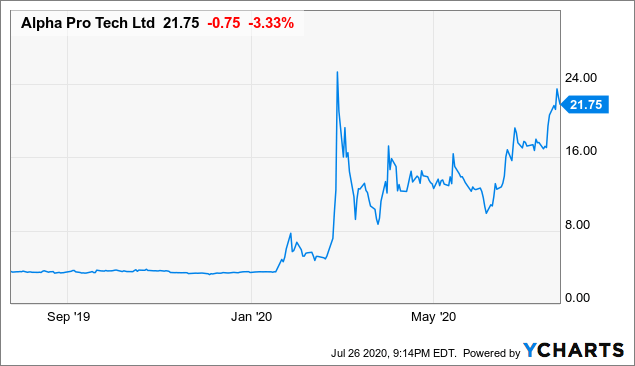

Alpha Pro Tech (NYSEMKT:APT) has experienced extraordinary revenue growth and price appreciation as a result of COVID-19. The stock price has appreciated over 500% YTD! The main growth catalysts are its N95 Particulate Respirator face mask and face shields. There appears room for further stock appreciation given the strong backlog and potential 2020 earnings.

APT is a unique company as its two operating segments are Building Supply and Disposable Protective Apparel.

Per the 2019 10-K:

The Building Supply segment consists of a line of construction supply weatherization products, namely housewrap and synthetic roof underlayment, as well as other woven material. This line of products is a natural extension of our core capabilities: creating proprietary products designed to protect people and environments.

The Disposable Protective Apparel segment consists of a complete line of disposable protective garments (shoecovers, bouffant caps, coveralls, gowns, frocks and lab coats), as well as face masks and face shields.

The historical financial performance has been boring. It's a steady company that generates high-single-digit EBITDA margin and has no debt. How the tables have turned. The novel COVID-19 has caused a spike in demand for N95 masks and face shields. Sales have skyrocketed and so has the stock price. The opening bullet points from the 1Q20 press release say it all:

EPS increases over 300% to $0.39 per diluted share for the quarter.

Revenue for the first quarter of 2020 increased 47.5% to $18.2 million, compared to $12.3 million for the first quarter of 2019.

Net income for the first quarter of 2020 increased 338.6% to $5.3 million, compared to $1.2 million for the first quarter of 2019.

Data by YCharts

Data by YCharts

In the release, it is noted that the company has booked $47MM in orders for the N95 mask and $13MM for face shields. The orders are expected to be fulfilled in 2020. A portion of those orders are booked for 2021. This is all great news, but there has to be a catch.

There are a few things to consider. The fulfillment amount during 1Q was lower than expectations due to a manufacturing disruption. It is hard to blame a company for this when the delay was caused by an earthquake. This is an once-in-a-lifetime opportunity for APT and an earthquake disrupted production. You cannot make this stuff up! Thankfully the plant is up and running at normal capacity and new production lines are expected to ramp up in the next few months. This leads me to believe that Q2 may be underwhelming given the production cycle. However, management continues to state that orders will be filled in 2020. Another concern is the stability of revenues. Will this be a one-year event and then revenue returns to normal? I do not know, but I am confident in the earnings potential for 2020.

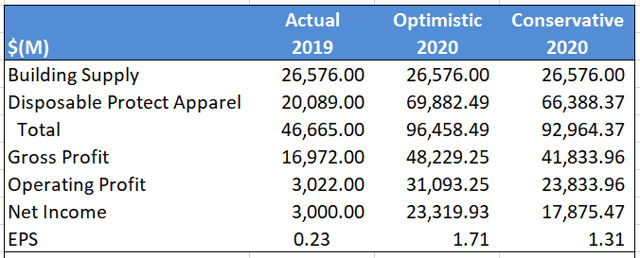

Given the orders booked, I put together a conservative and optimistic case to estimate financial performance.

Source: APT 2019 110-K

Optimistic Scenario

Building Supply is left unchanged from the prior year. While there was growth in 1Q, management is cautious that level of growth will continue. For the DPA segment, revenues outside of N95 masks and face shields have no growth (conservative method) and the majority of the orders are fulfilled in 2020. Both gross and operating profit margins expand given the favorable product mix, leading to net income of $23MM and diluted EPS of $1.71.

Conservative Scenario

The methodology is largely the same as the Optimistic Scenario, but the orders completed are further discounted. Similarly, margins do not expand as much comparatively leading to EPS of $1.31.

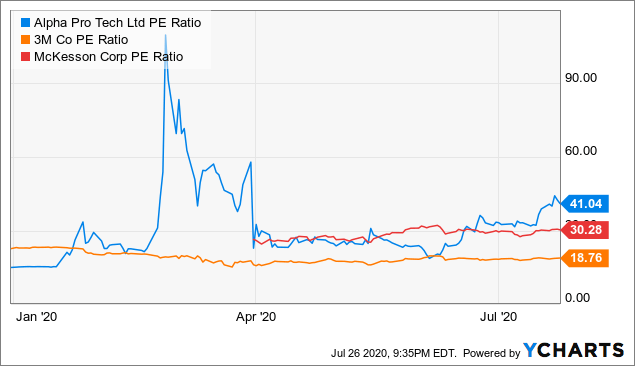

This leads us to the fun section of determining the estimated stock price. APT is unique as its competitors are either private companies or large companies like 3M (NYSE:MMM) or McKesson (NYSE:MCK). As laid out in the chart below, APT's PE is much higher than both 3M and McKesson. Early in the pandemic, APT's PE exploded as investors were showered with positive press releases, but that has come down significantly as investors had time to digest the news.

Data by YCharts

Data by YCharts

APT is the only true-play in this segment, and that should call for a higher premium than compared to its competitors. What should be the PE? 90? 40? 20? Right now, it is a fast-growth company at least for 2020, and that uncertainty is holding it back. If a 20x PE was applied to either cases I laid out earlier, there is good upside potential.

Alpha Pro Tech was once a boring and sleepy company. The tides have turned, and it is experiencing rapid growth and earnings due to the COVID-19 pandemic. APT is uniquely situated to book orders and provides investors a play to capture momentum in the face mask and face shield market. The price has gyrated as financial performance was not up to expectations, but there still lies significant demand for its products. The question an investor has to figure out is the demand going to last beyond 2021. The 2Q20 earnings and press release could provide a clue if production has been met and if the pipeline continues into next year. Right now, I am not completely certain on full-year revenue performance and this level of orders will continue over the next five years.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

https://seekingalpha.com/article/4361104-alpha-pro-tech-is-uniquely-positioned-to-capture-demand-for-face-masks