PlanetaryWorks_______________Canada will loose its oil resources (Oilsands) to world oil supermajors.

We get to thank our Federal Government for this ongoing achievement. (With a momentary exception - The 1979 energy crisis caused oil prices to peak again, introduction of the National Energy Program NEP by Pierre Trudeau discouraged foreign investment in the Canadian oil industry. The program was dismantled. In the 1984 election the Progressive Conservative Party of Brian Mulroney was elected to a majority in the House of Commons with the support of western Canada after campaigning against the NEP.However, Mulroney did not eliminate the last vestiges of the program until two and a half years later. The conservative government's delay was a contributing factor to the creation of a new conservative party, Western Canada's Reform Party of Canada.) Wikipedia

_____________________________________________________________Related Post:

PlanetaryWorks

http://www.stockhouse.com/Blogs/ViewDetailedPost.aspx?p=88743_____________________________________________________________The

Seven Sisters of the petroleum industry is a term coined by an Italian entrepreneur, Enrico Mattei,

that refers to seven oil companies that dominated mid 20th century oil production, refining, and distribution.

The Seven Sisters consisted of three companies formed by the breakup by the U.S. Government of Standard Oil, along with four other major oil companies. With their dominance of oil production, refinement and distribution, they were able to take advantage of the rapidly increasing demand for oil and turn immense profits.

Being well organized and able to negotiate as a cartel, the Seven Sisters were able to have their way with most Third World oil producers. It was only when the Arab states began to gain control over oil prices and production, mainly through the formation of OPEC, beginning in 1960 and really gaining power by the 1970s, that the Seven Sisters' influence declined.

The Seven Sisters were the following companies:

- Standard Oil of New Jersey (Esso), which merged with Mobil to form Exxon Mobil.

- Royal Dutch Shell (Dutch 60% / British 40%)

- Anglo-Persian Oil Company (APOC) (British). This later became Anglo-Iranian Oil Company (AIOC), then British Petroleum, and then BP Amoco following a merger with Amoco (which in turn was formerly Standard Oil of Indiana). It is now known solely by the initials BP.

- Standard Oil Co. of New York ("Socony"). This later became Mobil, which merged with Exxon to form ExxonMobil.

- Standard Oil of California ("Socal"). This became Chevron, then, upon merging with Texaco, ChevronTexaco. It has since dropped the 'Texaco' suffix, returning to Chevron.

- Gulf Oil. In 1984, most of Gulf became part of Chevron, with smaller parts becoming part of BP and Cumberland Farms, in what was, at that time, the largest merger in world history. A network of stations in the northeastern United States still bears this name.

- Texaco. Merged with Chevron in 2001. The merged company was known for a time as Chevron Texaco, but in 2005, changed its name back to Chevron. Texaco remains a Chevron brand name.

As of 2005, the surviving companies are ExxonMobil, Chevron, Royal Dutch Shell, and BP, now members of the "supermajors" group.

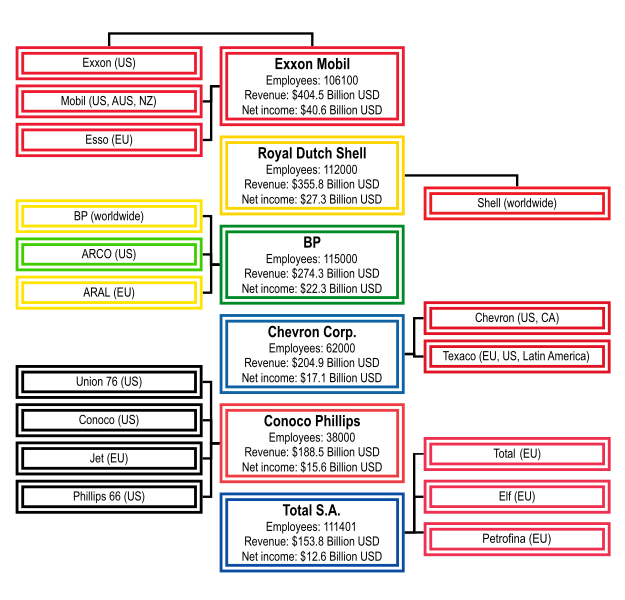

The term supermajor illustrates the six largest, non state-owned energy companies, as seen in popular financial mediums around the world. Trading under various names around the world, they are considered to be:

- ExxonMobil (XOM)

- Royal Dutch Shell (RDS)

- BP (BP)

- Chevron Corporation (CVX)

- ConocoPhillips (COP)

- Total S.A. (TOT)

The supermajors began to appear in the late 1990s, in response to a severe deflation in oil prices. Large petroleum companies began to merge, often in an effort to improve economies of scale, hedge against oil price volatility, and reduce large cash reserves through reinvestment. Exxon and Mobil (1999), BP and Amoco (1998), Total and Petrofina (1999) and subsequently Elf Aquitaine (2000), Chevron and Texaco (2001), and Conoco Inc. and Phillips Petroleum Company(2002) all merged between 1998 and 2002. The result of this trend created some of the largest global corporations as defined by the Forbes Global 2000 ranking, and as of 2007 all are within the top 25.

As of December 1, 2006,ExxonMobil ranks first among the supermajors in terms of size (market capitalization), cash flow (12 months), revenue (12 months), and profits.

As a group, the supermajors control about 5% of global oil and gas reserves with largest supermajor, ExxonMobil, ranked 14th. Conversely,95% of global oil and gas reserves are controlled by state-owned oil companies, primarily located in the middle east.

Chart of the major energy companies dubbed "Big Oil" sorted by latest published revenue

The "New Seven Sisters"

On 11 March 2007, the Financial Times identified the "New Seven Sisters", the most influential and mainly state-owned national oil and gas companies from countries outside the OECD. They are:

- Saudi Aramco (Saudi Arabia)

- JSC Gazprom (Russia)

- CNPC (China)

- NIOC (Iran)

- PDVSA (Venezuela)

- Petrobras (Brazil)

- Petronas (Malaysia)

The FT article notes that Pemex of Mexico is excluded from such a list.

_________________________________________________________________

Investing in Foreign Oil

Aug 2nd, 2007 | By Penny Sleuth Contributor | Category: Commodities, International

In Mergers and Acquisition news on Tuesday, we saw a major player in the Canadian oil sands get bought out. The board of directors at Western Oil Sands unanimously approved an offer from Marathon Oil Corp. to obtain all of Western Oil Sands’ outstanding shares for about $6.2 billion. Marathon ended up paying approximately $2.24 per barrel of bitumen. That $6.2 billion bought it 31,000 barrels per day of production, a 20% interest in an operating mine and 2.6 billion barrels of bitumen, along with approximately $70 million of Western Oil Sands’ debt.

The Canadian oil sands’ 180 billion barrels of oil reserves are second only to the reserves of Saudi Arabia. Canada is definitely much more geopolitically stable than the Middle East and Nigeria, and its reserves are not in post-Peak, as are the likes of Mexico or Saudi Arabia. This region has large potential for future oil production.

Some of the opposing arguments to the Canadian oil sands are that they are less economical to produce than conventional crude oil. This is very true, but we have already picked the low-hanging fruit in the world of oil. We are left with oil sands, deepsea production, CTL and GTL substitutes.

The Canadian oil sands are going to be a vital supply to the U.S. and the world, and it makes a whole lot of sense for local oil companies to head north of the border in order to get their hands on as much of the oil sands as possible. But, they missed the boat.

On April 27, Statoil, a Norwegian gas and oil company, climbed aboard the oil sands train when it bought out the privately owned North American Oil Sands Corp. (NAOSC) in a deal that fell just short of $2 billion.

Statoil received 257,200 acres of oil sands leases in the Athabasca region of Alberta. The leases hold oil reserves estimated to be around 2.2 billion barrels. By the end of 2009, a pilot project is expected to be implemented to produce 10,000 barrels per day. By the end of the next decade, Statoil believes that it will have 100,000 barrels per day of production from this buyout.

Just how bad did Statoil want this deal to work? There was a private placement of NAOSC shares issued in December at C$13.50. Statoil paid C$20 per share in April. Many investors thought Statoil overpaid, as its share price dropped on the news, but I believe that this Norwegian gas and oil company is looking far beyond $70 oil.

But Statoil isn’t the only, or the first, foreign prospect looking to grasp a piece of the Canadian oil sands.

In 2004, Enbridge Inc. put into plans the construction of an oil pipeline from Edmonton, Alberta, to the coast of British Columbia. Enbridge also announced that a Chinese company was taking a 49% stake in the operation and that the majority of oil will go to China. This pipeline is projected to carry approximately 20% of ALL oil sands production by 2010.

China has also taken minority stakes in four other smaller oil sands producers. This is an interesting strategy. The Chinese do not want to create controversy or be in the headlines. They would much rather subtly get their oil and be on their way. There are 180 billion barrels of oil reserves. With more production coming online every year, China is set to grab 20% of it, and nobody really knows.

These small Canadian oil sands producers are getting bought out left and right. It only makes sense. You have 180 billion barrels of proven oil reserves. You have one of the most geopolitically friendly areas on this earth, and you have a world where conventional oil is starting to run out. Nations everywhere are in the process of trying to get their hands on as much oil as possible.

We have only seen the tip of the iceberg for M&A activity in the market for Canadian oil sands producers. It doesn’t matter where the buyers come from, because these juniors are without prejudice when it comes to payday.

There is one particular company that stands out as a potential buyout target, Oilsands Quest Inc. (BQI: AMEX). On July 12, BQI released a report saying that it had resource potential in excess of 10 billion barrels of bitumen on its properties. Since the report was released, BQI’s share price has increased nearly 60%. That’s just a start…

BQI has 250 million outstanding shares on a fully diluted basis, of which management owns 19%.

Since, Marathon just paid $2.24 per barrel of bitumen reserves in its buyout of Western Oil Sands, let’s be conservative and value BQI’s reserves at $1. That would give us a share price of nearly $40.

I realize that this is a very big number with BQI’s share price currently trading around $4.20. But it is reasonable to think that it could get a bid at $20 with the buyer paying 50 cents per barrel. And what if more than one buyer comes in and starts bidding at BQI? Anyway you look at it, these guys could very easily end up in the sights of China, Norway or even the U.S.

There will surely be more M&A activity in the Canadian oil sands. So we’ll certainly keep an eye out to see where this oil goes.

Sincerely,

Nick Jones

August 2, 2007

http://www.pennysleuth.com/investing-in-foreign-oil/

_________________________________________________________________________________________

Imperial Oil, controlled by ExxonMobil, which owns 69.8% of its stock.

Shell Canada, owned by Royal Dutch Shell.

British Petroleum Canada, owned by British Petroleum.

Ultramar fuels, owned by US-based Valero.

There are currently three large oil sands mining operations in the area run by Syncrude Canada Limited, Suncor Energy and Albian Sands owned by Shell Canada, Chevron, and Marathon Oil Corp.

Syncrude Canada Ltd. is the world's largest producer of synthetic crude oil from oil sands and the largest single source producer in Canada. It is located just outside Fort McMurray in the Athabasca Oil Sands, and supplies about 13% of Canada's oil requirements.

The company is a joint venture involving a number of companies, including Canadian Oil Sands Limited, Imperial Oil, Petro-Canada, Nexen, ConocoPhillips, Mocal Energy (a subsidiary of Nippon Oil Exploration) and Murphy Oil. As a result, the consortium is not traded directly but can be traded under the individual partners: Canadian Oil Sands Trust, Petro Canada, Nexen, and so forth . The Canadian Oil Sands Trust, with the largest stake (and with Syncrude involvement as its only business), is publicly traded on the TSX under the symbol COS.UN.TO.

Minesite at Syncrude's Mildred Lake plant

Major Athabasca Oil Sands Projects (as of December 2007) | Project Name | Type | Major Partners | National

Affiliation | 2007 Production

(barrels/day) | Planned Production

(barrels/day) |

| Suncor | Primarily Mining | Suncor Energy | Canada | 239,100 | 500,000 |

| Syncrude | Mining | Syncrude | Canada (some USA) | 307,000 | 550,000 |

| Albian Sands | Mining | Shell(60%), Chevron(20%), Marathon(20%) | NL, USA | 136,000 | 770,000 |

| MacKay River | SAGD | Petro-Canada | Canada | 30,000 | 190,000 |

| Fort Hills | Mining | Petro-Canada(60%),UTS Energy(20%),Teck(20%) | Canada | — | 140,000 |

| Foster Creek, Christina Lake | SAGD | EnCana Energy(50%), ConocoPhillips(50%) | Canada, USA | 6,000 | 400,000 |

| Surmount | SAGD | Total S.A.(50%),ConocoPhillips(50%) | France, USA | — | 193,000 |

| Hangingstone | SAGD | Japan Canada Oil Sands (JACOS) | Japan | 8,000 | 30,000 |

| Long Lake | SAGD | Nexen(65%), OPTI Canada(35%) | Canada | — | 240,000 |

| Horizon | Mining and in situ | Canadian Natural Resources Limited | Canada | — | 500,000 |

| Jackfish I and II | SAGD | Devon Energy | USA | ?? | 70,000 |

| Northern Lights | Mining | Total S.A.(60%), Sinopec(40%) | France, China | — | 100,000 |

| Kearl | Mining | Imperial Oil, ExxonMobil | USA | — | 300,000 |

| Sunrise | SAGD | Husky Energy(50%), BP(50%) | Canada, UK | — | 200,000 |

| Tucker | SAGD | Husky Energy | Canada | ?? | 30,000 |

| Joslyn | Mining and SAGD | Total S.A. (76%), Oxy (15%), Inpex (10%) | France, USA, Japan | — | 225,000 |

| Ells River | SAGD | Chevron(60%), Marathon(20%), Shell(20%) | USA, NL | — | 100,000 |

| Terre de Grace | SAGD | Value Creation Inc | Canada | — | 300,000 |

| Kai Kos Dehseh | SAGD | StatoilHydro | Norway | — | 200,000 |

| Black Gold Mine | Mining? | Korea National Oil Corporation | Korea | — | 30,000 |

| Total | | | | 726,100 | 5,068,000 |