In a

recent Stockhouse article, we detailed how a Vancouver-based Canadian gold and silver exploration company maximized shareholder value to the very snappy tune of a

seven-bagger return from June to early August of 2020. At press time, shares of

Blackrock Gold Corp. (BRC) (

TSX-V.BRC,

OTC: BKRRF,

Forum) were trading about $0.66, which represents among the best price yet investors can buy them for since they hit 29 metres of 965 g/t silver equivalent on their very first drillhole into their Tonopah West project, which put them on the map this summer. BRC’s value has been trading much higher in the wake of some of the best drill results in Nevada this year, CDN$12 million in private funding raised since June 1

st, including a CDN$5 million investment in the Company from

billionaire investor Eric Sprott and the mention of a potential spin-out which aims to unlock further value for investors in 2021.

The months long consolidation in gold & silver stocks may make for great bargain shopping as we enter what is historically among the strongest times of the year for precious metals. So what will 2021 bring? Well Stockhouse Editorial recently caught up with Blackrock’s President & CEO, Andrew Pollard, to update us on the Company’s latest drill results from its ongoing drill program at its Tonopah West Project, BRC’s impressive market cap increase in 2020, and what he’s looking forward to most for investors in 2021.

SH: So, Andrew, can we start off with a little background info about yourself and the history of Blackrock Gold Corp.?

AP: My involvement with Blackrock originally started as that of an investor in it. I was enamoured with the Silver Cloud project they picked up in 2018 and took a significant position in the Company at that time. Not only that, but my enthusiasm for the property caused a lot of people in my network to also take a position. Fast forward a little over a year later and the company was insolvent, trading at 3c the day before I joined and had a market cap smaller than what a one bedroom apartment goes for in Vancouver. The performance had nothing to do with the project; in fact, it hadn’t been given a chance, with next to no work done on it over that time. It was clear change was needed and I felt given the fact many others followed me into the company as investors, it was up to me to clean it up. The project was something that I knew had merit, significant exploration upside potential and I was certain the market would respond to it but it was clear the wrong team was behind it. For fifteen years prior, my only job, having founded and run a mining executive search consultancy, was ensuring that the right people were behind the right projects. This was a situation I knew I was uniquely qualified to handle and I went back to basics, reconstituting the management and board with an aim to building a team worthy of the project. It was evident right off the bat that we managed to capture lightning in a bottle in terms of the dynamic we’ve assembled and since then it’s been a wild ride, having seen the market cap grow from $1m to over $150m at one point, and our share price touch $1.61 this summer. The best part is, from my perspective our future has never been so bright. Sure, there’s been a month’s long pullback in precious metals, and we certainly haven’t escaped that, but we’ve clearly got our hands on something special here and it’s pullbacks like these where long-term friendships are often made.

SH: As briefly mentioned in the introduction, BRC recently released results of multiple high-grade gold and silver core intercepts at its Victor Target on the 100% controlled Tonopah West project located in the Walker Lane trend of Western Nevada. Can you tell us a bit about the results?

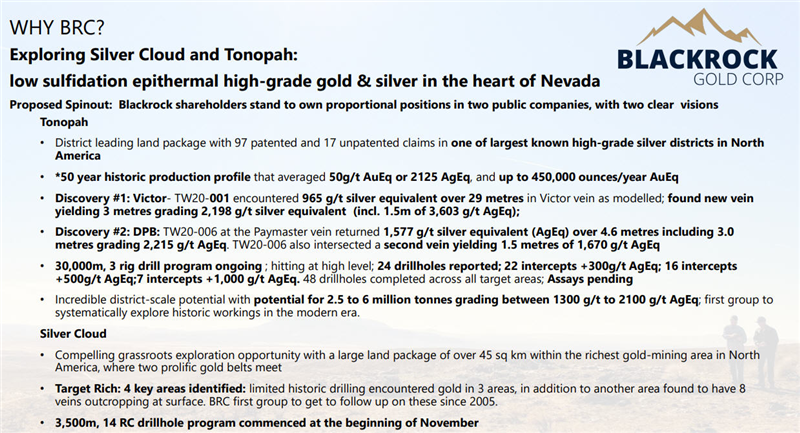

AP: Well to take a step back here for those that aren’t yet familiar, but the Tonopah silver district is one of the largest, and highest-grade historic silver districts in North America. In Nevada it’s second to only the Comstock Lode in terms of historic production, having produced 174m ounces of silver and 1.86m ounces of gold during the early 1900s. Between the years of say 1900 and 1930 it was easily one of the most significant precious metals districts in America, though the nail in the coffin for it at the time was when silver prices tanked from $1 an ounce, falling to 35c an ounce in just a few short years by the early 30s. Even in spite of the high-grade nature of the district, with historic production averaging in excess of 2 kg/t silver equivalent, the low prices caused all the large mining companies in the district to fold. Fast forward just under 100 years later, and these historic mines on our property have been hiding in plain sight, untouched, unexplored ever since. We’re the first group to target many of the historic workings on our property, due to the fact that the project is primarily comprised of patented (privately owned) mining claims, which had been held and passed down generationally. It was only recently that the bulk of these claims came available for the first time since 1930, and Ely Gold Royalties did a masterful job in consolidating what now represents the entire western half of this district. We optioned the property from them literally the day they were able to tie up the final parcel, and we haven’t looked back since.

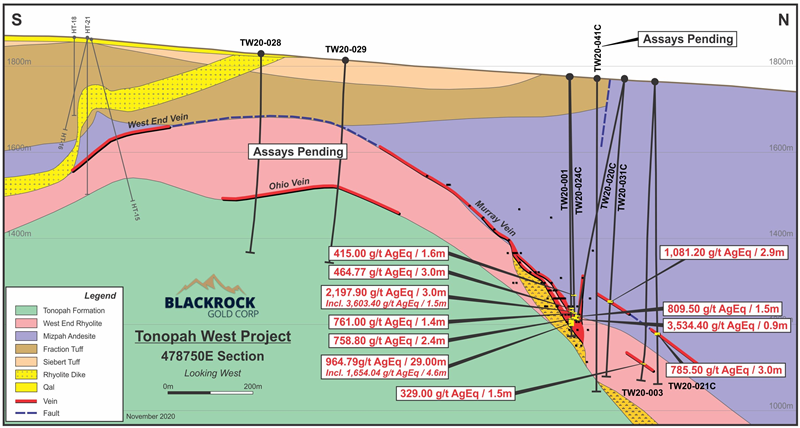

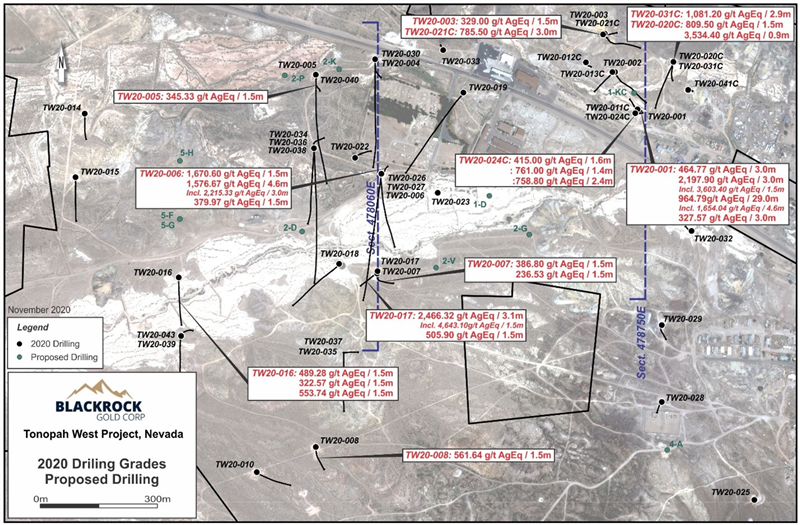

Our Victor target represents one of the largest historic mines on our property and our initial drillhole into it this summer is very much what put us on the map, having hit 29m of 965 g/t AgEq, in addition to two other high grade vein zones. The story goes that in the mid-1920’s the Tonopah Extension Mining Company mined Victor down to the 1880 ft level where they encountered a significant amount of water. Given the vein was reported to have been 24m thick at that point, rather than turn around, they took out significant debt to commission diesel generators and some heavy-duty water pumps. These took years to be built and installed and by the time they were, metals prices had collapsed, and the company folded on the back of the debt they took on. Our first drillhole was targeting that same area where they stopped mining, and though the market was clearly surprised by that first big hit (it added over $100m to our market cap in the span of a week), it was precisely what we said we were targeting in the first place. I love it when a plan comes together. Since that first hole, we’ve now established multiple vein zones in that area, so far roughly 210 metres by 150 metres and still open, with our highest grade hit thus far in excess of 3,600 g/t AgEq. I say “thus far” as we’ve got completed holes at the lab awaiting assay right now, so I always hold out hope for better.

(Click image to enlarge)

SH: The company’s obviously been very busy recently with multiple drill rigs spinning at Tonopah West. Can you walk us through some of the project highlights to date?

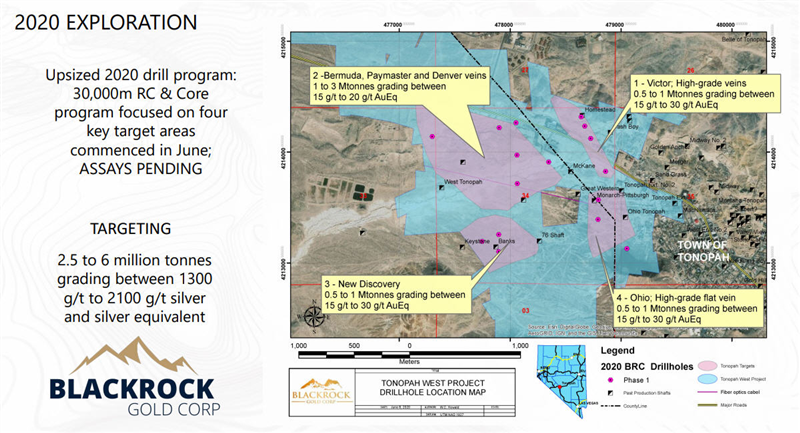

AP: What’s great about this project is the fact that it’s actually the holdings of multiple former historic mining companies that are consolidated as one for the first time in history. It’s as if we have multiple projects in one. It’s the definition of target rich, and it’s not like we’re starting with a clean sheet of paper either in terms of targeting. As opposed to grassroots, most of our targets are much more mine expansion style drilling, where we’re targeting strike and plunge extensions to veins that were previously mined. Not only that, we keep encountering new ones. We had reason to believe that operations shut down not because the companies thought they were mined out, they shut down due to low metals prices and given our initial results, it appears we may just be correct.

We’re only midway through our maiden round of drilling, which was originally slated to consist of 7,500 metres when we started in June but we’ve since gone pedal to the metal, expanding from one drill rig to three, and we’re expecting to have completed 30,000 metres or so by years end. As maiden rounds of drilling go, we’ve been hitting at an obscene rate. As of today we’ve reported assays for 24 drillholes (and an additional 24 completed holes pending assay at the lab) and we’ve had 22 significant intercepts ranging in thickness from 1 to 29 metres, and grades from 300 g/t to 4,643 g/t AgEq. We’ve seen gold grades of up to 26 g/t, and silver in excess of 2 kilograms/t.

(Click image to enlarge)

SH: The company’s obviously been very busy recently with multiple drill rigs spinning at Tonopah West. Can you walk us through some of the project highlights to date?

AP: What’s great about this project is the fact that it’s actually the holdings of multiple former historic mining companies that are consolidated as one for the first time in history. It’s as if we have multiple projects in one. It’s the definition of target rich, and it’s not like we’re starting with a clean sheet of paper either in terms of targeting. As opposed to grassroots, most of our targets are much more mine expansion style drilling, where we’re targeting strike and plunge extensions to veins that were previously mined. Not only that, we keep encountering new ones. We had reason to believe that operations shut down not because the companies thought they were mined out, they shut down due to low metals prices and given our initial results, it appears we may just be correct.

We’re only midway through our maiden round of drilling, which was originally slated to consist of 7,500 metres when we started in June but we’ve since gone pedal to the metal, expanding from one drill rig to three, and we’re expecting to have completed 30,000 metres or so by years end. As maiden rounds of drilling go, we’ve been hitting at an obscene rate. As of today we’ve reported assays for 24 drillholes (and an additional 24 completed holes pending assay at the lab) and we’ve had 22 significant intercepts ranging in thickness from 1 to 29 metres, and grades from 300 g/t to 4,643 g/t AgEq. We’ve seen gold grades of up to 26 g/t, and silver in excess of 2 kilograms/t.

(Click image to enlarge)

SH: Some of the world’s most important gold and silver mining districts are found in Nevada’s three major northwest trending belts – the Carlin trend, the Cortez trend and the Walker Lane trend. Can you give us some general details about the Walker Lane trend and what makes it so special?

AP: The Walker Lane belt is home to one of the largest precious metals endowments in the world, hosting over 80 million ounces of gold. Though it’s known for gold, it was silver that really put it, and in fact Nevada on the map following the massive discovery of the Comstock Lode in the 1850s. To this day, Nevada is known as the “Silver State”. They say Nevada became a state due to the Comstock discovery, and it stayed a state because of Tonopah, which was discovered in 1900 and spurned one of the last big gold rushes that led to many nearby district scale discoveries including Goldfields, which grew to become Nevada’s largest city soon thereafter.

(Click image to enlarge)

SH: Some of the world’s most important gold and silver mining districts are found in Nevada’s three major northwest trending belts – the Carlin trend, the Cortez trend and the Walker Lane trend. Can you give us some general details about the Walker Lane trend and what makes it so special?

AP: The Walker Lane belt is home to one of the largest precious metals endowments in the world, hosting over 80 million ounces of gold. Though it’s known for gold, it was silver that really put it, and in fact Nevada on the map following the massive discovery of the Comstock Lode in the 1850s. To this day, Nevada is known as the “Silver State”. They say Nevada became a state due to the Comstock discovery, and it stayed a state because of Tonopah, which was discovered in 1900 and spurned one of the last big gold rushes that led to many nearby district scale discoveries including Goldfields, which grew to become Nevada’s largest city soon thereafter.

(Click image to enlarge)

SH: You’ve also recently started a 3,500 metre drill program at your Silver Cloud property along the well established Northern Nevada Rift gold trend.

AP: Correct. This is a program we’ve been looking forward to for the better part of a year now as the bulk of the drilling is focused on a newly delineated target that is directly adjacent to Hecla’s Hollister mine. Last summer we found 8 veins outcropping at surface on our side of the claim map and identified a large geophysical and geochemical anomaly that effectively lights it up like a Christmas tree. Hollister is renowned for their grades, having produced roughly 450k ounces at roughly an ounce per tonne gold, and that system points directly where we’re drilling. This is a very exciting program for us as we’re testing to see if we hold the western extension of the system. In addition to that, we’ve got 3 other targets we’re testing, across 14 drillholes. Silver Cloud represents a landholding of roughly 45 sq km’s right where the Carlin trend connects with the Northern Nevada Rift, easily one of the most productive gold mining regions in the world.

SH: When you talk about “untapped potential” in your investor deck at both Tonopah West and Silver Cloud, just how blue sky is the opportunity here?

AP: We’re targeting high grade gold and silver in arguably the best mining jurisdiction on the planet. We see a lot of potential value we can unlock here, especially given the selloff the industry has experienced since August. Since our big share price run in July it’s been a perfect storm, where despite phenomenal results at the project level, we’ve given back a lot of our gains. At one point in March our stock had traded down to 7c at the peak of the Covid selloff, and just 4 months later we hit a high of $1.61 on huge volume. A lot of investors made a fortune during that run and we’ve had our share of profit taking to contend with. Add in a precious metals market that is coming off the worst single month (November) performance since 2016, and throw in the magical time of year that is tax loss season, and we’re in my opinion one of the best “Black Friday” bargains out there right now. This is a moment in time. A lot of shareholders who were in very low, have been replaced with those at higher levels. Gold is entering what is consistently seen as one of its seasonally strongest periods of the year, and tax loss season also comes with an end date. We’re a drill driven story and we have 24 completed holes at the lab from Tonopah, and drills turning at Silver Cloud through the end of the year. Not only that, we’re looking into the potential of spinning out Silver Cloud into a new company in 2021, ultimately giving Blackrock investors a proportional holding in two very focused companies, with purpose-built teams for each. We’re going to complete this round of drilling at Silver Cloud as we need to have those results bake in for valuation purposes, but we see this as potentially icing on the cake for investors in early 2021.In the interim, we get to look forward to results, which should start rolling in soon.

SH: What sets Blackrock apart from other junior precious metals companies in this space, and what makes your business model attractive to investors?

(Click image to enlarge)

SH: You’ve also recently started a 3,500 metre drill program at your Silver Cloud property along the well established Northern Nevada Rift gold trend.

AP: Correct. This is a program we’ve been looking forward to for the better part of a year now as the bulk of the drilling is focused on a newly delineated target that is directly adjacent to Hecla’s Hollister mine. Last summer we found 8 veins outcropping at surface on our side of the claim map and identified a large geophysical and geochemical anomaly that effectively lights it up like a Christmas tree. Hollister is renowned for their grades, having produced roughly 450k ounces at roughly an ounce per tonne gold, and that system points directly where we’re drilling. This is a very exciting program for us as we’re testing to see if we hold the western extension of the system. In addition to that, we’ve got 3 other targets we’re testing, across 14 drillholes. Silver Cloud represents a landholding of roughly 45 sq km’s right where the Carlin trend connects with the Northern Nevada Rift, easily one of the most productive gold mining regions in the world.

SH: When you talk about “untapped potential” in your investor deck at both Tonopah West and Silver Cloud, just how blue sky is the opportunity here?

AP: We’re targeting high grade gold and silver in arguably the best mining jurisdiction on the planet. We see a lot of potential value we can unlock here, especially given the selloff the industry has experienced since August. Since our big share price run in July it’s been a perfect storm, where despite phenomenal results at the project level, we’ve given back a lot of our gains. At one point in March our stock had traded down to 7c at the peak of the Covid selloff, and just 4 months later we hit a high of $1.61 on huge volume. A lot of investors made a fortune during that run and we’ve had our share of profit taking to contend with. Add in a precious metals market that is coming off the worst single month (November) performance since 2016, and throw in the magical time of year that is tax loss season, and we’re in my opinion one of the best “Black Friday” bargains out there right now. This is a moment in time. A lot of shareholders who were in very low, have been replaced with those at higher levels. Gold is entering what is consistently seen as one of its seasonally strongest periods of the year, and tax loss season also comes with an end date. We’re a drill driven story and we have 24 completed holes at the lab from Tonopah, and drills turning at Silver Cloud through the end of the year. Not only that, we’re looking into the potential of spinning out Silver Cloud into a new company in 2021, ultimately giving Blackrock investors a proportional holding in two very focused companies, with purpose-built teams for each. We’re going to complete this round of drilling at Silver Cloud as we need to have those results bake in for valuation purposes, but we see this as potentially icing on the cake for investors in early 2021.In the interim, we get to look forward to results, which should start rolling in soon.

SH: What sets Blackrock apart from other junior precious metals companies in this space, and what makes your business model attractive to investors?

(Blackrock President & CEO, Andrew Pollard. Photo courtesy Blackrock Gold Corp.)

AP: We’re targeting high grades in a great jurisdiction. Not only are we targeting high grades, we’ve been hitting them consistently at Tonopah West. The grades alone make it a standout, but what makes it even rarer within the silver space is it’s a silver primary precious metals district. Historically it produced at a 100 to 1 silver to gold ratio, which is right in line with what we’ve seen with our drilling thus far too. Silver is generally a by-product of base metal mines, be it copper, lead, zinc, which accounts for about two-thirds of all of silver production. As a by-product produced on the back of other commodities, those operations can’t scale up to reap the benefits of a high silver price. Having a pure play silver and gold district makes it unique. Add in the fact that we’re not in some far flung part of Mexico or Alaska or the Yukon, but literally next to a town, with a highway running across our property that is situated directly halfway between Las Vegas and Reno, Tonopah stands out in a league of it’s own. Unlike much of the exploration industry, we can work 12 months of the year here, whereas a lot of groups have already shut down drilling. Our investors can look forward to news throughout the year in terms of drilling results whereas most others in our space are confined to a season or two.

(Blackrock President & CEO, Andrew Pollard. Photo courtesy Blackrock Gold Corp.)

AP: We’re targeting high grades in a great jurisdiction. Not only are we targeting high grades, we’ve been hitting them consistently at Tonopah West. The grades alone make it a standout, but what makes it even rarer within the silver space is it’s a silver primary precious metals district. Historically it produced at a 100 to 1 silver to gold ratio, which is right in line with what we’ve seen with our drilling thus far too. Silver is generally a by-product of base metal mines, be it copper, lead, zinc, which accounts for about two-thirds of all of silver production. As a by-product produced on the back of other commodities, those operations can’t scale up to reap the benefits of a high silver price. Having a pure play silver and gold district makes it unique. Add in the fact that we’re not in some far flung part of Mexico or Alaska or the Yukon, but literally next to a town, with a highway running across our property that is situated directly halfway between Las Vegas and Reno, Tonopah stands out in a league of it’s own. Unlike much of the exploration industry, we can work 12 months of the year here, whereas a lot of groups have already shut down drilling. Our investors can look forward to news throughout the year in terms of drilling results whereas most others in our space are confined to a season or two.

(Click image to enlarge)

(Click image to enlarge)

For more news and information on Blackrock Gold Corp., visit

blackrockgold.ca.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.