(Lithium salt flats in Salar de Uyuni, Bolivia. Courtesy Wikimedia Commons)

When things go wrong sometimes the end result ends up being right. Witness the public relations debacle that was the

unveiling of the new Tesla EV pickup truck last week that went, well, wrong. But not so wrong as to completely damage the Tesla brand, just the window of the truck that wasn’t quite as

unbreakable as advertised.

Despite the steel ball glass-busting debacle, Tesla shares traded up 2.2 percent as of 9:45 a.m. in New York on Monday. The stock slumped 6.1 percent on Friday after the company’s chief designer shattered two windows during a demo intended to show off the strength of the truck’s panes of glass. A publicity stunt gone awry to be sure, but it remains doubtful that it will inflict any substantial collateral damage to the $60 billion dollar company.

On Sunday night, Tesla Inc. Chief Executive Officer Elon Musk revived the practice of reporting reservation counts. Musk said via Twitter that Tesla had received 200,000 orders for its Cybertruck, despite the

botched demo that led to a broken window and sparked meme’s making fun of the vehicle’s steel trapezoid shape.

The tally Musk tweeted Sunday restores another source of intrigue for investors, analysts, journalists, fans and skeptics of the company, as the figures are inherently used as a proxy for demand. Musk’s tweets broke with recent practice at Tesla, which had stopped giving reservation figures on quarterly earnings calls, saying the metric wasn’t relevant.

So what’s the long game for investors in Tesla or, more significantly to Stockhouse readers, for the battery metals market in general?

What will 2020 bring? Analysts are somewhat varied in their 2020 forecasts. For lithium some are forecasting oversupply and weak prices, while others maintain prices will remain high due to strong demand and the typical Li supply lag.

Bullish and bearish demand trends for EV battery metals over the coming years have revealed that China will remain the key driver of direct EV metals demand, but the EU will be another major player.

The analysis by

Fitch Solutions Macro Research estimates that indirect growth for cobalt, nickel, and lithium will be the strongest across the EU under the bullish scenario, which is underpinned by favourable policy assumptions. Fitch forecasts the EU will witness the fastest average growth in indirect demand for cobalt (25.8 percent year-over-year), nickel (31.0 percent y-o-y) and lithium (27.9 percent y-o-y) up to 2028.

At the EU level, mandatory emissions targets introduced by the European Commission for the automotive industry – for the region to meet emissions targets – could prompt automakers to accelerate their EV development plans.

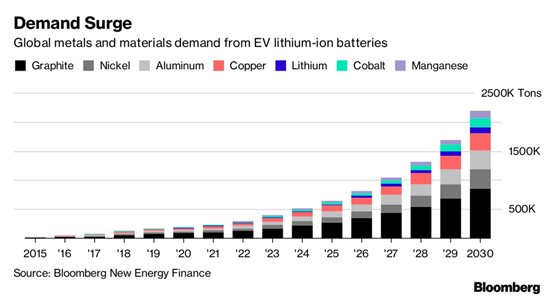

So, what does it all mean moving forward? From now to 2040 at least, the global market will see an

unprecedented demand drag on the EV battery metals – lithium, cobalt, rare earths, graphite, nickel, and copper. The chart below shows the impact that a 100 percent electric vehicle planet would have on the key EV metals, noting those with smaller markets like lithium and cobalt would feel the greatest impact. Lithium would see a near 30-fold demand increase.

Battery Metals Companies to Keep an Eye On

- American Manganese Inc. (TSX: V.AMY, OTCQB: AMYZF, Forum)

- American Battery Metals Corp. (CSE: ABC, OTCQB: FDVXF, Forum)

- Argentina Lithium & Energy Corp. (TSX-V: LIT, Forum)

- Belmont Resources Inc.(TSX: V.BEA, Forum)

- Canada Cobalt Works Inc. (TSX-V:CCW, OTCQB:TAKRF, Forum)

- Ceylon Graphite Corp. (TSX-V: CYL, OTC: CYLYF, Forum)

- Go Metals (C.GOCO, OTC: GOCOF, Forum)

(Click image to enlarge)

(Click image to enlarge)

The rapidly changing energy future, from EVs to enormous energy storage solutions and nanotechnology, will require more tech-grade battery metals. And with that, the challenges of finding and extracting these increasingly rare minerals from a dwindling terrestrial supply.

FULL DISCLOSURE: American Manganese Inc., American Battery Metals Corp., Argentina Lithium & Energy Corp., Canada Cobalt Works Inc, Belmont Resources Inc., Ceylon Graphite Corp. and Go Metals are clients of Stockhouse Publishing.