generator business model and collaborating with partners who share the same objective of advancing our strategic mineral holdings.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.

(Harry Barr, Chairman and CEO of New Age Metals | Image via New Age Metals)

In the meantime, we will also continue to seek out partnerships for our Alaskan Genesis PGM Project and our Manitoba Lithium Division.

In 2018, the USGS published a list of 35 critical minerals and both Platinum Group Metals and lithium were on this short list. Therefore, we are confident that our projects have a role to play as society moves forward with the objective of being “green.” New Age Metals intends to deliver value to our shareholders by employing our project generator business model and collaborating with partners who share the same objective of advancing our strategic mineral holdings.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.