(Image via Glencore / Electric Royalties Ltd.)

When it comes to the Electric Vehicle (EV) revolution, the future is imminent and those who have adopted this next level lifestyle agree that what they need is a lot of power … and a lot of resources.

(Image via Glencore / Electric Royalties Ltd.)

When it comes to the Electric Vehicle (EV) revolution, the future is imminent and those who have adopted this next level lifestyle agree that what they need is a lot of power … and a lot of resources.

For investors, electrification is one of the most sure-fire long-term plays. Unfortunately, many investors jumped on the electric vehicle bandwagon long before the driving fundamentals of lower costs and widespread utility were correctly positioned and were disappointed.

A slow but certain rise in demand for certain metals is what early investors have anticipated, this caused pressure over time on limited supplies that are not ramping up fast enough.

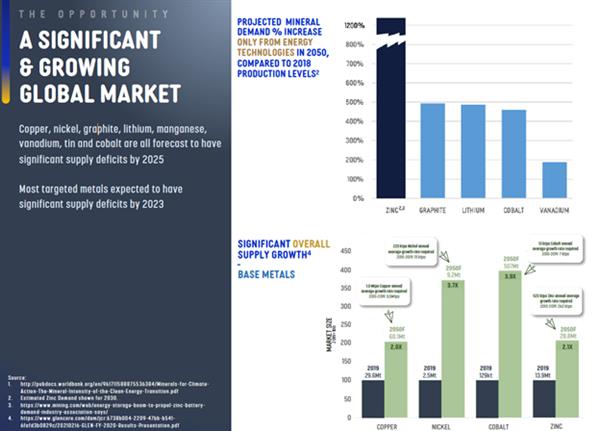

Global electric vehicles number approximately 2 million on today’s roads. In less than a decade, that number is forecast to increase by 7,000% to over 140 million. A wide range of requisite commodities, including well-known battery metals like lithium, graphite, cobalt, manganese, and vanadium, as well as base metals like nickel, copper, and tin, see forecasted demand growth rates well above 250% over the next ten years.

This opens the door for

Electric Royalties Ltd. (TSX-V: ELEC, Forum) to seize an opportunity within the demand for a wide range of commodities (lithium, vanadium, manganese, tin, graphite, cobalt, nickel, and copper.

ELEC recently entered into

an agreement with

Globex Mining Enterprises Inc. (TSX: GMX) to acquire two royalties. The Middle Tennessee (MTM) Royalty is the first cash-flowing royalty, and results in Electric Royalties becoming the only cash-flowing royalty Company solely focused on the battery metals sector.

Chief Executive Officer Brendan Yurik took time out of his busy schedule to speak with Stockhouse Editorial and answer some burning questions that have been on the minds of investors ….

Q: Thank you for joining us today. Let’s begin by bringing everyone up to speed; can you give us a rundown on what Electric Royalties is all about?

A: Well, we are a royalty company first and foremost, that’s important because it’s a tremendous business model with a huge number of advantages over traditional mining companies including increased diversification, higher valuation multiples, less G&A and overhead requirements, no responsibility for cost-overruns/project development costs, no holding costs associated with holding royalties and generally we are able to secure them against the projects themselves as a form of security etc. I could go on for days about the benefits of being a royalty company.

Second, we are the only royalty company out there focused exclusively on the entire suite of metals required to move the world towards clean energy via batteries, electric vehicles, energy storage, renewable energy etc. So those metals include lithium, zinc, cobalt, copper, nickel, manganese, tin, graphite and vanadium. We see two decades of exponential growth ahead and a new paradigm of demand for all these metals moving now into the future so we’re very excited about the long runway we have ahead.

What benefit does royalty financing bring to companies seeking royalty financing and also to potential investors or shareholders of ELEC?

A: For investors, we offer a way for investors to get exposure to the entire EV space with low risk via diversification and significant upside potential. Investors will continue to benefit from operators of the projects we hold royalties on moving those projects along at their own expense over time (and none of our expense), as royalties we hold mature and start to pay cash back to the company, continued consolidation and creation of additional royalties to the portfolio and ultimately higher prices across the board for the metals we are actively pursuing. Mining can be a very challenging industry for new entrants to figure out yet there is a lot of interest out there because the demand side is undeniable over the longer term so we offer a perfect way for those investors to get that exposure without the typical risk associated with a mining investment.

For the companies, there are two cases:

1) Consolidation of existing royalties

Often times individuals or groups own royalties that are non-core to the business or not getting proper value in an entity that isn’t a focused royalty company so in these situations there is arbitrage opportunity to provide some upfront value, often in consideration of shares in ELEC, and capture the increased valuation multiple that we receive in the market as a pure play royalty company. Most new royalty groups out there are focused exclusively on this area of royalty acquisitions which are much easier to put together.

2) Royalty financing

However, my experience has been alternative financing / project financing advisory to the junior mining space for my entire career and the real opportunity and the real benefit to mining companies looking to help build out the metals supply chain required for the electric revolution is from royalty financing, which creates new royalties. Royalty financing at it’s core is an alternative form of financing that also has many benefits to the companies, they’re not dilutive like equity, there is no fixed repayment timeline as in debt or streaming, and they can generally fit into almost any financing package ie. You can do debt, royalty and equity financing in a combination as needed. There has been a serious lack of capital going to the battery metals space relative to some of the industries they will be replacing over time like oil and gas, likely on the scale of 1/1000 dollars respectively goes into battery metals versus oil and gas. With supply pipelines across all these crucial future metals very thin, having enough metals to achieve a clean energy economy is probably the biggest risk to the world being able to do so. We are trying to foster exploration, development and production of these metals by offering royalty financing to the capital-starved companies in the space looking to build the projects necessary to supply the lithium, cobalt, manganese, zinc etc. needed to do so.

Q: The MTM Royalty focuses on zinc production at the operating Middle Tennessee Mine, can you explain what a sliding-scale, gross metal royalty is?

A: Sliding scale royalties aren’t that uncommon and at their core they’re essentially offering the royalty holder the additional upside if metal prices are higher ie. in our case with MTM the royalty is a 1.4% Gross Revenue Royalty when zinc prices are above US$1.10/lb as they are today. When the metal price is higher then the operator of the mine is also making more money and thus has more ability to pay and so it doesn’t burden the mine more than at a lower rate.

And on the flipside it offers protection to the operator such that at a lower than expected metal price, ie. in our case with MTM the royalty doesn’t pay out at zinc prices below US$0.90/lb which is helpful because at lower than expected metal prices the operators ability to pay is significantly hindered.

Just to round that out, the MTM royalty pays out as a 1% Gross Revenue Royalty between US$0.90 and US$1.10 per pound zinc prices. And I’m very bullish on zinc prices longer term between inflationary pressures from loose monetary policy to the fact zinc is used in almost everything and is shaping up to be a key metal in the future of energy storage, batteries and renewable energy as well.

Q: As the only cash-flowing royalty Company solely focused on the battery metals sector, how unique is your approach compared to other royalty companies?

A: Well, our area of focus is a key part of our approach, and targeting exclusively the entire suite of metals required for the clean energy boom. By and large most royalty groups focus on one or two metals which to me takes away from the diversification benefit of being a royalty company as you are diversified by projects maybe but you are / can be way overweight towards one specific commodity. The other aspect of that is that we aren’t competing with the original / major royalty groups out there which are traditionally gold focused, as are most of the new entrants.

The second thing is that we are equally focused, if not more so, on creating new royalties which has many benefits such as making sure the royalty covers the entire property, usually we include an option to increase our royalty over a period of time if things are going well, make them gross revenues so there is no deductions on royalty payments etc. etc. Very few new royalty groups have created new royalties like our deal with Northern Graphite for example.

Third is that we are putting an emphasis on getting cash flowing royalties as cash is always key, it helps stave off dilution as capital is generated internally for new acquisitions and ultimately paves the way for us to start a dividend program for investors in the near future.

Q: Having generated royalties of around $4.7 million since 2017, can you break down this project’s value opportunity?

A: This royalty has a lot going for it, a strong operator in Trafigura, good jurisdiction in the US, good operating history with over 2.7 billion lbs of zinc already produced, long life of mine ahead with 15 years based off current resources and significant exploration potential to keep on extending that life over time.

It’s a major milestone for the company, 95% of mining companies never achieve cash flow.

We see operational improvement upside from Trafigura taking over as operator, price upside as zincs role in the clean energy transition grows more profound and potential to continually increase the life of mine so we’re very excited to get this royalty. Ultimately the royalty is on track to pay out about C$1.2 million at its current Jan-Feb pace of revenues however we see that increasing as Covid delays et al from 2020 are addressed and production is ramped up to nameplate capacity. Currently the average P/CF multiples received by base metal royalty groups is around 15x so if cash flow were to say increase to $2 million annually as predicted then the valuation we should receive in the market should be around $30 million as an example.

Q: The Company is also acquiring a new 1% Gross Revenue Royalty on the Glassville manganese project, can you expand a bit on what this GRR will do for your business?

A: There is only one district in North America right now that we see having the ability to supply manganese domestically to the end users that require it for EVs, batteries etc. We already own a royalty on the most advanced project, Battery Hill, in that district operated by Manganese X, the Glassville project is 8km away from Manganese X’s Battery Hill project and has one of the only other resources outlined in that district so we’re excited to increase our exposure in the area.

Q: As we await more details in the coming weeks, is there anything you can share now to whet investor appetite in the meantime?

A: We got off to a bit of a slow start after going public during Covid in July / August last year but we’re really coming along now and we have a lot of deals in our pipeline and every day approaching us so it’s going to be an exciting year to be an ELEC shareholder. We’re going to be putting together a financing plan in the next few weeks to capitalize the company so we can start to take down these acquisitions on a constant basis and we are definitely looking to add another couple producing royalties in 2021. That’s all I will say on things for now but it’s definitely a good time to get into Electric Royalties, I don’t think there is ever going to be a better entry point moving forward.

Q: How large is ELEC’s strategic focus in the EV battery market and how will the Company become a strategic player in the EV battery supply chain?

A: We’re planning to foster growth of the supply chain across all the needed metals including lithium, tin, zinc, copper, nickel, vanadium, manganese and graphite. We offer a platform that can take investment from non-traditional mining investors that can compete and beat other investment value propositions outside of the mining space and get that capital to the companies that need it. Longer term we see ourselves potentially branching out with initiatives to help boost exploration and we’ve been talking to a few groups with AI about partnerships to maybe make that happen already, we have had and continue to have discussions with recycling groups looking to transition to the ultimate goal of a closed loop economy whereby all metals are recycled back for further use over the long term and we have talked to technology groups that are developing new technologies that minimize the environmental impacts of mining or allow previously locked resources to be mined. Some of those initiatives are probably a little ways away yet but we’re entrepreneurial and always open to ways we can help support / foster the supply chain and be a solution for the EV industry’s biggest challenge, ensuring enough metals for the clean energy future.

Q: The EV revolution boasts some big expectations among companies and shareholders … what is your vision of the future of electric power?

A: Big expectations yes but I still think everyone is underestimating the impact on demand that this will have across all these metals. I also think that very few people have a real grasp of what the project pipelines look like for future supply – in short they’re not very robust. And everyone outside of the mining industry needs to wrap their head around the real issue of development timeline – the average time now from a new discovery to production, if all goes well, is 15-20 years so action to support the supply chain needs to be taken early on when it’s been identified as an issue, and the world is years behind on this already. So, the biggest threat to the future is definitely having enough of these metals to make it happen.

That said, I think the future is very bright and I’m excited about the future of electric power. There are electric planes under development already, electric public transportation is already starting to be mandated and funded in different regions and ultimately I do see a world in which everything is electric / clean energy. We should have started down this path much sooner.

And it’s an exciting time to be in mining as the new paradigm means mining might actually get some attention for the first time in a long time. I joined the mining space and always intended to because I figured natural resources are the building blocks of everything we have in our lives and are a finite resource, the finite part didn’t have the demand drivers in place to make that really matter before but the electric revolution is changing that and mining will become more of a mainstream industry as we move forward into the future.

Thank you again for taking the time to speak with us today, anything further to add?

My family and I combined are the largest combined shareholder of the company so management interests are definitely aligned with shareholders and we’re a low risk way to get exposure to the entire clean energy transition which will have undeniable benefits to Electric Royalties moving forward. Interested investors should buy now and hold, within 3-5 years they will see incredible returns on their capital and should be receiving dividends before then as well, don’t wait too long because we’re only going up from here.

For more information about the Company, visit

electricroyalties.com.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.