(Image via Delta 9 Cannabis)

(Image via Delta 9 Cannabis)

If you ask many cannabis operators how to achieve success in today’s market, you’d find it hard to get a confident reply.

Yet

Delta 9 Cannabis Inc.(

TSX:DN, OTC:VRNDF, Forum) has been one of the bright success stories in Canadian cannabis that would be able to articulate a solid answer.

The Manitoba-based cannabis operator has been quickly growing its footprint in Western Canada and managing to turn a sizeable profit at the same time. On Nov. 13 the Company

released its Q3 fiscal results and the industry insiders were impressed to see

432% growth in operating revenues to $6.7 million for the quarter.

Stockhouse readers know that the

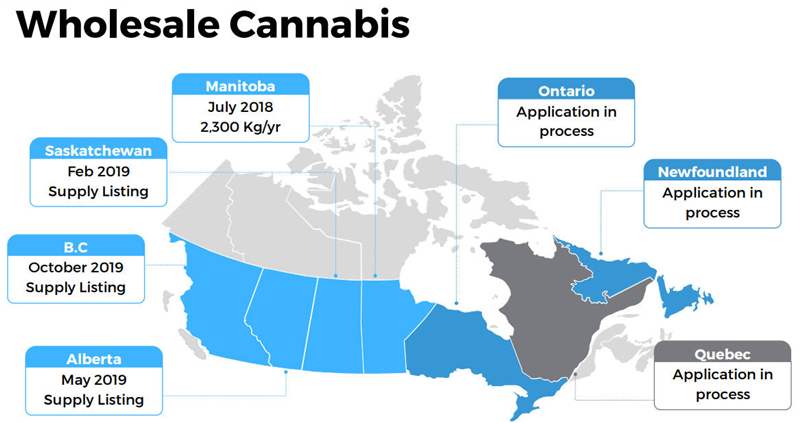

vertically integrated company achieved this success through strong growth in its wholesale, retail, and B2B revenue streams. And it looks like that growth isn’t stopping any time soon.

On Dec. 2, Delta 9 announced it had

received Health Canada approval to increase production capacity by 2,975 kg/year at its Delta Facility in Winnipeg, a 56% increase. Part of the Company’s Phase II expansion of the facility, the approval will see the installation of 95 Grow Pods, Delta 9’s proprietary modular containers.

And the Company is continuing to pursue retail expansion in Alberta as well. On Nov. 21, Delta 9 announced that it

entered into a definitive agreement to acquire two retail cannabis stores. Once the transaction is completed, the Company will have six stores across Western Canada and is likely looking to add more.

Stockhouse Editorial recently spoke with Delta 9’s CEO John Arbuthnot on the Company’s success. We also asked about Delta 9’s continued expansion and where the Company is heading next.

Thanks for taking the time to speak with us John. Lately is seems like Delta 9 is able to find success where others in cannabis struggle. How do you do it?

I think a big part of the success for us has been our diversified revenue strategy. We have 3 main segments to our business with wholesale, retail, and B2B revenue streams. As we have seen some producers struggle to ramp sales through the mid part of this year, we have seen our retail unit post very strong performance. Revenues from the retail unit alone in Q3, 2019 were $4.35 Million up 24% from the previous quarter. Moving forward I think this diversified strategy provides our investors with unique exposure to several verticals in the Canadian cannabis space.

One of the Company’s success points has been in wholesale cannabis production and you’ve just secured Health Canada approval for 95 new Grow Pods at the Delta Facility in Winnipeg. What can investors expect from the additional capacity?

On the production and wholesale side of our business the first goal for us this year was to scale production and drive down our per unit production costs. We anticipate the cultivation side of the industry will be very competitive over the next few years so we see achieving production costs per gram of around $1.00 as essential to become competitive. In our last two quarters we have seen our costs come in around this area so I think we have seen great success on this key milestone and we will be well positioned to compete in the wholesale side of the industry. The approval of the additional 95 Grow Pods will allow us to continue to scale our production and wholesale revenues into 2020.

The additional pods are part of your Phase II expansion of the Delta Facility. Can you update us on the expansion progress and its recent changes?

As a part of our news release on the approval for the 95 Grow Pods we have updated investors on the next section of the Phase II development. The next stage of development will include an additional 129 Grow Pods which will increase our total number of Grow Pods under license to 420. Overall the Company is taking a more conservative approach to capital deployment in light of the current capital markets environment. Our goal is to ensure that our current licensed production assets are operating at design capacity and we achieve efficient sell through rates while continuing with our organic expansion strategy.

(Image via Delta 9 Cannabis)

Your current strategy seems to be one of conservative and calculated growth. Would that be a fair assessment?

Yes, I think that is a fair assessment. We have always believed that in building a business the growth trajectory and capital deployment needs to be right sized to the financial results that the company is producing. We have seen significant revenue growth over the past few quarters and are trending towards positive Adjusted EBITDA, these are all positive metrics for us which show that our business plan is based on solid fundamentals.

That “calculated” growth is continues on the retail front, where Delta 9 is in the process of acquiring two retail stores in Alberta. How will these stores contribute to your footprint?

We are currently operating 4 cannabis stores in the province of Manitoba. The planned acquisition of 2 retail stores in Alberta will be our first step outside of our home province. With the success we have seen in our retail unit so far this year I think we are very bullish on growth in retail. Our plan is to rollout a chain of Delta 9 branded retail stores across Western Canada over the next few years.

You’ve also spoken about expanding your reach into Western Canada even further. Where is the Company currently looking?

We very much like Manitoba, Saskatchewan, and Alberta, as markets which allow for vertically integrated retail. The prairie markets have been very proactive in rolling out larger numbers of retail stores per capita and being very conducive to business operators. We will release formal plans and precise locations as those plans crystalize over the year. The prospect of Ontario allowing for privatized wholesale and retail in 2020 is very exciting for the industry and to us as well.

(Image via Delta 9 Cannabis)

Your current strategy seems to be one of conservative and calculated growth. Would that be a fair assessment?

Yes, I think that is a fair assessment. We have always believed that in building a business the growth trajectory and capital deployment needs to be right sized to the financial results that the company is producing. We have seen significant revenue growth over the past few quarters and are trending towards positive Adjusted EBITDA, these are all positive metrics for us which show that our business plan is based on solid fundamentals.

That “calculated” growth is continues on the retail front, where Delta 9 is in the process of acquiring two retail stores in Alberta. How will these stores contribute to your footprint?

We are currently operating 4 cannabis stores in the province of Manitoba. The planned acquisition of 2 retail stores in Alberta will be our first step outside of our home province. With the success we have seen in our retail unit so far this year I think we are very bullish on growth in retail. Our plan is to rollout a chain of Delta 9 branded retail stores across Western Canada over the next few years.

You’ve also spoken about expanding your reach into Western Canada even further. Where is the Company currently looking?

We very much like Manitoba, Saskatchewan, and Alberta, as markets which allow for vertically integrated retail. The prairie markets have been very proactive in rolling out larger numbers of retail stores per capita and being very conducive to business operators. We will release formal plans and precise locations as those plans crystalize over the year. The prospect of Ontario allowing for privatized wholesale and retail in 2020 is very exciting for the industry and to us as well.

(Image via Delta 9 Cannabis)

And unlike other operators in the industry, Delta 9 has solid business-to-business prospects through its proprietary Grow Pods. How does this revenue stream stand out in the current market?

On the B2B side I think this segment really sets us apart as a diversified opportunity. This segment and sales of the Grow Pods gives investors exposure to the more “Picks and Shovels” side of the industry. As the Canadian and international landscape continues to evolve and provide opportunities for the cannabis industry this B2B opportunity for us to provide state of the art and turn key platforms for facility design and construction is a significant asset.

Delta 9’s latest fiscal quarter was noteworthy to many investors. How do you continue with that success moving forward?

Additional production capacity coming online will translate to growth in our production and wholesale business. From these additional retail stores will help drive topline growth into 2020. And our B2B segment has a significant pipeline of projects which we are looking to complete over the coming quarters. I think we are well positioned to continue to execute over the fourth quarter of 2019 and into 2020.

And as CEO of the Company, what is your long-term vision for where Delta 9 is headed?

I see Delta 9 as becoming a meaningful player in the Canadian cannabis space over the next few years. As one of the only vertically integrated Cannabis companies I think Delta 9 is well positioned to compete, and with a track record for strong execution from management I think this is a name investors should be watching.

(Video via Delta 9 Cannabis)

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.

(Image via Delta 9 Cannabis)

And unlike other operators in the industry, Delta 9 has solid business-to-business prospects through its proprietary Grow Pods. How does this revenue stream stand out in the current market?

On the B2B side I think this segment really sets us apart as a diversified opportunity. This segment and sales of the Grow Pods gives investors exposure to the more “Picks and Shovels” side of the industry. As the Canadian and international landscape continues to evolve and provide opportunities for the cannabis industry this B2B opportunity for us to provide state of the art and turn key platforms for facility design and construction is a significant asset.

Delta 9’s latest fiscal quarter was noteworthy to many investors. How do you continue with that success moving forward?

Additional production capacity coming online will translate to growth in our production and wholesale business. From these additional retail stores will help drive topline growth into 2020. And our B2B segment has a significant pipeline of projects which we are looking to complete over the coming quarters. I think we are well positioned to continue to execute over the fourth quarter of 2019 and into 2020.

And as CEO of the Company, what is your long-term vision for where Delta 9 is headed?

I see Delta 9 as becoming a meaningful player in the Canadian cannabis space over the next few years. As one of the only vertically integrated Cannabis companies I think Delta 9 is well positioned to compete, and with a track record for strong execution from management I think this is a name investors should be watching.

(Video via Delta 9 Cannabis)

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.