With the gold price hovering in and around the USD$2000 mark for the past few months, gold exploration companies are beginning to ramp up operations. Not every company can boast about having historically-producing properties in a mining-friendly jurisdiction, an experienced management team, big-time strategic investors, and the technological expertise to get results. But one junior explorer boasts all five.

QMX Gold Corp. (

TSX-V.QMX,

OTC: QMXGF,

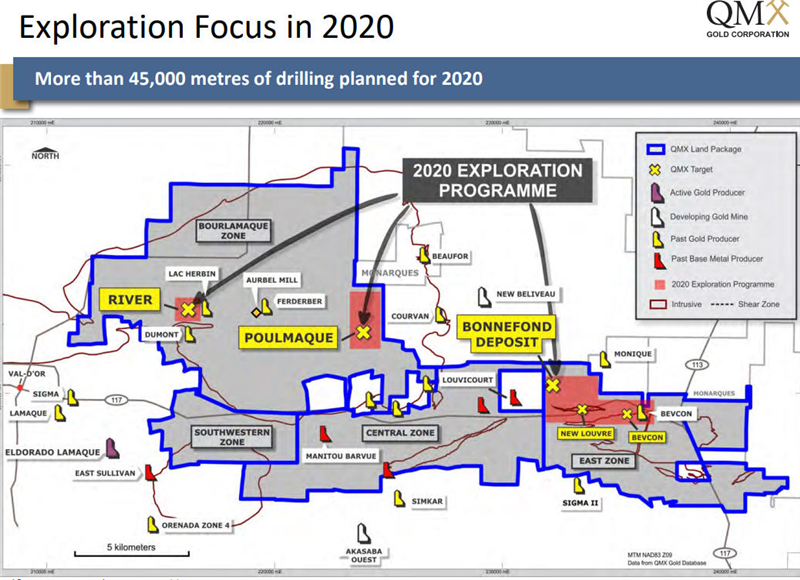

Forum) is a well-funded natural resource company engaged in the acquisition and exploration of mineral properties located in the Abitibi Greenstone Belt mining region of Québec. And while it is one of Canada’s most historically prolific mining jurisdictions, QMX Gold’s extensive land package remains largely underexplored.

Building on a broad exploration database, the Company is applying new, state-of-the-art geological models and systematically exploring new targets. In addition to controlling one of the most expansive land packages in the region, QMX Gold also owns the fully permitted Aurbel milling and tailings facility.

In July 2019, QMX Gold announced a NI 43-101-compliant resource estimate for its Bonnefond South property located on the eastern portion of QMX Gold’s land package, about 25 km east of Val d’Or and less than 25 km from the Aurbel mill. The property hosts

Indicated Resource of 4.75 million tonnes at 1.69 g/t gold or 258,700 oz. Inferred Resource of 2.4 million tonnes at 1.87 g/t gold or 145,100 oz.

Stockhouse Editorial recently caught up with QMX Gold’s President, Chief Executive Officer & Director, Brad Humphrey, to update us on the Company’s latest drill programs, its impressive market cap increase in 2020 and to discuss the latest Company happenings with our investor audience.

SH: So, Brad, can we start off with a little history of QMX Gold Corp?

BH: Sure, thanks. I joined QMX Gold in mid-2016, which was when the company was refocusing as an exploration company. Historically, QMX, and its predecessor company Alexis Minerals, was focused on production in Val d’Or and a development project in Manitoba. The company ran into financial challenges, which left it with around $20 million in debt, a $3 million market cap and very little cash on hand in mid-2016. But it controlled a spectacular, relatively underexplored, property in the heart of the Val d’Or mining camp.

Given the potential of QMX’s underlying asset base, there was a lot of support from all stakeholders to restructure and refocus the company. By 2017, QMX’s exploration team had identified numerous high-quality targets and drilling began. Drilling on Bonnefond, on the eastern side of the property, commenced in mid 2017 and by mid 2019 had already produced its maiden resource estimate.

At the same time, impressive results were returned from targets all across the nearly 200km² property, including the River Target on the western side and around the past producing Bevcon Mine on the eastern side.

Since 2019, the team in Val d’Or built a better understanding of the higher-grade shear system around the main Bonnefond intrusive, of which a portion will be included in the upcoming interim resource update. And this past summer, drilling successfully showed the depth potential of Bonnefond with a spectacular over a kilometre-long hole.

Currently, we are completing a 45,000m drill program in the Val d’Or camp and planning a 35,000m program for the winter.

So, it has been an exciting four years with the QMX exploration team continuing to build on a lot of success over that time.

SH: Can you tell us a bit about the Val d’Or Mining Camp jurisdiction?

BH: Val d’Or is located in Quebec on the Abitibi Greenstone Belt, one of the best mining jurisdictions in the world. Val d’Or has a long history of gold and base metals production and continues to report new discoveries. Val d’Or itself has all of the infrastructure, consultants and services required for exploration, development and production. It is a great place to be.

SH: The company’s been very busy recently with four drill rigs spinning on three different projects located on your Val d’Or Camp property. Can you walk us through the projects to date?

BH: Yes, we have had a very busy and productive year. QMX is fortunate to have multiple targets in our pipeline. We start with reconnaissance drilling, which moves to exploration programs and then if successful, resource expansion. Given the size of the property and the number of targets, we had to make sure we took a very systematic and methodical approach.

This approach put us in a strong position to have 4 drill rigs completing 45,000m in 2020. First on our most advanced project, Bonnefond, which is in the resource expansion phase, we completed infill drilling and expansion drilling in all directions including at depth. A portion of the 2020 program will be incorporated in our upcoming interim resource estimate update. Bonnefond continues to impress and grow. Currently we are following up on our success at depth and to the south.

On the western side of the property we have an exploration program underway on the River Target. River is located in a system that hosts three past producing gold mines and is located in close proximity to our Aurbel mill. We have been very pleased with the results to date on this high-grade target. River started as a reconnaissance program late in 2019.

And we also have an earlier stage reconnaissance program in an area we refer to as Poulmaque. This program is testing trends that Probe Metals had discovered just on the other side of our property boundary.

SH: QMX continues to expand its Bonnefond deposit in the Val d’Or East Zone. Some of the assay results look exceptional, including 73.2 metres of 6.48g/t Au, 4m of 35.56g/t Au, 2.31g/t Au over 101.0m and 44.95g/t Au over 6.5m. What’s happening here?

BH: Bonnefond has continued to impress and grow over the last couple years. Bonnefond is a mineralized intrusive with multiple enrichment zones surrounded by a mineralized shear system. Currently the resource just includes the open pit material within the intrusive, however over the past year our team in Val d’Or has expanded our understanding of the shear system to the north and south of the intrusive. We anticipate a portion of the shear system will be included in the upcoming interim resource update and expect this resource to continue to grow in all directions, including at depth, with our future drilling plans. Ultimately, we expect Bonnefond will be a combination open pit and underground operation.

We have assays pending from our campaign to the north of the deposit and are currently following up on the depth potential and completing an exploration program to the south of the deposit.

This winter we will begin to work to the east to test a number of targets along the 5 kilometre trend between Bonnefond and the past producing Bevcon mine. The eastern side of Bonnefond is easier to drill in the winter months so this will be a big focus for us. Of note, we will also be following up on an intersection we reported in mid 2019 where we cut 137.50g/t Au over 3.7 metres at Bevcon.

(Click image to enlarge)

SH: You’ve got some heavyweight mining interests tracking the project – Eldorado Gold Corp, O3 Mining, Osisko Gold, Probe Metals and Eric Sprott are all strategic investors. What should our investor audience glean from this type of participation in QMX?

BH: Yes, we have been very fortunate to have such supportive shareholders, particularly all of our neighbours in the Val d’Or area. We view this support as validation of our work to date and it supports our belief that there is considerable untapped potential across our extensive land package, which seems to be confirmed by our neighbour’s interest and their desire for us to succeed.

SH: As briefly mentioned in the intro, the Company has experienced a more-than-robust 200-plus% increase in its market cap so far in 2020. To what do you attribute this kind of investor confidence…both retail and institutional?

BH: QMX has worked extremely hard to build a pipeline of high-quality exploration targets since 2017. We have maintained our methodical and systematic approach even when the gold markets were challenging. When the overall gold markets started to see an increase in interest earlier in 2020, this approach put us in a strong position with a solid balance sheet, a growing resource and a number of very prospective targets.

I also believe the QMX team has built a strong track record over the years repeatedly reporting successful programs. Add in that our extensive land package is in one of the best mining jurisdictions in the world with possibly the lowest exploration costs, and it is easy to see why QMX would benefit early in the gold market recovery.

(Click image to enlarge)

SH: You’ve got some heavyweight mining interests tracking the project – Eldorado Gold Corp, O3 Mining, Osisko Gold, Probe Metals and Eric Sprott are all strategic investors. What should our investor audience glean from this type of participation in QMX?

BH: Yes, we have been very fortunate to have such supportive shareholders, particularly all of our neighbours in the Val d’Or area. We view this support as validation of our work to date and it supports our belief that there is considerable untapped potential across our extensive land package, which seems to be confirmed by our neighbour’s interest and their desire for us to succeed.

SH: As briefly mentioned in the intro, the Company has experienced a more-than-robust 200-plus% increase in its market cap so far in 2020. To what do you attribute this kind of investor confidence…both retail and institutional?

BH: QMX has worked extremely hard to build a pipeline of high-quality exploration targets since 2017. We have maintained our methodical and systematic approach even when the gold markets were challenging. When the overall gold markets started to see an increase in interest earlier in 2020, this approach put us in a strong position with a solid balance sheet, a growing resource and a number of very prospective targets.

I also believe the QMX team has built a strong track record over the years repeatedly reporting successful programs. Add in that our extensive land package is in one of the best mining jurisdictions in the world with possibly the lowest exploration costs, and it is easy to see why QMX would benefit early in the gold market recovery.

(Photo courtesy QMX Gold Corp.)

SH: What sets QMX apart from other junior gold mining companies in this space and what makes your business model attractive to investors?

BH: It is most definitely the large land package with a multitude of targets of which we have only really tapped into one – Bonnefond, which has a resource. Given the location and historical gold mines and showings we believe we have a higher probability of success through new discoveries and expanding known ones. The high interest and active investment of our much larger neighbours supports our belief that we are sitting on a future mine with the possibility of several open pits and underground mines across our land package.

SH: ‘Value and opportunity’ are catchphrases that really get the attention on resource sector investors, especially in gold exploration. What can you tell our audience that makes your exploration projects so intriguing and attractive?

BH: I believe it comes down to being in the right location supported by repeatedly strong results. Being in the Abitibi, with multiple current and past producers on and around our property provides comfort that we are in the right location. And the strong results we have reported consistently over the past several years across our land package provides strong supportive evidence that we are in the right area with the right team. That said, in my opinion, the most intriguing and attractive aspect is that we are just scratching the surface here, even with the success to date, we are just getting started.

SH: And lastly, Brad, if there’s anything else that I’ve overlooked that you’d like to add to the article, please feel free to elaborate.

BH: 2020 has been a great year for QMX, growing Bonnefond, our most advanced project, moving River to a full exploration target and reporting very impressive results all year from our 45,000m drilling program, all of this in spite of an early stop of our winter program due to COVID. Our 2021 winter program is expected to be 35,000m, with a particular focus on the 5km trend between Bonnefond and Bevcon on the eastern side.

Bonnefond itself is growing and we know there is strong mineralization at Bevcon from our past drilling, the trend between these two assets contains a number of very prospective targets that could also advance potentially making the East Zone much larger.

(Photo courtesy QMX Gold Corp.)

SH: What sets QMX apart from other junior gold mining companies in this space and what makes your business model attractive to investors?

BH: It is most definitely the large land package with a multitude of targets of which we have only really tapped into one – Bonnefond, which has a resource. Given the location and historical gold mines and showings we believe we have a higher probability of success through new discoveries and expanding known ones. The high interest and active investment of our much larger neighbours supports our belief that we are sitting on a future mine with the possibility of several open pits and underground mines across our land package.

SH: ‘Value and opportunity’ are catchphrases that really get the attention on resource sector investors, especially in gold exploration. What can you tell our audience that makes your exploration projects so intriguing and attractive?

BH: I believe it comes down to being in the right location supported by repeatedly strong results. Being in the Abitibi, with multiple current and past producers on and around our property provides comfort that we are in the right location. And the strong results we have reported consistently over the past several years across our land package provides strong supportive evidence that we are in the right area with the right team. That said, in my opinion, the most intriguing and attractive aspect is that we are just scratching the surface here, even with the success to date, we are just getting started.

SH: And lastly, Brad, if there’s anything else that I’ve overlooked that you’d like to add to the article, please feel free to elaborate.

BH: 2020 has been a great year for QMX, growing Bonnefond, our most advanced project, moving River to a full exploration target and reporting very impressive results all year from our 45,000m drilling program, all of this in spite of an early stop of our winter program due to COVID. Our 2021 winter program is expected to be 35,000m, with a particular focus on the 5km trend between Bonnefond and Bevcon on the eastern side.

Bonnefond itself is growing and we know there is strong mineralization at Bevcon from our past drilling, the trend between these two assets contains a number of very prospective targets that could also advance potentially making the East Zone much larger.

For more information, visit

www.qmxgold.ca

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.