Even with an ongoing global pandemic,

gold has remained hot. For enterprising investors and exploration companies, what’s the current best play?

At the start of the year, rising prices and strong, sustained fundamentals led experts to be bullish on the precious metal

well into 2020. The move at the time was to buy and grow, and many companies

looked to expand on exploration plans and acquisitions alike.

Once March and the COVID-19 coronavirus hit in earnest, the markets were shaken and forced everyone to momentarily stay on their toes. Since then, however, we’ve seen increased gold prices and rising stocks despite the setbacks, and companies looking to keep busy and plan for the hot market expected on the other side of the pandemic.

That’s why

Nexus Gold Corp. (TSX-V:NXS, OTC:NXXGF, Forum) has stayed as busy as ever during 2020. The Junior gold explorer is well known for having a strong base of projects in Western Africa and Canada, and this year it expanded on its portfolio with two new acquisitions in

Burkina Faso and

Newfoundland, respectively.

(Image via Nexus Gold)

(Image via Nexus Gold)

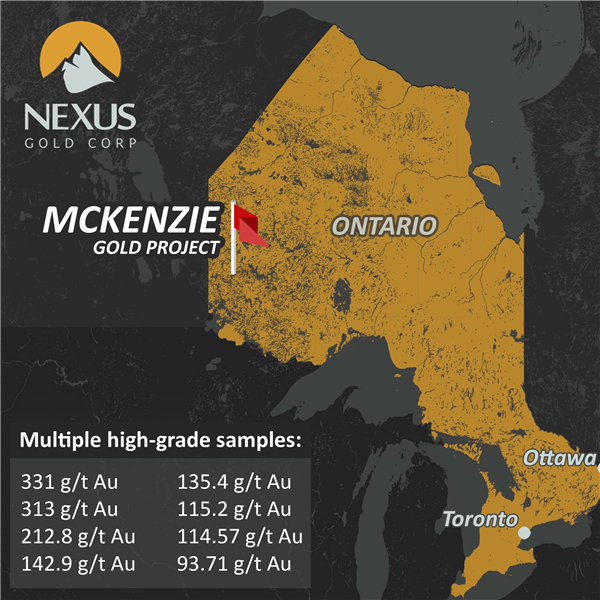

At the same time, the Company has looked to start tapping into its current promising projects, especially the McKenzie Gold Project in Red Lake, Ontario. In February, Nexus Gold announced a

minimum 1000m diamond drill program at the property.

How has Nexus Gold managed to navigate the current market? We caught up with Nexus Gold’s experienced President and CEO Alex Klenman to discuss his outlook for both the Company and the mining market in 2020.

Thank you for catching up with us Alex. Since our last conversation in December, it’s safe to say that we’ve had a crazy few months. How have things been for Nexus Gold recently?

It’s no secret the price of gold responds in a positive way to various types of chaos, and that’s certainly the case now. As a result, gold equities have become more attractive, so the last few months, although certainly tragic and disruptive, have actually been very busy for us.

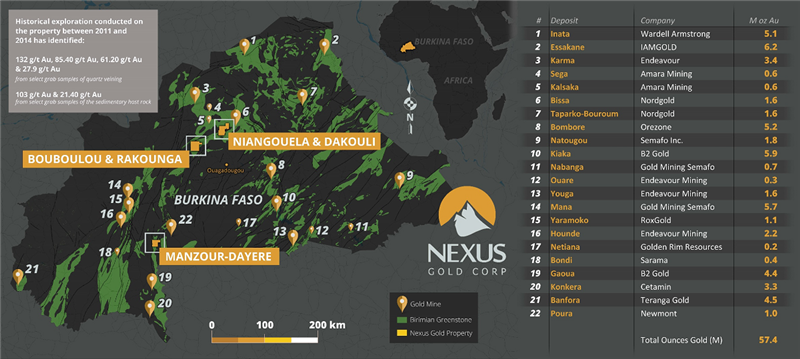

You started 2020 off on a busy note, adding to your portfolio with a new project in both West Africa and Canada. Let’s start with the Manzour-Dayere Gold Project in Burkina Faso, what can you tell us about the project?

We are always reviewing ground in Burkina, and this came up on our radar a while back. We like the area, in the southwest quadrant of the country, close to Ghana. The greenstone belts down there are very giving. The project has excellent size – 190-sq kms – and a slew of high-grade sample numbers, up to 132 g/t Au, which isn’t always that abundant in Burkina Faso. The artisanal miners in the area are going deep, down around 80 meters. That’s a good sign. So, it ticks a few boxes for us. The other thing about Manzour is, it’s 100% ours. No option payments and no terms to meet with a vendor. We now have 100% ownership of two highly prospective projects over there and I can envision us doing more of these types of acquisitions.

(Image via Nexus Gold)

Recently you also expanded on Canadian holdings with the acquisition of Dorset Gold in Newfoundland. What was attractive about the addition?

(Image via Nexus Gold)

Recently you also expanded on Canadian holdings with the acquisition of Dorset Gold in Newfoundland. What was attractive about the addition?

We have had our eye on it since last year, when we made the decision to expand into Atlantic Canada. There are several areas of interest on the property with excellent historical numbers. As it turns out, we were able to cut a subsequent earn-in deal and now have a funding partner for the project. We want to add project generation to our business model, and this is the second deal we’ve made in the last six months. If these partnerships can progress into the back half of the terms Nexus will begin to see significant income. As a junior explorer, revenue is almost impossible to generate. How do we obtain cash flow, even in small amounts? We bring on partners. And you can do that with a portfolio of projects.

Of course, Nexus Gold also announced a drilling program at the McKenzie Gold Project in Red Lake, Ontario. Can you elaborate on the plan?

You bet. We really like McKenzie. Great area, huge upside. Historical sampling – in the 2000s and more recently – has yielded bonanza grade gold up to 331 g/t. Even the limited drilling on the property hit some double-digit numbers. It’s in the right place for exploration drilling and it has the requisite criteria for targeting. We’re starting with a 1000 meters in the area where in the past a few drill holes teased with small high-grade intercepts. We plan on systematically working our way through the various zones where sample grades have been robust. We plan to conduct several programs at McKenzie this year. A good drill hole in Red Lake can change the trajectory of the company in a hurry, and that’s what exploration is all about.

Looking across Canada, Nexus Gold has a wide variety of impressive holdings in different provinces. What are the benefits of having such a vast Canada-wide portfolio?

Canada is a great place to work, it’s home, it’s eligible for flow through funding, and it provides a great hedge with our other interests. Expanding into Canada has balanced our overall risk factor. We are first and foremost a West African explorer. We control a decidedly large land package in Burkina Faso for a market cap of our current size. But Burkina can turn off investors whose risk tolerance may preclude places like West Africa. We love it there as we can operate next to dozens of larger companies and many majors, and you can still find ground with million-ounce potential. Canada gives us a built-in safety valve. We’re no longer 100% exposed to potential geopolitical issues, while adding a whole other layer of upside to the company.

And we’ve only touched on a handful of the Company’s ten exploration projects. What other updates can you give us about Nexus Gold’s Canada and West Africa projects?

We’re going to get some work done this summer at our New Pilot project here in BC. In addition, we’re still intent on conducting some meaningful drilling in Burkina, particularly at our Bouboulou project, which is inching closer to a maiden resource, and our Dakouli II project, which we feel has a ton of value a few drill holes can unlock. We will announce our Burkina plans soon as internal discussions are and have been underway in the past few weeks.

(Image via Nexus Gold)

In March the markets and the world were thrown into disarray with the ongoing pandemic, how has Nexus Gold been affected?

(Image via Nexus Gold)

In March the markets and the world were thrown into disarray with the ongoing pandemic, how has Nexus Gold been affected?

The permitting process for Red Lake was delayed, for sure. But the folks in Ontario were great and the delay wasn’t too overwhelming. We were also in discussions with others on how we could push our Burkina initiatives forward in a meaningful way right before the pandemic took hold. Just recently those talks began again, so we’re optimistic we can get where want to go. Other than not being in the office, work has been ongoing and at times, very busy.

Did your strategy have to shift in light of everything that’s been happening? What is next on the Company’s roadmap?

No, we haven’t changed plans. We want to drill a lot now. We’re a couple dozen or so holes away from establishing a resource at Bouboulou, it’s something we’ve wanted to do for some time, and we feel now is the optimal time to pursue that. Projects like McKenzie in Red Lake and Dakouli in Burkina offer exciting discovery upside, so we’re intent on drilling as the main focus of 2020.

In the markets, we’ve seen gold and other metal prices fall at first and then quickly recover and surge higher. What’s your outlook for the mining market?

Unquestionably this is now the strongest gold market we’ve seen in a long time. Although some think a correction is imminent, others like the Bank of America in the US have called for massive increases in the gold price, as much as $3000 an ounce in some cases. Even if we do correct in the short term, the macro economic picture puts gold in a good position to potentially see exponential growth in the latter of 2020 and into 2021. Gold and subsequently gold equities are a good place to be at the moment.

And as President and CEO, what is your vision for where Nexus Gold is heading this year and beyond?

We’re going to get the work done, and we’re going to continue to tell our story and build our audience. A discovery hole is always in the picture, and we want ounces, either by drilling them out at a place like Bouboulou or acquiring them via a larger deal. Either way we are intent on growth, and we’re going to give our shareholders a shot at a good return 2020 and beyond.

Thank you taking the time to speak with us Alex and we hope everyone stays safe and healthy during this time. Is there anything you’d like to add before we end?

Don’t underestimate our resolve. We’re here, we’re focused, we go to battle every day, we have some great backers, and our team is solid. I’m excited about the future and think there are some very good days ahead.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.