“They say the best place to discover a mine is in the shadow of a headframe.”

Maria Smirnova, Portfolio Manager Sprott Asset Management

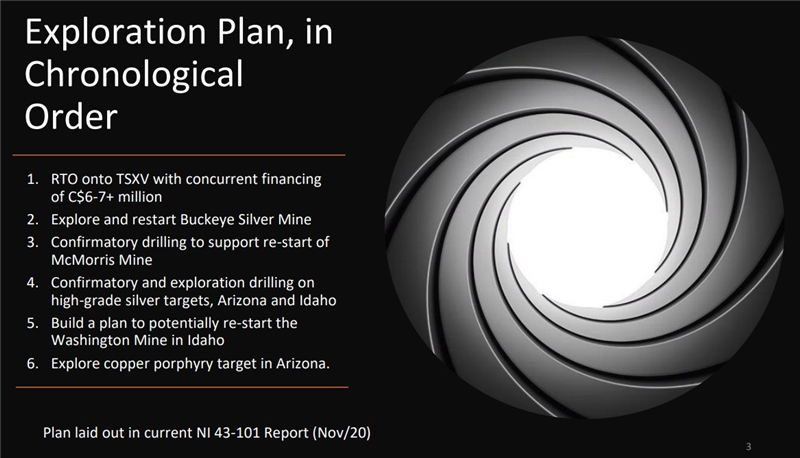

Soon-to-be-listed on the TSX Venture Exchange with concurrent minimum financing of CDN$3 million, Canadian-based Silver Bullet Mines Inc. is a multi-asset, junior resource company focused on silver resource development, the re-starting of former producing silver mines, and the exploration for a copper/gold porphyry. The first former producer to be put back into production is its 100%-owned Buckeye Silver Mine near Globe, Arizona, about 80 miles east of Phoenix.

Soon-to-be-listed on the TSX Venture Exchange with concurrent minimum financing of CDN$3 million, Canadian-based Silver Bullet Mines Inc. is a multi-asset, junior resource company focused on silver resource development, the re-starting of former producing silver mines, and the exploration for a copper/gold porphyry. The first former producer to be put back into production is its 100%-owned Buckeye Silver Mine near Globe, Arizona, about 80 miles east of Phoenix.

Of note, the current management of Silver Bullet Mines, while with another company, drilled 14 holes totalling near 1500 metres to determine the extent of one of the Buckeye silver veins. The mineralization was shown to continue along strike and at depth. All holes intercepted the target returning silver mineralization. The company then produced 500 ounces of silver from the Buckeye Mine in 2017 and 2018 as proof of concept. Management believes the time is now to put the Buckeye Mine back into production and will start the process by defining a mineralized block for bulk sampling and processing in its own pilot plant.

While additional exploration is still required to confirm the results, due to the high-grade silver and the copper (344 grams/tonne silver and 1% copper) found in soil samples, Silver Bullet Mines' Black Diamond project holds the potential for a copper porphyry. Silver Bullet’s recent NI43-101 technical report provides support for this theory.

Silver Bullet Mines recently added another high-grade silver mine to its asset base with the Washington Mine located near Boise, Idaho. We expect some public disclosure around the historical production from this mine in upcoming news releases. This mine is located on patented mining lands owned 100% by the Company.

Peter M. Clausi, VP Capital Markets and Director is an experienced lawyer, investment banker, shareholder rights activist and public company executive. He is currently the CEO of GTA Financecorp Inc., CEO of CBLT Inc. and a director of Camrova Resources Inc. Stockhouse Editorial reached out to Mr. Clausi to update us on the Company’s latest exploration projects, the Company’s general strategy and business model, and all things Silver Bullet Mines Inc [SBM].

SH: To start off, can you update our investor audience on any new company developments, especially in the wake of the COVID-19 pandemic?

SBM: Though the pandemic created minor problems with the completion of the NI43-101 report, we have continued to move forward. Our geological crew were on-site collecting samples and preparing to implement our re-start and exploration plans. At the mill site we have commenced the movement of the mill to our new company-owned site and site prep is ongoing. This site is located on mining patents with no third-party obligations.

SH: For our investor audience that might not be that familiar with this region, can you tell us a bit about the historic Arizona Silver Belt?

SBM: All of this is anecdotal and pre-dates NI43-101 so please realize much work will need to be done to confirm this story, But it’s a romantic history. As outlined in our January 2021 technical report, the history of entire area goes back to the mid 19th century. It is purported our mine site is where the Apache found native silver and hammered the soft metal into bullets. This real fact may have turned into the legend of the Lone Ranger and his fabled silver bullets. This area at the time was also known as the Rich-man Basin, the name of which has since morphed into Richmond Basin. At the end of the 19th century ore was direct shipped to the smelter in San Francisco, with grades reported to be averaging 250 ounces per ton silver as historically reported but not confirmed by the Company at this time. There were several gravity mills reported to have operated on the property during this historic production period. In all there are 5 past producing mines on our property and numerous adits and pits.

SH: You’ve said that the company can mitigate risk by re-starting production for less than CDN $1 million in less than a year. How so?

SBM: We currently have a small pilot plant. We hope to be able to increase the capacity of that plant to be capable of processing approximately 100 tons per day. Our plan is that we will drill from underground to identify and block out higher grade mineralized shoots along the vein, develop these blocks, stockpile the high-grade silver-copper mineralization, and then ship to our 100%-owned nearby facility to be processed in the upgraded facility. This will enable us to confirm and build our silver resources and generate income as we do so.

SH: What can you tell our metals & mining investors about your production program to date, and what to expect looking forward into 2021?

SBM: We are currently upgrading the mill site for the installation of the mill equipment. The assay facility is being moved to our new site and the infrastructure improvements are commencing the first week of March. Over six million dollars has been spent here since 2012 so the infrastructure has been updated. Engineering is complete and we will be ordering the equipment within the next few weeks. Our goal is that we begin processing our first bulk sample in the fourth quarter of this year.

SH: What are the advantages, from an investor’s perspective, of being an exploration company and a near-term producer?

SBM: This gives the shareholders the best of two worlds. Near-term production at Buckeye minimizes risk as it reduces the need for another financing. If we do this correctly and the silver price behaves, the company will likely never have to do another financing. Then we can assess the exploration upside at several targets while we develop the rest of the property. Some investors call this the PPSS, the “Pre-Production Sweet Spot”.

SH: Can you update us on your soon-to-be public listing?

SBM: We are fortunate to have found a great business group in Pinehurst Capital 1. It’s a Capital Pool Company trading on the TSX Venture Exchange. The team at Pinehurst are supportive of our complementary plans of risk-mitigation at Buckeye and blue-sky exploration elsewhere. The listing application is in with the TSXV.

SH: What about the exploration upside at the four other former producers and the long play for a possible copper porphyry?

SBM: The plan is to start immediately moving the McMorris Mine towards silver resource development using state of the art processes, and to explore the areas around the other three former producers to help us decide which to next attack. We have already used hyperspectral imaging to outline potential anomalies and we have completed 800 plus soil samples on less than 10 % of the property. Along with this exploration work, the Richmond Basin and its veins were mapped and sampled where exposed, confirming high grade silver in place to over 1000 g/t as reported in the technical report. As for the copper, we are in copper country and we have evidence of copper in the soils, in the float and even in the silver doré bars poured in 2018. One of the main prospects on the property is the Black Copper that looks to be associated with skarn style mineralization and extends based on sampling for over several hundred feet with grades in excess of 7% copper with a couple of grams gold, again as outlined in the technical report. This prospect indicates there is a copper generating mineralizing system on our land. We need to continue the discovery process while working with the industry partners to find out what we have here. We think it is significant.

SH: Can you tell our audience about building your corporate management team…especially the experience and innovative ideas they bring to the metals & mining space?

SBM: We believe the team is as important as the property! Our onsite crew consists of 3rd generation miners, our assayer spent 40 years with a major metallurgical company, our process team has built over 200 mills and exported to over 40 countries, and our geological team has worked around the world.

SH: What sets Silver Bullet Mines apart from other junior exploration companies in this space, and what makes your business model attractive to investors?

SBM: What sets SBMI apart from the rest is this: our story is simple. We own 5 past producers in friendly Arizona and note the Frasier Institute named Arizona as the world’s second-best mining jurisdiction for 2020. We can put the Buckeye back into production for under CDN$1M in less than a year. That’s unheard of. We will use the cashflow from the Buckeye to finance exploration and development at the other four former producers. Once the silver is flowing, we can get to work on the potential copper porphyry. We have a tight share structure and we look to generate near-term cash flow to support our exploration efforts.

SH: And finally, Peter, if there’s anything I’ve overlooked that you’d like to talk about, please feel free.

SBM: Once we hit production at Buckeye, one metric to value the company is as a multiple of cash flow + a bonus for exploration. We feel there is a lot of meat left on the bone for investors to feed upon.

(Click image to enlarge)

For further information and technical disclosures, please visit www.silverbulletmines.com

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.