2018 was an unusual year for the electric vehicle (EV) battery metal miners. While the market saw a massive 70% growth in electric car sales in 2018, most of the lithium, cobalt, graphite, and nickel miner’s stock prices fell in the wake of some oversupply issues and concern over the US/China trade war and China’s economic slowdown. Of course, for greater context, it should be noted that 2016 and 2017 were stellar years with many EV metal stocks doubling, tripling or more.

What will 2019 bring? Analysts are somewhat mixed in their

2019 forecasts. For lithium some are forecasting oversupply and weak prices, while others maintain prices will remain high due to strong demand and the typical Li supply lag.

According to a Reuters report, demand for lithium carbonate (Li

2CO

3) is still strong with Argentina’s Li production set to

triple by 2019. And, Argentina is

the hotspot for lithium exploration amongst the three countries within the ‘Lithium Triangle’.

What battery metals analysts can say with some confidence is that any junior EV metal miner that can make significant progress towards production is likely to do well, especially assuming electric vehicles continue to grow rapidly. It’s easy to forget we could be looking at a 50+ fold increase in EV’s between 2017 and 2040 – based on

Bloomberg’s forecast. Other research firms are increasingly making similar estimates, and the battery supply chain is gearing up with over 60 mega battery metal factories already in the planning or construction stage. Many cities and countries are even

banning or punishing gasoline or diesel vehicles to reduce carbon emissions by 2032.

So, what does it all mean? From now to 2040 at least, the global market will see an unprecedented demand pull on the EV metals – lithium, cobalt, rare earths, graphite, nickel, and copper. The chart below shows the impact that a 100% electric vehicle planet would have on the key EV metals, noting those with smaller markets like lithium and cobalt would feel the greatest impact. Lithium would see a near 30-fold demand increase.

Where is all the lithium?

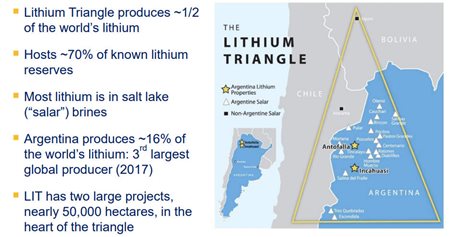

Exploration companies have a great interest in the vast

Lithium Triangle in South America that covers great swaths of Chile, Bolivia, and Argentina. It’s been estimated the Lithium Triangle hosts about 55% of the world’s lithium resources. Argentina currently produces approximately 16% of the world’s lithium, making the country, the third largest global producer in 2017. The lithium in these areas is mined in above and below-ground salt lake, or salar, brines.

(Click image to enlarge)

Argentina Lithium & Energy Corp.

(Click image to enlarge)

Argentina Lithium & Energy Corp. (

TSX-V: LIT,

OTCQB: PNXLF,

Forum) stands on the technological forefront of delivery of this industrially and strategically-vital metal commodity, mining an area of over 60-thousand hectares in Argentina’s biggest and most bountiful lithium region.

On March 13th, 2018, The Company commenced its first drill program at

the Incahuasi Salar in northwestern Argentina. The program was budgeted to include up to four diamond drill holes to depths of approximately 400 metres. To date, two holes have been completed to depths of 300 and 190 metres respectively. The third hole is still in progress and has passed 200 metres depth. Brine samples are being submitted for analysis on a batch basis, and results will be published at the end of the program when all analytical results are received and interpreted. Today, Argentina Lithium is proud to announce drilling has just started at their fourth hole on Incahuasi.

On June 4, 2018, The Company also announced commencement of a Controlled Source Audio-frequency Magneto-telluric (CSAMT) geophysical survey program to map deeper stratigraphic units (layers) in order to delineate additional drill targets at its 100%-controlled Arizaro Lithium Brine Project in Salta Province, Argentina.

The South American battery metals connection continues with

Lithium Chile Inc. (

TSX: V.LITH,

Forum). The Company is exploring lithium brine properties in Chile – one of the biggest lithium-producing countries in the world and home to more than half of the resource’s reserves. Lithium Chile owns 15 projects, encompassing 159,950 hectares on Li-rich salars in Chile, which boasts “the largest, high-grade lithium reserves and lowest-cost lithium production in the world.” Recent work on LITH’s multiple lithium projects has confirmed strong lithium grades in the surface samples and testing has shown low Mg to Li ratios - an important factor in production.

Exploration is underway and the company is targeting initial resource estimates later in 2019.

The North American lithium exploration sector is heating up, as well.

Belmont Resources Inc.(TSX: V.BEA, Forum) is an emerging Canadian resource company with big plans to meet the strategic global demand for lithium. The company has recently acquired 2,056 hectares (5,080 acres) of lithium exploration and development rights in the Kibby Basin property in Monte Cristo Valley, Esmeralda County, Nevada.

After several years of being active in the Kibby Basin, Belmont Resources is now in the final stage of potentially making some sensational discoveries via the drill bit.

(Click image to enlarge)

In Closing

(Click image to enlarge)

In Closing

Lithium is about to support almost every major energy source – including heat-resistant glass and ceramics, lithium grease lubricants, flux additives for iron, plus steel and aluminum production – and the vast Lithium Triangle in South America holds over half of the world’s lithium resources. The impending lithium boom could be comparable to the oil boom after the combustion engine and gasoline car was revolutionized by Henry Ford in 1908 with the Model T. Today we have the Tesla Model 3.

The future is now in the global battery metals market. For investors looking for value and opportunity in the exploding sector battery metals space, now may be just the right time to take a long hard look at the sector.

FULL DISCLOSURE: Argentina Lithium & Energy Corp. and Belmont Resources Inc. are paid clients of Stockhouse Publishing.