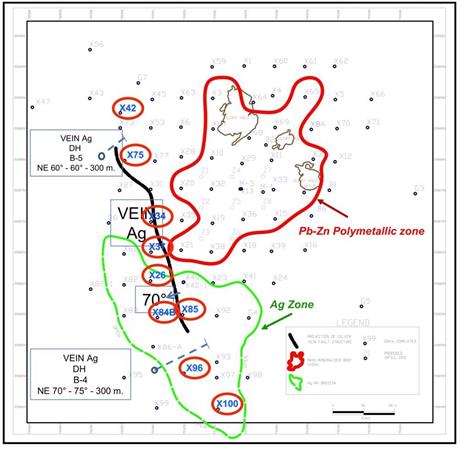

(Location of the drill holes in the High-Grade Silver zone to the SW of Bilbao. Image via Xtierra Inc. Click to enlarge.)

Investors have enjoyed a resurgence of mining stocks in 2020 primarily due to the rise of gold and silver prices but for those looking to invest into precious metals with a lower risk strategy, there is a unique avenue one can take to seize a decisive advantage – Royalty investing.

Xtierra Inc. (TSX-V: XAG, OTC: XRESF, Forum) is focused on monetizing its Mexican silver assets in order to use the  proceeds to acquire a portfolio of cash flowing royalties to provide direct exposure to gold, silver and copper revenues. Given the positive outlook on the silver price, XAG will drill 2 of its high grade silver zones on its Bilbao property in the Central Silver Belt of Mexico in the State of Zacatecas in order to maximize the value of its silver resource.

proceeds to acquire a portfolio of cash flowing royalties to provide direct exposure to gold, silver and copper revenues. Given the positive outlook on the silver price, XAG will drill 2 of its high grade silver zones on its Bilbao property in the Central Silver Belt of Mexico in the State of Zacatecas in order to maximize the value of its silver resource.

The Company holds an interest in two mineral projects and two royalties:

La Laguna is a tailings project with an estimated 12 million ounces of silver and Bilbao, a polymetallic sulfide and oxide replacement silver-lead-zinc-copper project has an estimated 8 million ounces of silver. Ideally, XAG would like to sell the projects for cash and/or shares to operators in order to convert the historical investment of over $40 million into cash flowing royalties.

In 2019, the Company bought back the 1.5% NSR on the Bilbao project and in 2020 acquired 88% of the shares of Minera Portree de Zacatecas, SA de CV which holds an asserted 2% NSR on the 6 Parroquia or Portree mining concession which are part of the Cozamin Mine expansion operated by Capstone Mining Corp., which is challenged by Capstone.

To find out more, Stockhouse Editorial sat down with Xtierra Inc. Chief Executive Officer Tim Gallagher ….

Thank you for joining us. Xtierra’s goal is to increase share value by accumulating a diversified portfolio of cash flowing royalties in order to pay increasing dividends and for those new to the Company’s story, can you elaborate on this a bit?

We learned from our prior success with Metalla Royalty and the retelling of the Franco Nevada story, that investors can make extraordinary returns through the conversion of a mining company into the genius of the royalty model via the acquisition of even a single cash flowing royalty.

What are some advantages for mining royalties compared to direct equity investment that investors should be aware of?

Investing in royalties in general is a lower risk, lower overhead proposition. Its more akin to the asset management business taking a percentage of the assets and creating a portfolio rather than the risks of being in the actual underlying business. So taking a percentage of the revenues, especially when commodity prices (gold, silver, copper) are rising provides direct access to an increasing cash flow. Direct equity investment is riskier because the investor is exposed to the daily uncertainty of mining operations, capex, employees and the volatility of profits, perhaps only related to a single asset in a specific location.

Some compare royalty investing to investing into real estate, what are your thoughts?

There is definitely a similarity to a REIT or collecting ‘rent’ on an investment backed by the security of land and buildings as well as the premium valuation derived by lower interest, discount or cap rates.

Is it a challenge to stand apart from the pack of gold and silver operators out there? How do you do it?

Firstly, we are not trying to be in the mining business or operations. We want the upside and premium accorded the precious metals outlook in a zero interest environment without the risk and this is best achieved through this hybrid financial investment product - “

a cash flowing royalties portfolio”.

Looking at your Bilbao silver property, a small drill campaign of five holes for a total of 1,500 meters into two previously identified areas of high-grade silver mineralization is underway … can you offer an update?

We expect to begin drilling next week through November and December with drill results expected in January. We are excited about this campaign as previous drilling delivered much higher silver grades at 10-15 ounces per ton vs 2 ounces in the main deposit with the implication of doubling our silver resource.

Can you give us a rundown on the Central Silver Belt, other players in the area, historical production, etc.

Mexico has been the world’s largest silver producer for 500 years and the state that produces the most is Zacatecas. The country has produced billions of ounces of silver and currently produces over 200 million ounces per year. The top Mexican silver companies include Fresnillo, Pan American, First Majestic, Coeur, Fortuna, Endeavour, etc.

How does Xtierra fair when compared to its peers in the silver metal sector in terms of share price and market cap?

XAG is roughly a $20 million market cap, trading at about $1 per ounce of silver equivalent resource, so it has a lot of upside compared with its peers based on its modest valuation, upcoming drill results and most importantly its emerging royalty strategy.

The Company is always pursuing new opportunities including identifying and evaluating new potential royalty acquisitions, any news on this front to share?

In addition to its 2 existing Mexican royalties with their potential to generate near term cash flow, the company has identified a number royalty deals in Canada, the United States, Chile, Colombia, Peru, etc. If its possible to sell the Bilbao asset for cash, then the proceeds will be used to acquire these royalties. Otherwise, XAG will judiciously raise the funds as required.

Can you tell us a bit about yourself and highlight the experience of Xtierra’s leadership team?

I am a former banker (TD, UBS) and broker (LOM) who has focused on active investing and taking companies public since 1997. In 2016, I converted Excalibur into Metalla Royalty and in 2018, I started Music Royalties Inc. so I am singularly focused on the monetization of long term cash flows into monthly dividends for not only the income but the extraordinary capital gains that can be generated in a perpetual roll-up. We have tremendous expertise in our shareholders who are seasoned investors who provide ongoing support, capital and ideas.

Finally, what is your take on the gold and silver markets right now and where do you see both in the coming years?

Clearly, both the gold and silver prices have had a spectacular run over the last year and are in a consolidation phase pending the results of the US election. With the US and Canadian Central Banks keeping a lid on rates until 2023 and the explosion in fiscal stimulus, government debts have soared, so I expect gold prices to get to at least US$2,500 per ounce and silver to US$50 per ounce this cycle. They could certainly overshoot these targets for a short time, but I think their long run appreciation really just keeps pace with inflation and other assets.

Thank you again for joining us, anything further to add?

I want to emphasize that the simple royalty model evidenced by the peer group values $1 million paid out in the form of dividends at $100 million market cap for a 1% dividend rate, which is tantamount to the yield on a perpetual bond. So if one can buy that cash flow for 5-10x, then that is the formula for unlimited upside for investors in a perpetual roll-up or acquisition strategy. Franco-Nevada is the brand that proved this thesis in its 35 year ascent from $2 million to $34 billion market cap.

To find out more about the Company, visit

xtierra.ca.

FULL DISCLOSURE: Xtierra Inc. is a client of Stockhouse Publishing.