You guys who know me already understand why it is that I am constantly looking for whipsaws. The best risk vs reward opportunities are sparked from such events. We often refer to whipsaws as failed breakdowns or failed breakouts depending on the direction of the underlying trend. From failed moves come fast moves in the opposite direction, and that’s why we look for them.

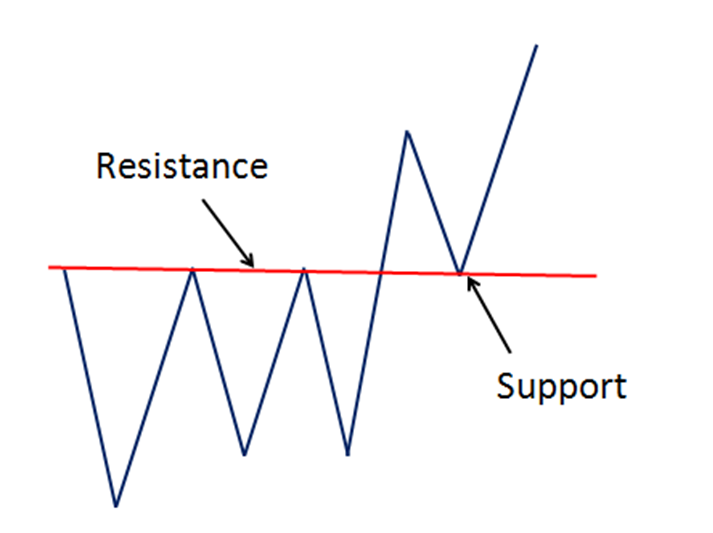

The idea behind support and resistance is that when markets meets resistance, or a level where supply exceeds demand, prices continue to fall from that price until eventually it breaks through it. Sometimes it tests resistance once or twice and sometimes 3 – 4 times, but the idea behind it remains the same. Once resistance has been broken, any sell-offs back to that former resistance should turn into support. This is the principle of polarity. See here:

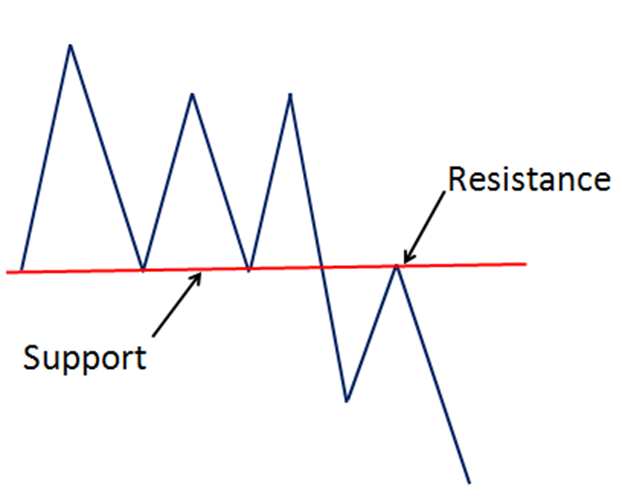

It’s the same thing on the way down. When prices find support, or a level where demand exceeds supply, prices continue to bounce from that price until eventually it breaks through it. Once that occurs, any bounces back to that support level should be met with resistance, more sellers than buyers. See here:

/feeds.feedburner.com/~r/benzinga/etfs/~4/py3Vr3_IB20" height="1" width="1" alt=""/>More...

/feeds.feedburner.com/~r/benzinga/etfs/~4/py3Vr3_IB20" height="1" width="1" alt=""/>More...