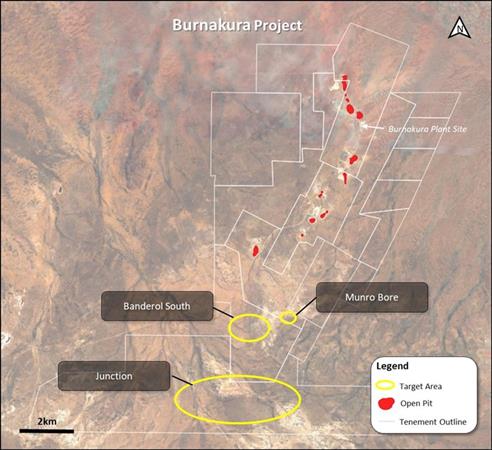

(High potential target locations undercover at the Burnakura project. Image via Monument Mining Ltd. Click to enlarge)

Two regions in the world that are blessed with various Natural Resources, especially gold, are Malaysia and Western Australia. It can be a challenge for investors to know who will strike riches, perseverance can pay off for both traders and miners alike, especially when gold is selling for more than $1,900 (USD) per oz. and you are in the business of building gold mines.

Monument Mining Ltd. (TSX-V: MMY, FSE:D7Q1, OTC: MMTMF, Forum)

(High potential target locations undercover at the Burnakura project. Image via Monument Mining Ltd. Click to enlarge)

Two regions in the world that are blessed with various Natural Resources, especially gold, are Malaysia and Western Australia. It can be a challenge for investors to know who will strike riches, perseverance can pay off for both traders and miners alike, especially when gold is selling for more than $1,900 (USD) per oz. and you are in the business of building gold mines.

Monument Mining Ltd. (TSX-V: MMY, FSE:D7Q1, OTC: MMTMF, Forum) is an established Canadian gold producer that

owns and operates assets in Malaysia and Western Australia. The Selinsing Gold Mine is a producer with growth potential, comprised of the Selinsing, Buffalo Reef, Felda Land, Peranggih, and Famehub projects in Pahang State, Malaysia. The Murchison Gold Project comprises Burnakura, Gabanintha and Tuckanarra JV (20% interest) properties in Western Australia, a well-known attractive project to be potentially developed into a cornerstone gold project at major Murchison goldfield in Western Australia.

In June 2021, MMY announced that it had commenced an extensive exploration program at Murchison, which includes plans for 15,000 metres of aircore (AC) drilling. The Company explained that the intent of the program is to test beneath cover for potential mineralization that will lead to the discovery of shallow stand alone or satellite gold deposits to add to the current gold resource base at Murchison and establish it as a cornerstone gold development project.

Monument has been in production for 11 years at Selinsing in Malaysia and has its sights set on building the production profile to become a multi-project producer with assets in multiple jurisdictions and has a strong cash position. Its share price has clocked in a good performance over the past year, rising nearly 120% in value since last June.

(Monument Mining stock chart – June 2020 to June 2021. Click to enlarge.)

(Monument Mining stock chart – June 2020 to June 2021. Click to enlarge.)

Stockhouse Editorial caught up with Monument Mining’s President and Chief Executive Officer, Cathy Zhai to dig deeper into this opportunity ....

Thanks for joining us today at Stockhouse, let's start off by getting a little bit of information about yourself and the company to introduce Monument to the Stockhouse mining investor audience.

I have been the President and CEO since January 2018, and formerly was the CFO at Monument since 2001 (formally Moncoa Corporation). My over 20 years of experience includes executive and senior positions covering executive management, business strategic planning, development and corporate finance in the mining industry and other business sectors. I played a major role in the company’s corporate development and financings, as well as directly participating in the establishment of the Selinsing Gold Mine from its start up.

What is Monument Mining’s business model and how does it make money?

Monument is looking to become a larger scale gold mine producer and significantly increase its market cap for its shareholders’ best interest.

The Company’s business model is to find near production gold assets with the potential for over 1 million ounces of gold resources, acquire them, finance them, and then work to putting those assets into production to produce cash flow. We use the cash flow from the project for expansion and exploration work to increase the gold reserves and resources for sustainable production, and for other value creation opportunities at corporate level for all stakeholders.

This is what we did at the Selinsing Gold Mine, we quickly put it into production in 2010 and used the cash flow to expand the plant, and in 2019 we fully replaced our resources with a new NI43-101 resource for six year life of mine. We also own the Murchison Gold Project which has upside potential to be developed into a cornerstone project for the Company, through our exploration programs.

What is the value creation strategy Monument is implementing?

In 2020 and early 2021, the Company streamlined its projects to focus on its gold portfolio at Selinsing and Murchison, by selling 80% of the Tuckanarra property in Western Australia, and spinning out the Mengapur Copper and Iron project in Malaysia.

The value creation strategy is to grow the Company’s asset value by strengthening the gold resource base while establishing multiple gold production lines for sustainable cash flow to de-risk and support such growth. The Company is seeking to develop the Murchison gold project into a cornerstone asset through an aggressive two-year exploration program to delineate additional gold ounces. The Company is also developing the Selinsing Sulphide Project into production through a two stage de-risking process to produce cash flow and has an opportunity to develop a niche market through bio-leaching process with third party sulphide concentrates to provide sustainable cash resources.

The company recently began an extensive drilling at the 100%-owned Murchison Gold Project, potentially a new cornerstone project for MMY, what is the company hoping to achieve out of this drilling program?

To date at Murchison, the exploration has focused on infill, and extensional drilling in and near the existing open pits and known mineralized systems, which resulted in the July 2018 NI 43-101 mineral resource estimate totalling 381,000 ounces. Together with mine development and existing gold processing plant care and maintenance, Murchison Gold Project has established the initial production base.

Now, this new extensive exploration program will focus on discovering a larger scale gold system through evaluating the potential areas under cover or elsewhere in the 170km

2 highly prospective land held by the Company; and upon success turning Murchison into a cornerstone gold project and further expand its position in the Murchison Goldfield.

The program initiated from Burnakura southwest to the existing mineralization zones at the unexploited Munro Bore extension and the Bandererol South and Junction, which are highly prospective. The target areas will be evaluated using on the ground exploration techniques including soil sampling, AC drilling, Reverse Circulation (RC) drilling, and geological mapping to test for indications of significant gold mineralization.

In the meantime, additional high quality potential targets distal to known deposits or beneath cover at Burnakura and Gabanintha will be further evaluated and defined through integration and evaluation of historical data. The continuity of field exploration and geological analysis and interpretation will be progressed in this disciplined manner to lead towards potential new discoveries and hopefully enable the Company to become a larger scale gold producer.

What kind of exploration potential does the Murchison Goldfield offer, and what are Monument’s Murchison Gold Project land holdings in this area?

The Murchison Goldfield is a very prolific gold mining region and has had many historical mines dating back to the 1900s, which have produced millions of gold ounces. The area still hosts significant gold production through current operating mines, and exploration success continues within and surrounding the area.

Monument land tenements include 125.6km

2 at Burnakura, 43.4km

2 at Gabanintha, and 63.6km

2 at the Tuckanarra JV (Monument has a 20% interest).

The recent successful exploration at the Tuckanarra Project joint ventured by ODY and the Company has intersected significant visible gold in the known mineralization zone, gives Monument the confirmation and re-inforces the view that extensive high-grade gold mineralization remains to be discovered at Burnakura and Gabanintha.

Can you walk us through the expansion strategy at the Selinsing Gold Mine for the planned Sulphide gold project?

Selinsing has been in gold production since September 2010 using a CIL plant and processing oxide ore, and we are now transitioning to sulphide ore production with a six year life of mine NI43-101 resource estimate and feasibility study (January 2019).

The expansion strategy is to place the project into sulphide ore production by implementing a two stage approach. The first stage is to add a flotation plant to the existing processing plant to deliver flotation production in the second quarter of 2022 and produce saleable gold concentrates. The proceeds from this phase can be used to add a second stage bioleaching plant to potentially develop a niche market with third party sulphide concentrates to produce sustainable cash resources to support Company growth.

The company has had long term support in their local communities, what is the Company’s position on corporate social responsibility (CSR), and why are these beliefs so valuable to your operations?

Monument is committed to promoting a strong health and safety workplace culture, minimizing the environmental footprint, and strengthening our ties to the communities in which we work. We understand that it is our responsibility to integrate economic, environmental and social dimensions into our business decision-making processes. Our objective is to make a positive difference in the communities where we are located, and seek to improve social and economic circumstances through economic contributions and community involvement through consulting, support and development.

Thank you again for the time to learn more about your company. Is there anything else you would like to cover that we might have missed?

The Company is also seeking to augment current and future production via a suitable acquisition strategy, and is looking for near production gold sector acquisition targets with 1 million ounce gold resource potential that we can put into production and expand through development and exploration. We are continuously appraising potential acquisitions to grow our mineral resources to generate profits from sustainable precious metal production, so stay tuned.

For more details on this company, visit

monumentmining.com.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.