Yahoo (NASDAQ:YHOO, Forum) quietly shut down its Yahoo Screen streaming service this week, putting a $42m loss to rest in yet another example of a company that doesn’t know what it is, doing things it doesn’t know enough about, in ways that defy common sense.

If you’re tired of shorting oil and gas, and have run out of ways to bet against coal, a look at the smouldering ruins of what was once the great tech hope of planet earth in Yahoo is probably something to consider betting against, given where they are and what they have wasted.

To be sure, Yahoo Screen was terrible. Blaming its closure on the three original content properties they created for the medium, season six of former network TV sitcom Community, sci-fi sitcom Other Space, and basketball-based Sin City Saints is like blaming the guy who makes Donald Trump’s suits for the fact that he’s an execrable douchebag.

Here’s what it looked like – you decide if you would have come back.

Conceived as an answer to Netflix (NASDAQ:NFLX, Forum) and Youtube, the thing was unusable, unwieldy, empty and unnecessary. Just because YouTube exists does not mean every tech company needs its own version, especially a lesser one.

Yahoo has a market cap of $30 billion right now, but I can’t tell you why. The company is a giant of the technology sector, with more money than it knows what to do with and a name that has literally been a household word for 20 years, having rocketed from college dorm room obscurity to superstardom in advance of the dotcom boom.

But it is, if you wipe away the brand name, a terrible company. It’s a case study in losing your way, a thesis in how to fall ass backwards into failure after failure and still –somehow- stay alive.

The big question for the company is now, as it has been for the last 15 years… what exactly is Yahoo?

When I first encountered what would become the first big leader in search, it was back in the early days of the web (that’s what we used to call the internet, young people) in 1995. Its URL was https://akebono.stanford.edu/yahoo and it had just been renamed from its earlier title, “Jerry and David's Guide to the World Wide Web.”

It looked like this:

Oddly, a hand-aggregated list of websites in a set of broad categories was actually pretty ground-breaking stuff at the time. And when Yahoo automated things, thereby ending the long submission backlog that was literally the worst thing about owning a website way back then, they quickly dominated the world.

That screenshot should be sent to all Yahoo execs today, because it was the last time Yahoo was actually Yahoo. As soon as it got big and wealthy and profitable, it also got stupid.

Rather than innovate in search, where it had a sizable lead, Yahoo lingered, eventually paying Google (NASDAQ:GOOG, Forum) to power its own searches. When it bought ClassicGames.com and turned that entity into Yahoo Games, immediately dominating the online game world, it did nothing with it for years, ultimately shuttering the service in 2014 when it decided it couldn’t keep the thing secure.

Yahoo led, and faltered, on search advertising, fantasy sports, web-based mail services, news aggregation, web hosting, chat, email groups, e-cards, contests, auctions, job listings, task management, instant messaging, photo hosting, the list goes on. The reason the company faltered after high priced acquisitions in all these areas is, none of them were core. All of them were someone’s idea, then that someone moves on, then someone else is left with an entity they know nothing about.

At Google, this wasn’t the case. Search was at the core of its business and search-based ads were its revenue earned. While Yahoo spent billions chasing page views, Google chased time spent and clicks and stickiness. Yahoo tacked new things on and left them to hang, while Google integrated them into one big thing that was easier to be a part of than not.

Let’s put it another way: While Google was having a party, inviting all the cool people to one place, Yahoo was walking around the neighbourhood buying other people’s parties, staying for one beer, and moving on.

When Yahoo bought out Flickr in 2005, it was rapidly becoming a giant in social media which, at the time, was an exciting new thing. If you took photos, liked photos, or needed to host photos, you used Flickr. There was just nothing else.

But when Yahoo bought Flickr, it sat on it for years, doing nothing to take advantage of its dominance because nobody at Yahoo understood it’s potential. Then along came Instagram and Flickr just diiiiiiiied.

Oh, it still exists, in fact it was re-launched at a big splashy affair in 2013, but when I logged into my old account just now, the most recent upload from my friends happened 15 months ago. Stick a fork in it.

Yahoo Messenger was a big deal for a moment, but anyone who used it quickly got sick of getting unsolicited robo-friend requests from women who supposedly ‘really like your pic’ and want to get to know you better. Yahoo never figured this out and the only people still using Yahoo Messenger are your grandparents. And that guy in the basement suite who still thinks he’s a chance with SuzieBuns98. Go get her, tiger.

Yahoo Mail is in a similar time warp. If you went back to 2005 and logged into your Yahoo mail account, the only difference between now and then would be about 93,029,835 spam emails in your inbox.

In early 2008, despite having royally screwed up every single move they’d taken in the previous decade (how’s that Geocities purchase looking for you, guys?), Microsoft made a takeover offer for $44 billion. Microsoft CEO Steve Ballmer, who with the wisdom of hindsight should be thanking his lucky stars his offer was rejected, plopped $33 a share on the table. Yahoo’s board said they wanted $37. Ballmer eventually backed out, and ten months later Yahoo was valued at $8.94 per share. Good business, lads.

A year later, Yahoo announced a deal with Microsoft to allow the company to use their search engine to power Bing, for no cash up front. In return, Microsoft would handle search for Yahoo. Basically, they turned a potential $4 billion payday into a wash. Good business, lads.

Under Yahoo’s stewardship, the internet lost AltaVista, MyM, AlltheWeb, Yahoo Buzz, Jumpcut, Rocketmail, Wretch, MyBlogLog, Upcoming, Farechase, My Web, Kickstart, Briefcase, Yahoo for Teachers, Audio Search, FoxyTunes, FireEagle, Sideline, Yahoo People Search, Yahoo Events, HotJobs, Yahoo Mash, Yahoo 360, Bix, GeoCities, Yahoo Meme, Babel Fish, Yahoo Next, Yahoo Maps, Yahoo Music Unlimited, Yahoo Chat, Yahoo OMG, Yahoo Personals, Yahoo Pipes, Yahoo Widgets, Yahoo Voice..

When Carol Bartz came in as CEO in 2009, she told PCWorld that she struggled with the question of what Yahoo actually was. She said her execs had figured it to be their users’ ‘home on the internet’.

In other words, Yahoo was a bookmark. A $30 billion bookmark, tossing around cash in an effort to justify itself.

Realistically, there is no Yahoo anymore. The front page of the site is an abysmal mess of pap news and clickbait that looks like something I built in 1997 using Notepad. If it was called Crazy News of the Day instead of Yahoo, you wouldn’t value it at $700.

Today’s headlines: ‘Did aliens leave behind this 2800-year-old Nokia?’ and ‘15 jaw-dropping female golf players’ (do you mean golfers?)

What Yahoo does have is money, and so the current form of Yahoo is basically a late-stage tech startup investment firm with no unifying purpose other than staying active. It’s a 55-year-old divorcee playing Ultimate Frisbee with 20-year-olds and buying them all beers later.

But even at that, it’s a bit of a failure.

The company spent $1.1 billion buying the social micro-blogging site Tumblr, which was actually a decent piece of business if you’re looking to connect with the prime demographic (and the hipster world), but users aren’t going to be holding their breath waiting for Yahoo to do anything with it. Tie it into Yahoo Mail and Messenger? Blurgh, no thanks.

It picked up task management company Astrid in May 2013, then closed it August of the same year, telling users to try competitors instead. Good business, lads.

It picked up social browser RockMelt in August 2013, and shelved it the same month, then bought video ad company BrightRoll for $640 million and mobile app maker Cooliris a few weeks later.

But what is it?

I’ll tell you what it is: It’s a massive short candidate.

The closure of Yahoo Screen is the first of what will be many other closures to come as CEO Melissa Mayer attempts to stop the bleeding, which will be tough because bleeding is what Yahoo execs do best. It’s what they’ve always done.

“The past was alterable. The past had never been altered. Oceania was at war with Eastasia. Oceania had always been at war with Eastasia.”

Yahoo, right now, is in the wind-up phase of its existence, but it won’t publicly say so for fear of causing stock to fall even further than the 36% it has dropped in the last year. Significant shareholders are calling for the sale of the company’s core business, and the board is reeling after it had planned to spin off its share in Chinese e-commerce monster Alibaba, only to be told by the IRS that it may face a big tax bill in doing so.

According to Reuters, Yahoo’s 7th, 23rd and 30th largest shareholders (a group holding a considerable amount of cash between them) have already implored the board to make a sale happen – and now. Verizon is reportedly interested, though I’ve no idea why.

To be sure, nothing can fix Yahoo right now. It would need time to refocus on its core business, and it has none. It would need patience to restructure, and investors have none. If it sells core assets, it basically becomes a capital pool company with an old name that means nothing anymore. And if it doesn’t sell those assets, they become worth a lot less every day.

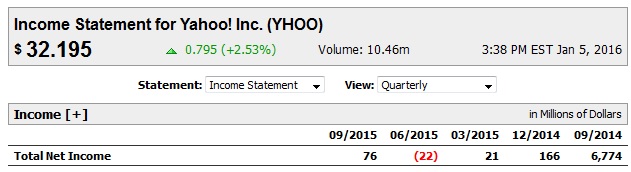

If you can look at the following quarterly net income figures and see Yahoo as being a good bet right now – or even not ‘substantially over-valued’ – then by all means place your bets as you choose.

But if you take out that household name and just look at the numbers, and track record, and what’s coming, Yahoo’s stock could drop by 60% and still be overpriced.

Come back, Lycos, everything is forgiven.

--Chris Parry

https://www.twiter.com/chrisparry